Get the free Application for Individual Investors

Get, Create, Make and Sign application for individual investors

Editing application for individual investors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual investors

How to fill out application for individual investors

Who needs application for individual investors?

A comprehensive guide to the application for individual investors form

Understanding the application for individual investors form

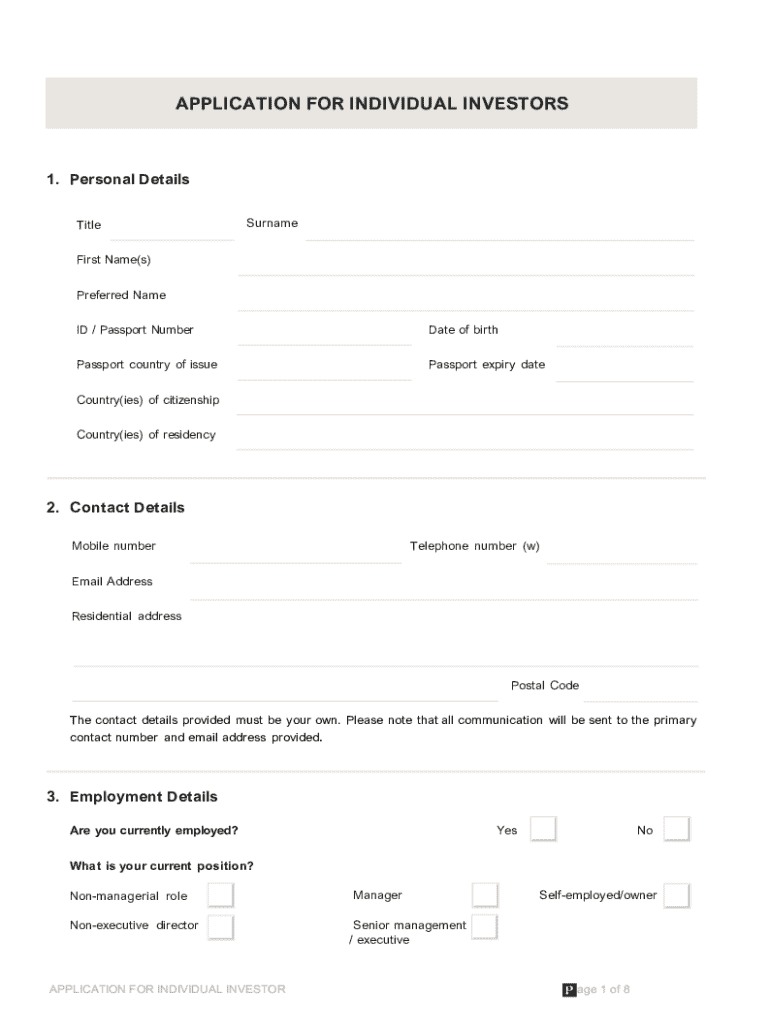

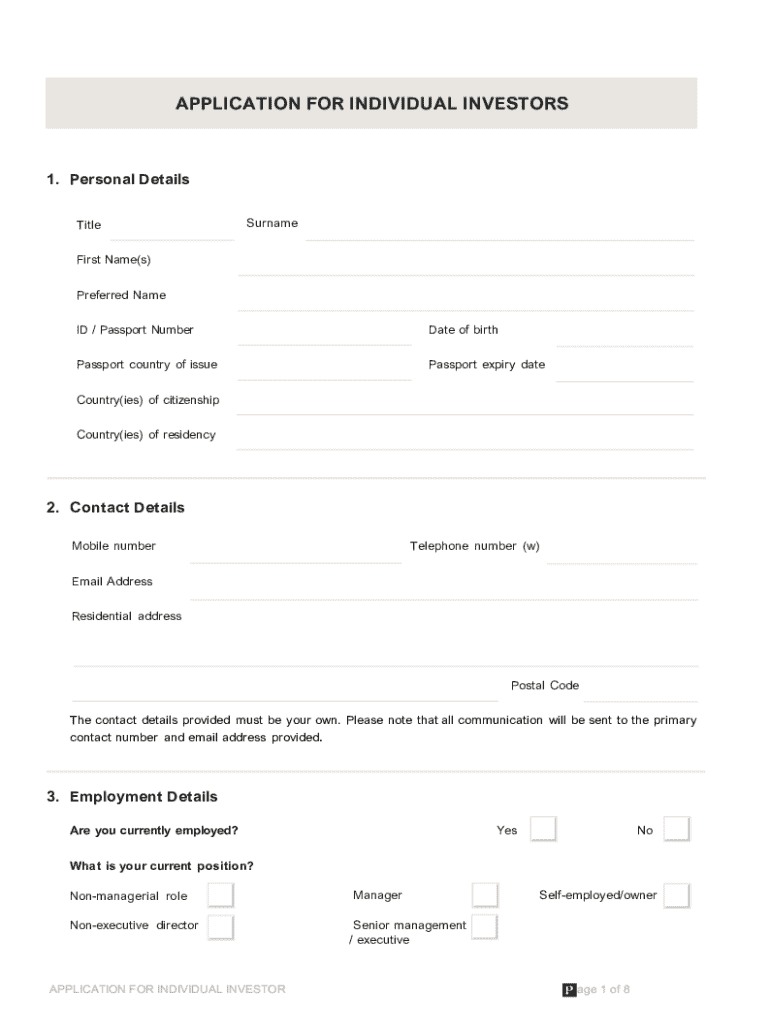

The application for individual investors form is a vital document for anyone looking to invest through a financial institution. This form collects essential information about the investor's personal details, financial status, and investment goals. It serves to ensure that investment firms align their offerings with the investor's needs, risk profile, and investment experience.

