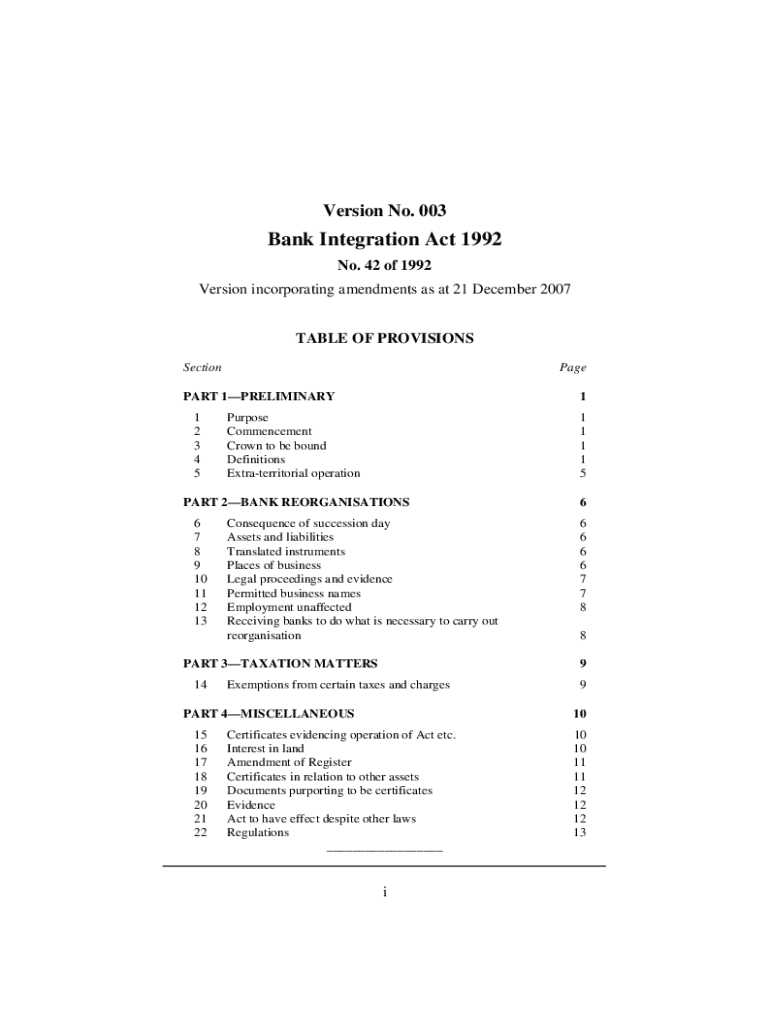

Get the free Bank Integration Act 1992

Get, Create, Make and Sign bank integration act 1992

How to edit bank integration act 1992 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bank integration act 1992

How to fill out bank integration act 1992

Who needs bank integration act 1992?

A Comprehensive Guide to the Bank Integration Act 1992 Form

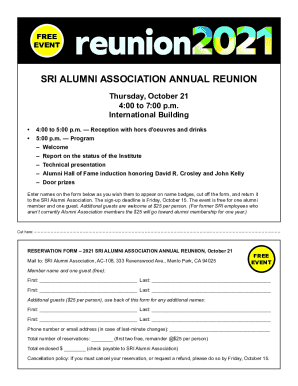

Overview of the Bank Integration Act 1992

The Bank Integration Act 1992 was introduced as a significant legislative measure aimed at enhancing the efficiency and integration of banking systems in the United States. Its primary goal was to promote more robust banking operations that are consistent with evolving economic conditions while ensuring compliance with regulations that govern the financial sector. This act serves as a critical framework that not only impacts banks but also shapes the broader financial landscape.

Among its crucial aims, the act focuses on facilitating seamless integration between banks and mandatory compliance measures that safeguard both institutions and their customers. The necessity for transparent operations and effective oversight is highlighted throughout the legislation.

Key provisions of the Act

Understanding the Bank Integration Act 1992 Form

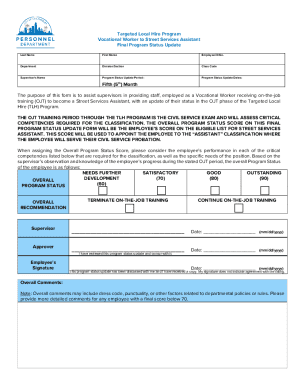

The Bank Integration Act 1992 Form is a crucial document that facilitates compliance with the act. Designed to gather essential information from financial institutions, the form ensures that banks can adhere to integration requirements set forth by the legislation. Its primary purpose is to create an organized process for banks to demonstrate compliance while imparting accountability and transparency within their operations.

Submitting accurate and complete documentation via this form is paramount, as it reflects the institution's commitment to adhere to regulatory standards. Any errors or omissions in the form can lead to significant delays or penalties, hence emphasizing the importance of its meticulous completion.

