Get the free Additional Insured Application

Get, Create, Make and Sign additional insured application

How to edit additional insured application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out additional insured application

How to fill out additional insured application

Who needs additional insured application?

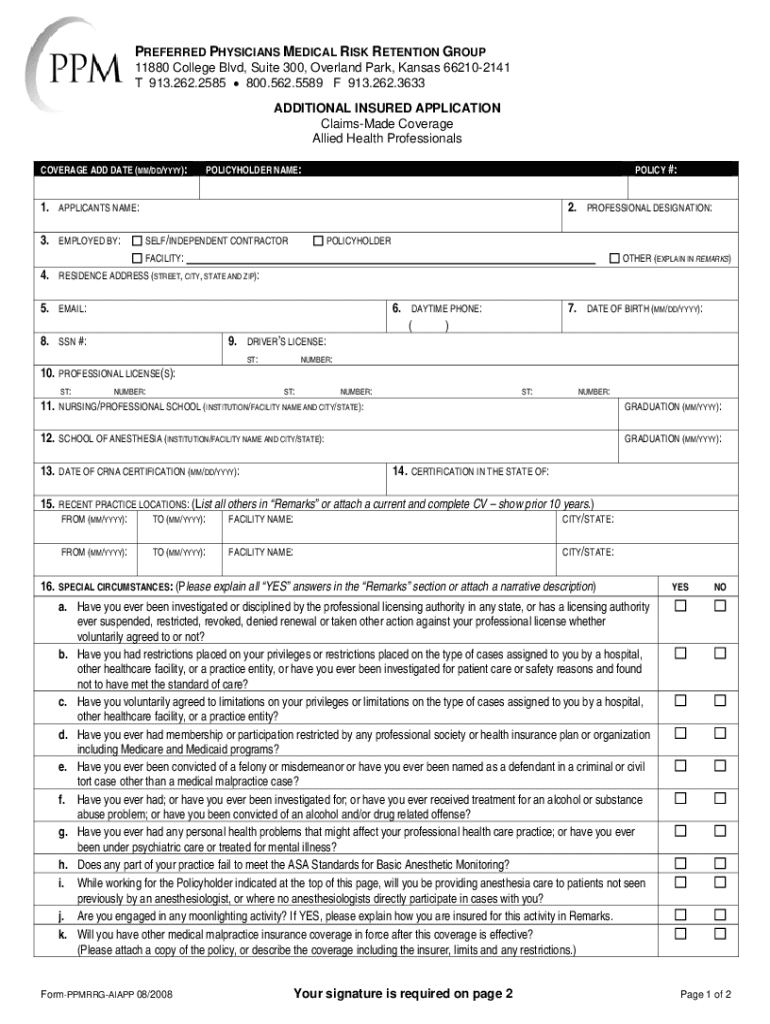

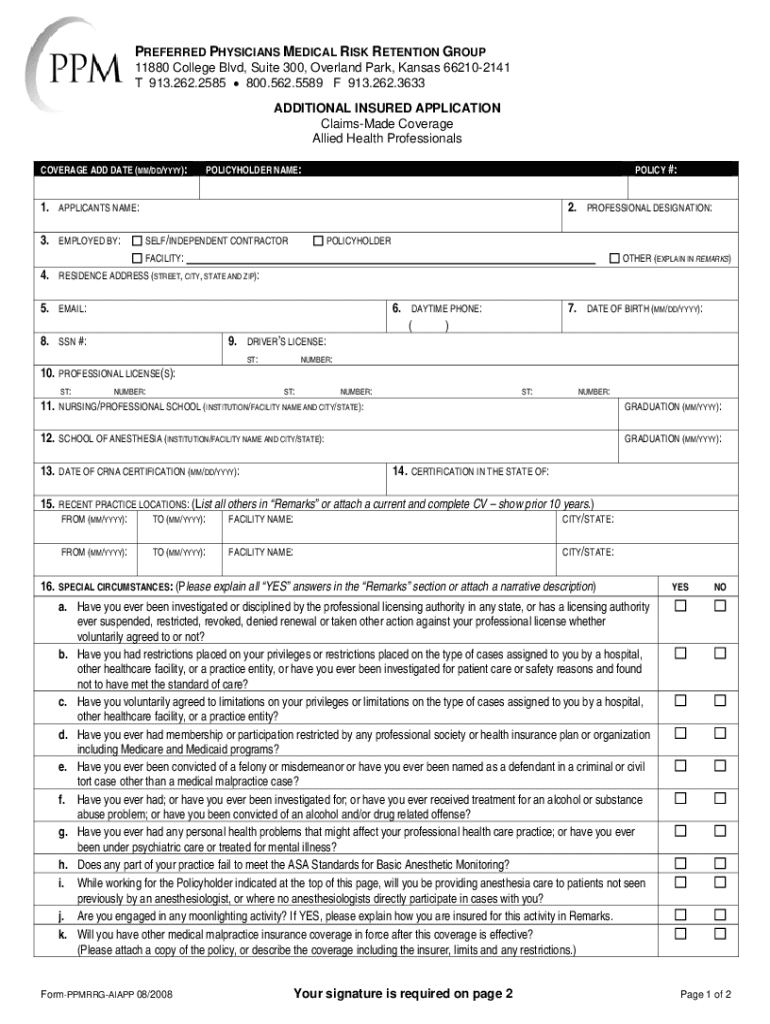

A comprehensive guide to the additional insured application form

Understanding the additional insured application form

An additional insured application form is a crucial document within liability insurance frameworks. Its primary function is to extend coverage to a third party under an existing insurance policy, typically for liability claims. This status is essential as it offers an additional layer of protection for the specified party, ensuring they are not left vulnerable in the event of lawsuits or claims that may arise from work performed by the insured party.

The importance of additional insured status cannot be overstated. Often held by contractors, property owners, and businesses collaborating on projects, it significantly reduces the financial exposure in cases of claims or legal challenges. In essence, having someone named as an additional insured means that they can benefit from the liability coverage provided by the primary contractor's insurance.

Who needs an additional insured application form?

Various scenarios necessitate the need for an additional insured application form. One of the most common situations arises from construction projects, where general contractors often require subcontractors to add them as additional insureds on their insurance policies. This practice protects the general contractor from any liabilities resulting from the subcontractor's work.

Similarly, property owners frequently need an additional insured status when leasing their property to business entities. This arrangement shields property owners from legal claims arising from accidents or incidents occurring on their premises. Thus, businesses entering contracts that involve shared responsibilities or risks should carefully consider who might require this added coverage.

The types of entities that can be added as additional insured can range from individuals to corporations, including other organizations involved in the project or contract. Common examples include a subcontractor adding a general contractor, a tenant adding a property owner, or a supplier adding a major buyer in a commercial agreement.

How to complete the additional insured application form

Completing the additional insured application form can be straightforward with a systematic approach. Here’s a step-by-step guide to ensure you provide all necessary information effectively and accurately.

Utilizing interactive tools such as those available on pdfFiller can greatly simplify the completion process. The platform allows users to edit, sign, and manage their documents online, reducing errors and enhancing collaboration.

Managing and submitting your additional insured application

Once you have completed the additional insured application form, the next step is submission. Depending on your insurer's requirements, this can often be done through several convenient methods.

