Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

How to Fill Out Form 8-K: A Comprehensive Guide

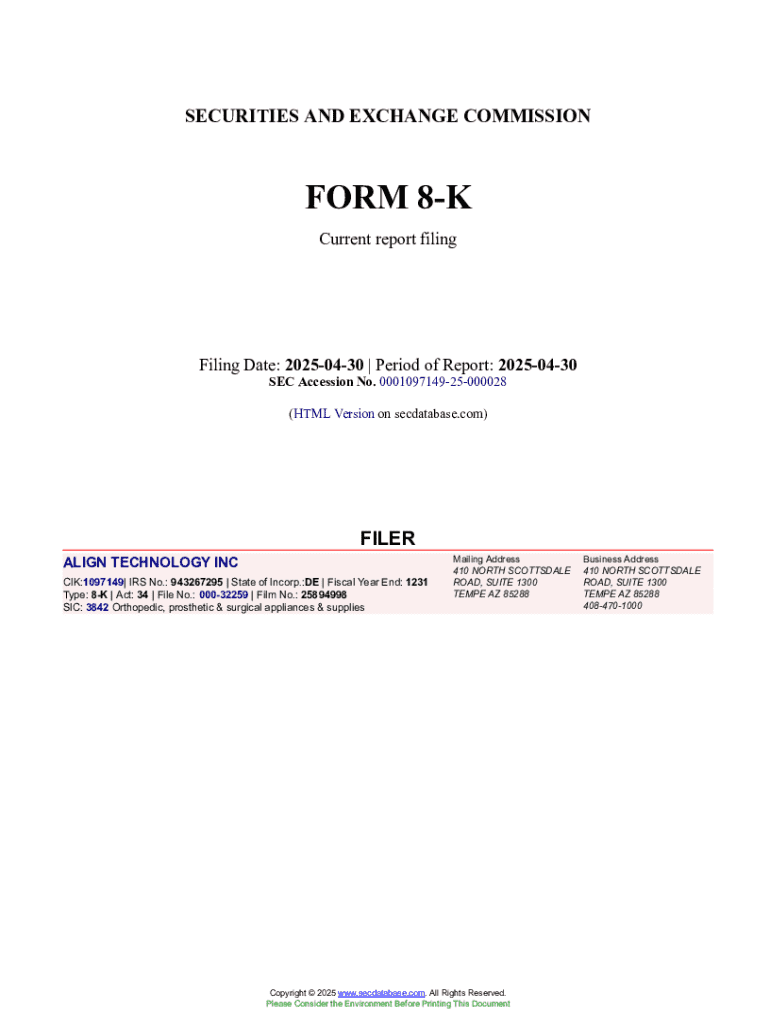

Understanding Form 8-K

Form 8-K is an essential document required by the Securities and Exchange Commission (SEC) that publicly traded companies must file to report major events affecting their financial status or operations. This non-annual filing serves as a critical communication tool for companies, ensuring timely disclosures to investors, analysts, and other stakeholders.

The vital purpose of Form 8-K is to maintain transparency and integrity in financial reporting. By promptly disclosing significant events, the form helps investors make informed decisions, thus fostering trust in the capital markets.

When to file Form 8-K

Companies are required to file Form 8-K under specific circumstances, including but not limited to:

Timeliness is critical when filing Form 8-K. Generally, companies must report these events within four business days of their occurrence. Delays can lead to potential penalties, including fines and damage to the company's reputation.

Key components of Form 8-K

Form 8-K has a general structure designed to comprehensively capture the event being reported. The main sections provide a framework for essential disclosures to investors and the public.

A detailed breakdown of the key items included in Form 8-K is as follows:

Over the years, Form 8-K has undergone several amendments to improve transparency and adapt to evolving market conditions. These changes often reflect a response to crises or major shifts within the financial landscape.

Filling out Form 8-K

Filling out Form 8-K requires careful attention to detail to ensure compliance with SEC regulations. Here’s a step-by-step guide to completing the form.

The preparation phase involves gathering necessary documentation and detailed information about the event being reported. Key considerations include:

As you fill out each section of Form 8-K, practical tips include providing precise and clear details about the event and ensuring that all required signatures are included. Be aware of common mistakes, like missing crucial information or failing to respect deadlines, which could lead to compliance issues.

Utilizing tools like pdfFiller can simplify the form completion process. This platform offers features for collaborative editing, easy e-signing, and cloud storage, making it accessible for your team to manage documentation effectively.

After filing Form 8-K

Once Form 8-K is filed, a series of processes follow that begin with SEC review and public access. Understanding what happens next can help manage expectations.

After submission, the SEC may review the form but typically allows public access, making the contents available for shareholders and analysts. It's crucial for companies to maintain records and keep documentation as part of their governance practices.

Tools like pdfFiller can significantly assist in post-filing management. The platform’s document management capabilities allow for organizing and accessing past filings, ensuring that teams can easily track their compliance history.

Frequently asked questions about Form 8-K

While filling out Form 8-K may seem straightforward, various questions often arise regarding the filing process and specific situations that necessitate or exempt the requirement to file.

Best practices for compliance include developing internal protocols for timely filing, conducting periodic reviews of the compliance strategy, and integrating tools for document management to ensure transparency and accuracy.

The role of Form 8-K in financial reporting

Form 8-K plays a critical role in maintaining the integrity of financial reporting. For investors and analysts, timely access to key information assists in evaluating a company’s financial health and governance practices.

Different industries may have varying requirements when it comes to filing Form 8-K, reflecting the unique circumstances and regulatory environments that impact financial disclosure.

For example, technology and pharmaceutical companies often face rapid changes necessitating frequent disclosures, while utility companies may have less frequent but still critical reporting obligations.

Leveraging technology for efficient filing

Using pdfFiller for filing Form 8-K significantly enhances efficiency through its cloud-based features. The platform simplifies document creation, allowing users to edit, e-sign, and collaborate seamlessly.

The integration of technology into the document management workflow streamlines operations. Corporate teams can maintain a standardized approach to filing and tracking Form 8-K submissions, aiding compliance with SEC regulations while saving time.

Additionally, pdfFiller enables teams to engage in real-time collaboration, ensuring all necessary input is collected efficiently and accurately.

Continuous learning and updates

It's vital to stay informed about potential changes to Form 8-K regulations to ensure ongoing compliance. This could be achieved through subscribing to relevant updates from the SEC or utilizing platforms like pdfFiller that offer alerts about regulatory changes.

Leveraging newsletters and continuous learning resources provided can empower companies to adapt quickly to changes affecting Form 8-K and other filing requirements.

This proactive approach not only aids compliance but also strengthens a company's overall governance framework.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 8-k?

Can I create an eSignature for the form 8-k in Gmail?

Can I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.