Get the free Brown County Room Tax Commission

Get, Create, Make and Sign brown county room tax

Editing brown county room tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brown county room tax

How to fill out brown county room tax

Who needs brown county room tax?

Brown County Room Tax Form How-to Guide

Overview of Brown County room tax

The Brown County Room Tax is a specific tax levied on the hospitality sector, primarily targeting accommodations such as hotels, motels, and short-term rentals. This tax plays a pivotal role in funding local infrastructure, tourism initiatives, and various community services. The revenue generated from this tax is funneled back into the community to enhance public resources and promote local tourism, benefiting both residents and visitors alike.

All establishments that rent out rooms or accommodations for a fee within Brown County are mandated to collect and remit this tax. This includes anyone operating a short-term rental, regardless of whether they manage the property directly or use a third-party platform. Compliance ensures that local services remain well-funded and that the county continues to thrive as a sought-after travel destination.

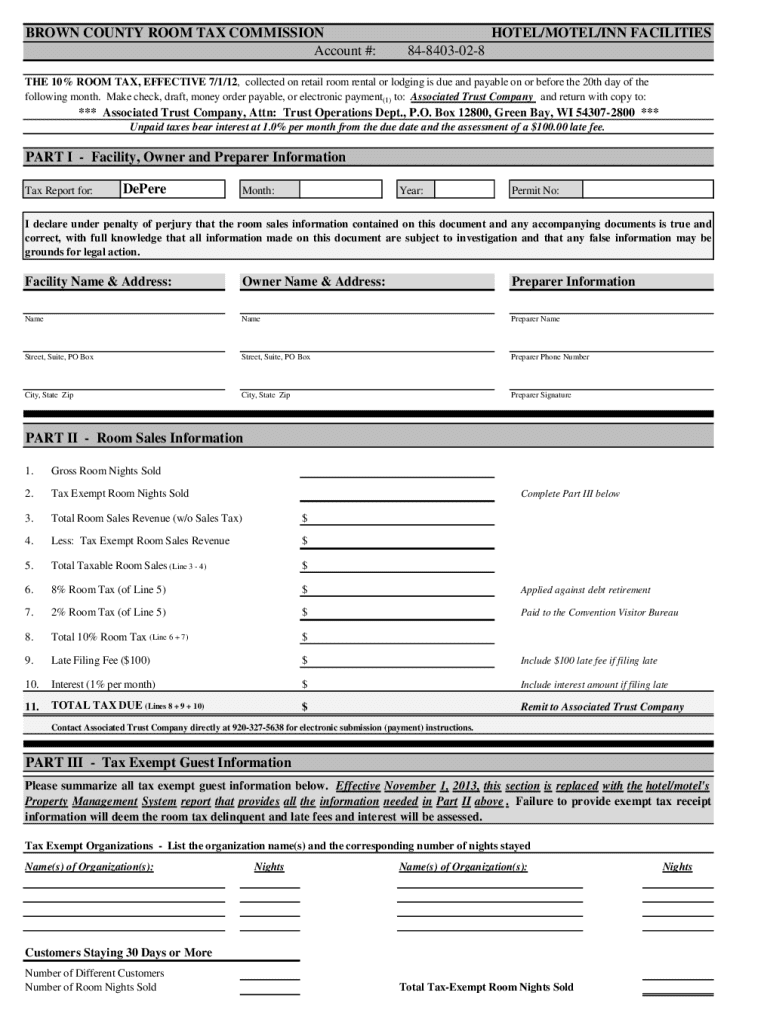

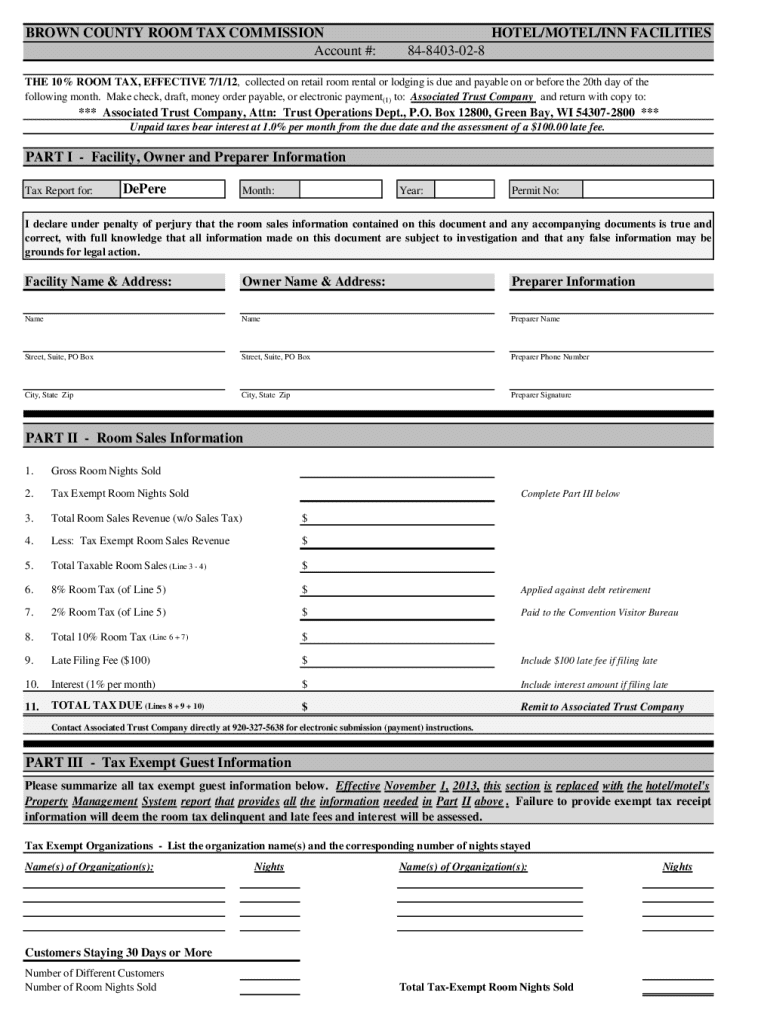

Understanding the Brown County room tax form

The Brown County Room Tax Form is an essential document used to report and remit the collected room tax. This form not only serves as a formal declaration of taxable income from rentals but also helps in maintaining transparency within the local economy. Effective completion of this form guarantees that the collected funds are appropriately directed toward community enrichment projects.

