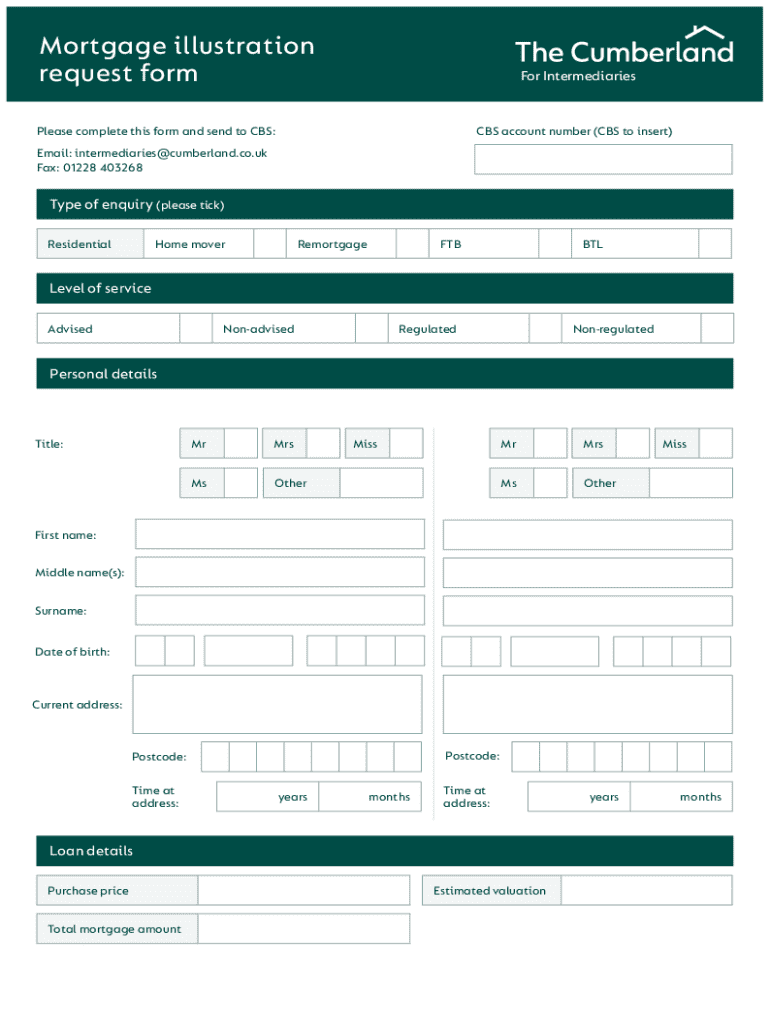

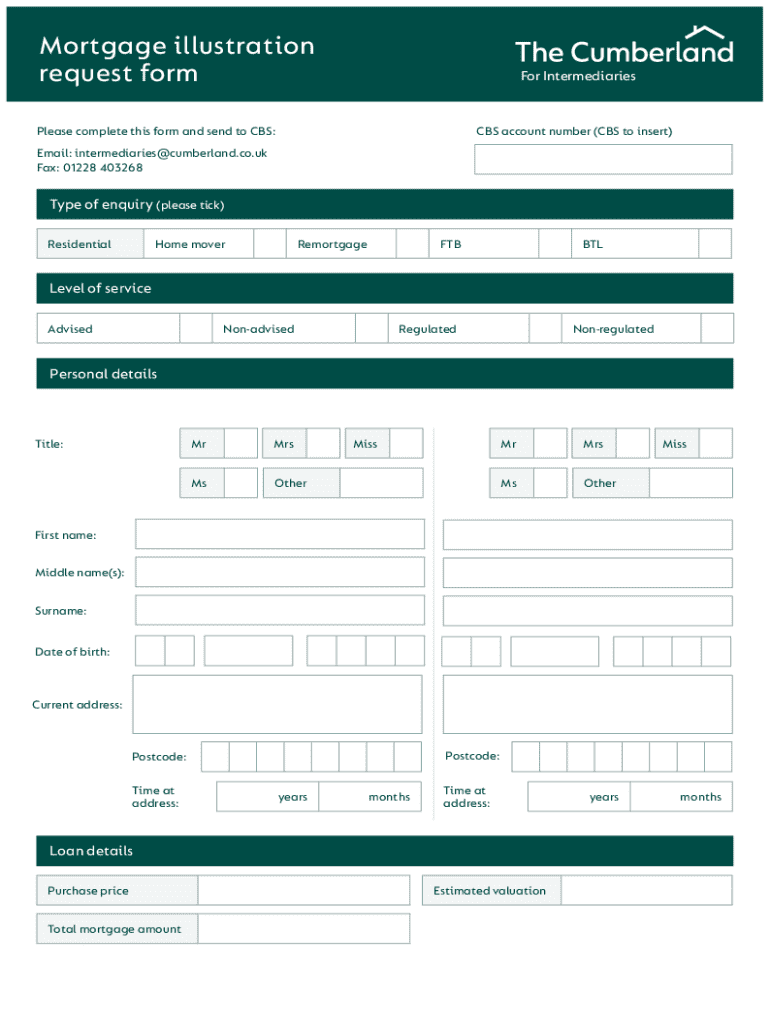

Get the free Mortgage Illustration Request Form

Get, Create, Make and Sign mortgage illustration request form

Editing mortgage illustration request form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage illustration request form

How to fill out mortgage illustration request form

Who needs mortgage illustration request form?

