Get the free Employee Direct Deposit Authorization

Get, Create, Make and Sign employee direct deposit authorization

Editing employee direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee direct deposit authorization

How to fill out employee direct deposit authorization

Who needs employee direct deposit authorization?

The Complete Guide to the Employee Direct Deposit Authorization Form

Understanding employee direct deposit

Direct deposit is a system where an employee’s paycheck is electronically transferred into their bank account, streamlining the payment process. This method is crucial as it ensures timely payment, reduces the chances of lost checks, and facilitates easier financial planning for employees. Employers also benefit from direct deposit, as it simplifies payroll processes and reduces costs associated with printing checks.

The benefits of direct deposit are manifold: employees gain instant access to their funds, while employers witness fewer administrative burdens. Additionally, direct deposit can contribute to a more sustainable business model by reducing paper waste. As trends shift towards digital solutions, direct deposit clearly stands out as a preferred choice for both parties.

How direct deposit works

The direct deposit process starts with an employer setting up an account with a bank or a payroll service provider. The employee fills out the Employee Direct Deposit Authorization Form, which provides the necessary bank account details. Once submitted, the employer’s payroll department verifies the information and schedules the payments accordingly. Funds are then directly transferred to the employee's bank account on scheduled paydays—often as soon as the day of payment.

