Get the free Non-residential Tax Incentive Program Application

Get, Create, Make and Sign non-residential tax incentive program

Editing non-residential tax incentive program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-residential tax incentive program

How to fill out non-residential tax incentive program

Who needs non-residential tax incentive program?

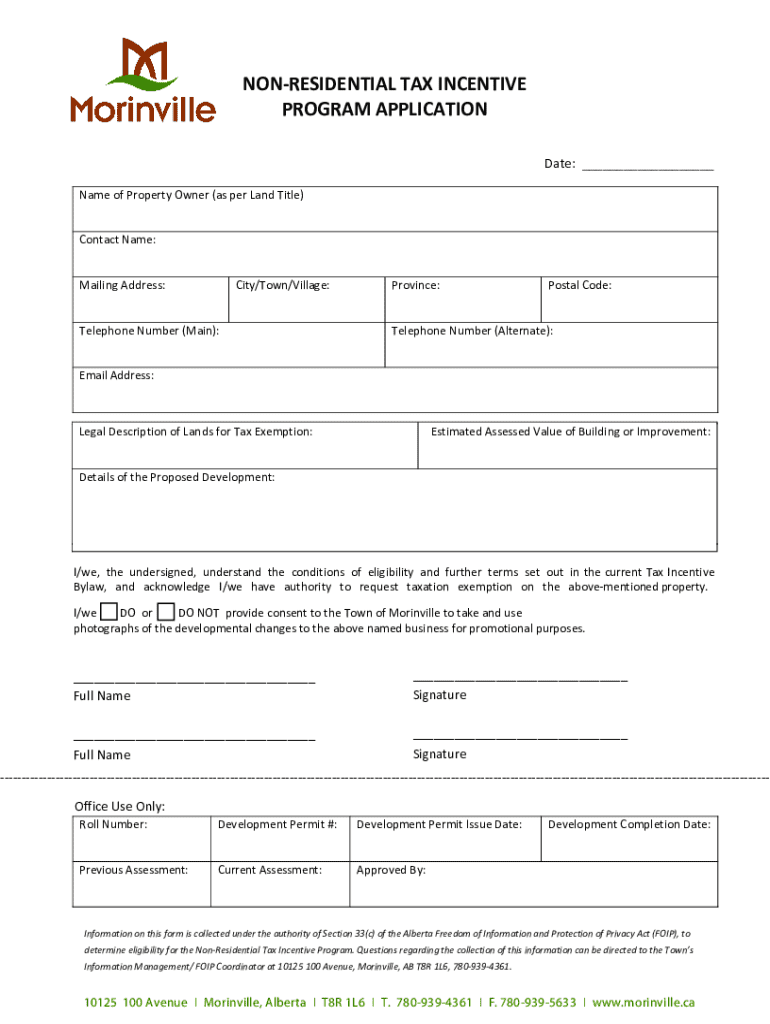

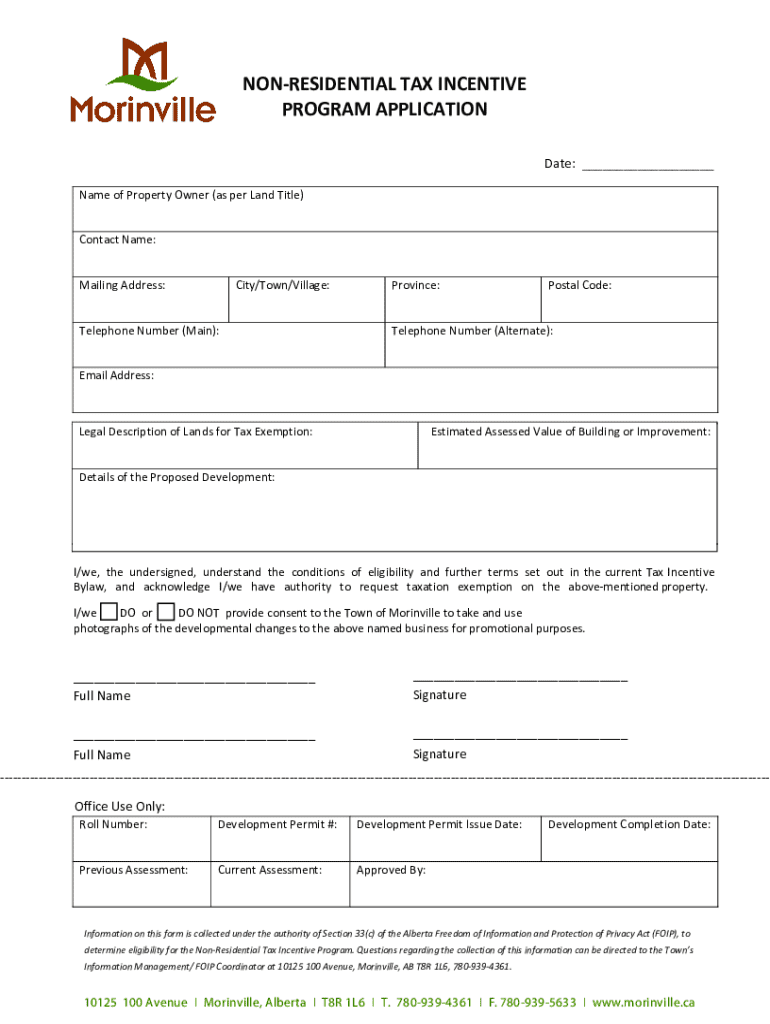

Comprehensive Guide to the Non-Residential Tax Incentive Program Form

Overview of the non-residential tax incentive program

Non-residential tax incentives are crucial mechanisms designed to stimulate economic growth by supporting local businesses. These incentives often come in the form of tax exemptions or reductions, aimed at reducing the financial burden on businesses that qualify. They play a vital role in attracting new enterprises and retaining existing ones, thus contributing to a thriving economic environment.

The objectives of these programs include fostering job creation, enhancing community appeal, and driving investments. By participating, local businesses can significantly reduce their operating costs, allowing them to reinvest in their operations and contribute positively to the local economy. The key benefits for participating businesses often include lower property taxes, increased cash flow, and the ability to invest savings into growth initiatives.

Eligibility criteria for the non-residential tax incentive

To qualify for the non-residential tax incentive program, certain eligibility criteria must be met. Generally, businesses engaged in commercial or industrial development activities are considered for these incentives. This includes retail establishments, manufacturing facilities, and service providers that hold a physical location within the designated area.

Factors influencing eligibility also encompass property types, the scale of investment, and the stage of development. For instance, new constructions, property renovations, or expansions could qualify for the program. Essential documentation includes proof of business registration, financial statements, and plans outlining the intended improvements or developments, which substantiate the claim for eligibility.

