Get the free Tangible Personal Property Listing

Get, Create, Make and Sign tangible personal property listing

How to edit tangible personal property listing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tangible personal property listing

How to fill out tangible personal property listing

Who needs tangible personal property listing?

A Comprehensive Guide to the Tangible Personal Property Listing Form

Overview of tangible personal property (TPP)

Tangible personal property (TPP) refers to physical items that can be touched, seen, and valued, which include inventory, machinery, furniture, and equipment. Understanding and accurately reporting TPP is crucial for individuals and businesses alike, as this impacts property tax calculations and ensures compliance with local regulations. TPP plays a significant role in assessing a business's operational capabilities and financial health.

It is important to delineate between tangible and intangible property. Tangible assets are physical entities, whereas intangible assets include patents, copyrights, trademarks, and goodwill. This distinction is critical for reporting purposes, as each type of property is treated differently in finance and taxation. Furthermore, numerous regulations govern TPP, including how it should be reported for tax assessments and audits. Failing to adhere to these can lead to financial penalties.

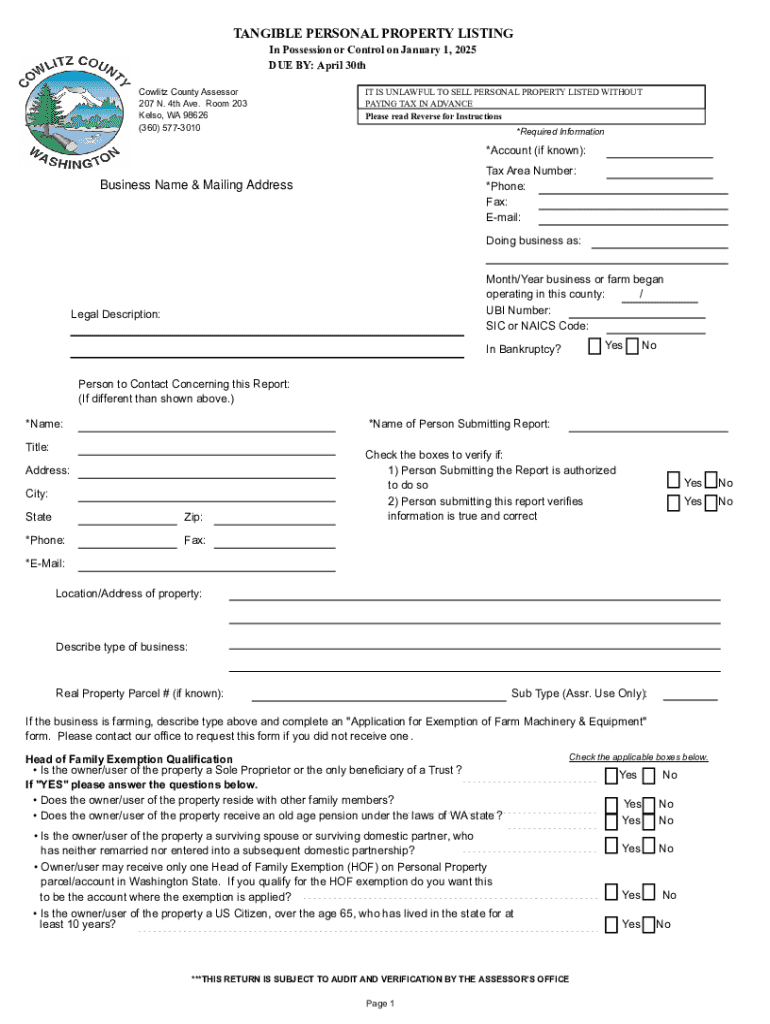

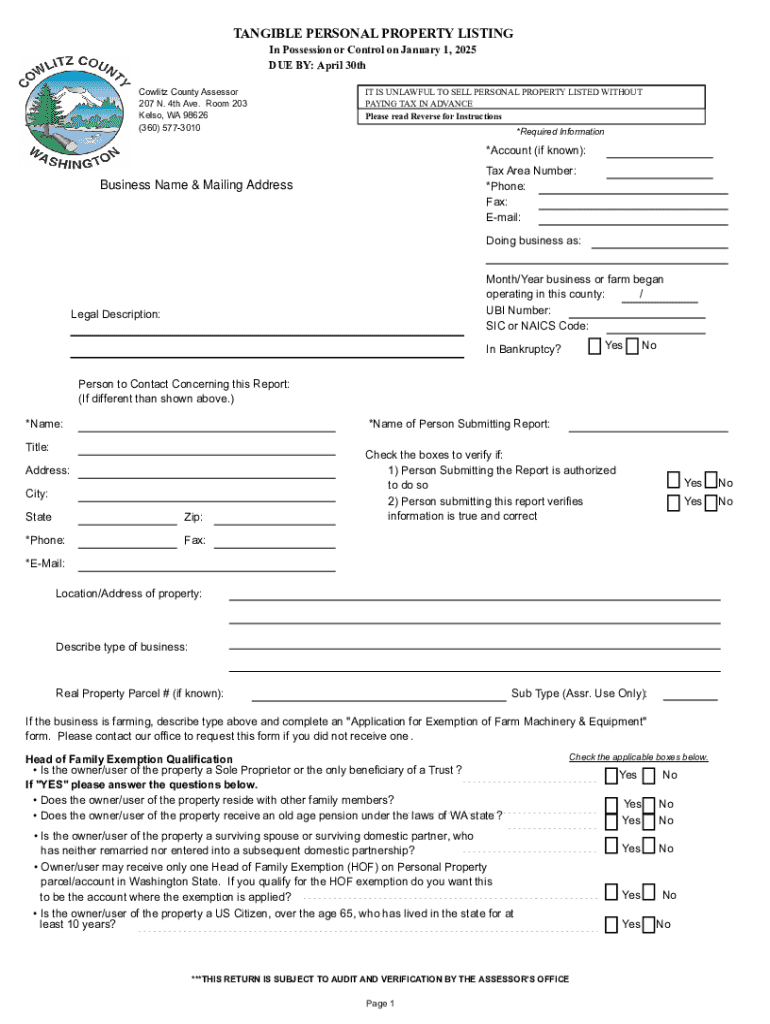

Understanding the tangible personal property listing form

The tangible personal property listing form serves as the official documentation for property owners to declare their tangible assets to local tax authorities. This standardized form helps local governments assess property taxes accurately, ensuring that businesses pay a fair amount based on their holdings. The primary goal of this form is to gather data that will facilitate the systematic valuation of TPP.

Key information required on the form typically includes basic business information, a detailed description of the property being listed, and valuation details. Accurate completion of these fields is essential for all stakeholders: it provides local governments with the necessary data and helps property owners avoid potential conflicts or issues with tax assessments.

How to access and fill out the TPP listing form

To begin the process of submitting your tangible personal property listing form, you need to access it through pdfFiller, a convenient all-in-one document management platform. Users can navigate to the platform to find the form easily without extensive searches or confusion.

Follow these steps to access and fill out your TPP listing form:

Once you have the form open, complete the following steps for a successful submission:

Interactive tools for enhanced form management

One of the significant advantages of using pdfFiller for your TPP listing is its robust set of interactive tools designed to streamline form management. These features facilitate a smooth experience for users, whether they are working solo or as part of a larger team.

