Get the free New Accounts Report

Get, Create, Make and Sign new accounts report

How to edit new accounts report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new accounts report

How to fill out new accounts report

Who needs new accounts report?

A comprehensive guide to the new accounts report form

Understanding the new accounts report form

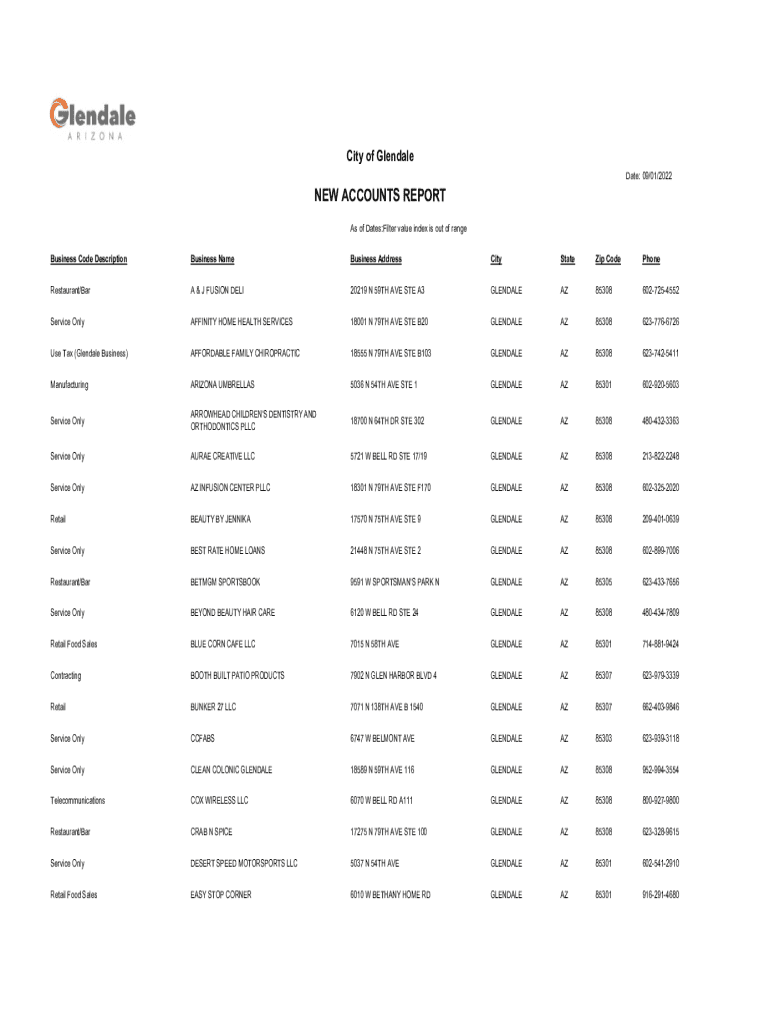

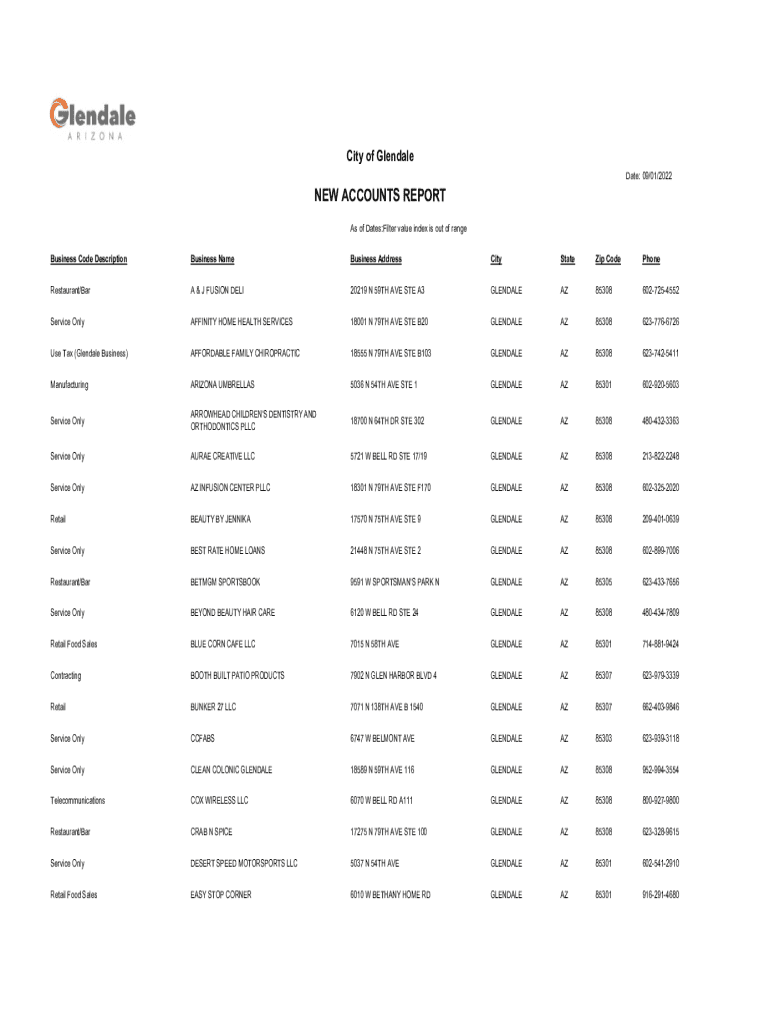

The new accounts report form serves as a vital document intended primarily for financial institutions, organizations, or governmental entities to collect essential information about new accounts. The form’s primary purpose lies in documenting the details of newly opened accounts to facilitate compliance with regulatory requirements and maintain accurate financial records.

Accurate reporting is paramount in financial contexts, as it mitigates risks associated with fraud, money laundering, and mismanagement of funds. Consequently, organizations must ensure that the new accounts report form is meticulously filled out to reflect true and complete information. Key stakeholders who benefit from this form include financial institutions, regulatory bodies, auditors, and account holders, all of whom rely on the accuracy of the data provided.

Components of the new accounts report form

The new accounts report form typically comprises several main sections that systematically gather different types of information critical for account registration. These sections include identifying information, account details, and a financial data section. Each part plays a key role in constructing a complete and compliant report.

1. **Identifying Information**: This section requests personal details such as the account holder’s name, address, contact information, and social security number or taxpayer identification number.

2. **Account Details**: Here, users specify the type of account being opened, such as savings, checking, or investment, along with the account number once it’s established.

3. **Financial Data Section**: This area captures essential financial information, including details about the account holder’s income, sources of funds, and anticipated transaction volumes.

Required documentation for submission

To support the information provided in the form, certain documentation is typically required during submission. This could include identification documents such as a driver's license or passport, proof of income via pay stubs or tax returns, and any additional documentation mandated by regulatory standards.

Organizations must also ensure compliance with various local and federal regulations, as failure to do so can lead to penalties or other legal consequences.

Filling out the new accounts report form

Completing the new accounts report form accurately is essential to avoid delays in processing. Follow these step-by-step instructions for each section:

Common mistakes to avoid during this process include using ambiguous language, failing to double-check entered information, or omitting required documents. To ensure the form is accurate and complete, take time to review and verify all details before submission.

Editing and formatting your new accounts report form

