Get the free No Claim Discount Proposal Form

Get, Create, Make and Sign no claim discount proposal

Editing no claim discount proposal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out no claim discount proposal

How to fill out no claim discount proposal

Who needs no claim discount proposal?

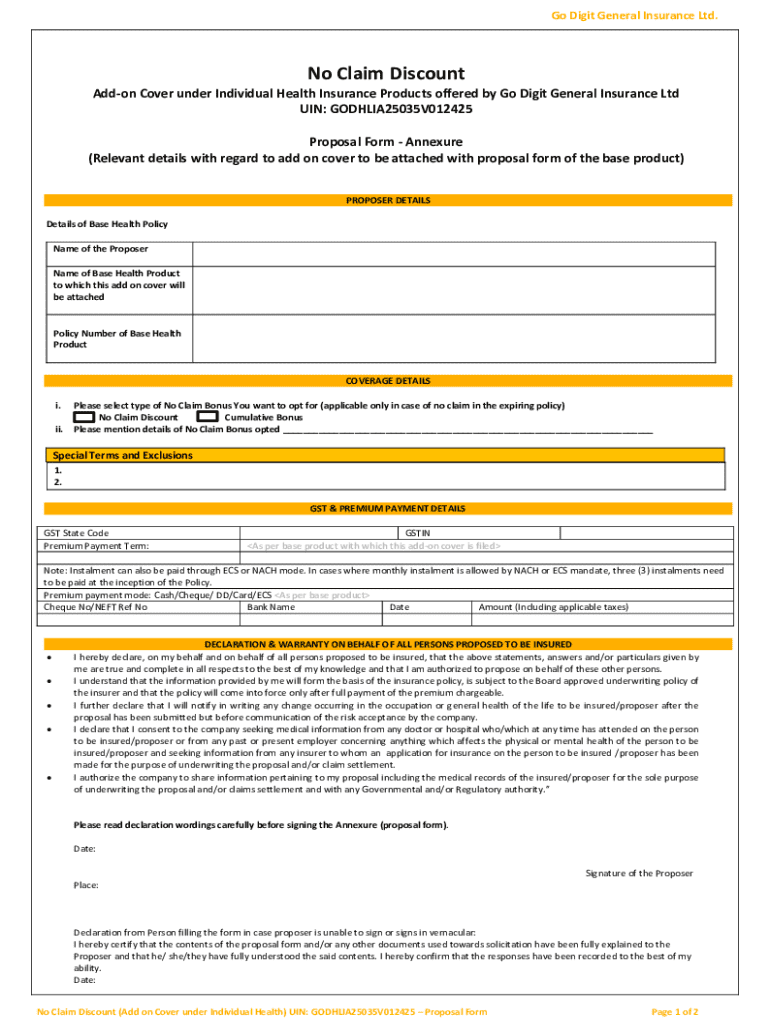

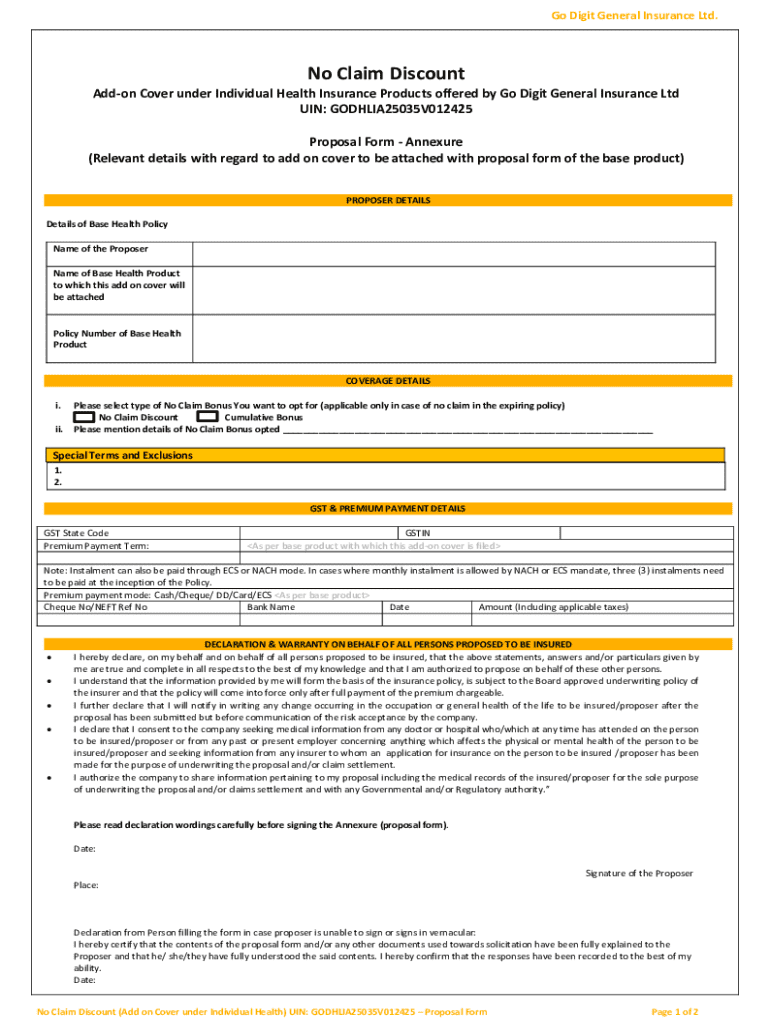

Completing Your No Claim Discount Proposal Form: A Comprehensive Guide

Understanding the no claim discount proposal

A No Claim Discount (NCD) is a benefit extended by insurance companies that rewards policyholders for not making any claims during a policy period. This discount can significantly reduce your insurance premium, reflecting your risk level as a customer. The rationale is simple: if you haven’t claimed, you present a lower risk, thus justifying a reduction in the premium.

For both policyholders and insurance companies, NCDs play a critical role. Policyholders benefit from lower costs and potential savings over time, while insurance companies retain a more manageable portfolio of lower-risk clients. Understanding how NCDs function is vital for maximizing your policy benefits.

Important considerations before completing the proposal form

Before you embark on filling out your no claim discount proposal form, it’s crucial to assess your eligibility. Typically, policyholders need to have held a continuous insurance policy without claims for a specified duration, often between one to five years. However, exceptions exist, such as previous claims that may affect your eligibility.

To navigate this effectively, gather all necessary documents before submitting your proposal. This may include your current policy details, proof of no claims from your previous insurers, and identification. Having accurate records can significantly streamline the process and enhance the chances of approval.

Navigating the no claim discount proposal form

Completing the no claim discount proposal form efficiently requires attention to detail. Begin with Section 1: Personal Information. Here, you must provide accurate details such as your name, address, and contact information. Ensuring this information is correct is crucial, as any discrepancies can delay the approval process.

In Section 2, you’ll enter Policy Information. This includes your policy number and the type of coverage you have. Make sure the information provided matches exactly with your insurance documents to avoid any potential confusion.

Next, Section 3 focuses on No Claim History. It's vital to report your claim history accurately. Inaccurate or misleading information can lead to rejection of the application. Lastly, in Section 4, you’ll come across the Declaration & Signature section, which serves to confirm the accuracy of your provided information.

Tips for successful submission and approval

Submitting your no claim discount proposal form can be straightforward if approached methodically. However, many applicants fall into common traps. Mistakes such as completing the incorrect form or neglecting to attach supporting documents can significantly impede progress.

