Get the free Ftb 3534

Get, Create, Make and Sign ftb 3534

How to edit ftb 3534 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftb 3534

How to fill out ftb 3534

Who needs ftb 3534?

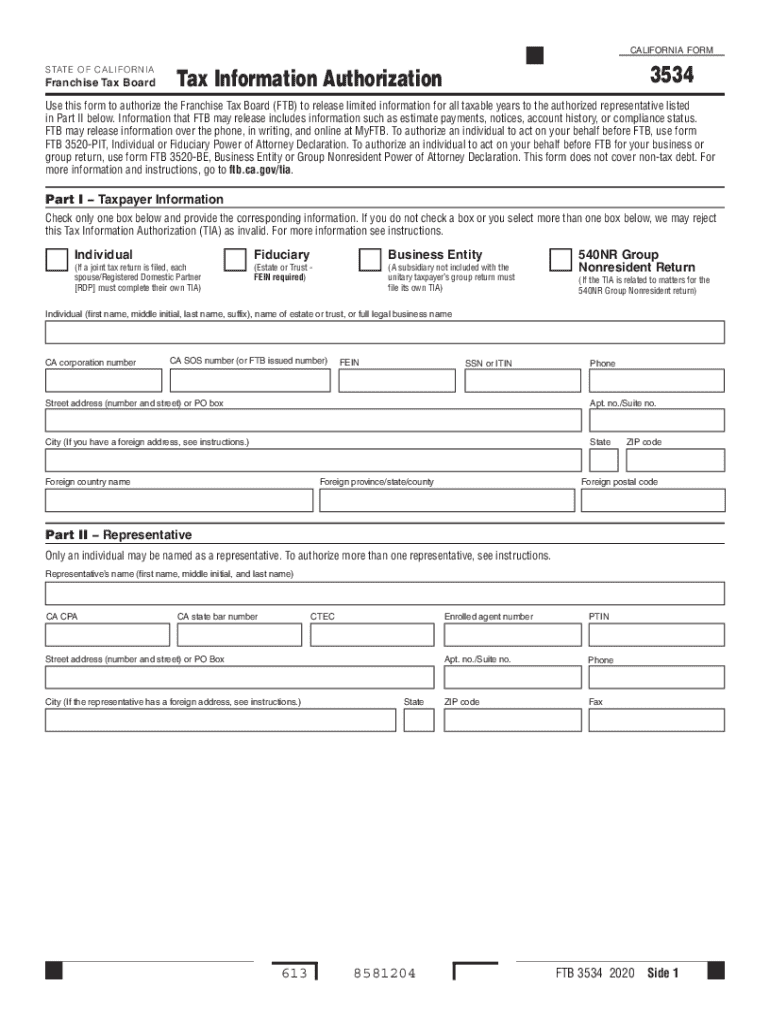

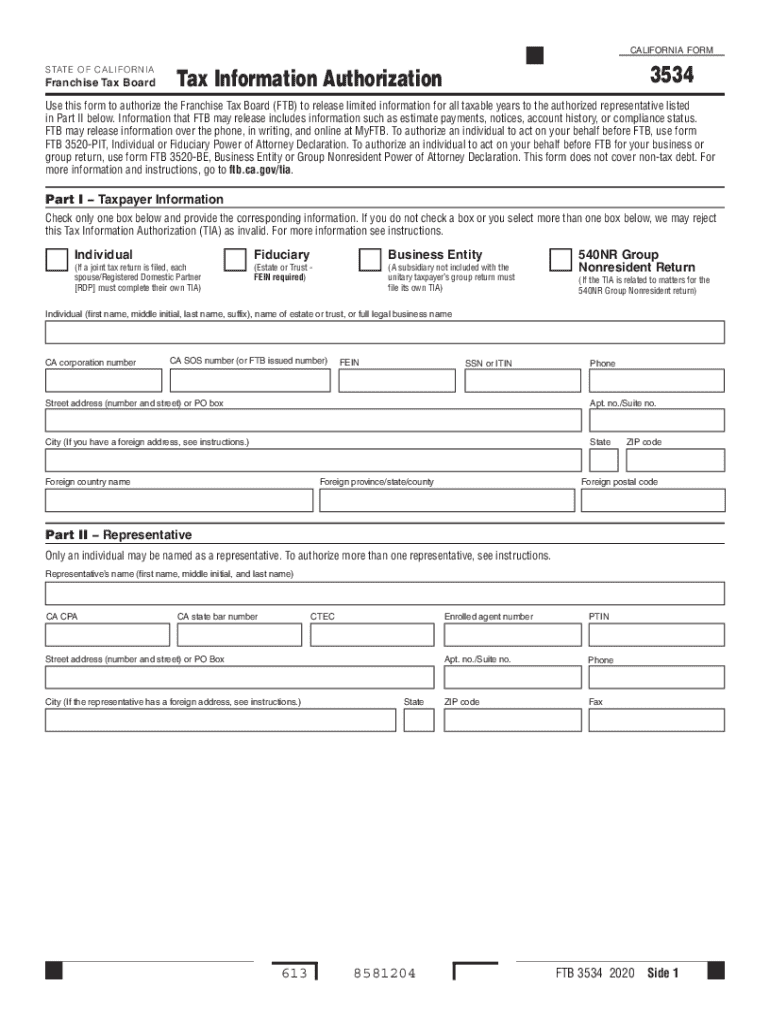

FTB 3534 Form: A Comprehensive Guide for Tax Information Authorization

Overview of FTB 3534 Tax Information Authorization

The FTB 3534 form, officially known as the Tax Information Authorization, is a critical document used in the California tax system. This form allows taxpayers to authorize a third party, often a tax professional, to access their tax information and represent them before the California Franchise Tax Board (FTB). Its purpose is to streamline communication between the FTB and the authorized representative, ensuring that tax-related matters are handled efficiently and accurately.

Utilizing the FTB 3534 form is essential in navigating the complexities of tax processes. By officially designating a representative, taxpayers can ensure that their interests are effectively managed—especially during audits or any correspondence that requires expert handling. It also provides peace of mind, knowing that qualified professionals can access pertinent information to advocate on their behalf.

This form is particularly important for individuals who may not be well-versed in tax regulations or those who are too busy to manage their tax affairs personally. It serves a target audience that includes individual taxpayers, business owners, fiduciaries, and estate representatives looking for clarity in their interactions with tax authorities.

Key features of the FTB 3534 form