The importance of the application cannot be understated. It is not just a bureaucratic hurdle; it lays the groundwork for establishing a trust-based relationship between the investor and financial entity. By providing a comprehensive overview of an investor's financial background, goals, and expectations, the application aids in tailoring investment plans suited specifically to individual circumstances.

Eligibility criteria generally include being of legal age and possessing a valid identification document. Investors may also need to demonstrate basic financial literacy and a clear understanding of the risks involved in investing. Not all investors will require the same details; tailored forms can sometimes be provided based on the investment product being pursued.

Navigating the pdfFiller platform

pdfFiller introduces a robust cloud-based document management solution that streamlines the process of filling out the application for individual investors form. With accessible features designed to enhance user experience, pdfFiller makes the cumbersome process of managing application forms straightforward and efficient.

pdfFiller simplifies the application process through its comprehensive toolkit, allowing you to fill, sign, and submit forms online without the hassle of traditional paperwork. Here are some key features that enhance your experience:

Step-by-step guide to completing the application

Completing the application for individual investors form involves several steps, each crucial for ensuring a successful submission. Let’s walk through the entire process.

Step 1: Accessing the application form. To find the application form on pdfFiller, navigate to the templates section where various forms are categorized. You can open the application form directly in pdfFiller or download it for offline completion.

Step 2: Filling in personal information involves entering required sections such as your full name, contact details, and legal identification. Ensure you double-check this information for accuracy to avoid delays in processing.

Step 3: The financial information section will ask about your income, investment experience, and risk tolerance. Be transparent about your financial background, including current assets, previous investments, and any potential debts. Providing comprehensive details here will help advisors recommend appropriate investment products.

Step 4: After filling out the necessary information, use pdfFiller’s eSignature feature to sign the document. Double-check all entries to ensure correctness before finalizing the application.

Editing and customizing the application form

With pdfFiller's extensive tools, customizing the application form to better suit your needs is straightforward. You can easily edit fields, highlight crucial sections, and incorporate comments that can clarify your intent or specify details for review.

Additionally, pdfFiller enables you to attach supporting documents directly to your application, such as proof of income or prior investment records. This feature can significantly enhance the credibility of your application and provide the financial institution with a more rounded view of your financial status.

Managing submissions and tracking your application status

Once you’ve completed the application, submitting it via pdfFiller is seamless. After submission, you can save and retrieve your application at any stage, which means you can pause and return to it without losing any progress.

Tracking the status of your individual investor application is easy through the pdfFiller dashboard. Simply log in, locate your application in your submissions folder, and you can view its current status. If any additional information is required, you'll be alerted directly through your account.

Frequently asked questions (FAQs)

After submitting your application, you might wonder what comes next. Generally, the application goes through a review process, where the financial institution evaluates your details. This may take several days, and you will be notified via email regarding approval or any required adjustments.

Common errors that applicants face include missing information or inconsistencies in financial details. To avoid these, always double-check your application before submission. If you have additional questions or require support, most platforms, including pdfFiller, offer direct contact options with their customer service team.

Tips for successful individual investment applications

To ensure your application for individual investors forms gets the best possible outcome, follow these best practices:

Going paperless with pdfFiller

Transitioning to a digital approach for document management brings numerous benefits. By relying on pdfFiller, investors can significantly reduce paper waste, streamline processes, and ensure quicker access to necessary documents. All interactions are archived electronically, making retrieval for future reference a breeze.

Implementing strategies for maintaining organized digital records is critical. Create folders or tags on pdfFiller to categorize your forms and submissions. This organization can aid you in efficiently managing multiple applications and tracking progress over time.

Explore more resources

In addition to the application for individual investors form, pdfFiller offers a variety of additional forms and templates to cater to diverse financial needs. Whether you are an occasional investor or managing a portfolio, having access to correctly formatted documents can save time and simplify processes.

Interactive tools available on pdfFiller can assist in making informed investment decisions, and community resources offer valuable insights and support for investors tackling similar financial journeys.

Testimonials and success stories

Many users have shared their successful experiences after utilizing pdfFiller for their application for individual investors forms. By simplifying the application process, pdfFiller has empowered clients to navigate through the requirements swiftly and effectively.

Case studies showcase instances where users, after a meticulous application process, have successfully secured their first investments and seen positive growth, demonstrating the real impact of well-completed, properly submitted applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the application for individual investors in Chrome?

Can I create an electronic signature for signing my application for individual investors in Gmail?

How do I edit application for individual investors on an Android device?

What is application for individual investors?

Who is required to file application for individual investors?

How to fill out application for individual investors?

What is the purpose of application for individual investors?

What information must be reported on application for individual investors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.