Get the free Oklahoma Small Business Income Tax Return

Get, Create, Make and Sign oklahoma small business income

How to edit oklahoma small business income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oklahoma small business income

How to fill out oklahoma small business income

Who needs oklahoma small business income?

Oklahoma Small Business Income Form: A Comprehensive Guide

Understanding the Oklahoma Small Business Income Form

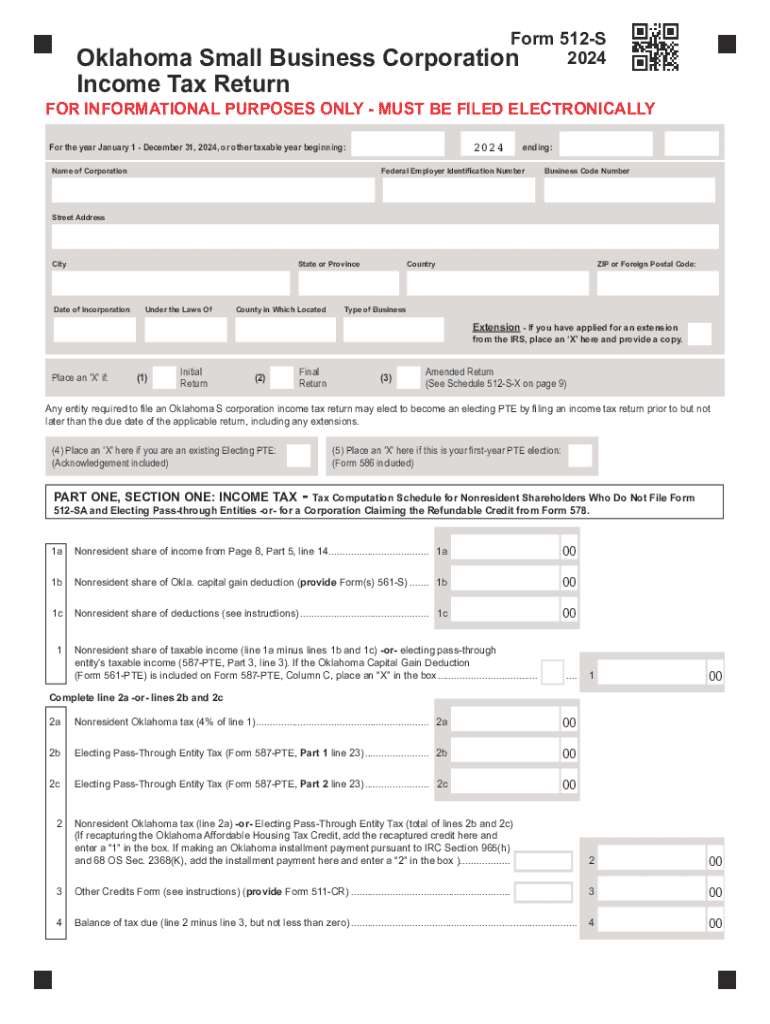

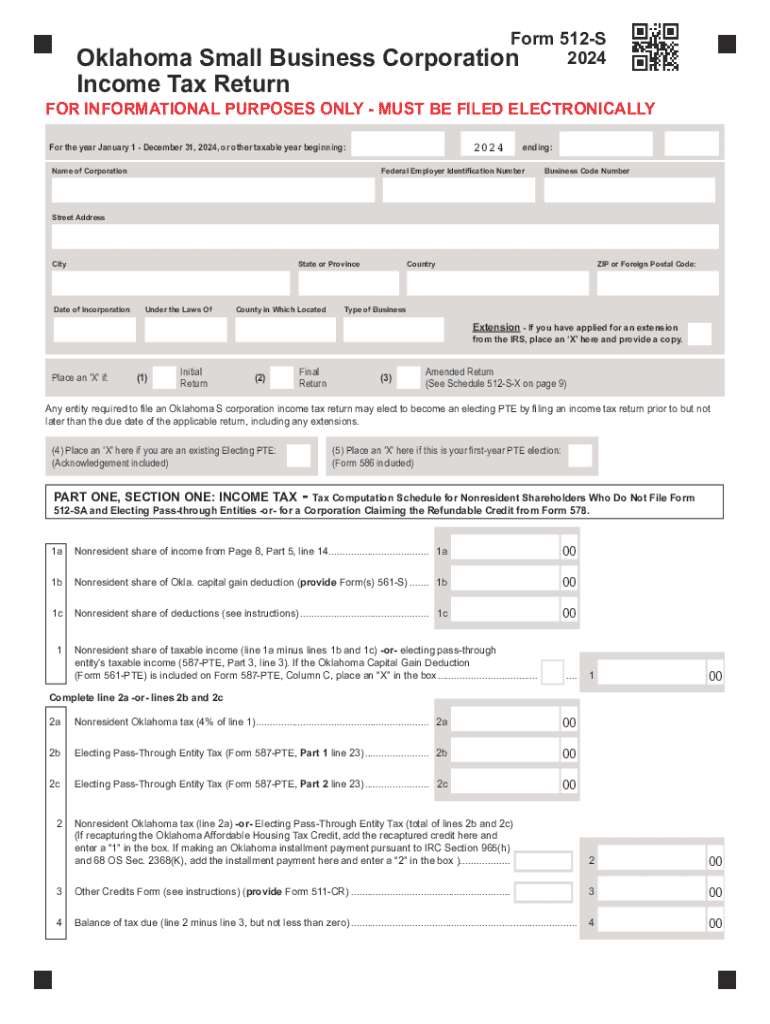

The Oklahoma Small Business Income Form is a critical document for reporting income earned by small businesses operating within the state. This form collects essential information regarding the business's financial performance throughout the tax year, allowing for accurate taxation and compliance with state regulations.

