Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out in-kind donation form

Who needs in-kind donation form?

In-kind donation form: A comprehensive how-to guide

Understanding in-kind donations

In-kind donations encompass gifts in the form of services, goods, or skills rather than cash. They provide nonprofits with valuable resources that might be hard to acquire through traditional funding channels. Unlike monetary donations, which immediately inject funds into an organization, in-kind donations are tangible items that can directly support programs, events, or organizational needs. Examples include office supplies, food for events, or professional services like web design.

The significance of in-kind donations is multifaceted. They reduce operational costs, thereby enhancing a nonprofit's capacity to fulfill its mission. Dedicated and engaged donors often choose in-kind gifts based on personal expertise or surplus assets, creating a sense of community involvement that monetary contributions alone may not engender.

Both donors and recipients benefit from in-kind donations. Donors can often claim these contributions as tax deductions, provided they maintain meticulous records—this is where the in-kind donation form becomes essential. Nonprofits benefit by receiving the resources they need without the associated costs, allowing them to direct potential funds into meaningful community programs.

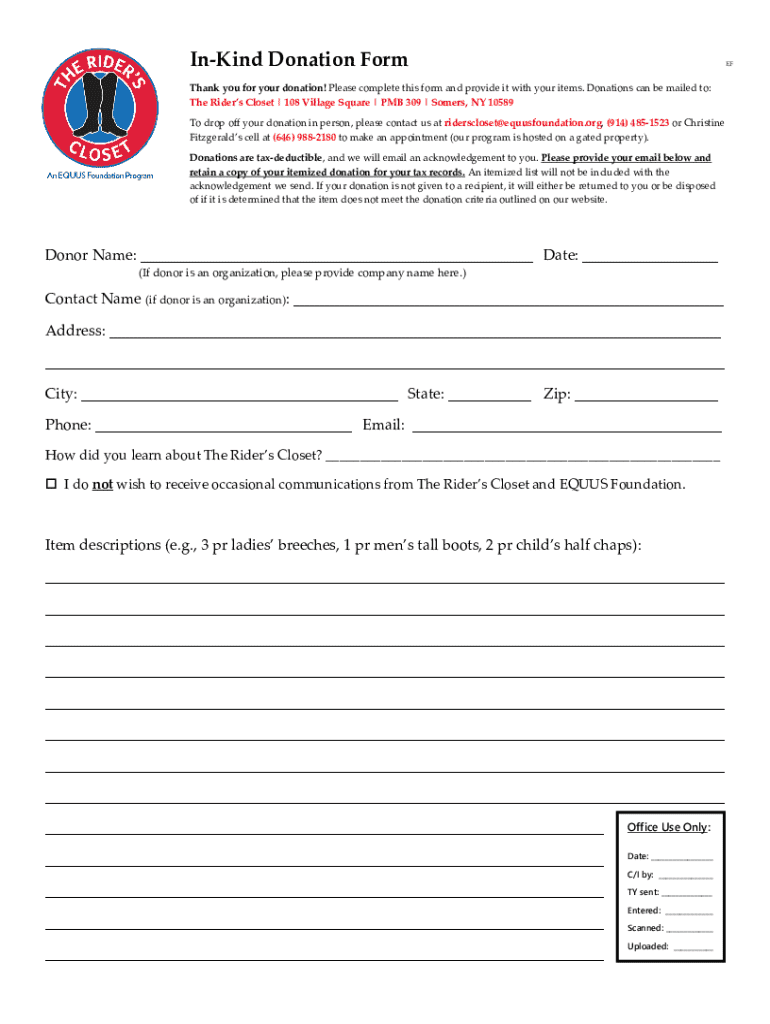

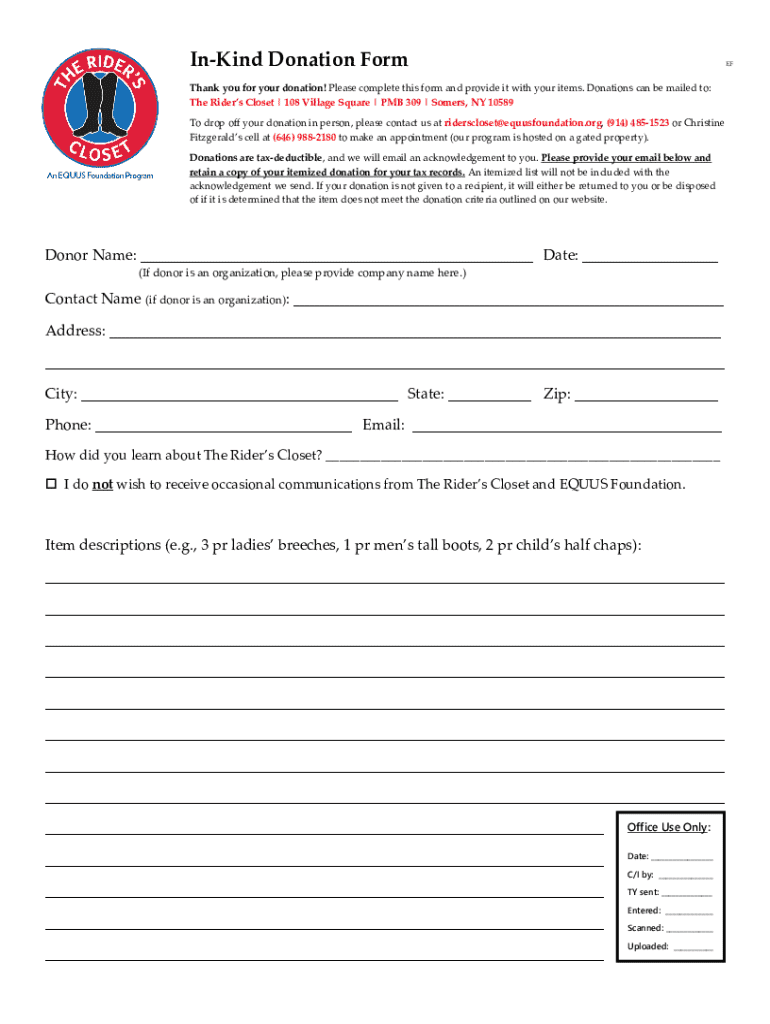

Overview of the in-kind donation form

The in-kind donation form is a critical document that facilitates the acknowledgment, evaluation, and management of donations. It assists both donors and nonprofits in outlining the specifics of the contribution being made, ensuring that all parties are compliant with tax codes and regulations surrounding charitable giving. This form not only records the donation but also serves as proof for tax purposes, aiding both donor and nonprofit during audits.