Key components of the form include sections for personal information, a detailed tax calculation segment, and payment information. The personal information section requests the taxpayer's details, while the tax calculation section allows users to compute the total amount owed based on rates and rental income. Additionally, documenting payment methods is crucial to ensure accurate processing of the tax payments.

Avoiding common mistakes while filling out this form is crucial for compliance and efficiency. For instance, failing to report all rental income or miscalculating the tax owed can lead to penalties. It's advisable to double-check figures and ensure accuracy when completing each section.

Step-by-step instructions for filling out the Brown County room tax form

Filling out the Brown County Room Tax Form may seem daunting, but following systematic steps can streamline the process. Start by gathering all necessary information to facilitate accurate completion.

Step 1: Gather required information

Before starting the form, compile essential details including your address and contact information, specifics about the rental units, and accurate records of rental income alongside occupancy rates. Having these figures easily accessible will simplify the tax calculation process.

Step 2: Complete the taxpayer information section

Accurate completion of the taxpayer information section is paramount. Whether you're operating as an individual, partnership, or business entity, ensure all details are correct to avoid processing delays. Mistakes in this section can hinder further steps in the submission process.

Step 3: Calculate the room tax owed

To calculate the room tax owed, identify the total rental income and apply the appropriate taxable rate from the guidelines provided by Brown County. For instance, if your total rental income for a designated period is $10,000 and the applicable room tax rate is 8%, the tax owed would be $800. Utilize such tangible examples to internalize the calculations required.