Details of the non-residential tax incentive

Understanding how exemptions work is critical for businesses applying for this program. Typically, exemptions can be calculated based on a percentage of the property tax owed, dependent on certain conditions and the specific incentive structure in place. The program may cover various portions of property taxes, primarily focused on real estate taxes assessed on commercial or industrial properties.

The duration of the exemption varies according to program specifics but commonly ranges from 5 to 10 years. Renewal processes for these tax incentives often require businesses to demonstrate continued adherence to program requirements and performance metrics. This ensures ongoing compliance and accountability in the benefits offered.

Step-by-step application process

The application process for the non-residential tax incentive program can be broken down into clear steps, making it manageable for businesses. First, preparing for the application is essential. This includes gathering required documents such as business licenses, financial records, and any project proposals. Engaging in an initial consultation with local officials can provide valuable insights into the requirements and improve the quality of your application.

Completing the application form

When it comes to filling out the non-residential tax incentive program form, it's beneficial to break it down section by section. The form typically requires details about the business, the nature of the investment, and how that aligns with eligibility criteria. Utilizing interactive tools available at pdfFiller can streamline this process, enabling easy editing, signing, and document management.

Submitting the application

Once completed, businesses can submit their applications through various methods. Online submissions are increasingly popular due to their convenience, but in-person submissions may also be accepted depending on local regulations. It’s critical to pay attention to important deadlines for submission, as missed deadlines could result in delayed processing or disqualification from the program.