After completing the initial form, utilizing editing tools can enhance clarity and professionalism. pdfFiller’s editing tools make it easy to modify existing PDF forms, allowing users to make necessary updates without starting from scratch.

Adding interactive elements, such as digital signatures, is also straightforward with pdfFiller. This allows for seamless eSigning processes, enhancing the efficiency of document handling. Furthermore, users can insert comments or annotations to facilitate collaboration with team members or advisors.

Submitting the new accounts report form

Once the new accounts report form is filled out and edited for professionalism, the next step involves submission. Two primary submission options are generally available:

After submission, a verification process typically occurs to confirm that all data is accurate and complete. It’s common to receive a confirmation email or notification once the form has been processed. Account holders should stay alert for any follow-up communications or requests for additional information.

Collaborating on the new accounts report form

Collaboration is crucial, especially for teams managing multiple account openings. pdfFiller enables users to easily share the form with team members for collective input.

Additionally, utilizing cloud storage options ensures easy access to the form from anywhere, facilitating better teamwork and seamless document management.

Troubleshooting common issues

Even with diligent efforts, users might encounter issues during form completion or submission. Addressing common questions can help alleviate concerns:

Being prepared with solutions can ease the process and enhance your efficiency when dealing with the new accounts report form.

Best practices for future reports

Establishing best practices for managing your new accounts report form and future submissions is essential for ongoing compliance and efficiency. Consider Implementing the following strategies:

Implementing these best practices creates a streamlined approach to handling financial documentation effectively.

Leveraging pdfFiller for document management

pdfFiller provides an all-in-one platform that excels in paperless document management, particularly when handling forms such as the new accounts report form. The platform's key features include easy editing, seamless eSigning, and efficient collaboration, making it a cornerstone for managing financial documentation.

Interactive tools for enhanced reporting

Integrating your new accounts report form with other platforms can enhance reporting capabilities significantly. Leveraging features like customizable templates ensures you meet specific reporting needs efficiently.

These interactive tools not only streamline processes but also enhance transparency, making it easier to track and analyze data effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new accounts report from Google Drive?

How do I fill out new accounts report using my mobile device?

How do I fill out new accounts report on an Android device?

What is new accounts report?

Who is required to file new accounts report?

How to fill out new accounts report?

What is the purpose of new accounts report?

What information must be reported on new accounts report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.