Key components of the in-kind donation form include sections for donor information, a detailed description of the goods or services, and the estimated value of these contributions. Each section must be filled out carefully to ensure clarity and accuracy, which can be crucial in the event of any disputes regarding the donation's value or specifics.

Step-by-step instructions for filling out the in-kind donation form

Filling out the in-kind donation form is straightforward if you follow these steps carefully. Start by gathering necessary information pertaining to the donation, including donor contact details, a clear description of the items or services being offered, and their estimated value. This is crucial as the completeness and accuracy of the information can affect tax deductions and nonprofit record-keeping.

Next, access the form, which is conveniently available on pdfFiller. Here you can find options to either fill the form online or download it for later use. Once accessed, proceed to complete the form by filling out each section meticulously. This includes ensuring that the description of the items is accurate and comprehensive to convey their value and utility effectively.

After filling out the in-kind donation form, it's essential to review the information provided. A careful double-check can save time and prevent misunderstandings in the future; common mistakes include underestimating item values or providing incomplete donor information. Once you’re satisfied with your entries, you can either electronically submit the form or print it and deliver it directly to the nonprofit.

Customizing your in-kind donation form

Flexibility is a key feature of the in-kind donation form when using pdfFiller's editing tools. Immediately upon accessing the form, you find a user-friendly interface that allows for the addition of personal touches. Users can customize the form by editing sections or adding a signature field, which is particularly useful for collaborative work involving teams. Being able to make these adjustments enhances usability and ensures the document meets specific organizational needs.