Step 4: Finalize payment information

Next, indicate your payment choice. Options often include online payments, checks, or electronic transfers. Depending on your situation, select the most convenient option. It's essential to keep in mind that timely submission of payment is vital to avoiding penalties.

Step 5: Review and submit the form

Prior to submission, meticulously review your entries. A common pitfall is submitting forms with errors. Verify that all calculations are correct and that you've included all necessary documents. You can typically submit the form online or via traditional paper submission; choose the method that aligns with your circumstances.

Tools for managing your Brown County room tax submission

Managing your room tax submission can be simplified significantly through the utilization of cloud-based tools, such as those offered on pdfFiller. These tools provide a streamlined way to create, fill, and manage forms, ensuring compliance and reducing stress related to documentation.

pdfFiller's standout features include e-signature functionality, which allows you to sign documents seamlessly from your device without printing. The platform also supports collaboration, enabling team members to work together on documents in real time. Furthermore, with robust document management capabilities, you can store all your room tax forms securely in one location.

Common FAQs about the Brown County room tax form

Understanding common queries can simplify navigating the Brown County Room Tax Form further. For instance, many individuals ask whether they need to complete the form for short-term rentals. The answer is yes; any rental operation, regardless of duration, is obliged to comply with this tax regulation.

Additionally, those using online platforms for property management might wonder how their tax obligations differ. In such cases, it's essential to verify that these platforms are remitting the taxes on behalf of their users; otherwise, property owners are responsible for their tax compliance.

Resources and contacts for assistance

For any questions or assistance relating to the Brown County Room Tax Form, reaching out to local tax offices can provide clarity. The Brown County tax office offers resources including direct contact numbers and in-person assistance for query resolution.

Additional resources can be accessed through the Brown County website, where updated information on local tax regulations is made available. For specific inquiries related to document management, the support offered by pdfFiller is invaluable as they specialize in providing assistance around form-related questions.

Exploring related forms and applications

In addition to the Brown County Room Tax Form, several other forms contribute to the administrative coherence within the local hospitality sector. Some relevant applications include the Short-Term Rental Permit Application, Mobile Storage Unit Permit, and Building Permit Application. These documents ensure compliance with local laws and maintain regulation across the accommodation industry.

Access to these forms is streamlined on platforms like pdfFiller, which allows you to navigate directly to the necessary documents without hassle.

Community information and local insights

The revenue generated from the Brown County Room Tax significantly impacts local businesses and community projects. Funds from the tax have been allocated toward enhancing local parks, supporting community events, and promoting Brown County as a prime destination for tourists. Restaurants, shops, and local attractions reap the benefits brought by the influx of visitors.

Community events, such as the annual Brown County Fair and local artisan markets, are made possible in part through funding derived from the room tax. Such events foster community spirit and stimulate the local economy, underscoring the vital role that responsible rental property management and room tax compliance play in sustaining local livelihoods.

Next steps for room tax compliance

To remain compliant with room tax regulations, establishing a systematic approach to track rental income and taxes owed is crucial. Consider implementing accounting software or a spreadsheet to monitor earnings and tax obligations efficiently. This proactive approach not only eases the filing process but also minimizes the risk of errors.

Additionally, setting reminders for filing deadlines can help avoid late payments. Regularly reviewing your rental agreements and property status ensures you stay informed of any changes affecting your tax obligations. Utilizing platforms like pdfFiller for ongoing document management can facilitate continuous compliance, enabling ease in submitting documentation as required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify brown county room tax without leaving Google Drive?

How can I send brown county room tax for eSignature?

Can I create an electronic signature for signing my brown county room tax in Gmail?

What is brown county room tax?

Who is required to file brown county room tax?

How to fill out brown county room tax?

What is the purpose of brown county room tax?

What information must be reported on brown county room tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.