Get the free F300-e2

Get, Create, Make and Sign f300-e2

How to edit f300-e2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f300-e2

How to fill out f300-e2

Who needs f300-e2?

A Comprehensive Guide to the f300-e2 Form

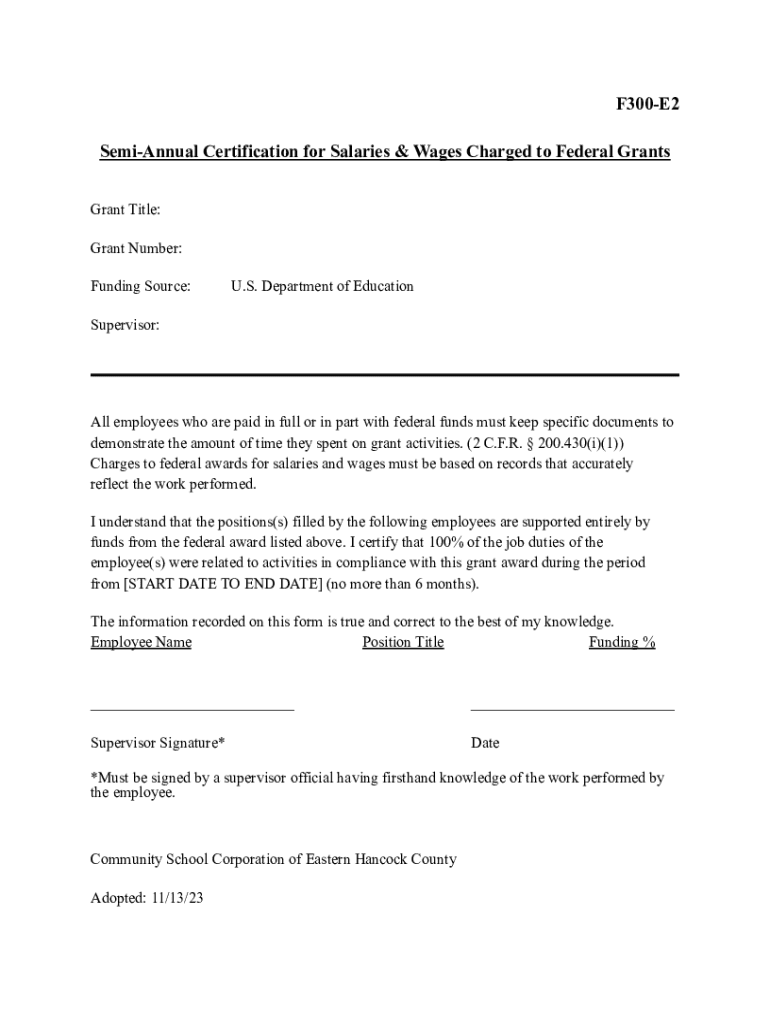

Overview of the f300-e2 form

The f300-e2 form serves as a crucial document used primarily in various applications where clear and concise personal and financial information is required. Functioning as a formal record, its primary purpose is to gather detailed insights about individuals or entities for administrative purposes, ensuring proper assessment and regulatory compliance.

Key features of the f300-e2 form include its structured layout, which allows for ease of comprehension and completion. It typically encompasses sections that detail personal information, financial standings, and necessary consents or declarations. This arrangement not only streamlines the data collection process but also enhances the clarity of the information presented.

The importance of the f300-e2 form in document management cannot be overstated. By facilitating organized data submissions, it plays a vital role in maintaining records in a systematic manner, thus aiding in efficient processing whether for governmental, financial, or other institutional requirements.

Understanding the f300-e2 form structure

To accurately fill out the f300-e2 form, understanding its structure is essential. The document is typically divided into three main sections: personal information, financial details, and consent and declarations. Each segment is designed to capture specific data points necessary for the overall processing of the form.

Common terminology found within the f300-e2 form includes key terms such as 'net income,' 'gross assets,' and 'declarations.' Familiarity with these terms is pivotal for those completing the form, as they help define the necessary financial and legal obligations.

For users wishing for a deeper understanding, an annotated visual guide can be particularly helpful. Such visual representations break down the form into its component parts, showcasing what each field requires and relevant instructions.

Step-by-step instructions for filling out the f300-e2 form

Before you begin filling out the f300-e2 form, ensure you have all the necessary information and documentation at hand. This includes identification, financial records, and any previous submissions if applicable. Having reputable tools such as pdfFiller can significantly enhance the process, making it more streamlined.

To begin the completion process, follow these section-by-section instructions:

To ensure accuracy and completeness, double-check all entries before finalizing the document. Using tools like pdfFiller also allows for error correction and revisiting incomplete sections easily.

How to edit the f300-e2 form

Editing the f300-e2 form can be essential for maintaining accurate records or when errors occur. pdfFiller offers a suite of editing features designed for this purpose, allowing users to make changes seamlessly. To begin editing, follow this step-by-step guide.

These features not only simplify the editing process but also ensure that every necessary modification is efficiently recorded and completed.

eSigning the f300-e2 form

Digital signatures have become an essential aspect of form submission in our increasingly digital world. The process of eSigning the f300-e2 form not only validates your identity but also accelerates the approval processes.

Having a reliable method of electronic signing not only simplifies the submission process but also provides a level of security and legal integrity to your submissions.

Collaborating with team members on the f300-e2 form

Collaboration is essential when multiple stakeholders are involved in the f300-e2 form submission process. pdfFiller facilitates this through its specialized collaboration features, allowing users to work together efficiently.

These collaborative tools not only enhance the efficiency of filling out the f300-e2 form but also ensure that all contributions are documented and managed seamlessly.

Managing and storing your f300-e2 form

Once the f300-e2 form is filled and eSigned, proper management and storage of the document become paramount. Knowing the best practices for saving this form can prevent future issues with accessibility or compliance.

Implementing these practices ensures that your f300-e2 form remains secure, compliant, and easily accessible when needed.

FAQ section about the f300-e2 form

Addressing common queries around the f300-e2 form is essential for user confidence. Here are some frequently asked questions that shed light on the process.

This FAQ section should assist users in understanding how to manage their interactions with the f300-e2 form efficiently.

Exploring related forms and templates

The f300-e2 form is one among many essential documents for various formal proceedings. Identifying similar forms can broaden understanding and adaptability when dealing with different requirements.

Exploring related forms can provide valuable insights into their specific requirements and processes, aiding in overall document management practices.

User testimonials and success stories

Real-life experiences of users who have successfully submitted the f300-e2 form highlight the efficacy of this document in achieving desired outcomes. Testimonials reveal how streamlined processes through pdfFiller contribute to efficiency.

Case studies illustrate various scenarios where users relied on pdfFiller’s unique features to expedite their submissions, showcasing the practical advantages of employing a digital document management solution.

Interactive tools and resources for users

Utilizing tools and resources available on pdfFiller can enhance the management of the f300-e2 form. As an interactive platform, it provides a range of features that cater to user needs effectively.

Leveraging these resources not only aids in mastering the f300-e2 form but also elevates the entire document creation process, ensuring enhanced outcomes for individual and team users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit f300-e2 from Google Drive?

How do I edit f300-e2 straight from my smartphone?

Can I edit f300-e2 on an iOS device?

What is f300-e2?

Who is required to file f300-e2?

How to fill out f300-e2?

What is the purpose of f300-e2?

What information must be reported on f300-e2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.