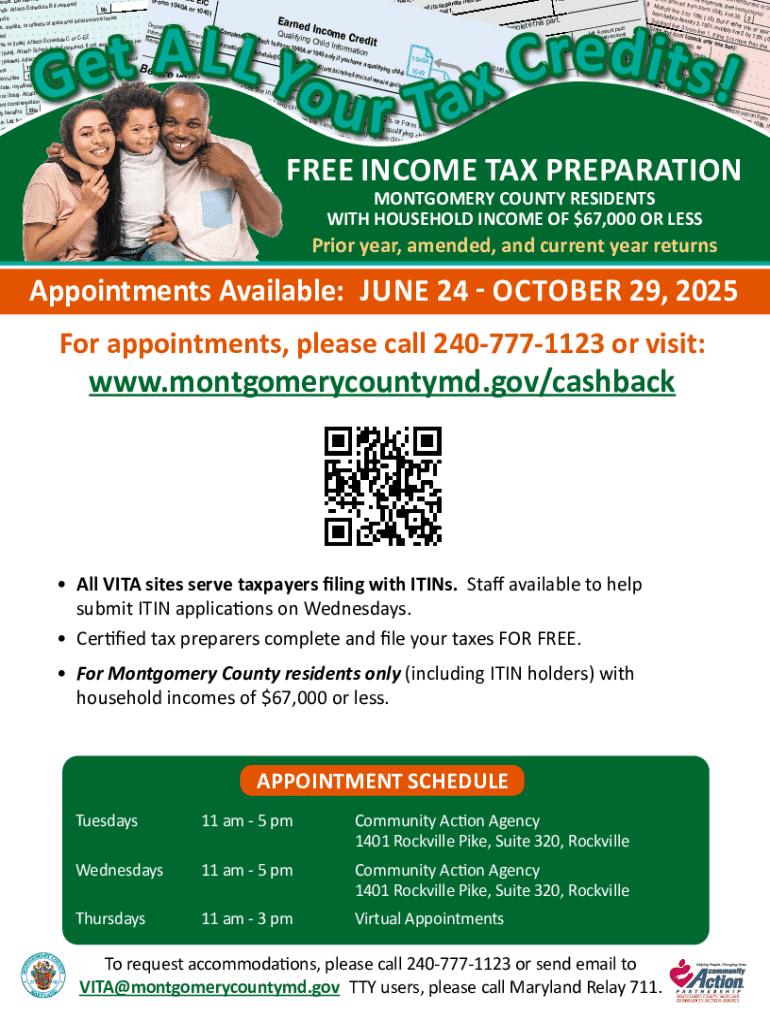

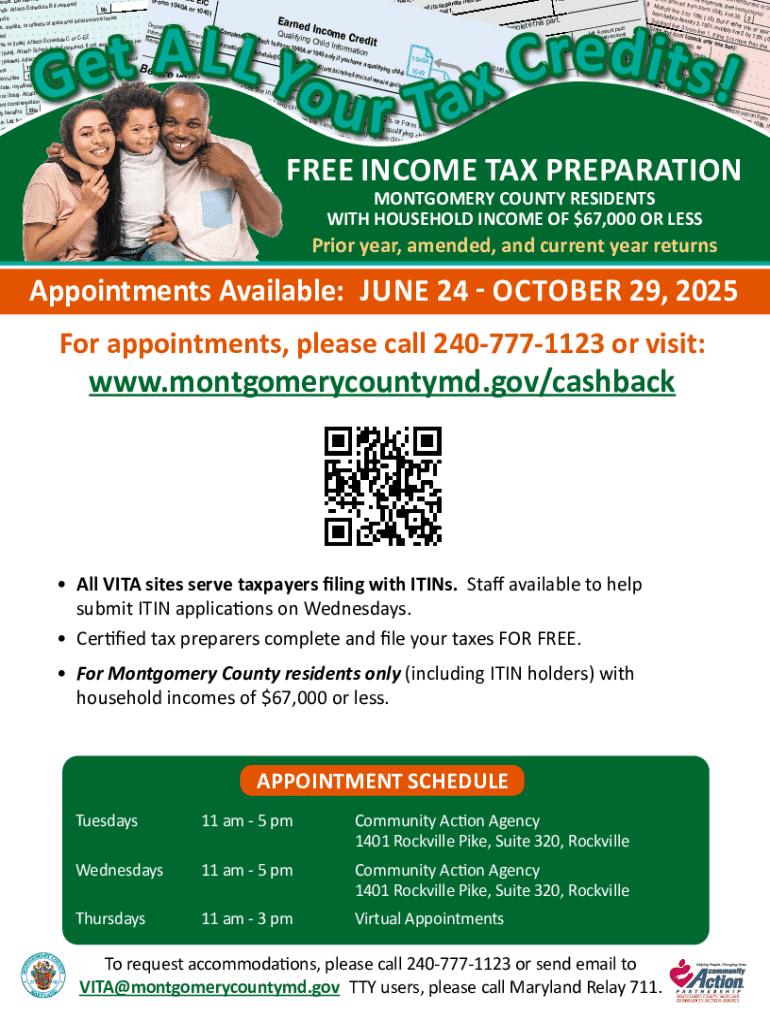

Get the Montgomery County Offers Free Tax Prep for Residents ...