The platform provides powerful editing features that allow users to modify fields, add annotations, and incorporate digital signatures directly on the form. This capability saves time and reduces the friction often associated with document management.

Common mistakes to avoid when filing

When completing the tangible personal property listing form, there are several common pitfalls that can result in complications or penalties. Awareness of these mistakes can save you time, money, and unnecessary stress.

Among the most frequent errors are the following:

Frequently asked questions about TPP listing

Several questions frequently arise regarding the reporting of tangible personal property. Understanding these common inquiries can provide clarity and ensure compliance.

Managing changes and updates to your TPP listing

Keeping your tangible personal property listing updated is vital for compliance and financial planning. Businesses grow, assets change, and circumstances can shift. Thus, it is essential to regularly review and amend your form as needed.

If you need to make changes to your TPP listing, follow these guidelines:

Resources for further assistance

Accessing accurate information and support regarding tangible personal property reporting can further enhance your experience. Many resources are available to assist businesses in ensuring compliance and understanding tax implications.

Understanding the implications of TPP reporting

Reporting tangible personal property accurately and on time can significantly impact your business's financial standing. Non-compliance can lead to severe consequences, including hefty penalties from local tax authorities.

Furthermore, businesses must be aware of potential taxes and exemptions available to them, as these can provide substantial savings. A timely and accurate filing can position a business favorably in the eyes of regulatory bodies, which in turn fosters goodwill and trust within the community.

Conclusion

Utilizing pdfFiller for managing your tangible personal property listing form simplifies the often cumbersome process of compliance. Users are not only equipped with interactive tools that enhance productivity but are also supported by a platform designed to make document handling a seamless experience.

With guidance from this article, individuals and teams can take full advantage of pdfFiller’s features to confidently manage their TPP listings, ensuring that they stay compliant and informed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tangible personal property listing from Google Drive?

How can I get tangible personal property listing?

How do I edit tangible personal property listing in Chrome?

What is tangible personal property listing?

Who is required to file tangible personal property listing?

How to fill out tangible personal property listing?

What is the purpose of tangible personal property listing?

What information must be reported on tangible personal property listing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.