Accurately completing the Oklahoma Small Business Income Form is crucial as it ensures that your business is taxed correctly, avoiding potential penalties. Errors or omissions can lead to liability issues and financial traps that small businesses cannot afford.

Key deadlines for submitting this form typically align with federal tax deadlines, usually falling on April 15 each year unless extensions are granted. Understanding these dates and the requirements for filing can save you from missed deadlines and the pitfalls they bring.

Who needs to file the Oklahoma Small Business Income Form?

Not every business owner is required to file the Oklahoma Small Business Income Form. Eligibility generally includes small businesses that operate as sole proprietorships, partnerships, or corporations within the state. If you are a sole proprietor and earn income through personal services or sales, you likely need to file this form.

Types of businesses that routinely must file include retail shops, service providers, and independent contractors. Specific cases also involve limited liability companies (LLCs) and non-profit organizations under certain conditions that generate unrelated business income.

Key components of the Oklahoma Small Business Income Form

Navigating the Oklahoma Small Business Income Form involves understanding its structure and key components. The form is divided into various sections, which include income details, deductions, and applicable credits.

Required information typically includes gross receipts, cost of goods sold, ordinary income, and any capital gains. Terms like ‘ordinary income’ refer to income generated from regular business activities, while ‘capital gains’ arise from selling business assets at a profit.

Step-by-step guide to completing the Oklahoma Small Business Income Form

Completing the Oklahoma Small Business Income Form requires a systematic approach. Start with gathering necessary documentation, including income statements, receipts, contracts, and relevant prior year tax returns. Properly organizing these documents eases the filing process.

As you move through the form, follow a line-by-line approach. Pay close attention to accurately reporting income figures and ensure that all deductions, such as business expenses like office supplies or vehicle expenses, are claimed. Common pitfalls include misreporting income or neglecting available deductions, which can lead to a higher tax liability.

To calculate your taxable income, subtract total deductions allowed by Oklahoma law from your gross income. This calculation provides a clearer picture of your taxable earnings.

Filing options for the Oklahoma Small Business Income Form

When it comes to submitting the Oklahoma Small Business Income Form, you have options. You can opt for traditional paper filing or choose electronic filing, which has gained popularity due to its convenience. Electronic submission often results in quicker processing times and reduced chances of errors.

Using pdfFiller can significantly enhance your experience with completing and submitting the Oklahoma Small Business Income Form. With features like auto-fill capabilities and template saving, you’ll streamline the process greatly. ESigning documents through pdfFiller further simplifies your filing, allowing you to maintain compliance without the hassle of printing and scanning.

Post-filing: what to expect after submission

Once the Oklahoma Small Business Income Form is submitted, it’s important to track its status to ensure it has been processed. The Oklahoma Tax Commission may reach out with follow-up questions or requests for additional documentation. Being organized and responsive can make this follow-up process smoother.

In the event of discrepancies or audits regarding your submitted form, maintaining organized records is key. Having robust documentation makes it easier to resolve any issues during discussions with tax authorities.

Managing your small business income records

Proper record management not only assists during tax season but also enhances your overall business efficiency. Best practices include maintaining detailed logs of all income and expenses, systematically organizing receipts and invoices, and ensuring data is backed up electronically.

Utilizing a tool like pdfFiller enables small businesses to keep their income records organized. With features for document management and easy documentation access, pdfFiller becomes an essential asset for ongoing business operations.

Further considerations for Oklahoma small business owners

Along with filing the Oklahoma Small Business Income Form, business owners need to consider other regulatory obligations, including obtaining a sales tax permit for retail operations or applying for an Employer Identification Number (EIN) if hiring employees. Ignoring these aspects might result in compliance issues down the line.

Keeping abreast of changes in state tax legislation is also crucial. Utilize resources available through the Oklahoma Tax Commission and local business associations to stay informed on regulatory changes and educational opportunities to support your business.

Resources for Oklahoma small business owners

Oklahoma small business owners can benefit from a variety of resources and support networks. Local organizations focus on providing assistance in entrepreneurship, financial management, and regulatory compliance. Additionally, online platforms offer tools valuable for business management, simplifying tax preparation processes.

Important contacts include the Oklahoma Tax Commission for tax-related inquiries and local chambers of commerce for general business support. Leveraging these resources can position your business for success.

Leveraging technology to streamline your filing process

In an era where efficiency is key, leveraging technology can simplify the filing process significantly. Utilizing cloud-based platforms like pdfFiller allows business owners to edit, sign, and manage documents from virtually anywhere. This flexibility not only helps alleviate the stress of gathering paperwork but also promotes real-time collaboration among team members.

Many small businesses have successfully enhanced their tax management with pdfFiller, showcasing how streamlined filing and document management practices can lead to better preparedness each tax season.

Final tips for small business success in Oklahoma

To ensure success as a small business owner in Oklahoma, routine financial reviews are paramount. Regularly assessing your financial status aids in making informed decisions aligned with tax obligations and business growth strategies.

Moreover, consult with tax professionals to help navigate complexities related to the Oklahoma Small Business Income Form and other tax requirements. Engaging with experts not only provides clarity but also can potentially maximize your tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get oklahoma small business income?

How do I make changes in oklahoma small business income?

How do I make edits in oklahoma small business income without leaving Chrome?

What is oklahoma small business income?

Who is required to file oklahoma small business income?

How to fill out oklahoma small business income?

What is the purpose of oklahoma small business income?

What information must be reported on oklahoma small business income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.