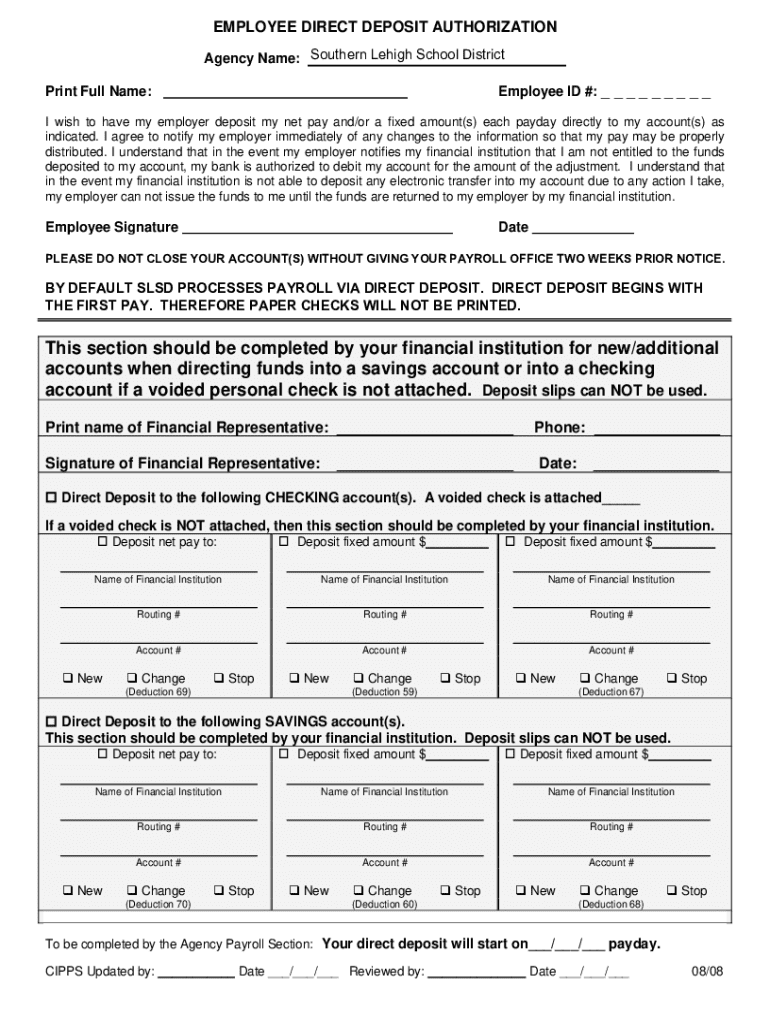

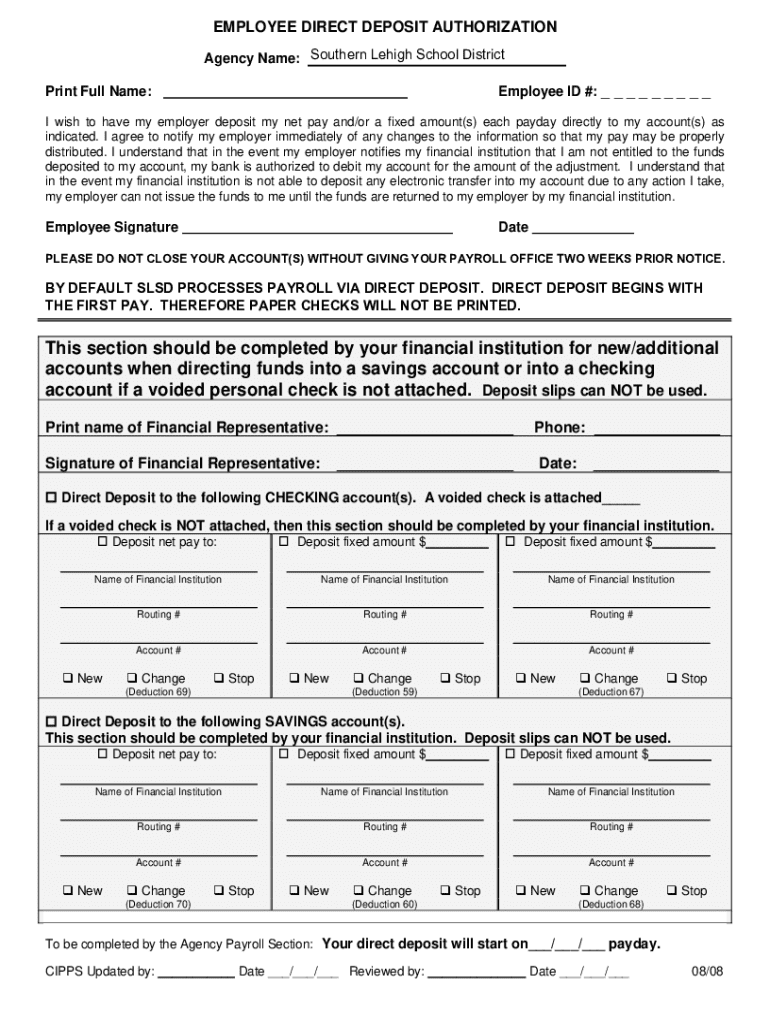

Overview of the employee direct deposit authorization form

The Employee Direct Deposit Authorization Form is a vital document in the direct deposit process, acting as a formal request from the employee to their employer. This form streamlines the entire setup process, ensuring all necessary bank account details are securely communicated and verified. Its significance cannot be overstated, as an accurately completed form is crucial for implementing direct deposit efficiently.

Key features of this form typically include sections for vital financial institution information, such as the bank's name, routing number, and account number. Additionally, it often contains space for account verification to confirm accuracy and avoid payment errors. Finally, employee signatures authenticate the submission and confirm approval for depository transactions.

Step-by-step guide to completing the employee direct deposit authorization form

Step 1: Gathering necessary information

Before filling out the Employee Direct Deposit Authorization Form, it’s essential to gather the proper documents and information. This includes your bank account details, such as account numbers and routing information, as well as personal identification, like a government-issued ID or Social Security Number. Having this information ready will facilitate the completion of the form.

Step 2: Filling out the form

To accurately fill out the Employee Direct Deposit Authorization Form, begin with your personal information, including your name, address, and Social Security Number. Next, provide your bank account details—be sure to include the account number and routing number clearly. After you’ve filled in the necessary information, sign and date the form to authenticate it.

Step 3: Reviewing the form

Once you've completed the form, take a moment to review all entries. Accuracy is paramount; double-check each section for completeness and correctness to mitigate potential issues with your direct deposits.

Step 4: Submitting the authorization

After verification, you can submit the authorization form. Depending on your employer's policies, you may have the option to submit the form electronically or deliver a paper copy. If opting for the electronic route, ensure that you have a secure network as this contains sensitive data.

Common pitfalls and how to avoid them

Incomplete information

One of the most common issues with the Employee Direct Deposit Authorization Form is leaving fields incomplete. Employers require all requested details to enable accurate processing, so it's crucial to fill out every section diligently. This ensures that your direct deposit will occur without complications.

