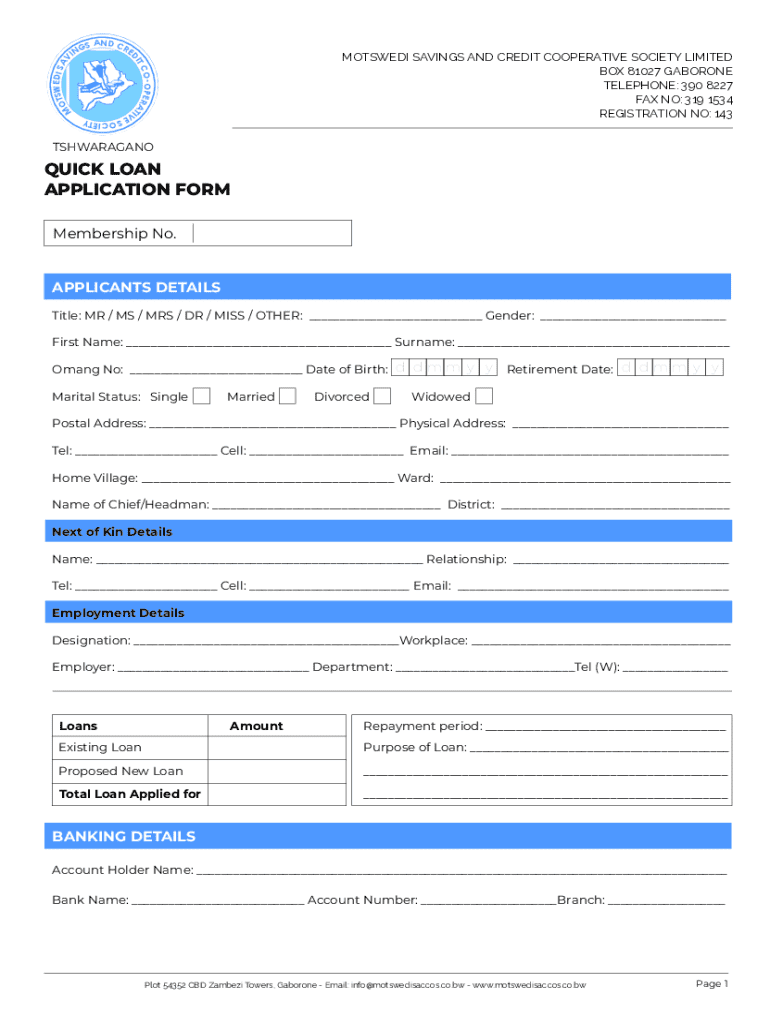

Get the free motswedi saccos forms pdf download

Get, Create, Make and Sign motswedi saccos forms pdf

Editing motswedi saccos forms pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motswedi saccos forms pdf