After submission, anticipate a confirmation email or message from your insurer. Processing times can vary, but typically, you should expect to hear back within a week or two. Any potential follow-up actions may require additional clarifications or adjustments if your application raises questions from the insurer.

Frequently asked questions about additional insured application forms

The additional insured application form raises various concerns and misconceptions. Some common inquiries include the timeline for processing and the implications of adding multiple additional insureds to a policy.

Processing time can differ based on the insurer, but typically, applicants can expect a response within a few business days to weeks. If multiple entities are added as additional insureds, it is crucial to understand that each one may require separate agreements or endorsements, which could complicate the process.

Best practices for using the additional insured application form

To ensure compliance and legal safety when dealing with additional insured application forms, understanding your insurance policy is paramount. Familiarize yourself with the terms and limitations of your liability insurance to minimize risks.

Additionally, maintaining organized documentation of your insurance agreements, communication with insurers, and all endorsements will save time and mitigate confusion during any claims process. Engaging in effective communication with your insurer is also essential.

Real-world scenarios and case studies

Understanding the significance of being an additional insured can be illustrated through real-world examples. In one case, a construction company faced a lawsuit from a tenant in a building they were renovating. Because the general contractor had added the building owner as an additional insured on their policy, the insurer covered the claim, protecting both parties from crippling financial repercussions.

In another example, a supplier faced a defective product claim resulting in injuries. The supplier had added the distributor as an additional insured, which allowed the distributor’s insurance to cover the costs involved in the lawsuit. Such situations emphasize the advantages of securing additional insured status not only for claims protection but also for fostering positive business relationships.

Conclusion of the application journey

Navigating through the additional insured application process may seem daunting, but being informed can streamline the experience considerably. It’s essential to remain aware of what to monitor post-application, including keeping track of communication with your insurer and reviewing the coverage details meticulously once they have processed your request.

Understanding the intricacies of the additional insured application form is crucial in successfully managing your liability exposure. With the right resources and comprehensive understanding, you can confidently navigate the insurance landscape and effectively protect your interests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in additional insured application?

How do I edit additional insured application in Chrome?

Can I create an electronic signature for the additional insured application in Chrome?

What is additional insured application?

Who is required to file additional insured application?

How to fill out additional insured application?

What is the purpose of additional insured application?

What information must be reported on additional insured application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.