In addition to customization, pdfFiller enables users to save and manage their forms with cloud storage benefits. This feature allows you to retrieve and modify forms effortlessly, making it simpler to keep up with ongoing donation efforts and maintain accurate records over time.

Examples and samples of completed in-kind donation forms

Providing examples can greatly assist new donors in understanding how to fill out the in-kind donation form. A sample form for general items would typically highlight necessary sections including donor information, detailed descriptions of the contributions, and estimated values, all formatted clearly. High-value donations may require additional details and nuances, enhancing the form’s comprehensiveness.

Creating your own samples to share can also be beneficial. Consider putting together examples based on specific lessons learned from previous donations, tailoring them to address common questions or concerns around filling out an in-kind donation form. Sharing these samples with potential donors can foster understanding and encourage more giving.

Acknowledgment letters for in-kind donations

An acknowledgment letter for in-kind donations is not just a courteous gesture; it can also have significant tax implications for the donor. By providing a letter that details the nature of the gift, its estimated value, and the nonprofit's appreciation, organizations can facilitate a transparent and gracious relationship with donors. Such acknowledgments help reinforce a donor's choice while ensuring compliance for potential tax deductions.

When crafting acknowledgment letters, it is critical to include elements such as the nonprofit's details, a specific description of the donation, its estimated value, and a sincere thank you. Customizing these letters for different donor scenarios enhances their impact and strengthens the relationship between the organization and its supporters.

Tools and resources for managing in-kind donations

pdfFiller offers a suite of interactive tools to optimize in-kind donation management effectively. From collaborative options for teams to track donation records to built-in features for inventory management, pdfFiller stands out as a comprehensive solution for organizations. These tools can streamline the donation process, making it easier for nonprofits to evaluate incoming contributions accurately.

Additionally, having access to FAQs about in-kind donations provides ongoing support. Organizations can refer to these resources for guidance on common concerns, ranging from legalities surrounding valuations to best practices for donor engagement. By leveraging these resources, nonprofits can ensure a positive experience for both themselves and their donors.

Best practices for nonprofits handling in-kind donations

Creating a clear donation policy is essential for nonprofits to manage in-kind contributions effectively. A well-defined policy outlines the types of donations accepted, guides the evaluation of potential gifts, and ensures consistency in communications with donors. This proactive approach helps avoid misunderstandings and cultivates trust between organizations and their supporters.

Furthermore, engaging actively with donors enhances long-term relationships. Strategies such as regular updates on how donations are used, feedback opportunities, and recognition of contributions through newsletters or social media can significantly boost donor loyalty. Much like monetary gifts, in-kind donations require appreciation and acknowledgment to ensure donors feel valued and continue their support.

Legal considerations surrounding in-kind donations

Understanding the legal landscape surrounding in-kind donations is critical for nonprofits. State and federal regulations dictate how contributions are documented and reported for tax purposes. Nonprofits must stay informed about these laws as they can affect the eligibility of donations and the associated tax deductions for donors. Proper documentation can mitigate risks during audits and ensure all parties are compliant with legal frameworks.

Additionally, considerations around liability arise when receiving in-kind contributions. Nonprofits must evaluate potential risks associated with using certain items or services, making it necessary to have clear policies in place to protect both the organization and the donors. By understanding legal requirements, nonprofits can safeguard their missions while maximizing the impact of received contributions.

Support and assistance

pdfFiller provides robust customer support options to assist users in managing their in-kind donation forms and addressing any questions that arise. Users can reach customer service through various channels, ensuring that help is accessible whenever needed. This support structure is especially vital for teams navigating the complexities of donation management, ensuring they can maintain operational efficiency.

Furthermore, community resources and extensive FAQs are at the users' fingertips, helping to illuminate common queries regarding in-kind donations. Engaging with these resources fosters a better understanding of documentation processes and helps organizations navigate notable challenges successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form for eSignature?

How do I complete pdffiller form online?

How do I edit pdffiller form online?

What is in-kind donation form?

Who is required to file in-kind donation form?

How to fill out in-kind donation form?

What is the purpose of in-kind donation form?

What information must be reported on in-kind donation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.