Get the free No Financing Contingency

Get, Create, Make and Sign no financing contingency

Editing no financing contingency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out no financing contingency

How to fill out no financing contingency

Who needs no financing contingency?

No Financing Contingency Form: A Comprehensive Guide for Buyers and Sellers

Understanding the no financing contingency

A no financing contingency is a clause in real estate contracts that indicates a buyer will not rely on external financing to complete the purchase of a property. This form effectively removes a buyer’s ability to back out of a deal based on their inability to secure a mortgage. The importance of this clause lies in its influence on transaction efficiency, speed, and the confidence it instills in sellers regarding the buyer’s financial situation. By eliminating a financing contingency, buyers convey their readiness and capability to close the deal, which can significantly alter the dynamics between buyers and sellers.

Advantages of no financing contingency for buyers

In today’s competitive real estate market, buyers seeking to make an offer that stands out may find that opting for a no financing contingency provides a distinct advantage. By removing this contingency, buyers position themselves as serious contenders, ultimately increasing their chances in a bidding war. This assurance can encourage sellers to consider their offer more favorably, knowing that there is less risk of the transaction falling through due to financing issues.

Advantages of no financing contingency for sellers

For sellers, receiving offers without financing contingencies can provide numerous advantages. When they accept an offer under such terms, they tend to benefit from a smoother transaction process that reduces complications and risks associated with mortgage approvals. This can lead to quicker closings and increased confidence in the buyer's commitment to the purchase.

Assessing your financial situation

Before deciding to waive the financing contingency, it is crucial to evaluate your financial situation meticulously. Understanding your financial readiness not only influences your decision but also highlights the importance of securing preapproval from your lender. This verification assures both you and the seller of your financial stability, thereby enhancing confidence in your offer.

Steps to obtain a no financing contingency form

Successfully navigating the property purchase process with a no financing contingency begins with preparation. Follow these critical steps to obtain your no financing contingency form, ensuring you’re well-positioned to make an attractive offer.

