Get the free Direct Deposit Authorization

Get, Create, Make and Sign direct deposit authorization

How to edit direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization

How to fill out direct deposit authorization

Who needs direct deposit authorization?

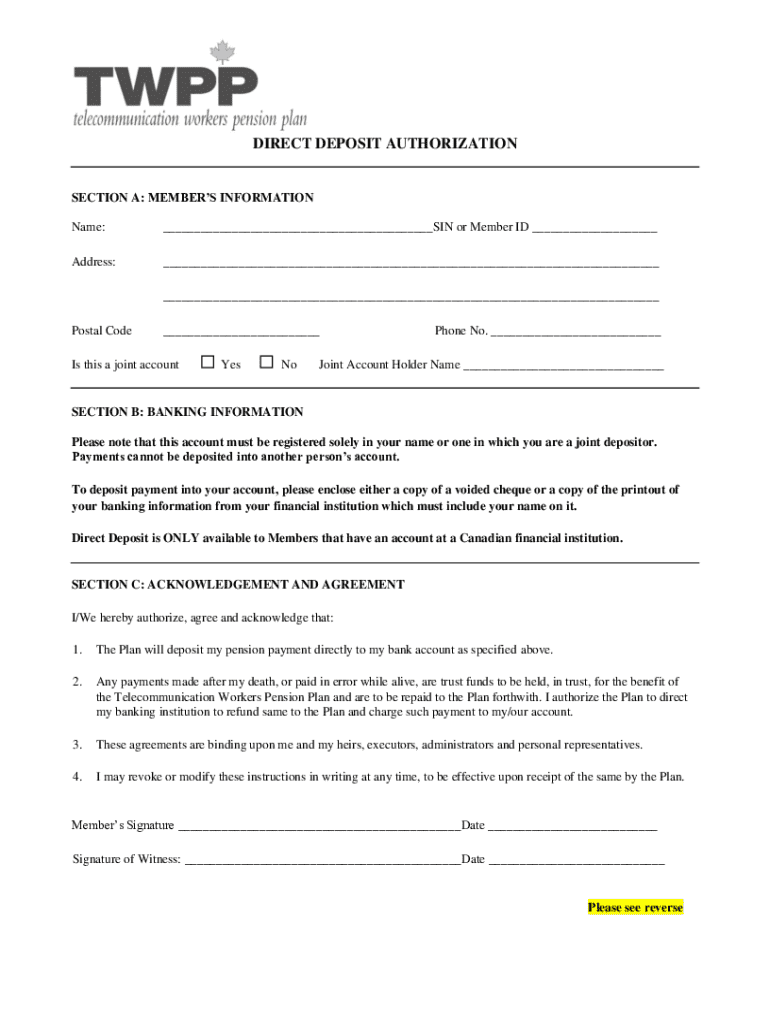

Understanding the Direct Deposit Authorization Form

Understanding the direct deposit authorization form

A direct deposit authorization form is a document that allows an individual to request that their earnings, such as salary or other payments, be deposited directly into their bank account. This process eliminates the need for physical checks, streamlining the payment method and ensuring faster access to funds. As our economy advances towards digital solutions, the significance of direct deposits grows, appealing to employers and employees alike.

The importance of direct deposit cannot be overstated. In rapidly changing financial landscapes, businesses and employees prefer getting paid electronically, which not only speeds up transactions but also reduces the cost of processing physical checks. This form of deposit has become prevalent in various sectors, allowing for easier budgeting and financial planning.

When to use a direct deposit authorization form

Direct deposit authorization forms are commonly used in various situations including employment, government benefits, and for payments from freelance work. The primary use case is when an employee starts a new job and needs to set up how they will receive their paychecks. Government agencies also require such forms to disburse benefits like Social Security or unemployment payments.

Individuals should be aware that organizations may require this form whenever there's a change in banking information, like switching banks or changing accounts. Before submitting a direct deposit authorization form, it's essential to ensure that you have all required information at hand and that you understand your organization’s policies regarding direct deposits.

Components of a direct deposit authorization form

A direct deposit authorization form typically consists of several components designed to collect all necessary information for processing. Understanding these components can help individuals fill out the form accurately and avoid any potential issues.

