Get the free Advance Deposit Hardship Waiver

Get, Create, Make and Sign advance deposit hardship waiver

Editing advance deposit hardship waiver online

Uncompromising security for your PDF editing and eSignature needs

How to fill out advance deposit hardship waiver

How to fill out advance deposit hardship waiver

Who needs advance deposit hardship waiver?

A comprehensive guide to the advance deposit hardship waiver form

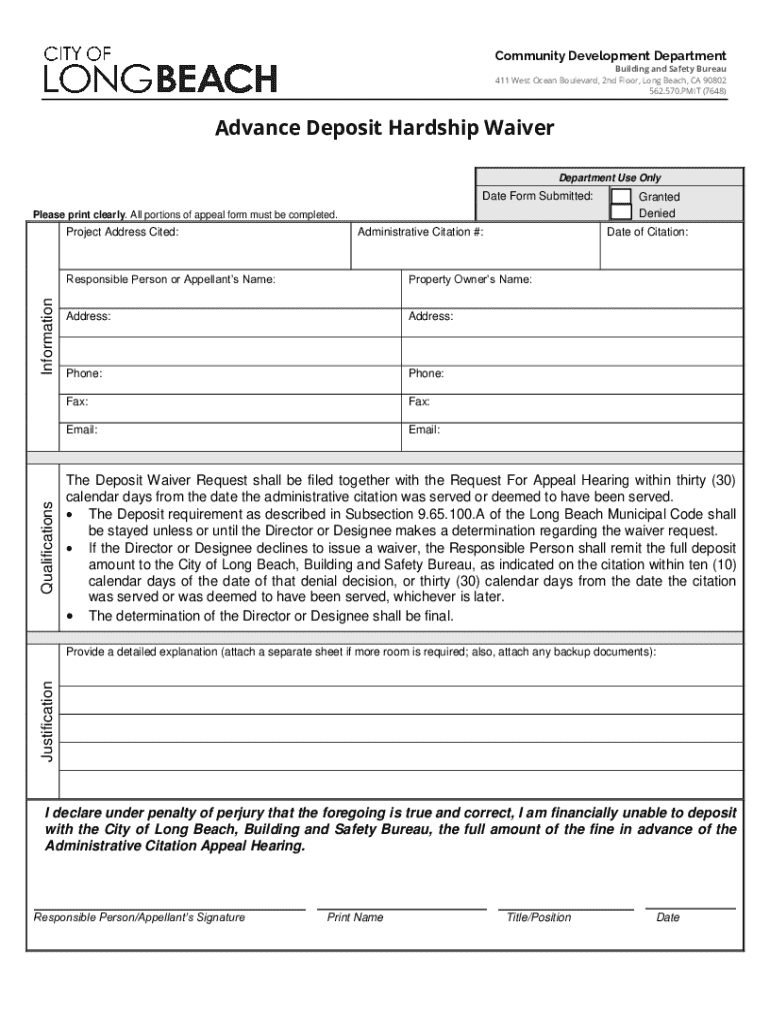

Overview of the advance deposit hardship waiver form

The advance deposit hardship waiver form is a critical document that allows individuals and businesses facing financial difficulties to request a waiver for advance payments typically required for various services, events, or contracts. The primary purpose of this form is to provide a structured process for requesting relief based on quantifiable hardships. This waiver can be especially vital during times of unexpected expenses or economic downturns, offering a lifeline to those unable to meet advance payment requirements.

The importance of this form cannot be understated, as it acknowledges the financial struggles that many individuals and teams face. By leveraging this waiver, applicants can potentially alleviate financial stress, redirect funds to immediate needs, and ensure that they can still access necessary services or participate in events. The key benefits of utilizing the waiver include preserved relationships with service providers, reduced financial strain, and the opportunity to maintain normalcy during turbulent times.

Who qualifies for the hardship waiver?

Eligibility for the advance deposit hardship waiver form typically hinges on demonstrating a legitimate financial hardship. Individuals and businesses may qualify based on various criteria, including changes in employment status, significant medical expenses, or unexpected emergencies that impact their financial stability. For instance, individuals who are recently unemployed or have incurred high medical costs due to illness may find themselves eligible, as these situations significantly affect their ability to meet advance payment obligations.

Documentation is a crucial component of the waiver application process. Applicants are often required to submit proof that substantiates their claims of hardship. This could include unemployment verification letters, hospital bills, or other financial statements that clearly outline their current financial constraints. Having the correct documentation ready is key to increasing the chances of approval.

Step-by-step instructions for filling out the form

Preparing to fill out the form

To begin, gather all the necessary information you will need to complete the advance deposit hardship waiver form. This typically includes your personal details, an accurate description of your hardship, supporting documentation, and your signature. Understanding a brief overview of the sections within the form can make the process seamless.

