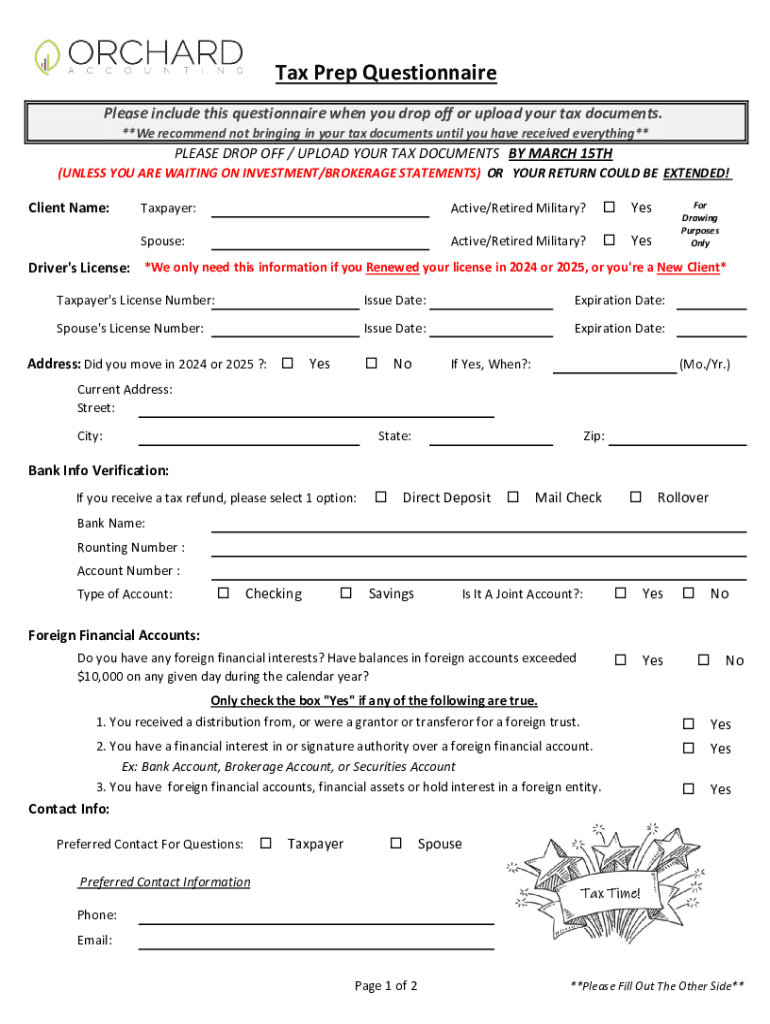

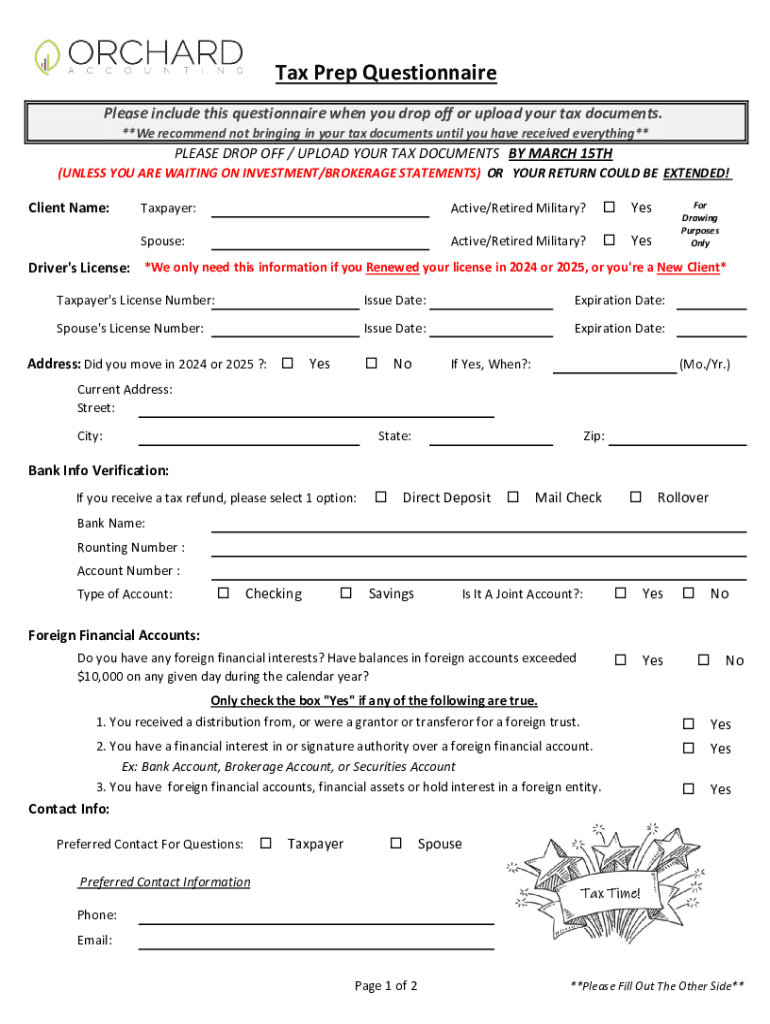

Get the free Tax Prep Questionnaire

Get, Create, Make and Sign tax prep questionnaire

How to edit tax prep questionnaire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax prep questionnaire

How to fill out tax prep questionnaire

Who needs tax prep questionnaire?

Tax prep questionnaire form: A comprehensive guide

Understanding the importance of a tax prep questionnaire

The tax prep questionnaire form plays a fundamental role in the tax preparation process. This structured document helps both individuals and businesses gather essential financial data, simplifying the often complex job of filing taxes. By utilizing a tax prep questionnaire, taxpayers can ensure that they provide their tax preparers with accurate and comprehensive information, reducing the risk of errors and potential audits.

