Get the free Application for Individual Life Insurance

Get, Create, Make and Sign application for individual life

How to edit application for individual life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for individual life

How to fill out application for individual life

Who needs application for individual life?

Application for Individual Life Form: A Comprehensive Guide

Understanding individual life insurance applications

An individual life insurance application serves as a formal request for a life insurance policy tailored for a specific person. It collects essential information needed by insurers to assess the risks involved in insuring that individual. The primary purpose of this application is to provide insurers with details regarding the applicant's age, health history, lifestyle choices, and financial goals, enabling them to offer an appropriate policy.

Individual life insurance is a cornerstone of financial planning, often viewed as a safety net for dependents and a means to ensure long-term financial security. It provides peace of mind that loved ones will receive a sum of money upon the insured's death, aiding in maintaining their standard of living and covering debts, such as mortgages or educational expenses.

Eligibility requirements for applicants

When considering an application for an individual life form, there are several eligibility requirements that potential applicants need to meet. Generally, age boundaries apply, with most providers accommodating applicants as young as 18 and up to age 70—though some insurers offer policies to seniors beyond this range drawing from a less conventional approach.

Health status is another critical factor. Insurers often require applicants to disclose any pre-existing health conditions, which can affect eligibility and premium rates. Necessary documentation typically includes government-issued identification and possibly recent medical records to affirm good health status when applying.

