Get the free Marine Personal Property Tax Return

Get, Create, Make and Sign marine personal property tax

How to edit marine personal property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out marine personal property tax

How to fill out marine personal property tax

Who needs marine personal property tax?

A Complete Guide to the Marine Personal Property Tax Form

Understanding the marine personal property tax form

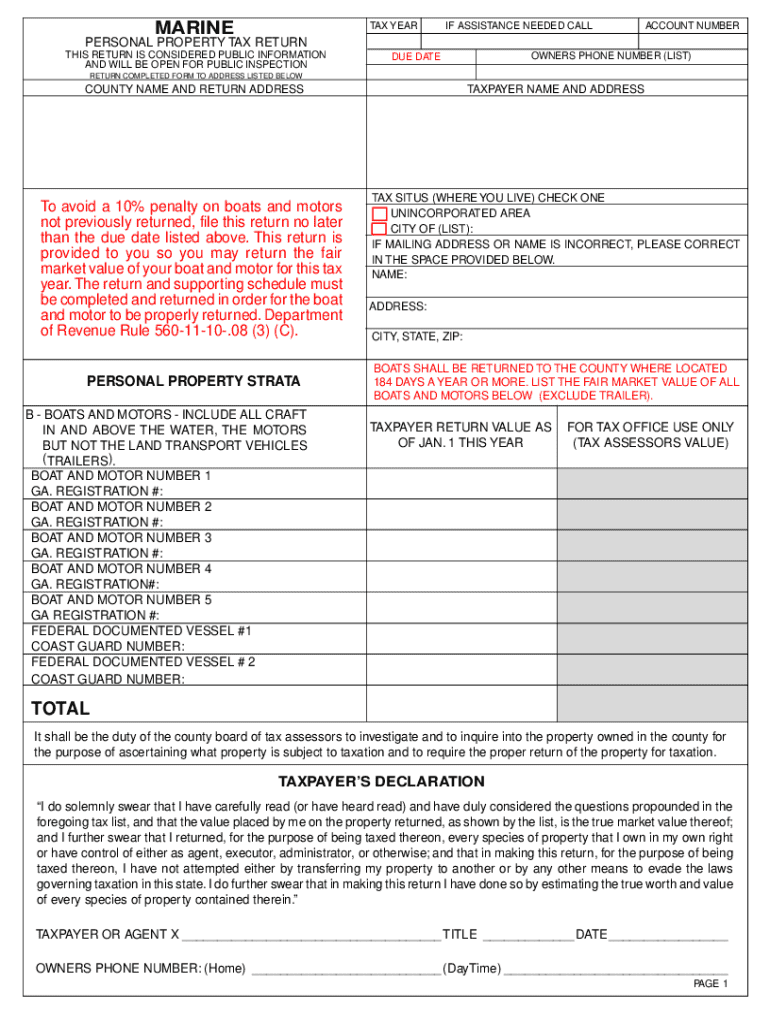

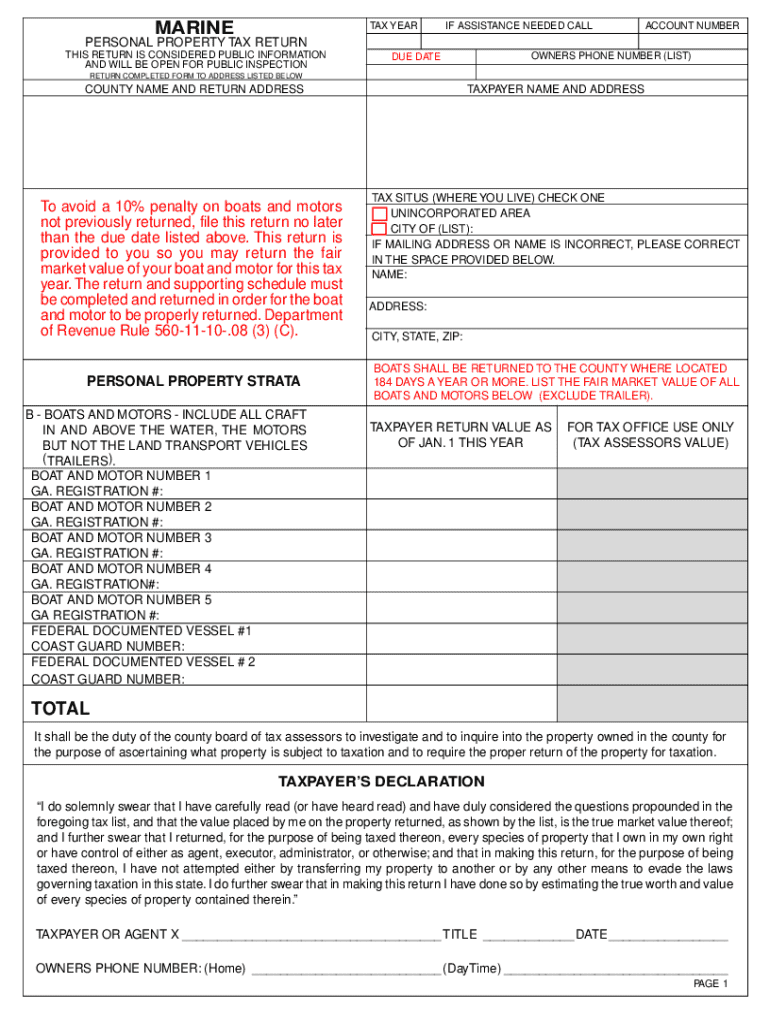

The marine personal property tax form is an essential document for boat and yacht owners. It serves to report the taxable value of marine assets, ensuring proper taxation according to local laws. Understanding this form is crucial for compliance and accurate accounting of taxes owed on your marine personal property.

Various marine assets fall under this taxation umbrella, including vessels, jet skis, and certain types of marine equipment. Each type of asset has different valuation methods, and it is important for owners to know which items are subject to tax to avoid penalties.

The taxation process for marine properties often involves separate municipal regulations. Property owners are responsible for filing the correct forms by set deadlines, which can vary widely depending on the jurisdiction.

Preparing to complete the marine personal property tax form

Before diving into the form, it is vital to gather all necessary documentation. This ensures that the filing process is smooth and accurate. Key documents include proof of ownership, recent tax valuation documents, and relevant receipts and bills, which help establish the ownership and value of the marine assets.

In addition to documents, specific information must be gathered to complete the form effectively. This includes a detailed description of the marine property along with vessel specifics such as year, make, model, and registration number.

Step-by-step instructions for filling out the marine personal property tax form

Completing the marine personal property tax form can seem daunting, but breaking it down into manageable sections can help streamline the process.

Filing your form by the due date is critical to avoid penalties. Each jurisdiction will have different rules about where to submit the form and which payment methods are accepted. Be sure to confirm these details ahead of time.

Utilizing pdfFiller’s features for marine personal property tax forms

pdfFiller offers a range of features that streamline the process of managing marine personal property tax forms, making it easier for owners to stay organized and compliant.