To mitigate these risks, double-check your application for accuracy and completeness. Opt for a method of submission that aligns with your comfort. Online methods may offer quicker processing times, while offline submissions should be tracked for verification.

What to expect after submission

After your submission, anticipate an average processing time which can vary between insurers. Understanding the typical timeline can reduce anxiety; generally, you may expect feedback within 10-14 business days, though some insurers may respond faster.

The outcomes of your proposal can range from acceptance, which leads to an updated premium reflecting your NCD, to denial. Should your proposal be denied, insurance companies typically provide reasons for the rejection, and an appeal process may be available. It’s beneficial to be aware of these next steps to navigate any potential challenges.

Managing your no claim discount

Once you secure your no claim discount, the next step involves understanding how to maintain it annually. Regularly reviewing your policy and renewing it without claims is essential in preserving your discount benefits. Insurers may provide notifications before your renewal date to reconfirm your no claim status.

Changes in your claims history post-approval are also critical. If you need to report a claim, it’s essential to understand how this affects your NCD status. Ultimately, being proactive ensures you continue to enjoy the financial advantages associated with your no claim discount.

Using interactive tools on pdfFiller

The use of interactive tools on pdfFiller enhances the process of completing your no claim discount proposal form. The platform allows you to fill, edit, and sign documents online ensuring a user-friendly experience. Utilizing formatting and annotation tools can help to clarify your responses and highlight important information in your proposal.

Collaboration is made easy on pdfFiller. You can share your form with colleagues or family members to gather necessary inputs or approvals. By delegating tasks within the platform, you streamline the process and ensure accuracy before submission.

Accessing support for your no claim discount proposal

Experience with the no claim discount proposal form can sometimes lead to questions. Fortunately, pdfFiller provides significant customer support options. You can reach out through various channels for guidance, ensuring you have help every step of the way as you complete your form.

Additionally, engaging in user communities and forums associated with pdfFiller can offer shared experiences and advice. Collaborating with other users allows you to learn from their journey and gain valuable insights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get no claim discount proposal?

Can I sign the no claim discount proposal electronically in Chrome?

How do I edit no claim discount proposal on an iOS device?

What is no claim discount proposal?

Who is required to file no claim discount proposal?

How to fill out no claim discount proposal?

What is the purpose of no claim discount proposal?

What information must be reported on no claim discount proposal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.