The FTB 3534 form is concise yet comprehensive, requiring specific information to ensure proper authorization. The essential details include taxpayer information and the representative’s credentials. This section ensures that the FTB can verify the identities of both parties involved in the authorization.

The form consists of several sections, each playing a crucial role in the authorization process. In particular, taxpayers must provide personal identifying details, such as their full name, address, Social Security Number (SSN), and tax identification numbers, along with the representative's information, including their name, address, and professional qualifications.

Detailed instructions on filling out the FTB 3534 form

Filling out the FTB 3534 form requires careful attention to detail. Here’s a step-by-step guide to assist taxpayers in completing the form correctly.

1. **Part I – Taxpayer Information**: Begin with entering your personal information, including name, address, and Social Security Number. If you are acting on behalf of a business or fiduciary entity, include the name of the business, its tax identification number, and any relevant fiduciary details.

2. **Part II – Designation of Representative**: Here, select the individual or entity that you are authorizing. Ensure you provide their full contact information and check that it aligns with their qualifications. An important aspect of this section is the required signature of both the taxpayer and the authorized representative; make sure both parties sign to validate the authorization.

3. **Part III – Access Permissions**: It is crucial to specify the level of access you wish to grant your representative. This section allows you to decide whether the representative can have complete access to your MyFTB account or limited access based on particular tax matters.