The form generally includes a personal information section, which collects the individual's name, address, and Social Security number. Bank account details must also be provided, including the bank's routing number and the individual's account number. Employment verification may be necessary to confirm the individual's affiliation with the organization making the deposits. Finally, signature and date fields ensure that the participant agrees to the terms and conditions of direct deposit.

Steps to complete the direct deposit authorization form

Completing a direct deposit authorization form requires careful attention to detail to ensure accuracy. The process can be simplified into a series of steps that guide users through the necessary information gathering and form completion.

First, gather the required documents and information, including personal identification and your bank's routing and account numbers. Next, fill out the form methodically, ensuring that each section is clear and legible. It is essential to double-check all entered data to prevent misrouting of funds. After reviewing, submit the form according to your organization’s guidelines, which may include electronic submission via platforms like pdfFiller or mailing a physical form.

Editing and signing your direct deposit authorization form with pdfFiller

pdfFiller offers users an intuitive platform for editing and signing direct deposit authorization forms efficiently. Using the pdfFiller tools, individuals can easily modify the form by adding text, making corrections, or even inserting images if needed for additional documentation.

One standout feature is the ability to eSign the authorization form, which follows a simple, step-by-step process to ensure individuals can sign their documents legally and securely. Electronic signatures hold the same validity as handwritten ones, making it an excellent option for those looking to expedite their document processes.

Managing your direct deposit authorization form

Managing your direct deposit authorization form is essential for keeping your banking information secure and updated. After completing and submitting the form through pdfFiller, users can save their document on the cloud and access it anytime, from anywhere. This accessibility allows for easier updates and modifications as needed.

If there are changes in banking information post-submission, users can easily update their direct deposit authorizations through pdfFiller’s platform. It is also crucial to track the status of any submissions to ensure that direct deposits are happening as expected. This may involve confirming with your employer or bank.

Frequently asked questions (FAQs) about direct deposit authorization

The direct deposit authorization form raises common questions that vary by individual circumstances and organizations. Some might wonder what to do in the event of changing banks or how long it takes for direct deposits to initiate. Understanding these frequently asked questions can help streamline the process.

For those who change banks, updating banking details on the authorization form is necessary to avoid missed payments. On average, it may take one to two pay cycles for direct deposit to begin following submission of a new form. It's also common for users to ask if they can set multiple accounts for direct deposit; this varies by employer but often can be accommodated. For issues with deposits, contacting human resources or payroll departments is the best course of action.

Using pdfFiller to streamline your form management

pdfFiller stands out as a premier solution for individuals and teams looking to create, edit, and manage their direct deposit authorization forms and other documents from a single platform. With features that allow users to access forms on the cloud, pdfFiller ensures that essential documents are available anywhere, anytime.

Another highlight is its compatibility with various document types, meaning users can handle all their form-related needs in one place. Adding to its appeal, pdfFiller employs numerous security measures to safeguard user information, assuring users that their sensitive data remains protected.

Best practices for your financial documents

Maintaining secure and updated financial documents is crucial for managing your personal and professional finances effectively. Individuals should regularly review their direct deposit information to ensure their banking details are current and accurate, minimizing the risk of missed deposits. It's also vital to understand consumer rights concerning direct deposit, including the right to receive timely payments and adequate notification of any changes.

Implementing best practices for document security is equally important. Consider using strong passwords, two-factor authentication, and encrypted document sharing methods to keep sensitive information protected. Regularly updating financial documents can prevent lapses in payment and help in achieving better budgeting and financial planning.

Conclusion: Why choose pdfFiller for your document needs

pdfFiller provides a user-centric approach to document management, streamlining the often cumbersome process of dealing with forms like the direct deposit authorization form. With numerous features designed to optimize performance and compliance, pdfFiller empowers users to manage their documents conveniently and securely.

The combination of ease-of-use, accessibility, and the ability to electronically sign documents makes pdfFiller an advantageous tool for individuals and organizations alike. Start using pdfFiller today to simplify your experience with direct deposit forms and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit direct deposit authorization in Chrome?

How do I complete direct deposit authorization on an iOS device?

How do I edit direct deposit authorization on an Android device?

What is direct deposit authorization?

Who is required to file direct deposit authorization?

How to fill out direct deposit authorization?

What is the purpose of direct deposit authorization?

What information must be reported on direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.