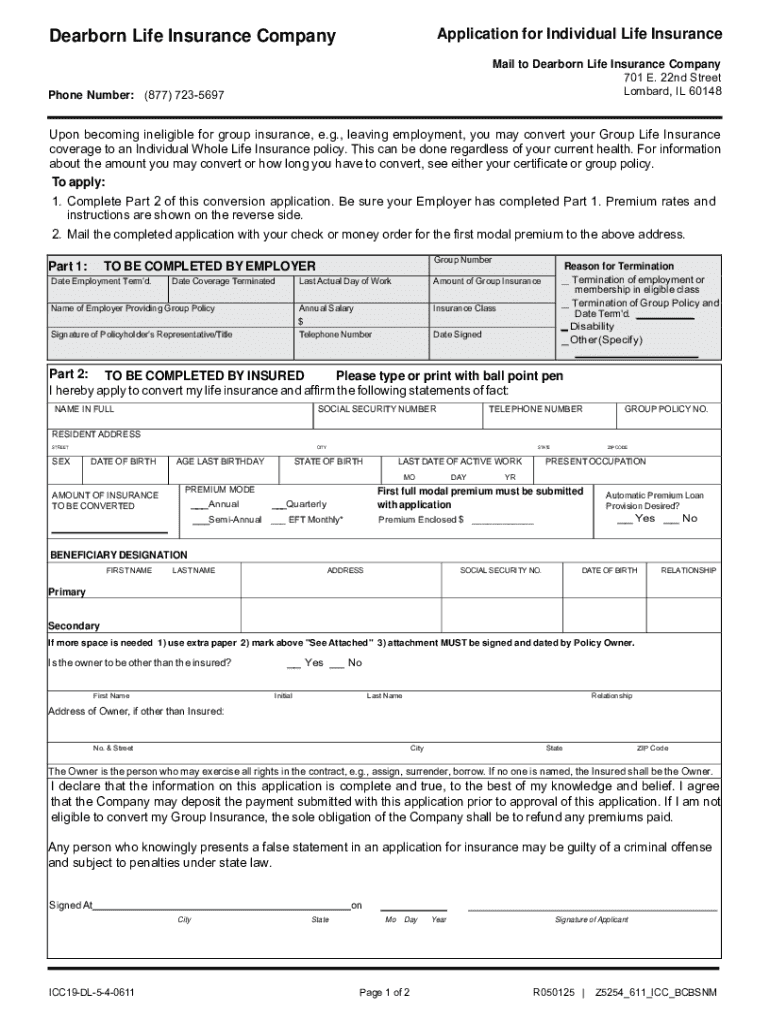

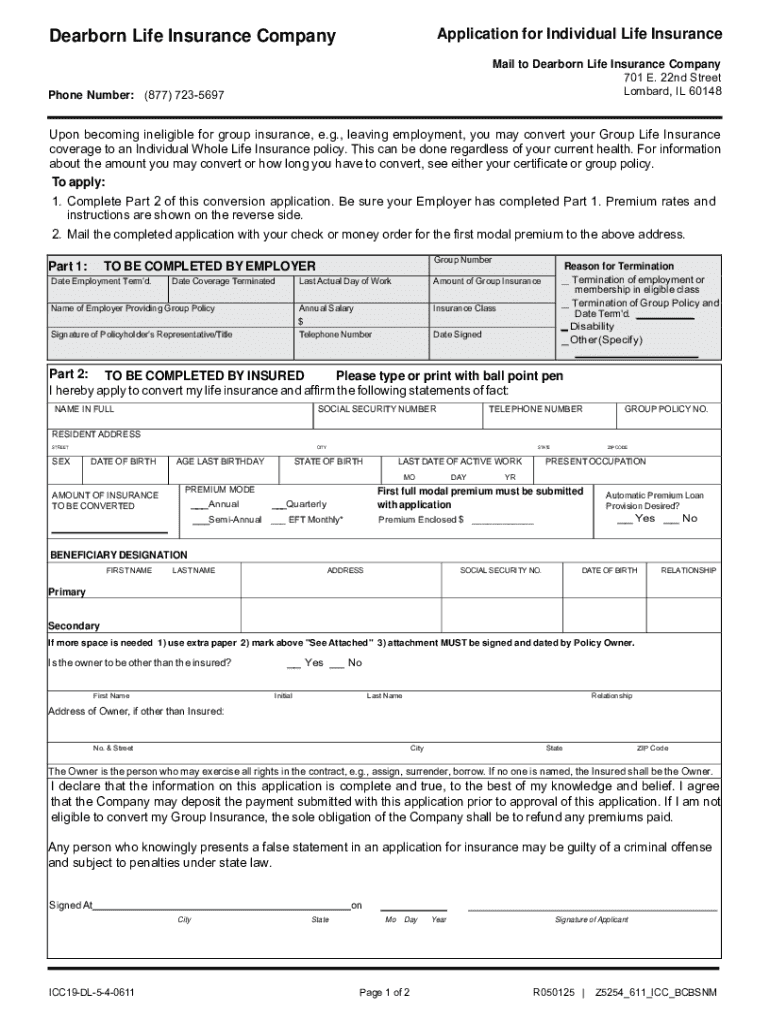

Preparing your application

Before diving into the application process, it’s crucial to prepare by gathering the necessary documents. The foundation of a complete application begins with identification documents, typically a driver’s license or social security number. These documents ensure that you establish your identity clearly.

In addition to personal identification, financial information comes into play. Applicants should be prepared to disclose details about their income, assets, and liabilities. This financial snapshot assists insurers in determining the appropriate coverage amounts needed. Medical records or a statement of health often provide clarity on your medical background, ensuring that all critical risks are disclosed upfront.

Assessing your life insurance needs

Understanding your specific financial needs is paramount when applying for individual life insurance. For instance, consider the size of your dependents' family, existing debts, and future expenses, such as funding education or retirement plans. Each of these factors will play a significant role in determining how much insurance coverage is necessary.

Filling out the individual life form

Completing the individual life insurance application requires careful attention to detail. Begin with personal information, including your name, date of birth, address, and citizenship status. Correct and complete entries in this section lay the groundwork for successful processing.

Next, select the coverage amount. Reflect on your earlier assessment and select a figure that meets your family's needs without burdening your finances. Then, designate your beneficiaries—those who will receive the policy payout. It’s wise to name more than one beneficiary to ensure clarity and ease of claim in your absence.