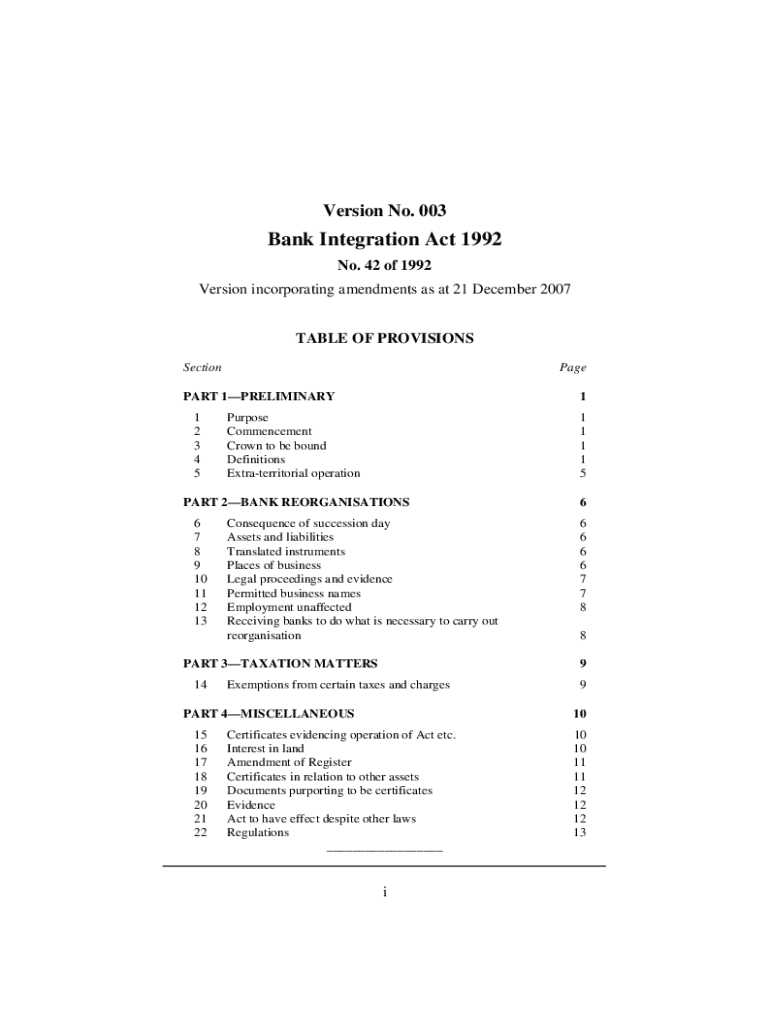

Detailed breakdown of the Bank Integration Act 1992 Form

The layout of the Bank Integration Act 1992 Form consists of several key sections, each tailored to collect specific information pertinent to compliance and bank operations. Understanding these sections is vital for effective form submission.

Sections of the Form

Common mistakes to avoid

Step-by-step guide to completing the Bank Integration Act 1992 Form

Completing the Bank Integration Act 1992 Form requires a thorough process. Below is a step-by-step guide to assist institutions in filling out the form accurately.

Step 1: Collect necessary information

Before beginning the form, gather all relevant documents, including those that provide entity information, compliance details, and integration procedures. This preparation phase is critical as it ensures you have all required data at your fingertips.

Step 2: Fill out the form

When filling out the form, clarity and accuracy are paramount. Use clear and concise language, and ensure that every required section is completed thoroughly. Recommended tools for editing include pdfFiller, as it can significantly simplify the process.

Step 3: Review and edit your submission

Proofreading your document before submission is essential to avoid any mistakes that could lead to compliance issues. Utilize pdfFiller’s features to finalize your edits and ensure your form is polished before sending it off.

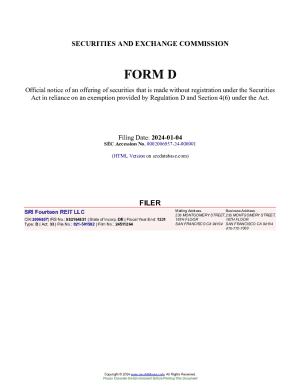

Utilizing pdfFiller for your Bank Integration Act 1992 Form

pdfFiller offers an impressive suite of features tailored for managing the Bank Integration Act 1992 Form effectively. With its streamlined interface, users can easily edit PDFs and ensure accurate form submissions.

Features of pdfFiller

Practical tips for using pdfFiller

Troubleshooting common issues with the Bank Integration Act 1992 Form

Even the best-prepared individuals may encounter issues when submitting the Bank Integration Act 1992 Form. Common problems often arise from submission errors or discrepancies in documentation.

Typical issues encountered

Solutions and how to resolve them

Future considerations related to the Bank Integration Act

As financial institutions adapt to new challenges and technologies, the regulatory landscape surrounding the Bank Integration Act 1992 continues to evolve. Staying abreast of potential changes is essential for compliance.

Evolving regulatory landscape

Potential modifications to the act or its associated documentation could impact how banks operate. Institutions must remain vigilant and ready to adapt their practices accordingly.

Importance of staying updated

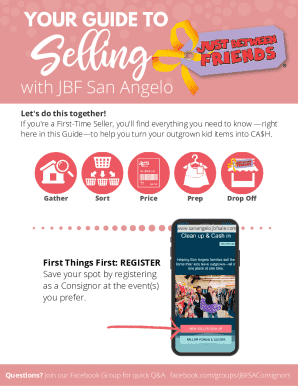

Conclusion: Streamline your documentation process with pdfFiller

Completing the Bank Integration Act 1992 Form is crucial for banks aiming to align with regulatory standards. Leveraging pdfFiller's advantages can greatly enhance efficiency, accuracy, and compliance. By integrating technology into your document management processes, you not only simplify your workflow but also ensure you are prepared for any future developments in banking regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bank integration act 1992 from Google Drive?

Can I sign the bank integration act 1992 electronically in Chrome?

How do I complete bank integration act 1992 on an Android device?

What is bank integration act 1992?

Who is required to file bank integration act 1992?

How to fill out bank integration act 1992?

What is the purpose of bank integration act 1992?

What information must be reported on bank integration act 1992?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.