Get the free New Account Application

Get, Create, Make and Sign new account application

How to edit new account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account application

How to fill out new account application

Who needs new account application?

Comprehensive Guide to the New Account Application Form

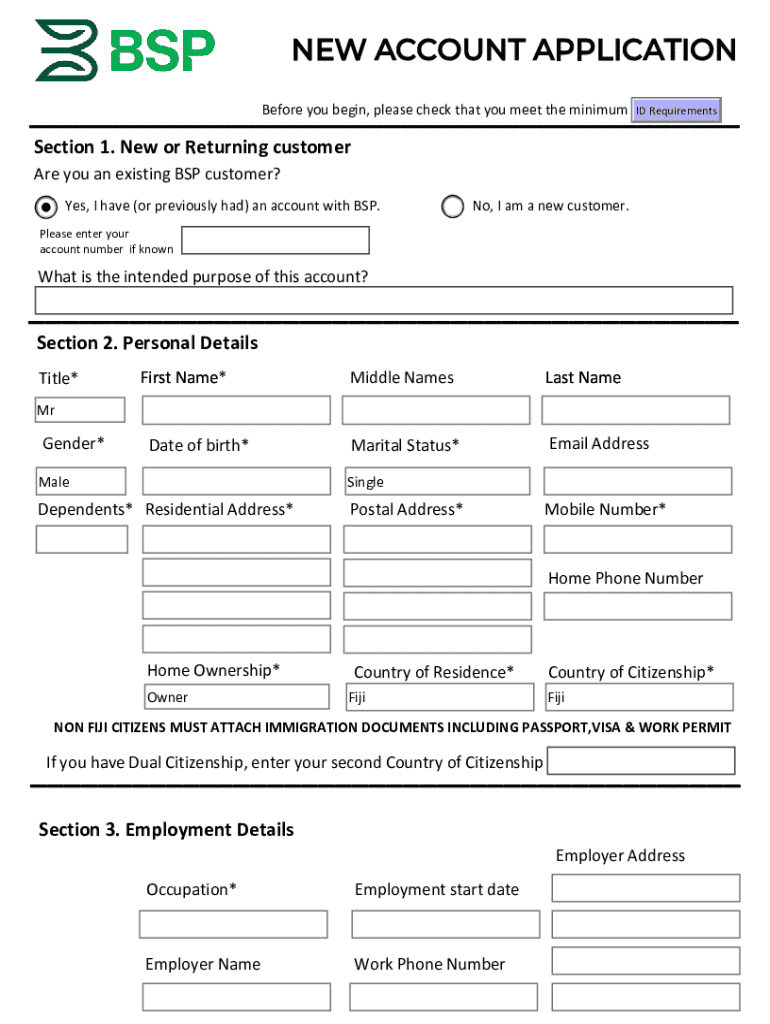

Overview of a new account application form

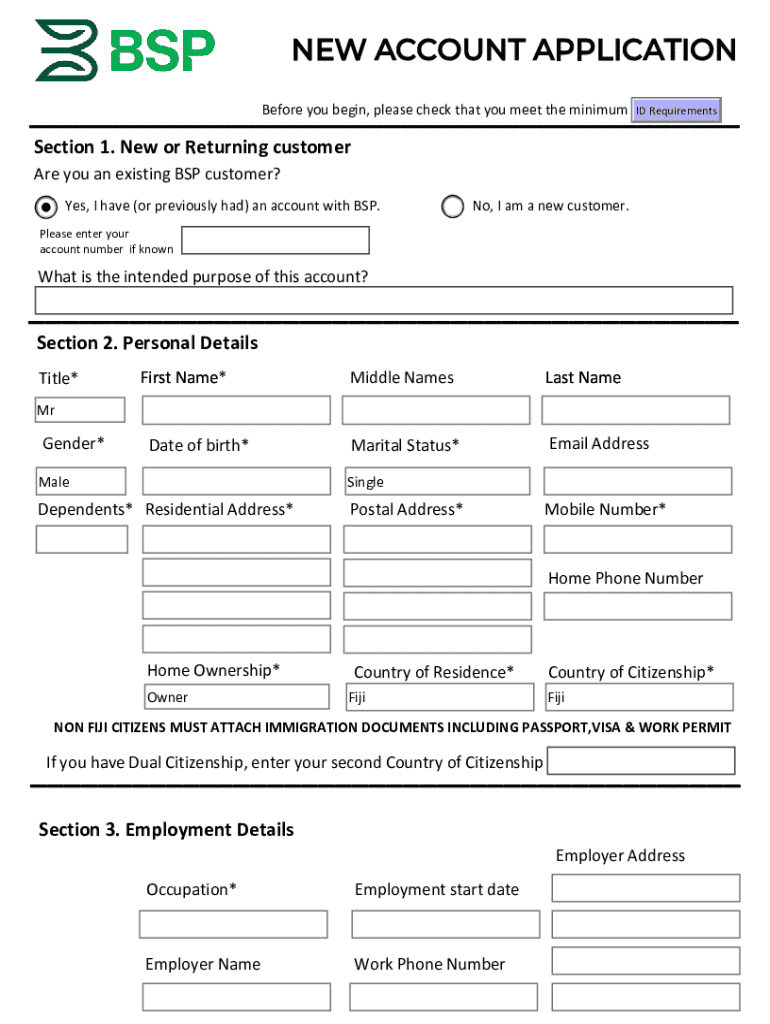

A new account application form is a critical document used by individuals and businesses to open different types of accounts, such as bank accounts, credit cards, or investment accounts. This form serves as the foundation upon which financial institutions evaluate potential customers, ensuring that the necessary information is collected to comply with regulatory and internal requirements.

For individuals, these forms simplify the process of managing finances, while for businesses, they are instrumental in establishing banking relationships and securing funding. Accuracy in completing this form is paramount, as it can directly influence your access to financial products and services.

Types of new account application forms

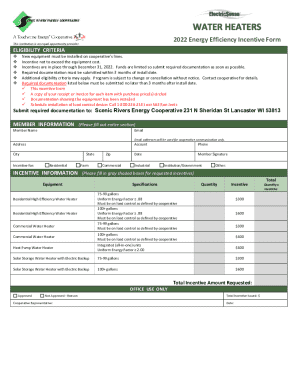

There are various types of new account application forms tailored to meet different financial needs. Understanding each type can help you determine the right form to complete.

Step-by-step guide to filling out a new account application form

Filling out a new account application form can seem daunting, but a systematic approach can simplify the process. Here's how to navigate it.

Editing and managing your application form with pdfFiller

pdfFiller provides a seamless experience when it comes to editing and managing your new account application form. You can easily make changes to your application using its intuitive interface.

The e-signature features offered by pdfFiller help ensure that your signed documents are both secure and legally binding. Additionally, if you are working as part of a team, pdfFiller’s collaboration tools allow for sharing and real-time editing of documents, making it simple to collaborate effectively.

Common questions about new account applications

As a prospective applicant, you may have some pressing questions. Addressing these can provide clarity and confidence in the application process.

