Get the free Employee and Employer Contribution Return Compliance Statement

Get, Create, Make and Sign employee and employer contribution

How to edit employee and employer contribution online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee and employer contribution

How to fill out employee and employer contribution

Who needs employee and employer contribution?

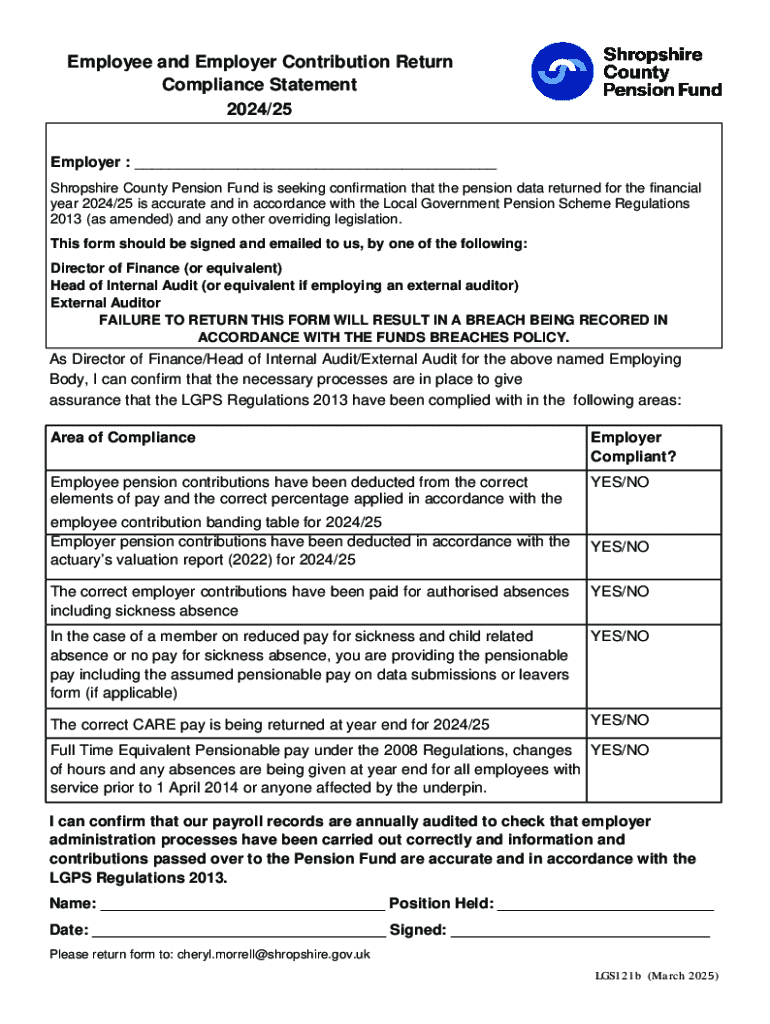

Understanding the Employee and Employer Contribution Form

Understanding employee and employer contributions

Employee and employer contributions represent a crucial aspect of the employment relationship, focusing on the financial commitments made by both parties. Employee contributions typically involve retirement plans, health insurance premiums, and other benefits that employees pay for through payroll deductions. On the other hand, employer contributions refer to the financial support provided by the employer towards benefits, such as matching retirement plans or health insurance premiums. These contributions are not just a means of providing benefits; they are foundational to effective financial planning, helping employees secure their financial futures while enabling employers to attract and retain talent.

The importance of these contributions cannot be overstated. They serve to enhance employee satisfaction and loyalty, foster a higher level of productivity, and comply with various regulations. Both employee and employer contributions play a vital role in establishing a comprehensive benefits package, which is essential in today’s competitive job market.

Types of contributions

Understanding the different types of contributions is key to managing employee benefits effectively. Contributions can broadly be categorized into employee contributions and employer contributions. Employee contributions are typically direct deductions from an employee's paycheck, designated for specific benefits such as retirement savings or health coverage. In contrast, employer contributions often come in the form of matching contributions to retirement accounts, company-sponsored health insurance, or other perks. Additionally, contributions can be classified as statutory or voluntary; statutory contributions are mandated by law (like social security), while voluntary contributions are determined based on individual and organizational choices.