Understanding the Mortgage Illustration Request Form

Understanding the mortgage illustration request form

A mortgage illustration provides a detailed overview of a mortgage product tailored for potential borrowers. This document outlines key financial metrics and repayment details, illustrating how different rates and terms can affect overall costs. Central to this process is the mortgage illustration request form, which is essential for borrowers seeking a clearer picture of their mortgage options.

The importance of the mortgage illustration request form cannot be overstated. It serves as the official medium through which lenders receive the necessary information to generate a personalized illustration. Completing this form accurately is crucial as it can influence the type of mortgage terms you receive, ensuring that your specific financial situation and goals are taken into account.

Types of mortgage illustrations

There are various types of mortgage illustrations designed for different purposes, each catering to specific borrower needs. The two most common types include owner occupier mortgages and buy-to-let mortgages, both offering unique illustrations to assist potential borrowers.

Owner occupier mortgages

Owner occupier mortgages are primarily designed for individuals who intend to live in the property they are purchasing. These illustrations highlight features such as fixed or variable interest rates, potential fees, and overall costs, ensuring the borrower can make an informed decision. The request process typically involves providing personal and financial information, similar to traditional mortgage applications.

Buy-to-let mortgages

In contrast, buy-to-let mortgages are tailored for investors who are renting out properties. The illustrations for these types of mortgages focus on rental yields, potential income, and costs associated with property management. The request process is slightly different, often requiring more detailed financial projections and information about the rental market.

Business development manager's role in illustrations

Business Development Managers (BDMs) play a pivotal role in obtaining mortgage illustrations by guiding clients through the process and ensuring that all relevant information is accurately captured. They help clarify issues and answer questions, providing an added layer of support during this complex stage.

The mortgage illustration request process

Submitting a mortgage illustration request may seem daunting at first, but following a structured step-by-step guide can streamline the process. Here’s how to do it effectively:

While submitting your request, be mindful of some common mistakes that could lead to delays or inaccurate illustrations. Double-check that all provided information is current and correct, pay close attention to deadlines, and ensure all necessary documentation accompanies your request.

Essential information required

To complete the mortgage illustration request form accurately, you’ll need to provide a range of personal and financial information. This includes details that help lenders form a clear picture of your financial situation.

Reviewing and understanding your mortgage illustration

Once you receive your mortgage illustration, it’s crucial to review it carefully. Key sections include the loan amount, interest rate, repayment terms, and the projected monthly payments. Understanding these elements is essential in evaluating whether the mortgage fits within your financial capabilities.

Additionally, the illustration will break down any associated fees, such as arrangement or valuation fees. Knowing how these fees impact your overall costs is vital for effective budgeting.

What to look for in a good illustration includes transparent fees, clear repayment terms, and competitive interest rates. It is advisable to compare several illustrations to ensure you’re obtaining the best terms available.

Enhancing your request with financial advisers

While you can submit a mortgage illustration request independently, involving a financial adviser can significantly enhance your experience. They can provide insights into the most suitable mortgage products for your situation and guide you through the nuances of the request process.

When to involve a financial adviser often hinges on your comfort level with the mortgage process. If you find the details overwhelming or are unsure about product comparisons, seeking professional guidance can be immensely beneficial.

The benefits of professional guidance include tailored advice that considers your financial goals, and potential access to exclusive mortgage deals that aren’t available to the general public. Finding the right adviser involves researching their credentials, understanding their fee structures, and ensuring they are well-versed in current market trends.

FAQs about mortgage illustrations

When navigating mortgage illustrations, you may have questions or concerns. Here are frequently asked questions that can provide clarity.

Additional tools and resources on pdfFiller

pdfFiller enhances the mortgage illustration request process with a suite of interactive tools for document management. These features allow users to efficiently create, edit, and manage their mortgage-related documents, ensuring everything is neatly organized.

The editing and eSigning features streamline the review process, enabling you to obtain necessary signatures quickly. Collaboration tools for teams also promote seamless communication between multiple parties involved in the mortgage application process.

Our commitment to customer support

At pdfFiller, providing exceptional support to our users is a priority. Our mortgage helpdesk is available to assist you with inquiries during your mortgage illustration request process. From initial queries to ongoing support, you can rely on our team's expertise.

Accessing personalized support from your local BDM ensures that you get tailored assistance relevant to your region and specific mortgage product. We’re dedicated to ensuring a smooth experience for clients from start to finish.

Updates and important information

The mortgage landscape is continually evolving, and staying informed about changes to mortgage products is crucial for potential borrowers. Current market insights can include trend shifts in interest rates or updates in lender policies that may affect available options.

Regular regulatory updates also play a significant role in how mortgage products are structured. Understanding these updates can empower borrowers to make informed decisions about their mortgage requests, ensuring they are taking advantage of all available opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage illustration request form from Google Drive?

How do I complete mortgage illustration request form online?

How do I edit mortgage illustration request form in Chrome?

What is mortgage illustration request form?

Who is required to file mortgage illustration request form?

How to fill out mortgage illustration request form?

What is the purpose of mortgage illustration request form?

What information must be reported on mortgage illustration request form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.