Common mistakes to avoid

During this critical step, common pitfalls can lead to complications. One frequent oversight is leaving sections incomplete. Each section demands thorough and honest disclosures for a smoother transition through underwriting. Additionally, misunderstanding insurance terminology can result in errors—read carefully and consider researching terms that seem unclear.

Tips for ensuring accuracy and clarity

Adopting digital tools like pdfFiller can greatly assist in filling out forms accurately. Using their interactive tools allows for organized input, making it easier to gather your information correctly. Furthermore, always proofread your entries, checking for typos or inaccuracies that could delay the application process.

Submitting your application

Once the application is completed, you need to submit it. There are generally two methods available: online or physical submission. Utilizing online platforms like pdfFiller ensures quick and efficient processing. Online submission is often more practical since it allows for instant confirmations.

However, if physical submissions are preferred or required, package and mail it carefully. Use secure mailing services to protect sensitive documents and ensure punctuality—check deadlines to avoid any interruptions in the review process.

Tracking your application status

After submission, stay proactive by tracking your application status. Most insurance providers offer online portals where you can log in to check updates. Understanding typical timelines for processing can help manage expectations, as thorough underwriting sometimes takes weeks. Patience is key during this time.

After you submit your application

The underwriting process is essential following your application's submission. Underwriters evaluate the information provided, assessing risk factors and determining coverage approval. The outcome can result in approval, requests for additional information, or, in some cases, denial due to unforeseen concerns.

If additional information is requested, it's vital to respond promptly and thoroughly. Preparing for follow-up calls with the underwriter can facilitate rapid responses to any queries, ensuring a smoother completion to your application.

Responding to underwriting questions

When responding to underwriting inquiries, clarity is paramount. Provide accurate documentation and answer questions directly to avoid further complications. Keeping thorough records of all communications ensures that you can refer back to them if additional questions arise or misunderstandings occur during the review.

Managing your policy post-application

Once your application is approved and your policy is in place, management becomes crucial. You may need to make adjustments over time, such as addressing changes in your personal information or beneficiary updates. Every time an important life event occurs, revisit your policy to ensure it still aligns with your current situation.

Understanding policy maintenance, including renewals and coverage adjustments, is vital for long-term security. Familiarize yourself with key deadlines related to premium payments and policy reviews to ensure continued coverage and avoid lapses.

FAQs on renewals and policy maintenance

Renewals allow you to maintain your coverage longer than the initial term, but they can come with premium adjustments based on age and changing health conditions. Setting reminders for renewal deadlines and assessments of your coverage needs will help you stay proactive.

Additional resources and tools

As you navigate the process of applying for and managing your individual life insurance, leveraging resources can enhance your understanding and streamline your efforts. pdfFiller offers an extensive forms library that includes various life insurance management documents. These tools help ensure you have what you need at your fingertips.

Additionally, it's interesting to understand the differences between individual and group insurance policies. Individual policies offer more personalized coverage, while group plans generally provide basic coverage through an employer. Also, exploring related products like critical illness insurance illustrates options available beyond standard life coverage.

Interactive educational tools, including calculators to estimate life insurance needs and comparison calculators, become invaluable resources in deciding comprehensive coverage that suits your requirements.

Security and compliance

In an era where data security is paramount, understanding how your information is protected is crucial when using digital platforms like pdfFiller. It prioritizes security measures to safeguard your personal and financial data, ensuring that your sensitive information remains confidential.

Moreover, understanding the legal aspects of electronic signatures is essential in the insurance domain. It’s vital to ensure that all actions taken during the application process are compliant with existing insurance laws—this includes the proper handling of consent and signature requirements for policy initiation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for individual life for eSignature?

How do I make changes in application for individual life?

Can I create an electronic signature for the application for individual life in Chrome?

What is application for individual life?

Who is required to file application for individual life?

How to fill out application for individual life?

What is the purpose of application for individual life?

What information must be reported on application for individual life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.