The benefits of employing a tax prep questionnaire are manifold. For individuals, it prompts users to think critically about their financial situation and ensures they capture all potential income sources and deductions. For businesses, a thorough questionnaire can help compile all relevant financial data necessary for reporting, enhancing compliance while maximizing eligible credits and deductions.

It's crucial to be aware of the common tax-related documents that should accompany the questionnaire, such as W-2s, 1099 forms, interest statements, and previous tax returns. Together with the questionnaire, these documents create a comprehensive picture of a taxpayer's financial landscape.

Key components of a tax prep questionnaire

A well-structured tax prep questionnaire form is centered around specific sections that gather vital details. The personal information section is typically the first component, requiring data such as the taxpayer's name, address, and contact details. It’s important to include either a Social Security Number (SSN) or a Taxpayer Identification Number (TIN) to avoid any confusion in identification.

Filing status is another critical component. This section determines whether the taxpayer is single, married filing jointly, married filing separately, or head of household. Accurate identification of filing status can significantly affect tax rates and available credits.

Lastly, capturing comprehensive information about income sources is crucial. Taxpayers should detail all forms of income, including employment income, investment earnings, business profits, and rental revenue. This section should not be underplayed, as all income must be reported to ensure compliance with tax regulations.

Deductions and credits: What to include in your questionnaire

Deductions and credits can substantially lower a taxpayer's liability, making it necessary to address these in the questionnaire. Common deductions that individuals may qualify for include mortgage interest, state and local taxes, charitable contributions, and medical expenses.

Key questions regarding credits should also be included. For instance, the Child Tax Credit and Earned Income Tax Credit are crucial for qualifying households and can result in significant savings. Additionally, education-related credits, such as the American Opportunity Credit or Lifetime Learning Credit, should also be considered, as many taxpayers may be unaware of their eligibility.

Assets, liabilities, and other essential financial information

Documenting assets accurately helps create a full financial overview for tax filing. Important assets to list in your questionnaire include real estate, vehicles, and investment accounts. Clearly stating these can lead to deductions and credits related to property taxes or other asset-related benefits.

Conversely, understanding liabilities is equally vital. It's essential to disclose mortgages, loans, and credit card debts as they impact overall financial health. Listing prior year’s tax returns can also be beneficial for context and reference, helping taxpayers to ensure that they do not miss any reoccurring details.

Asking the right questions: A comprehensive question breakdown

Creating an effective tax prep questionnaire is about asking the right questions. Sample questions might include: 'What is your total employment income?' and 'Do you have any investment income or capital gains?' Consider adding questions tailored to your financial landscape, such as 'Have you received any government assistance this year?' or 'What is your total credit card debt?'

Customization is key. Depending on individual circumstances, some may require additional pointers such as self-employment income or contributions to retirement accounts. It's crucial to ensure that all financial aspects are covered thoroughly.

How to use the tax prep questionnaire effectively

Utilizing the tax prep questionnaire form effectively involves careful preparation. Begin by gathering all necessary documents, including W-2 forms, 1099s, and previous tax returns. This will streamline the filling-out process and enhance accuracy.

Next, fill out each section systematically. Take your time and ensure that all information is entered correctly. Once completed, review the questionnaire for accuracy. Double-checking common omissions, such as missing income or deductions, can prevent complications down the line.

Leveraging technology for your tax prep questionnaire

In the age of technology, leveraging electronic document solutions can make tax prep more efficient. pdfFiller's cloud-based solutions offer notable benefits, allowing users to fill out and edit their tax prep questionnaire forms seamlessly. These digital tools simplify managing such data electronically.

Interactive tools available on pdfFiller provide capabilities for easy editing and document management. Users can access pre-made templates, customize their questionnaires, and securely save their progress online. To fill out the tax prep questionnaire form online, users can simply log in, select the form, and begin entering their information in a user-friendly interface.

Collaborating with your tax professional

Once your questionnaire is complete, sharing the document securely with your tax professional is critical. pdfFiller allows for secure sharing, ensuring that sensitive information remains private. After sending your questionnaire, set up a meeting with your tax preparer.

During this meeting, you can expect to discuss your financial situation in depth. Be prepared to clarify any points from your questionnaire and answer questions regarding any discrepancies. It's important to remember to avoid common pitfalls, such as withholding pertinent financial information that could impact your tax scenario.

Finalizing and submitting your tax prep questionnaire

The final step before submitting your tax prep questionnaire is double-checking for errors. Mistakes in a tax questionnaire can lead to significant issues, including penalties and audits. Therefore, take a meticulous approach to ensure all information is correct.

Once confirmed, utilizing pdfFiller's platform, you can digitally sign and submit your documents effortlessly. After submission, save confirmations and copies of all agreements and documents, as this is crucial should any questions arise in the future.

Ongoing document management and accessibility

Effective tax prep doesn't end with submitting your questionnaire. Organizing and storing tax documents year-round is vital for a streamlined tax season in the future. Utilizing pdfFiller aids in easy access and management of tax prep materials, allowing users to store documents securely and retrieve them as needed.

Preparing in advance for the next tax season is essential. Keeping track of financial changes, maintaining important documents, and regularly updating your questionnaire will make the process more manageable in subsequent years. Regular audits of your documents, combined with pdfFiller’s tools, create a proactive tax preparation strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the tax prep questionnaire in Chrome?

How do I fill out the tax prep questionnaire form on my smartphone?

How do I fill out tax prep questionnaire on an Android device?

What is tax prep questionnaire?

Who is required to file tax prep questionnaire?

How to fill out tax prep questionnaire?

What is the purpose of tax prep questionnaire?

What information must be reported on tax prep questionnaire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.