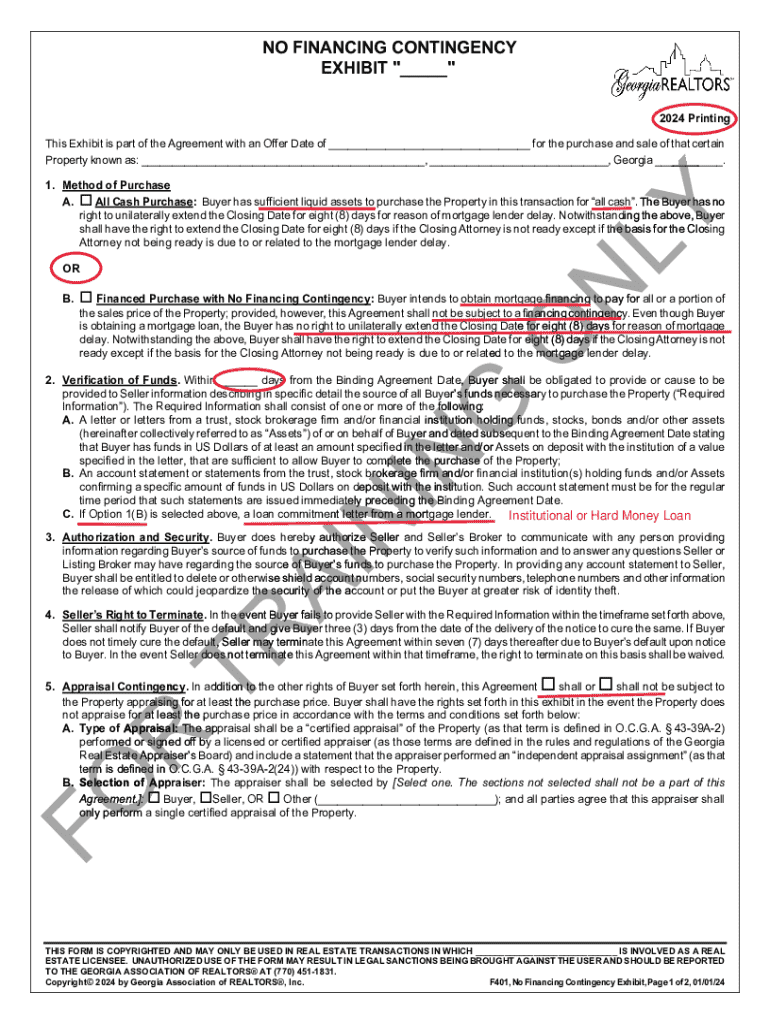

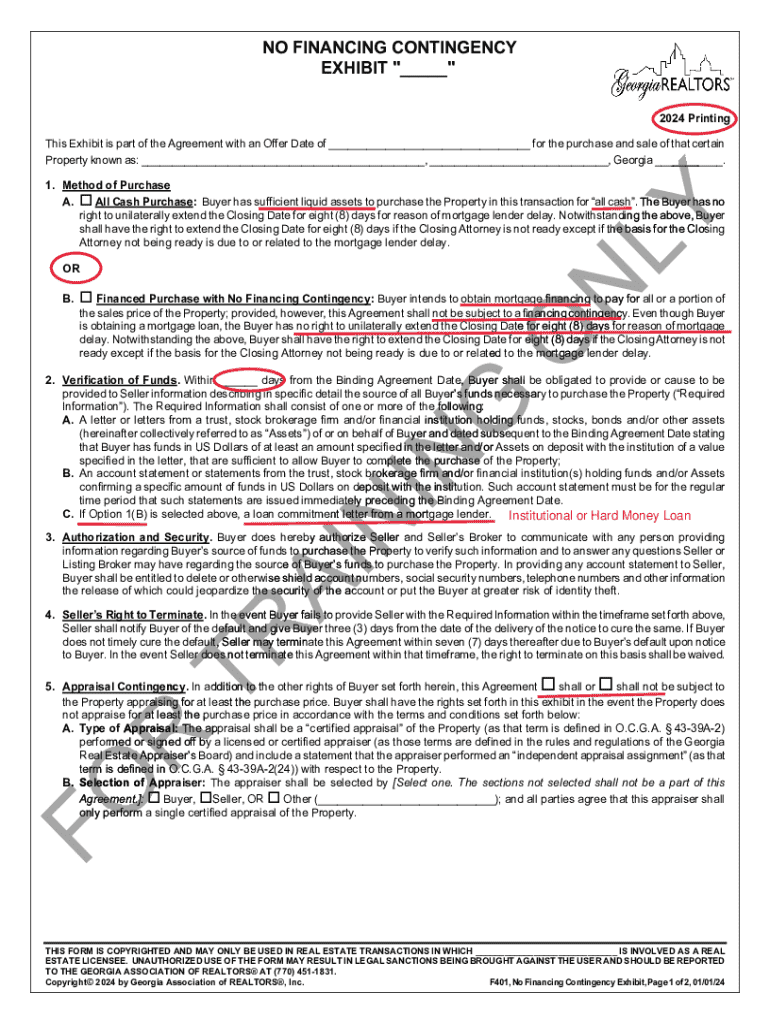

Filling out the no financing contingency form

Accurately completing the no financing contingency form is essential for a successful transaction. The form requires critical information, including your personal details, the property address, and a declaration of your financial readiness. Skipping any step or providing inaccurate data can lead to complications during the buying process. It's advisable to double-check your entries to avoid common mistakes.

Reviewing and submitting your offer

Submitting an offer that includes a no financing contingency requires careful preparation and clarity in presentation. The strength of your offer will significantly impact your chances of acceptance, especially in competitive markets. Ensure that your offer is not only competitive but well-structured and clearly states the absence of financing contingencies.

Potential risks and considerations

Despite the advantages, opting out of a financing contingency holds potential risks that should be acknowledged. Market fluctuations could affect property values after your purchase agreement, leading to challenges if your financial situation changes. Buyers should have a strong contingency plan in case of unforeseen circumstances, including a significant market downturn or personal financial adversity.

Real-world scenarios and case studies

Learning from both successful transactions and cautionary tales can guide prospective buyers and sellers in the realm of no financing contingency offers. Case studies illustrate practical implications, while market trend analyses equip buyers with necessary awareness.

FAQs about no financing contingency

Questions frequently posed by buyers and sellers regarding the no financing contingency form can clarify underlying concerns and guide transactions effectively. Understanding differences between financing contingencies and their absence is crucial for all parties involved.

Resources for further education

Elaborate tools and resources are easily accessible to help both buyers and sellers make informed decisions about no financing contingency options. Online calculators, templates, and articles provide expanded knowledge to navigate the financial landscape.

Using pdfFiller for document management

pdfFiller is an invaluable tool for managing your no financing contingency form and related documents. The platform allows users to seamlessly edit, eSign, collaborate, and manage documents in an efficient, user-friendly interface.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify no financing contingency without leaving Google Drive?

How can I edit no financing contingency on a smartphone?

Can I edit no financing contingency on an Android device?

What is no financing contingency?

Who is required to file no financing contingency?

How to fill out no financing contingency?

What is the purpose of no financing contingency?

What information must be reported on no financing contingency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.