Get the free Compliance Audit

Get, Create, Make and Sign compliance audit

Editing compliance audit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out compliance audit

How to fill out compliance audit

Who needs compliance audit?

Compliance Audit Form: A Comprehensive How-to Guide

Understanding compliance audits

A compliance audit is a systematic examination of an organization’s adherence to relevant laws, regulations, and internal policies. It seeks to ensure that an entity is operating in alignment with regulatory requirements and internal standards. The importance of conducting compliance audits cannot be overstated; they serve not only to mitigate risks but also to enhance the organization's credibility and operational efficiency.

Benefits of compliance audits include identifying areas of non-compliance, reducing the risk of fines or legal issues, and fostering a culture of accountability within the organization. Organizations must consider key regulatory frameworks, such as the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), and the Sarbanes-Oxley Act (SOX), as they form the foundation of compliance requirements across various industries.

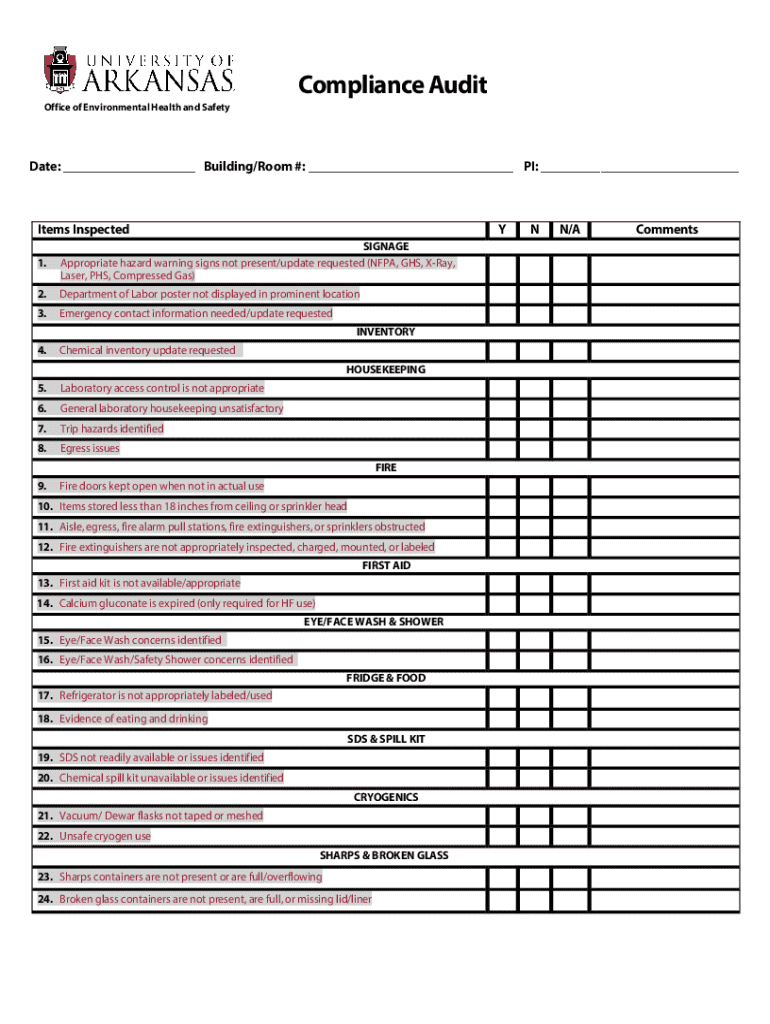

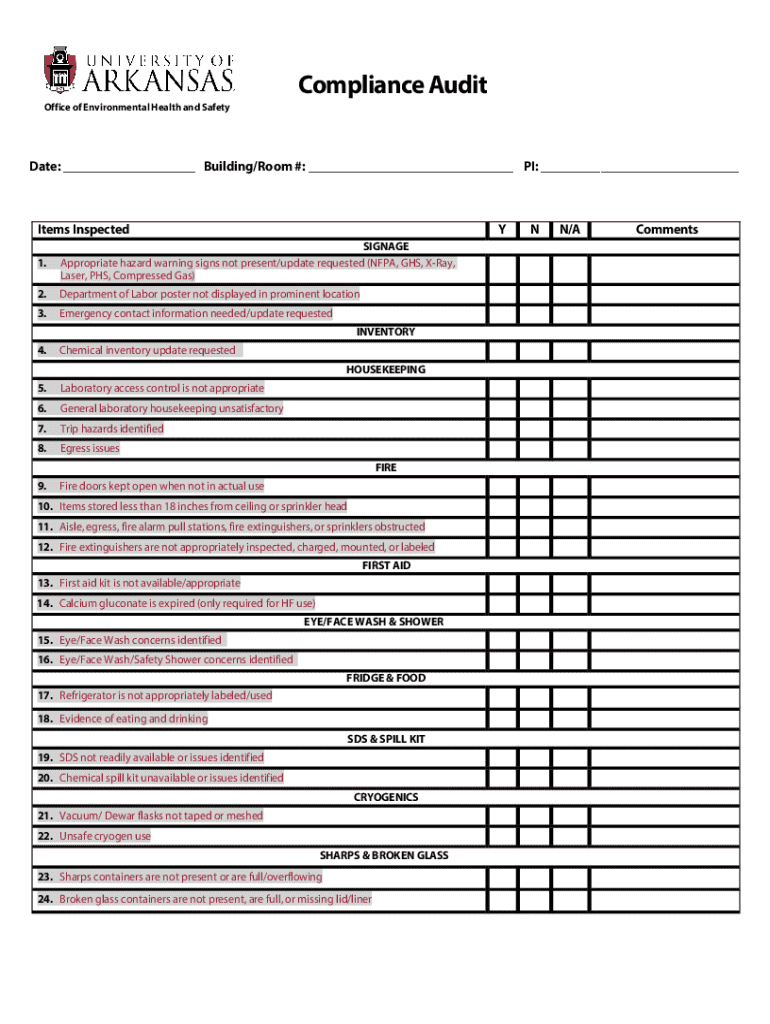

Overview of the compliance audit form

A compliance audit form is a structured document used to gather information and assess compliance against established criteria. It serves as the backbone of the audit process, allowing auditors to collect, evaluate, and organize data effectively. A well-structured compliance audit form includes specific elements like audit objectives, methods, and results, ensuring a systematic approach to compliance assessment.

By streamlining the audit process, a well-designed form enhances the efficiency of data collection and reporting. It ensures that critical compliance areas are not overlooked and that audit findings are documented accurately, facilitating an easier review and follow-up process.

Key components of an effective compliance audit form

An effective compliance audit form should encompass several key components to provide a comprehensive overview of the audit process.

Steps to create your own compliance audit form

Creating an effective compliance audit form requires a structured approach. Here are the steps to design your own compliance audit form.

Using the compliance audit form effectively

Filling out the compliance audit form requires diligence and attention to detail. To use the form effectively, auditors should adhere to certain best practices.

Interactive tools for compliance auditing

