Get the free Motor Vehicle Insurance Information

Get, Create, Make and Sign motor vehicle insurance information

Editing motor vehicle insurance information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle insurance information

How to fill out motor vehicle insurance information

Who needs motor vehicle insurance information?

Comprehensive Guide to the Motor Vehicle Insurance Information Form

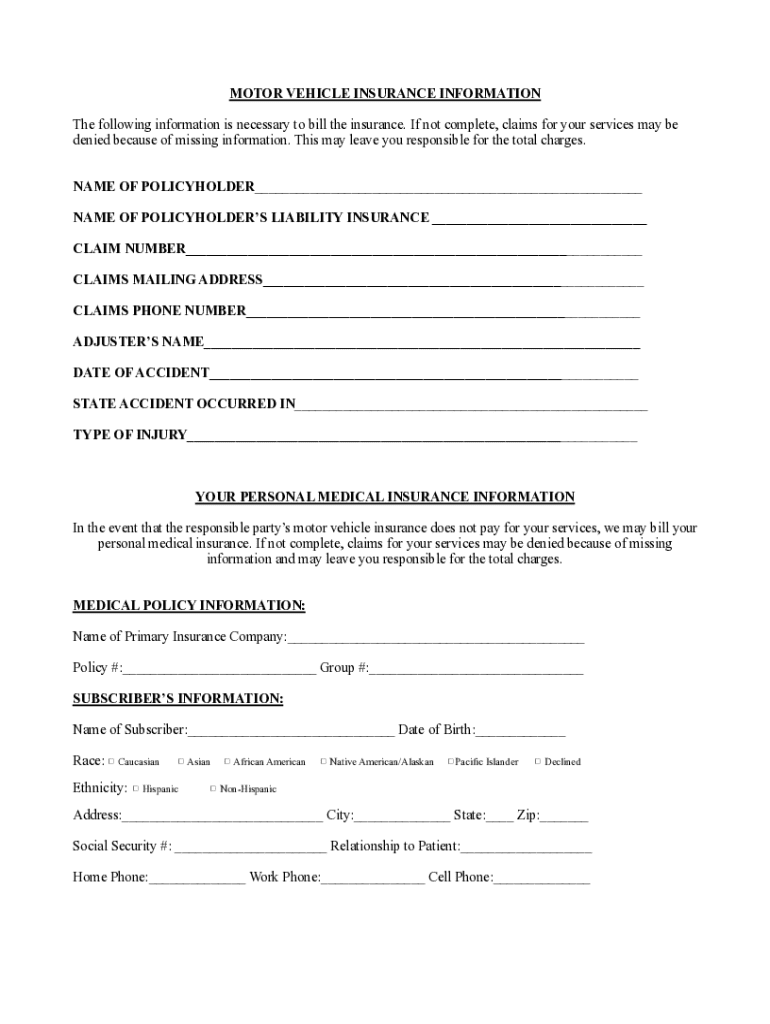

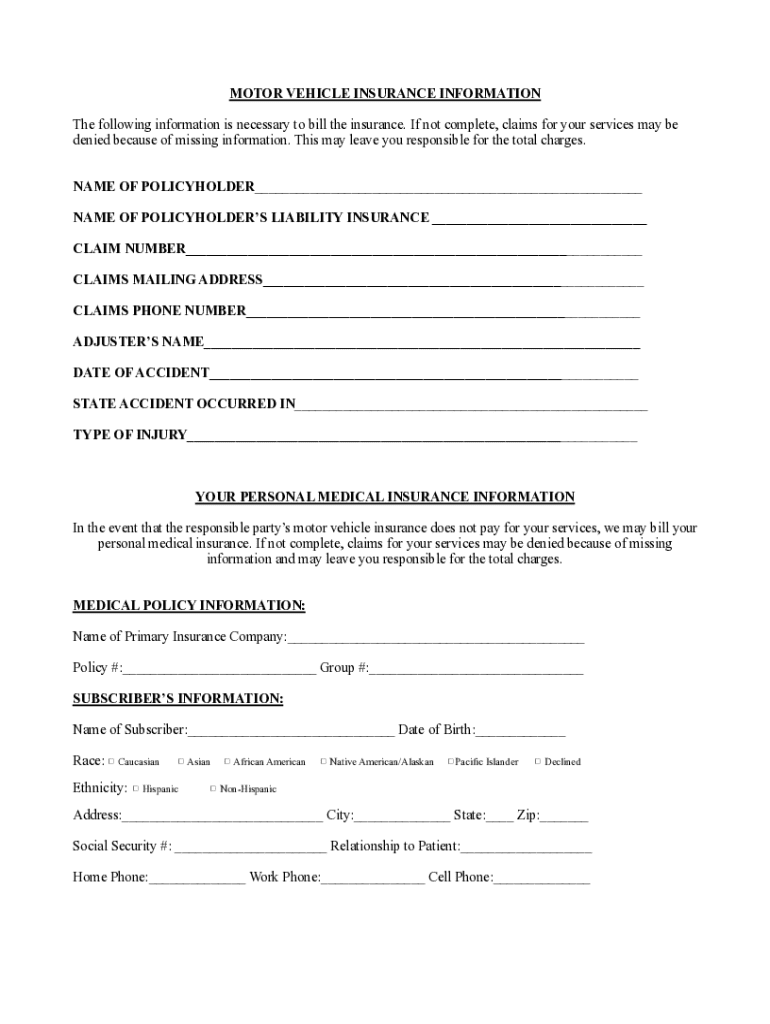

Overview of the motor vehicle insurance information form

The motor vehicle insurance information form serves as a crucial document for both insurers and policyholders. It provides necessary details that validate the vehicle's insurance coverage and ensures all parties are aware of their rights and responsibilities. The purpose of the form extends beyond mere data collection; it establishes a record that can facilitate claims, policy renewals, and compliance with state regulations.

Accurate and comprehensive information is paramount. Any discrepancies or omissions can lead to claims being denied or legal complications. From vehicle manufacturers to ownership details, every piece of information can impact the validity of your insurance policy, making it essential for the form to be filled out meticulously.

Anyone who owns or operates a vehicle is required to submit this form, including individuals, businesses, and fleet operators. With the variety of vehicles on the road today, each entity must provide the necessary details to ensure they are adequately covered by insurance.

Understanding motor vehicle insurance requirements

Motor vehicle insurance requirements can vary significantly based on local laws; however, several key types of coverage are commonly mandated. Liability insurance, which covers damages to other vehicles and medical expenses resulting from an accident for which you are at fault, is usually a fundamental requirement. Personal Injury Protection (PIP) provides coverage for medical expenses for you and your passengers, regardless of fault.

Uninsured/underinsured motorist coverage is another critical component, ensuring that if you're involved in an accident with a driver lacking sufficient insurance, you have the necessary coverage to protect yourself. On top of these mandatory requirements, drivers may choose to add additional insurance types to enhance their coverage.