Incorrect bank information

Another frequent pitfall involves inputting incorrect bank information. Submitting wrong account or routing numbers can halt the deposit process and may lead to complications in receiving your paychecks. To avoid these issues, double-check your details with your bank, verify your numbers, and confirm their accuracy before submission.

Signature issues

Finally, signature issues can also cause problems. Ensure that your signature is consistent with your bank's records. If there is a discrepancy between the signatures on your forms and your bank documents, this may lead to delays or denials in setting up your direct deposit.

Frequently asked questions (FAQs)

What to do if you change your bank account?

If you change your bank account, it’s important to complete a new Employee Direct Deposit Authorization Form with your updated account details. Submit it to your employer as soon as possible to avoid disruptions in your direct deposit payments.

How long does it take to activate direct deposit?

The activation time for direct deposit varies by employer and banking institutions. Generally, once your authorization form is submitted and processed, you can expect your direct deposit to start within one to two pay cycles.

Can you cancel your direct deposit authorization?

Yes, you can cancel your direct deposit authorization. To do so, submit a written request to your employer, alongside a new Employee Direct Deposit Authorization Form if you wish to resume deposits to a new account.

What happens if you make an error on the form?

If an error is identified prior to submission, simply correct it and ensure accuracy. If the form is submitted with an error, notify your employer immediately to rectify the mistake and minimize payment disruptions.

Tips for managing your direct deposit

Setting up bank notifications

To track and confirm deposits, consider setting up notifications with your bank. Most financial institutions offer alerts for incoming deposits, providing peace of mind and immediate confirmation of your pay.

Keeping your information updated

It’s vital to keep your banking information up-to-date. If you change accounts, promptly inform your HR department and submit an updated Employee Direct Deposit Authorization Form to ensure uninterrupted deposits.

Using pdfFiller’s tools for efficient management

pdfFiller offers a range of tools to help you manage documents efficiently. The platform allows users to edit PDFs easily, eSign documents securely, and collaborate seamlessly, making the process of filling out, signing, and storing forms like the Employee Direct Deposit Authorization Form effortless.

Additional considerations for employers

Legal obligations when implementing direct deposit

Employers need to be aware of legal obligations regarding direct deposit implementation. Compliance with various state and federal regulations is critical to protect both the business and employees. This includes ensuring employees consent to direct deposit and guaranteeing secure handling of their information.

How to encourage employees to use direct deposit

Encouraging employees to opt for direct deposit can be achieved through clear communication strategies. Providing incentives such as faster access to funds or organizing informational sessions can also promote understanding and willingness to embrace this digital payment solution.

Troubleshooting and support

Common issues and solutions

After submitting your Employee Direct Deposit Authorization Form, some common issues include missed payments or delayed deposits. If you experience any such problems, reach out to your employer’s payroll department or bank for assistance, as they can help identify and resolve the issues.

Where to seek help

In addition to contacting your employer, banking institutions can provide resources to help troubleshoot direct deposit issues. Customer service desks at banks are equipped to assist individuals with account-related inquiries, including concerns about direct deposits.

Utilizing pdfFiller for your direct deposit needs

How pdfFiller simplifies the process

pdfFiller streamlines the process of managing the Employee Direct Deposit Authorization Form by providing a user-friendly, cloud-based platform for document creation and management. With pdfFiller, users can easily access and complete forms from anywhere, ensuring convenience and efficiency.

Interactive tools and features to enhance your experience

pdfFiller’s interactive tools, like eSigning and collaboration features, enable users to complete forms swiftly and accurately. The platform’s capabilities in editing and securely storing documents greatly enhance the overall user experience, making it a go-to solution for managing essential documents like the Employee Direct Deposit Authorization Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get employee direct deposit authorization?

How do I make edits in employee direct deposit authorization without leaving Chrome?

How do I edit employee direct deposit authorization on an Android device?

What is employee direct deposit authorization?

Who is required to file employee direct deposit authorization?

How to fill out employee direct deposit authorization?

What is the purpose of employee direct deposit authorization?

What information must be reported on employee direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.