With technological advancements, creating and managing compliance audit forms has become more efficient. Digital solutions, including those provided by pdfFiller, allow for the easy creation, editing, and management of compliance audit forms.

Cloud-based platforms like pdfFiller enhance collaboration among teams, offering features like e-signatures and version control. By integrating these interactive tools, organizations can streamline their compliance workflows and ensure that all relevant parties can access and contribute to the auditing process from anywhere.

Real-world applications of compliance audit forms

Applying compliance audit forms in real-world scenarios can yield significant benefits for organizations. Case studies show how businesses have successfully implemented compliance audits to strengthen their operations.

Frequently asked questions about compliance audit forms

It's common to have questions regarding compliance audit forms. Here are some frequently asked questions that can clarify aspects of the compliance auditing process.

Integrating compliance audits into your organization's culture

Embedding compliance audits into an organization’s culture is vital for long-term success. Training staff about the importance of compliance and instilling a sense of responsibility ensures everyone understands the implications of their actions.

Fostering a culture of accountability and transparency can motivate employees to adhere to compliance protocols. Regular communication about compliance goals and achievements is essential, as is the establishment of continuous improvement mechanisms that enable ongoing assessment and refinement of compliance practices.

Scaling compliance audits: advanced strategies

As organizations grow, scaling compliance audits becomes increasingly important. Advanced strategies involve utilizing automation tools to enhance efficiency and conducting audits across multiple locations to ensure consistent compliance.

Employing dynamic risk assessment methods allows businesses to remain agile in addressing compliance changes. These strategies not only provide depth to compliance audits but also ensure the organization can adapt to evolving regulatory landscapes, ultimately safeguarding the organization’s integrity and reputation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my compliance audit directly from Gmail?

Can I create an eSignature for the compliance audit in Gmail?

How do I fill out the compliance audit form on my smartphone?

What is compliance audit?

Who is required to file compliance audit?

How to fill out compliance audit?

What is the purpose of compliance audit?

What information must be reported on compliance audit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.