Get, Create, Make and Sign montgomery county offers tax

How to edit montgomery county offers tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out montgomery county offers tax

How to fill out montgomery county offers tax

Who needs montgomery county offers tax?

Montgomery County Offers Tax Form: A Comprehensive Guide

Overview of Montgomery County tax forms

In Montgomery County, tax forms are essential documents required for the accurate reporting of income, property assessment, and various other tax-related matters. These forms play a significant role in ensuring compliance with tax regulations and help facilitate transparency between residents and the local government. Understanding the types of tax forms available is crucial for residents to successfully navigate their tax responsibilities.

Accessing Montgomery County tax forms

Finding and downloading tax forms in Montgomery County is a straightforward process. Residents can easily access the required forms through the county’s official websites. This section provides a step-by-step guide for locating these forms efficiently.

For enhanced document management, consider using the pdfFiller platform. This tool allows users to fill out and edit tax forms online, making it easier to manage documents from anywhere. pdfFiller provides features that simplify the process of preparing and submitting tax forms.

Step-by-step guide to filling out Montgomery County tax forms

Completing tax forms can appear complex, but having the right information and following a structured approach can make the process seamless. Here's what you need to know.

For property tax forms, it's crucial to accurately fill out the property tax declaration. Be mindful of common mistakes like incorrect property descriptions or failure to claim exemptions. Similarly, for employment tax forms like W-2 and 1099, ensure correct reporting of income earned and taxes withheld. These forms are typically provided by employers, but review them for accuracy before submission.

Editing and managing your tax forms

Once the forms are filled out, managing them efficiently becomes paramount. pdfFiller offers powerful editing tools to modify existing forms, allowing users to adapt documents as needed.

Managing multiple tax forms can be challenging. With pdfFiller, users can organize and save documents in cloud storage, facilitating easy access and retrieval at any time. Consider adopting tips for efficient document management, like categorizing forms by type or year and keeping a digital checklist to track submissions.

eSigning Montgomery County tax forms

The importance of eSigning tax forms cannot be overstated, as electronic signatures streamline the submission process. By using pdfFiller, residents of Montgomery County can easily eSign their tax documents, ensuring they are legally binding and compliant.

Using eSignatures is not only efficient but also entirely valid under Montgomery County law, ensuring all submissions are recognized legally, further simplifying the process for users.

Collaborative tools for teams

For teams managing tax forms, collaboration tools are essential for efficiency. pdfFiller’s real-time collaboration features enable multiple users to work on a tax form simultaneously, making it easier to gather input and finalize documents.

To enhance team efficiency when managing taxes, create a checklist of necessary tasks and recommended practices. This checklist may include deadlines, document types that require signatures, and secure methods for sharing information among team members.

Frequently asked questions about Montgomery County tax forms

Residents often have questions regarding their tax forms. Here are some common queries raised by the community, along with helpful troubleshooting tips.

If residents experience issues completing or submitting forms, common solutions include verifying input data, checking for missing signatures, and ensuring correct filing methods are followed.

Important deadlines and filing information

Montgomery County residents should be aware of critical deadlines throughout the tax filing process. Missing these deadlines can result in penalties and interest charges.

To stay informed about tax filing information and updates, regularly check the Montgomery County tax office resources, or subscribe to newsletters that provide the latest changes in tax laws and procedures.

Contact information for Montgomery County tax office

For personalized assistance, residents can reach out to the Montgomery County Tax Office. Having access to key contacts is crucial for promptly resolving tax-related queries.

Additional insights on Montgomery County tax policies

Staying updated on Montgomery County tax policies is essential for residents to effectively manage their tax obligations. Understanding the current tax policies can help ensure compliance and optimize financial planning.

Consider using resources available through the Montgomery County website and local financial advisory services to better understand tax regulations and any recent changes. Awareness is vital in navigating the complexities of tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my montgomery county offers tax directly from Gmail?

How do I edit montgomery county offers tax in Chrome?

How do I fill out montgomery county offers tax on an Android device?

What is Montgomery County offers tax?

Who is required to file Montgomery County offers tax?

How to fill out Montgomery County offers tax?

What is the purpose of Montgomery County offers tax?

What information must be reported on Montgomery County offers tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.