Get the free Make a gift aid declaration

Get, Create, Make and Sign make a gift aid

How to edit make a gift aid online

Uncompromising security for your PDF editing and eSignature needs

How to fill out make a gift aid

How to fill out make a gift aid

Who needs make a gift aid?

How to Make a Gift Aid Form: A Comprehensive Guide

Understanding Gift Aid

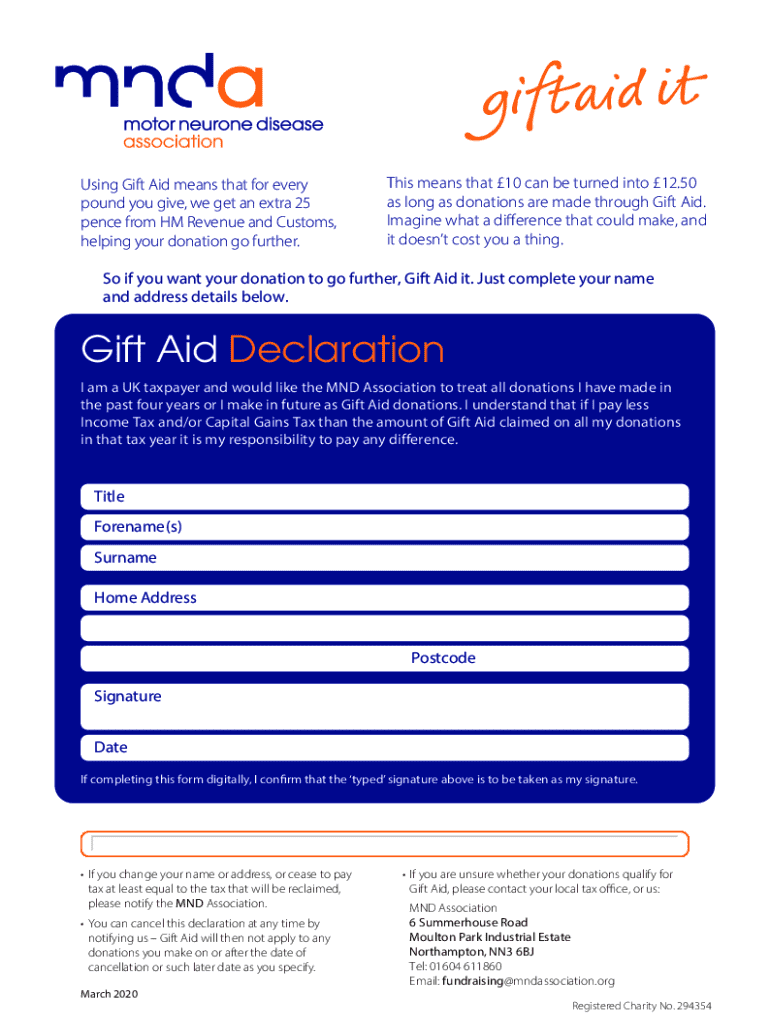

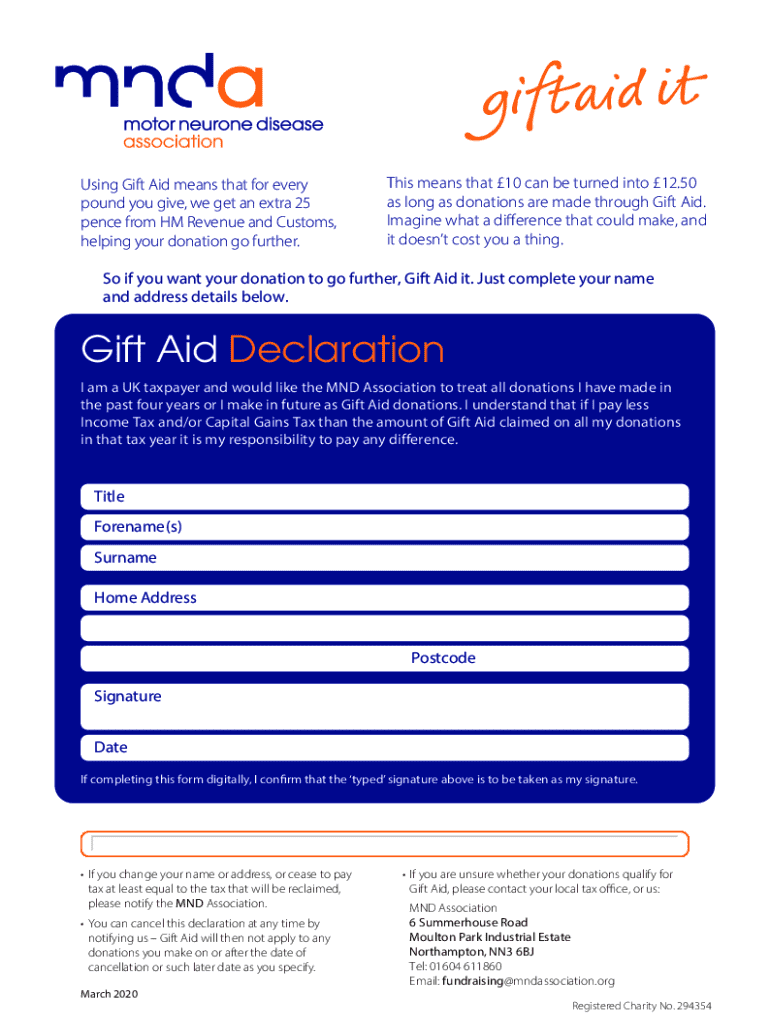

Gift Aid is a UK government scheme that allows charities to claim back tax on donations made by UK taxpayers. This means that for every £1 donated, charities can claim an additional 25p from HM Revenue and Customs (HMRC). It's an effective way to maximize donations without cost to the donor, encouraging more generous giving.

The benefits of using Gift Aid are significant. Charitable organizations can increase their revenue with minimal effort, which can make a big difference to smaller charities that rely heavily on donations. For donors, the process is straightforward, and they can feel good knowing their contributions are enhanced, effectively increasing their impact towards the causes they care about.

Eligibility for Gift Aid is straightforward but comes with specific criteria. Only donations made by UK taxpayers can qualify for Gift Aid. This includes cash donations, direct debits, and even donations of shares or property. It’s essential for donors to pay enough tax to cover the amount claimed by charities on their donations; otherwise, they may need to cover the shortfall.

Exploring the Gift Aid declaration process

The process of declaring Gift Aid starts with a Gift Aid declaration form. This document is essential because it communicates to HMRC while certifying that donors are eligible. There are two main types of Gift Aid declarations: single and multiple declarations. A single declaration is suitable for one-off donations, while a multiple declaration allows charities to claim Gift Aid on all future donations from the same donor.

Understanding which declaration is right for the current situation is crucial for both donors and charities. For example, if a donor is planning to donate regularly to a charity, a multiple declaration is often a more efficient route. Each declaration also contains essential information about the donor and the charity receiving the funds, which must remain accurate throughout the donation period.

How to make a Gift Aid form

Creating a Gift Aid form can be done easily using pdfFiller. Here’s a step-by-step guide to help you through the process.

Collaborating on your Gift Aid form

If you're part of a charity team or organization, collaborating on your Gift Aid form can streamline the process. With pdfFiller, you can easily share the form with other team members. Using the platform’s permission settings, you can also control who can access and edit the document.

Additionally, leveraging pdfFiller’s commenting and feedback features helps facilitate discussions related to the form. Team members can collaborate in real-time, ensuring that any questions or suggestions are addressed immediately, thus enhancing the efficiency of creating and managing Gift Aid declarations.

Submitting your Gift Aid form

Once your Gift Aid form is completed, the next step is submission. Typically, the form should be sent to the charity you wish to support, whereupon they will process the claim. Different charities may have unique submission methods, such as mail, email, or an online portal, so it’s important to confirm the correct submission process for the organization you're donating to.