Interactive tools and resources

pdfFiller offers an array of templates specifically designed for new account applications. These templates make it easy to complete your forms accurately and efficiently.

Users can access tailored templates for various financial institutions, ensuring that the forms meet specific standards. Additionally, sample forms are available for practice, allowing you to familiarize yourself with the information required.

Ensuring your application is secure

It's essential to safeguard your personal information throughout the application process. Adopting best practices can prevent identity theft and unauthorized access.

Further exploration of account types and their requirements

Each account type has unique requirements that you must understand for optimal account selection based on your financial goals. Retirement accounts typically focus on long-term savings, while non-retirement accounts might cater to immediate financial needs.

Links to other forms related to account applications are invaluable for those looking to expand their financial knowledge and options. Familiarity with the distinctions between retirement and non-retirement accounts enhances decision-making.

Frequently asked questions about pdfFiller

Understanding how pdfFiller operates can streamline your new account application process significantly.

Testimonials and success stories

Reading about others’ experiences can inspire confidence. Many users have successfully navigated their new account applications using pdfFiller, appreciating the platform's ease of use and time-saving features.

From individuals managing their personal finances to teams collaborating seamlessly on business accounts, the advantages of using pdfFiller are both significant and varied, showcasing its role in facilitating successful outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute new account application online?

How do I edit new account application in Chrome?

How do I edit new account application on an iOS device?

What is new account application?

Who is required to file new account application?

How to fill out new account application?

What is the purpose of new account application?

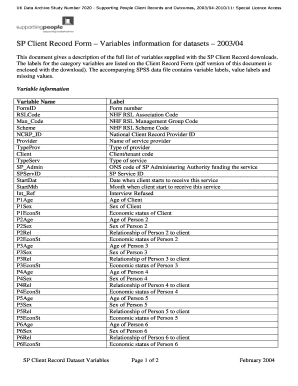

What information must be reported on new account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.