Get the free Business Valuation Review Checklist

Get, Create, Make and Sign business valuation review checklist

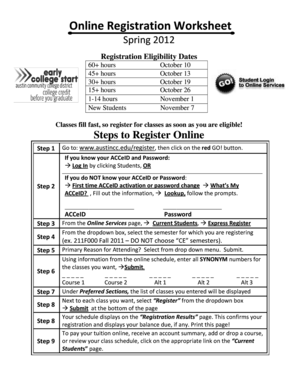

Editing business valuation review checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business valuation review checklist

How to fill out business valuation review checklist

Who needs business valuation review checklist?

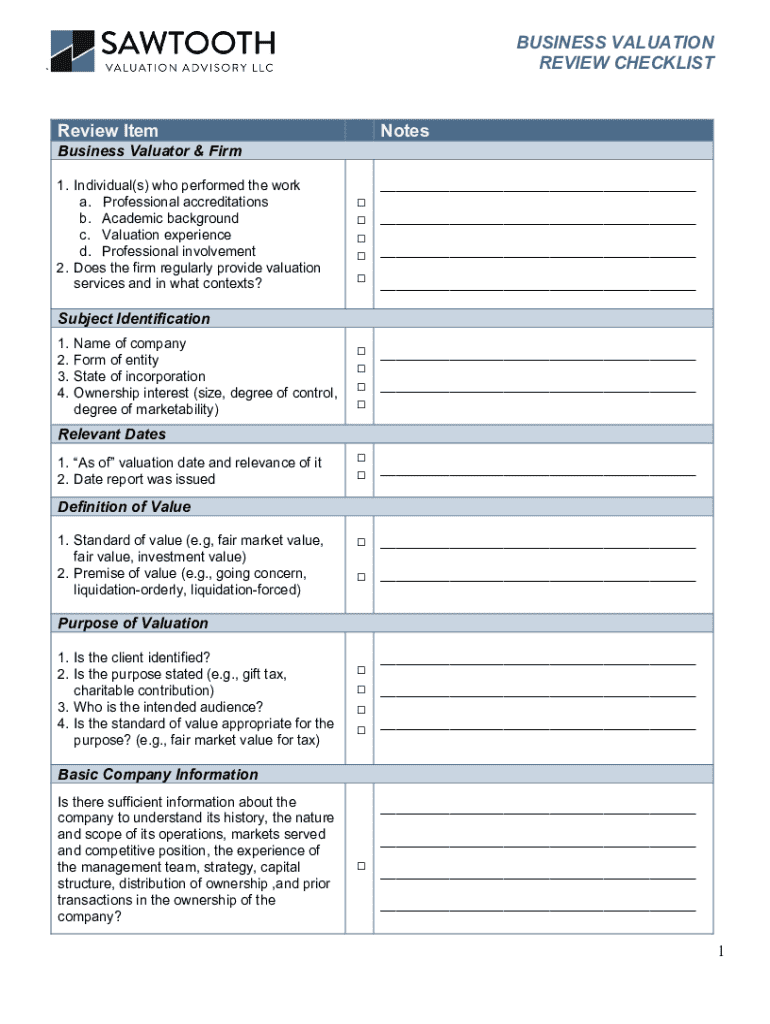

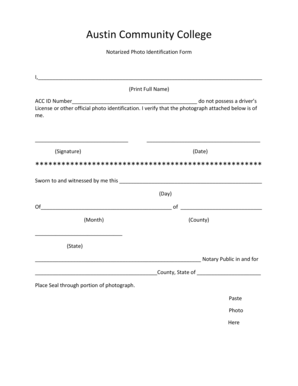

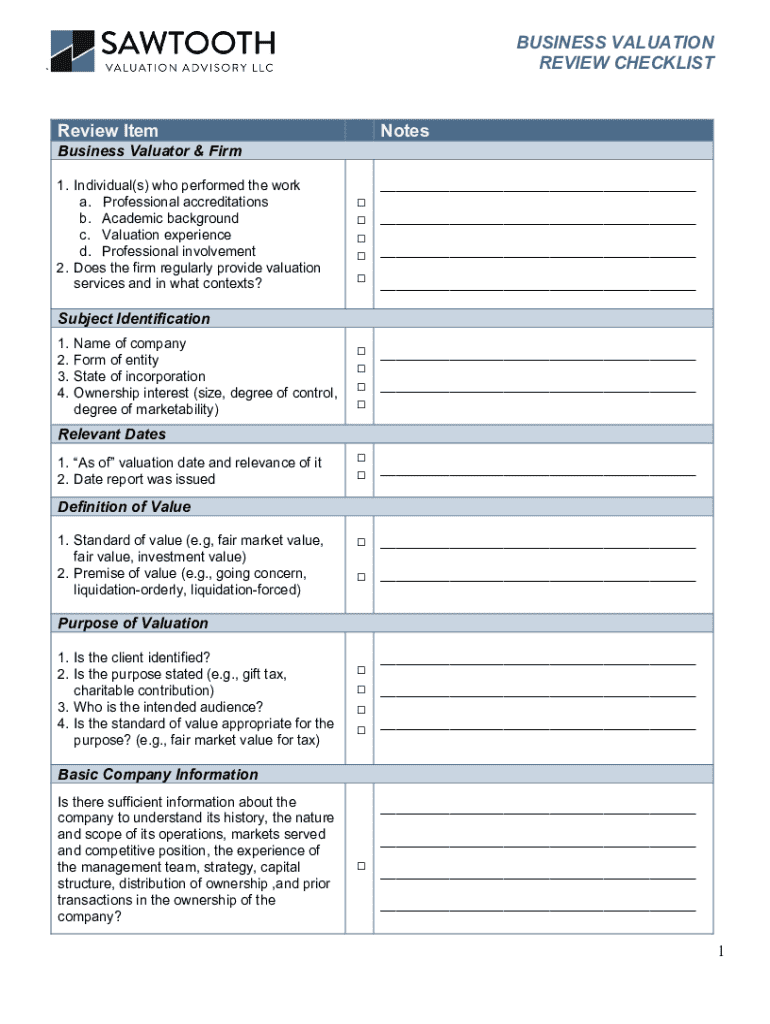

Business Valuation Review Checklist Form: A Comprehensive Guide

Overview of business valuation review

Business valuation is the process of determining the economic value of a business or company. It involves evaluating a company’s assets, liabilities, earnings, and competitive position. The objective is to arrive at an accurate assessment that reflects the market value under various scenarios. Utilizing a business valuation review checklist form can streamline this process by ensuring that all necessary information is gathered systematically.

Importance of a business valuation review

Conducting a business valuation review is crucial for multiple reasons. For business owners, it can clarify their financial standing and help in strategic planning. For potential buyers, understanding the value of a business can aid in negotiations. Furthermore, accurate valuations are vital during mergers, acquisitions, or even partnership formations, ensuring that all parties are informed and protected during the decision-making process.

Business valuation checklist essentials

A comprehensive business valuation checklist should encompass three primary categories: financial information, company information, and market information. Each element plays a crucial role in presenting a complete picture of the company’s worth.

Step-by-step guide to completing the checklist

Completing your business valuation checklist involves a series of structured steps that lead to a thorough evaluation.

Interactive tools for document management

Businesses increasingly need efficient document management systems to streamline their valuation processes. pdfFiller stands out with interactive tools that support comprehensive document workflows.

Common challenges and solutions in business valuation

Business valuation is not without its challenges. Many companies face obstacles that can complicate their evaluation efforts.

Specialized checklists

Depending on the purpose of the valuation, specialized checklists can provide focused guidance for both buying and selling businesses.

Necessary documents for a business valuation

Accurate documentation is the backbone of a solid business valuation. Here are critical documents you should gather.

Using pdfFiller for efficient document management

pdfFiller is a powerful tool for businesses looking to enhance their document management processes, especially during valuation.

Real-world application: case studies and examples

Successful business valuations often come from systematic processes, and implementing a checklist can lead to significant outcomes.

FAQs: frequently asked questions

Addressing common queries can demystify the process of business valuation.

Contact information for support

For any assistance with business valuation or to optimize document workflows, reach out to our support team.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business valuation review checklist for eSignature?

How do I edit business valuation review checklist online?

How do I fill out business valuation review checklist using my mobile device?

What is business valuation review checklist?

Who is required to file business valuation review checklist?

How to fill out business valuation review checklist?

What is the purpose of business valuation review checklist?

What information must be reported on business valuation review checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.