Detailed breakdown of each section

Common mistakes to avoid

When filling out the form, it's crucial to be meticulous. Common mistakes to watch out for include providing incomplete information, forgetting to attach necessary documentation, or omitting your signature. Omissions can delay your application or lead to outright denial, so taking the time to review before submission is essential.

Editing and customizing the waiver form with pdfFiller

How to upload your existing form

Using pdfFiller, you can easily upload your existing advance deposit hardship waiver form to start editing. Begin by logging into your account and selecting the option to upload a document. This allows you to have your form ready for immediate editing and customization.

Using interactive tools for customization

pdfFiller offers interactive tools that facilitate document customization. You can add notes, comments, and digital stamps to clarify certain details or highlight specific requests. Utilizing templates available on pdfFiller can accelerate your editing process, ensuring your form is both comprehensive and tailored to your specific needs.

Saving and exporting your form

Once you've completed your editing, pdfFiller provides various options for saving your waiver form. You can export your document in PDF format or choose other formats that suit your preferences. This flexibility ensures that you can store, share, or print your documents as needed.

eSigning the hardship waiver form

Advantages of eSigning

One of the key features of using pdfFiller is the ability to eSign your advance deposit hardship waiver form electronically. This method provides several advantages, including enhanced efficiency, security, and convenience. With eSigning, you can finalize your documents from anywhere, eliminating the need for printing, scanning, and manual signatures.

How to sign using pdfFiller

To eSign your waiver, simply click on the designated area for signatures within the pdfFiller platform. The system will guide you through the process, allowing you to draw, type, or upload your electronic signature effortlessly. Follow the provided prompts, and once signed, your document will be secure and ready for submission.

Legal validity of eSignatures

It's essential to understand that eSignatures carry the same legal validity as traditional handwritten signatures. Legislation such as the Electronic Signatures in Global and National Commerce (ESIGN) Act validates electronic signatures, ensuring that your signed document is legally binding. This assurance gives users peace of mind as they submit their hardship waiver forms.

Submitting your hardship waiver form

Where to submit the completed form

After completing your advance deposit hardship waiver form, the next step is submission. Depending on the policies of the organization or service provider, you may have several options for submitting your completed form, including online submission through their platform, in-person delivery, or mailing it to the designated address. Be sure to confirm the preferred method of submission.

Confirmation of submission

Once your form is submitted, it’s important to seek confirmation of your submission. Many organizations provide confirmation emails or acknowledgments to ensure that your application has been received. Familiarize yourself with the expected timelines for processing your application, as these can vary widely based on the volume of requests and the organization’s protocols.

What happens next?

Following submission, your hardship waiver application will undergo a review process. Depending on the circumstances presented in your application, you may receive either an approval or denial notification. If approved, you will be informed of any adjustments made to your payment requirement, while a denial may provide insights into what additional information might be necessary for reconsideration.

Managing your waiver application through pdfFiller

Tracking the status of your application

pdfFiller enables users to effectively manage their advance deposit hardship waiver applications. By utilizing pdfFiller’s tracking tools, you can easily monitor the status of your submission. This feature allows you to stay informed about any updates or requirements needed to facilitate the processing of your request.

Making amendments post-submission

Should you need to make amendments after submission, pdfFiller provides the facilities for updating your application. Whether additional documentation is required or you wish to appeal a denial, navigating these processes within the platform is user-friendly. Quick access to your documents allows you to address any necessary changes promptly.

Frequently asked questions (FAQs)

As with any official application process, users often have questions concerning the advance deposit hardship waiver form. Some common inquiries may relate to the qualifications needed for approval, how to effectively present proof of hardship, and clarifications on submission procedures. Having these FAQs readily available can assist users in troubleshooting any issues they might encounter during the application process.

Real-life success stories

Real-world testimonials illustrate the positive impact of the advance deposit hardship waiver form. Stories from individuals and teams who successfully navigated the waiver application process reveal how they were able to alleviate financial stress and maintain access to essential services or events. Case studies often highlight specific challenges faced and how effectively utilizing the waiver changed their circumstances, showcasing its importance during financial hardship.

Additional support and contact information

For those seeking further assistance with the advance deposit hardship waiver form, pdfFiller provides multiple avenues for support. Users can reach customer support through various channels, including email and chat options available on the pdfFiller platform. Moreover, additional resources and tools are accessible to aid users throughout the process, ensuring thorough guidance from start to finish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify advance deposit hardship waiver without leaving Google Drive?

How can I send advance deposit hardship waiver to be eSigned by others?

How do I edit advance deposit hardship waiver on an iOS device?

What is advance deposit hardship waiver?

Who is required to file advance deposit hardship waiver?

How to fill out advance deposit hardship waiver?

What is the purpose of advance deposit hardship waiver?

What information must be reported on advance deposit hardship waiver?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.