Tracking your Gift Aid claims is also important. After submission, keep an eye on confirmation and claim status updates from the charity. Most organizations will provide a method for you to confirm receipt, either through direct correspondence or a tracking system on their websites.

Managing changes or updates to your Gift Aid status

Over time, personal circumstances may change, impacting your Gift Aid declarations. It’s vital to update your donation statuses, such as changes in address, taxpayer status, or frequency of donations, to ensure compliance with HMRC guidelines. Neglecting to inform the charity about these changes can lead to complications in your Gift Aid claims, possibly affecting both the donor and the charity.

Reporting changes is straightforward; simply notify the charity and provide updated information. This helps maintain accuracy on all formal records and ensures that claims continue to be processed correctly and efficiently.

Additional considerations for higher rate taxpayers

Higher rate taxpayers have the unique opportunity to claim additional tax relief on their Gift Aid donations. If you pay tax at rates higher than the basic rate, you are entitled to reclaim the difference between the higher rate and basic rate on your self-assessment tax return. This not only reduces your taxable income but effectively allows you to support your chosen charities while offsetting some of your tax liabilities.

It’s imperative to keep accurate documentation of all donations and Gift Aid declarations for reporting purposes. This includes maintaining copies of your Gift Aid forms, which you can do seamlessly through the pdfFiller platform, ensuring easy tracking and management of your charitable contributions.

Navigating support and resources

Utilizing support options within pdfFiller can significantly enhance your experience while creating and managing Gift Aid forms. The platform offers comprehensive help sections, such as FAQs, which address common queries related to the Gift Aid process. Moreover, pdfFiller’s customer support is available to assist you with any technical issues you might face during form creation or submission.

Additionally, external resources from charity commissions and government websites provide guidelines and resources related to Gift Aid. These platforms offer valuable insights and updates on legal obligations, ensuring that charitable organizations remain compliant with current regulations. This further empowers users to fulfill their responsibilities as donors and fundraisers.

Best practices for using Gift Aid effectively

When engaging in Gift Aid, employing best practices can ensure maximum benefits. Strategies for encouraging donations include clear communication about how Gift Aid enhances contributions and educating donors on the process. Simultaneously, maintain accurate records of all donations and communications with charities for tax purposes. Accurate records simplify both tracking and future retrospective claims.

Annual reviews of Gift Aid claims can highlight trends in donor activity and identify potential improvements in the donation process. Such evaluations allow charities to refine their fundraising strategies, ultimately leading to increased fundraising success and donor engagement.

Staying updated with policies and regulations

The landscape of Gift Aid regulations can change, influencing the way donations are processed and claimed. Keeping informed about recent policy changes is key for both donors and charities. By regularly checking trustworthy sources such as HMRC’s official website or reliable charity networks, you can remain abreast of new developments, ensuring compliance and optimal claiming practices.

Furthermore, subscribing to newsletters or alerts from relevant organizations can provide timely updates directly to your inbox, making it easier to stay informed. Awareness of these updates not only helps avoid potential pitfalls but also encourages proactive adjustments to your Donation practices.

Contacting support for further assistance

If you encounter challenges while creating or managing your Gift Aid form, contacting pdfFiller’s customer support can provide the assistance you need. The platform offers various contact options, including live chat, email support, and an extensive knowledge base.

Ensure you have all relevant details at hand when reaching out for support, as this can facilitate quicker resolutions. pdfFiller's customer service team is available during regular hours and is dedicated to helping users navigate any obstacle, enhancing your experience in effectively utilizing their cloud-based document solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify make a gift aid without leaving Google Drive?

Where do I find make a gift aid?

How do I edit make a gift aid straight from my smartphone?

What is make a gift aid?

Who is required to file make a gift aid?

How to fill out make a gift aid?

What is the purpose of make a gift aid?

What information must be reported on make a gift aid?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.