The purpose of the employee and employer contribution form

The employee and employer contribution form is a necessary tool in the management of contributions. This form serves multiple purposes, providing a clear record of how much employees are contributing to their benefits and how much employers are committing to match or support those contributions. It simplifies the often complex landscape of benefits and contributions, ensuring that all parties are on the same page. The form is essential when onboarding new employees, making adjustments to contribution rates, or even during regular audits of benefits packages.

When approaching this form, it’s important to understand that certain sections will be required based on situational contexts, such as new hires or changes in investment elections. Each section of the form contains vital information needed for accurate reporting and compliance.

Key sections of the form

A typical employee and employer contribution form consists of several key sections that collect pertinent information. Here’s a breakdown of these segments:

Step-by-step guide to completing the form

Completing the employee and employer contribution form accurately is essential for valid records and transparency. Before tackling the form, gather necessary documentation to ensure you have all the required information. Essential details include Social Security numbers, employment data, and any previous contribution records.

1. **Employee Information**: Begin by filling in your basic details - this forms the foundation of the documentation. Ensure that the information is accurate and complete.

2. **Contribution Election**: This section is critical as it details how much you wish to contribute or how the employer will contribute. Be clear and precise with the amounts.

3. **Signature Requirements**: Ensure that the form is signed by both parties. Missing signatures could halt processing.

4. **Submission Instructions**: Finally, follow the specified instructions to submit the completed form. This might include returning it to HR or uploading it via a digital platform.

Digital solutions for form management

In the quest to streamline forms, using a digital solution like pdfFiller has transformed how organizations handle documentation. pdfFiller allows users to edit documents, sign them electronically, and share them seamlessly across teams. This flexibility is particularly beneficial for remote teams looking to maintain efficiency without being bogged down by paperwork.

The application enables various tools that simplify editing and signing processes. As organizations transition towards paperless environments, embracing a cloud-based platform like pdfFiller offers accessibility and efficiency.

How to use pdfFiller to fill out the contribution form

Using pdfFiller to fill out your employee and employer contribution form is straightforward:

Common mistakes to avoid

Completing the employee and employer contribution form accurately is paramount to avoid future complications. However, many individuals repeatedly make mistakes. Common errors include missing signatures, incorrect contribution amounts, or failing to complete personal information thoroughly.

To ensure your form is accurate prior to submission, consider the following checklist:

Managing changes and updates

Life can often prompt operational changes that may require employees to revisit their contribution forms. Events like job changes or salary modifications are typical triggers, necessitating an update to ensure accuracy in contributions.

Updating your contribution form is also crucial for maintaining compliance with tax and benefit regulations. If you need to submit updated information, utilizing pdfFiller can make this process seamless.

Process for submitting updated information

The process of handling revisions using pdfFiller is just as simple as filing the original form. Start by uploading the most recent version of the form, make necessary edits, and submit as required. Keeping detailed records of your contributions and updates can safeguard against discrepancies in your benefits plan.

FAQs regarding employee and employer contributions

With numerous questions surrounding contributions, it is essential to provide guidance. Some frequently asked questions include:

Addressing these concerns often involves input from HR or finance departments, emphasizing the importance of accurate records. Ensuring compliance with regulations helps to safeguard against audits and ensures contributions are managed effectively.

Expert insights and additional tools

To manage contributions effectively, it's crucial for both employees and employers to cultivate a system that fosters accuracy and consistency. Best practices include regularly reviewing contribution rates, adhering to compliance guidelines, and maintaining open communication between parties involved in the contributions.

By leveraging other tools available through pdfFiller, organizations can utilize related templates and forms tailored to payroll and benefits management. This consolidation of documentation aids in fostering clear understanding and operational efficiency.

Contacting support for assistance

As with any administrative process, knowing when to seek help is critical. Indicators that professional assistance may be needed include confusion regarding forms, discrepancies in contribution records, or an inability to access relevant tools.

pdfFiller provides several avenues for support, including chat options, email queries, and phone assistance. Engaging with support services can help clarify uncertainties and ensure a seamless experience when managing your employee and employer contribution form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employee and employer contribution for eSignature?

How do I make edits in employee and employer contribution without leaving Chrome?

Can I edit employee and employer contribution on an Android device?

What is employee and employer contribution?

Who is required to file employee and employer contribution?

How to fill out employee and employer contribution?

What is the purpose of employee and employer contribution?

What information must be reported on employee and employer contribution?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.