Understanding the pre-application meeting

A pre-application meeting can significantly enhance the chances of a successful application. The primary purpose of this meeting is to provide applicants clarity on the requirements and the program’s expectations. During this discussion, businesses can confirm their understanding of the guidelines and present any preliminary documentation for feedback.

Expect to discuss various topics during this meeting, including the eligibility criteria and specific project implementation timelines. It’s also important to prepare a list of questions to clarify uncertainties, ensuring businesses leave the meeting informed and ready to proceed with the application confidently.

Agreement terms and conditions

Participating in the non-residential tax incentive program comes with specific terms and conditions that businesses must adhere to. An overview of the agreement usually covers the expectations placed on both the business and the municipality providing the incentive. Responsibilities such as reporting on development progress and maintaining compliance with local codes are critical components of the agreement.

Cancellation of the exemption is also an important aspect to consider. Should a business fail to meet the outlined conditions or if significant changes occur to the business operation, the conditions and procedures for cancellation should be clearly understood to avoid potential penalties.

Common questions about the non-residential tax incentive program

Frequently asked questions

Many questions surround the non-residential tax incentive program, with common inquiries regarding what types of developments qualify under the commercial and industrial categories. It’s important to note that the exemption traditionally applies to both the buildings and the land, providing a more significant financial relief for businesses. Additionally, applicants should understand the implications if they do not meet the outlined conditions, as non-compliance can lead to loss of the incentive and financial penalties.

Resources for clarifications

To assist businesses in navigating the program, various resources can provide further clarification. Local government websites typically house valuable information, and contacting program representatives directly can yield personalized assistance. Networking with other local businesses that have succeeded in the program can also provide insider knowledge.

Tools for managing your application

Managing your non-residential tax incentive program form can be streamlined by utilizing tools such as pdfFiller. This platform not only allows users to edit and eSign documents easily but also facilitates collaboration, making it easier to share application materials amongst team members. A step-by-step guide within pdfFiller can assist users in navigating the various document management features.

Staying organized is key throughout the application process. Users can set reminders for deadlines, maintain checklists of required documents, and store all application materials in one accessible location. Effective document management reduces stress and increases the likelihood of a successful application.

Testimonials and success stories

Numerous businesses have thrived thanks to the non-residential tax incentive program. These success stories highlight the positive impacts on local economies, showcasing how businesses have leveraged tax savings to improve operations, expand their workforce, and invest in community projects. For instance, recent testimonials indicate that companies effectively utilized the program to double their revenue while creating new job opportunities in their communities.

Moreover, examples illustrate how pdfFiller has streamlined the experience for many applicants. By facilitating quick document preparation and electronic signatures, businesses have reported improved efficiency during their application processes, allowing them to focus more on strategic growth rather than administrative tasks.

Final thoughts on maximizing the non-residential tax incentive benefits

To maximize the benefits received from the non-residential tax incentive program, businesses should ensure they remain compliant with all program stipulations. Regular check-ins with local government representatives can enhance compliance efforts and provide valuable updates on any program changes. Understanding and adapting to shifts in local tax regulations will also play a critical role in leveraging the amount of tax relief received.

Staying engaged with local government resources ensures that businesses remain informed about upcoming opportunities related to tax incentives or economic development programs. This proactive approach not only safeguards businesses during the incentive period but can also open up additional avenues for funding and support.

Get connected

To enhance your understanding and navigate the non-residential tax incentive program effectively, personalized support is available through local economic development offices. Businesses are encouraged to explore other resources offered by pdfFiller, which can assist in various document-related tasks and more general business needs.

Moreover, participating in community engagement opportunities can foster relationships with local leaders and other businesses. Building these connections not only promotes collaboration but strengthens the local economic landscape, fostering a supportive environment for all.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in non-residential tax incentive program without leaving Chrome?

How can I edit non-residential tax incentive program on a smartphone?

How do I complete non-residential tax incentive program on an iOS device?

What is non-residential tax incentive program?

Who is required to file non-residential tax incentive program?

How to fill out non-residential tax incentive program?

What is the purpose of non-residential tax incentive program?

What information must be reported on non-residential tax incentive program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.