4. **Part IV – Signature Line**: After completing the form, both the taxpayer and the representative must sign this section. This finalizes the authorization, allowing the FTB to share tax information with the designated representative.

Important information regarding FTB 3534 form

Understanding the intricacies of the FTB 3534 form also involves grasping the duration and revocation of the authorization granted. Typically, the authorization does not expire unless explicitly stated or revoked by the taxpayer. If changes in representation occur—due to circumstances such as the death of the taxpayer or representative—immediate steps must be taken to notify the FTB.

Moreover, file the completed form with the FTB upon completion. Submissions can be made by mail or electronically, depending on the nature of the authorization. If your situation changes or if either party involved becomes incapacitated, professionals must understand how to promptly handle and communicate such events to maintain compliance and avoid penalties.

FAQs about FTB 3534 form

Addressing common queries regarding the FTB 3534 form can facilitate better understanding among users. A frequently asked question is, 'What should I do if I want to revoke the authorization?' You have the right to revoke authorization at any given time by submitting a written request to the FTB.

Another common question is, 'Can my representative access my tax information without this form?' The answer is no; only through a duly completed and signed FTB 3534 form can your representative obtain access to your tax details. Furthermore, many users often wonder about the confidentiality of shared information—a point that is particularly critical considering privacy laws.

Interactive tools and resources

Navigating the FTB 3534 form becomes easier with the aid of interactive tools and resources available at pdfFiller. They offer an online platform where users can fill out the form conveniently. Features such as interactive filling fields minimize errors by ensuring that the information is correctly aligned.

Utilizing cloud-based document management also provides added benefits, such as access to necessary forms regardless of location. This flexibility allows users to complete, edit, and store their forms on-the-go, making tax compliance less daunting. Additionally, pdfFiller offers options for eSigning and collaborative editing, significantly enhancing the user experience.

Related documents and forms

When dealing with taxes, it’s crucial to be aware of related documents and forms available alongside the FTB 3534 form. Commonly used forms include the FTB 540, California Resident Income Tax Return, and the FTB 3520, which deals with Power of Attorney authorization. Each of these forms serves specific purposes within the tax ecosystem.

To facilitate easy access, pdfFiller provides downloadable versions of the FTB 3534 form and links to other pertinent FTB forms and notices, streamlining the entire process for taxpayers.

Important contacts and support

For any inquiries regarding the FTB 3534 form, taxpayers can easily reach FTB representatives via their helpline or customer service email. Engaging with FTB support can clarify any doubts about the form and its processes.

pdfFiller also provides a wealth of support resources. Their platform includes troubleshooting tips for common issues encountered when filling out the form. Each user can access these resources conveniently through their account, aiding in the completion of documents without frustration.

Final thoughts on the importance of document management

Efficient document management plays a vital role in tax compliance. Proper submissions and timely access to information can significantly reduce stress during tax season. By utilizing the FTB 3534 form effectively, taxpayers can ensure that their interests are protected with valid representations, minimizing potential issues.

At pdfFiller, the commitment to empowering users for seamless document handling is paramount. By providing advanced tools and resources tailored for forms like the FTB 3534, they set their users on a course toward successful tax submissions, allowing taxpayer representatives to focus on providing strategic insights rather than getting bogged down with paperwork.

About pdfFiller

pdfFiller is a leading document management solution aiming at simplifying the creation, editing, and signing of PDF documents. The company's mission revolves around ensuring users can handle their essential paperwork efficiently without encountering the hassles often associated with document transactions.

The commitment to quality and accessibility in their offerings has positioned pdfFiller as a reliable partner for individuals and businesses alike. Their platform integrates intuitive features, helping users manage forms such as the FTB 3534 effortlessly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ftb 3534 without leaving Google Drive?

How do I complete ftb 3534 online?

How do I fill out the ftb 3534 form on my smartphone?

What is ftb 3534?

Who is required to file ftb 3534?

How to fill out ftb 3534?

What is the purpose of ftb 3534?

What information must be reported on ftb 3534?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.