Additional insurance types such as comprehensive and collision coverage help protect against non-collision-related damage and cover repair costs for your vehicle after an accident, respectively. Many states have specific insurance minimums, so it's essential to stay informed and ensure compliance to avoid fines or legal issues.

Preparing to complete the insurance information form

Prior to filling out the motor vehicle insurance information form, it’s crucial to gather all necessary information to ensure a seamless process. This includes specific vehicle details such as the make, model, year, and VIN (Vehicle Identification Number), which play a vital role in accurately identifying your vehicle in the insurance policy.

In addition to vehicle details, having the owner's information, including their name, address, and contact information, is essential. If you’ve previously held an insurance policy, be prepared to provide that information as well to demonstrate your insurance history. Ensuring you have identification documents, such as a driver's license or ID card, along with prior policy documents, if applicable, can also facilitate the process.

Step-by-step guide to filling out the form

Filling out the motor vehicle insurance information form can often seem daunting, but breaking it down into manageable sections helps streamline the process. Start with the personal information section. Here you’ll need to input your full name, address, and contact details. Be careful to ensure that your information is accurate as errors here can lead to delays.

Next, move to the vehicle information section where accuracy is crucial, especially regarding the VIN. This number uniquely identifies your vehicle and any inaccuracies may cause complications should you need to file a claim. The insurance history section allows you to report any prior coverage. Provide correct information, as this could affect your new policy’s rates. In the coverage selection section, carefully consider the options available and choose a coverage level that suits your needs.

Finally, the signatures and verification section requires you to confirm the accuracy of the information provided. Ensure that all parties involved sign the document, which can often be done electronically or through a handwritten signature.