These features not only save time but also enhance productivity, allowing users to focus on other essential aspects of marine asset management.

Common mistakes to avoid when filing the marine personal property tax form

When filling out the marine personal property tax form, certain pitfalls can arise that may jeopardize proper filing. Being aware of these mistakes can help ensure a successful submission.

By taking proactive measures and staying informed, marine property owners can navigate the tax filing landscape more effectively.

Frequently asked questions about marine personal property taxation

Taxation of marine personal property often raises various questions among owners. Here are some common inquiries that can provide clarity.

Related forms and documents

Aside from the marine personal property tax form, there are additional documents that marine property owners should be aware of for comprehensive tax management. These may include registration forms, valuation requests, and various local government tax forms.

Navigating support and professional assistance

While many people can navigate tax filings independently, some situations may necessitate professional assistance or guidance. Understanding when and how to seek help can greatly reduce stress during the filing process.

Latest updates on marine property tax legislation

Recent changes to marine property tax laws can directly impact how boat owners report their assets. Staying updated on legislation ensures compliance and potentially finding tax savings.

For example, tax reforms may have introduced new assessments or exemptions, fundamentally altering how marine property is valued and taxed. Regularly check official tax websites to stay informed of these developments.

Engage with pdfFiller

pdfFiller empowers users by providing an intuitive, cloud-based platform for document creation and management. Users can create, edit, and collaborate on any forms, including the marine personal property tax form, ensuring a seamless and efficient filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in marine personal property tax without leaving Chrome?

Can I create an eSignature for the marine personal property tax in Gmail?

How do I fill out marine personal property tax on an Android device?

What is marine personal property tax?

Who is required to file marine personal property tax?

How to fill out marine personal property tax?

What is the purpose of marine personal property tax?

What information must be reported on marine personal property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.