How to edit and manage your form

Once your motor vehicle insurance information form is filled out, you may want to make edits or changes as needed. Utilizing pdfFiller’s editing tools can significantly simplify this process. The platform offers robust text editing features allowing you to adjust any entries without hassle.

You can easily add signatures electronically or incorporate additional notes or corrections. After editing, ensure to save your form appropriately, whether it's storing it locally or uploading it to a secure cloud location. Consider sharing the completed form directly with insurance providers or other relevant parties through pdfFiller’s sharing options, which enhance collaboration for all involved.

eSigning your motor vehicle insurance information form

The benefits of electronic signing cannot be understated, particularly in the world of insurance documentation. eSigning not only expedites the process but also reduces the risk of physically losing documents. Additionally, many insurance providers accept eSignatures as legally binding, making it easier for you to finalize your insurance agreements.

Completing the eSignature process is straightforward. Once you've filled out your motor vehicle insurance information form, select the eSignature option provided by pdfFiller, following the on-screen prompts to add your signature. You can choose between drawing your signature, typing it, or uploading an image, providing flexibility to suit your preferences.

Further, it’s important to understand that eSignatures hold the same validity as handwritten signatures in most jurisdictions, ensuring that your signed documents are enforceable and accepted.

Submitting the form

With your motor vehicle insurance information form completed and signed, the next step is submission. There are various channels available for submission, including online options through your insurance provider’s portal or pdfFiller, mail-in options for traditionalists, and in-person submission where applicable. Be sure to follow the instructions specific to your insurer to avoid potential delays.

After submitting your form, confirm its receipt. Most insurers provide immediate confirmation via email or a notification on their platform, ensuring peace of mind. Be aware that the time it takes for your application to be processed may vary, but generally, you can expect a response regarding your insurance status or any additional documentation required.

Troubleshooting common issues

It’s not uncommon for forms to be rejected for various reasons, such as incorrect information or missing signatures. Familiarizing yourself with common rejection reasons can expedite the resolution of issues. If your motor vehicle insurance information form is returned for any reason, take immediate steps to correct the discrepancies and resubmit promptly.

Contact information for assistance is typically provided on your insurance provider’s website; don’t hesitate to reach out for clarification on what may be required. Additionally, frequently asked questions on their site can provide helpful information regarding specific issues you might encounter during the submission process.

Managing changes to your insurance information

Once you’ve submitted your motor vehicle insurance information form, various circumstances may arise necessitating updates. Whether it’s a change of address, a new vehicle, or a shift in coverage preferences, it’s essential to communicate these changes to your insurance provider promptly. It’s critical to keep your insurance documentation updated to reflect these changes accurately.

Companies may have specific timelines for reporting changes, so consult your insurance provider’s guidelines to avoid any lapses in coverage. Utilize pdfFiller's features to amend your previously submitted form easily and maintain up-to-date records with your insurer.

Additional considerations

When dealing with the motor vehicle insurance information form, understanding privacy and data protection is paramount. Your information is sensitive and should be handled with care. Platforms like pdfFiller prioritize the security of your data, employing encryption and compliance with regulations to keep your information safe.

Staying organized with your insurance documentation will save you time and stress in the future. Maintaining an up-to-date digital folder with all related forms, receipts, and communications can make managing your insurance as straightforward as possible.

Frequently asked questions (FAQs)

The motor vehicle insurance information form is essential for establishing and maintaining your vehicle’s insurance policy. It helps ensure that both insurers and policyholders have accurate records for claims and policy compliance.

If you need to make changes after submitting the form, reach out to your insurance provider immediately and inquire about the proper procedures for updates. Most insurers have protocols in place to handle post-submission adjustments.

Concerns about the security of electronic submissions are valid, but reputable providers ensure that data is transmitted securely. Confirm the use of secure channels when submitting your motor vehicle insurance information form electronically.

Missing a renewal deadline can lead to lapses in coverage, which may leave you exposed to potential risks. Stay proactive by marking your calendar or setting reminders to ensure timely renewals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get motor vehicle insurance information?

Can I create an eSignature for the motor vehicle insurance information in Gmail?

How do I fill out motor vehicle insurance information using my mobile device?

What is motor vehicle insurance information?

Who is required to file motor vehicle insurance information?

How to fill out motor vehicle insurance information?

What is the purpose of motor vehicle insurance information?

What information must be reported on motor vehicle insurance information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.