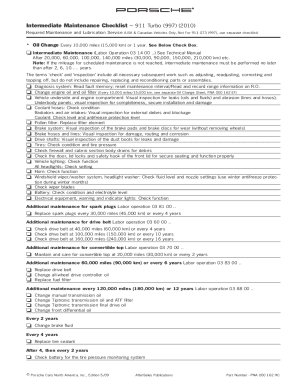

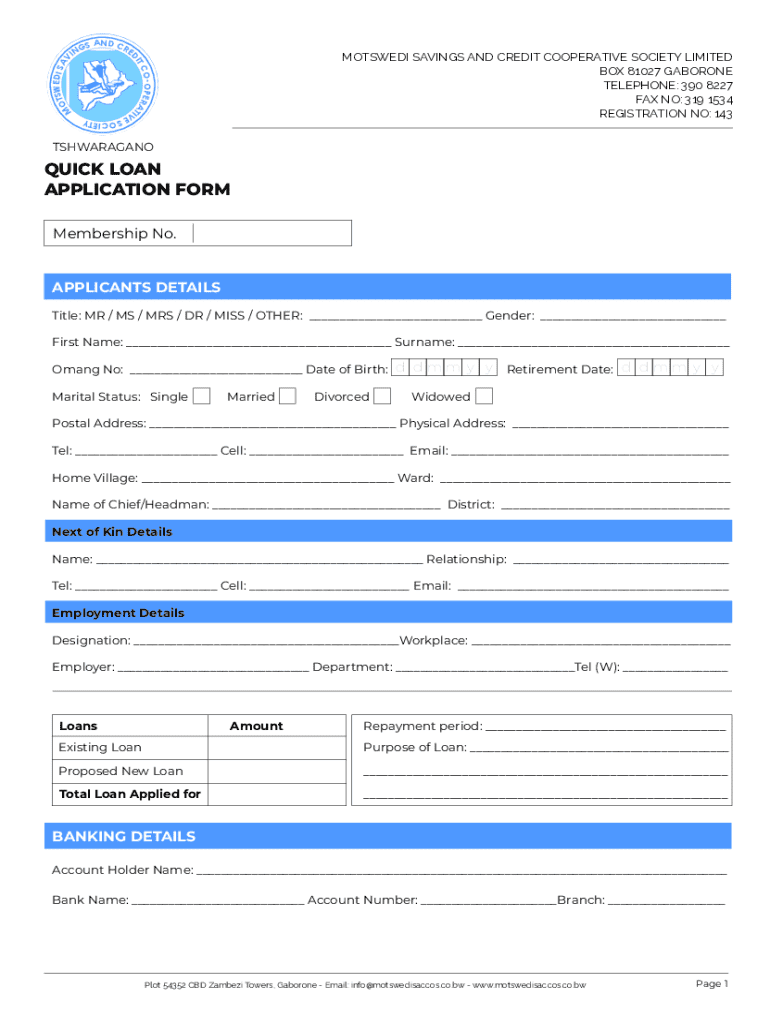

How to fill out quick loan application form

Who needs quick loan application form?

Your ultimate guide to the quick loan application form

Understanding quick loan application forms

A quick loan application form is a streamlined document designed to help individuals and teams secure financing with minimal hassle. These forms are tailored to gather essential information rapidly, enabling lenders to make swift decisions on loan approvals.

The importance of quick loan application forms cannot be overstated, especially in times of financial urgency or when unexpected expenses arise. They offer individuals a chance to quickly access the funds they need without prolonged waiting periods. For teams, these forms facilitate efficient budgeting and project management, ensuring that financial resources are available when required.

Benefits of using pdfFiller for quick loan applications

Utilizing pdfFiller for quick loan applications enhances the experience significantly by providing a plethora of features that make the process smoother and more efficient.

Seamless PDF editing

With pdfFiller, users can edit forms in real time, providing clarity and precision in their applications. This is particularly useful when dealing with complex loan documentation where accuracy is vital. Errors in a loan application can delay the process or result in loan rejection, making clarity in applications crucial.

Electronic signing features

The platform offers quick and secure electronic signing options. Users can eSign documents with just a few clicks, ensuring a hassle-free process. Moreover, electronic signatures hold the same legal standing as handwritten signatures, making transactions faster and safer.

Collaboration tools

pdfFiller's collaboration tools allow individuals and teams to work remotely and share loan applications easily. This feature is invaluable for business teams that may need multiple inputs before finalizing an application.

Cloud-based management

Another significant benefit is cloud-based document management. Users can access and manage their applications from anywhere, which is essential for those on the go. Additionally, pdfFiller prioritizes data security, ensuring that sensitive information remains protected.

How to fill out a quick loan application form

Filling out a quick loan application form can seem daunting, but following a clear process can simplify the experience. Here’s a step-by-step guide to navigating this essential task.

Step 1: Gather necessary information

Before accessing the loan application form, gather the necessary documents and information. This includes personal identifiable information (PII) such as your full name, social security number, and contact details. Furthermore, you should compile your financial information, including income statements, bank details, and any existing debts.

Step 2: Access the quick loan application form via pdfFiller

To begin, navigate to the pdfFiller website and locate the quick loan application form. pdfFiller has numerous built-in templates that can help speed up the process. If you're filling the form multiple times, consider saving a template for future use.

Step 3: Complete the form

When filling out the form, pay close attention to the instructions provided for each section. Ensure all required fields are completed accurately. A common mistake is leaving out critical information, which can hinder the approval process. Utilize autofill features if available to save time and reduce errors.

Step 4: Review and edit your application

After completing the application, take the time to review it for any potential errors or omissions. A clear and professional tone is vital; avoid slang or informal language. Mistakes can lead to delays or misunderstandings, so ensure everything is accurate and well-presented before proceeding.

Step 5: Sign and submit the application

The final step is to eSign the application. Follow the straightforward eSigning instructions on pdfFiller and ensure your signature is completed correctly. After signing, choose the appropriate method to submit your application – whether electronically, via email, or through mail.

Understanding loan terms and conditions

Before applying for a loan, it's essential to comprehend the terms and conditions outlined in the loan agreement. This understanding helps prevent any unpleasant surprises later on. Common terms to review include interest rates, repayment periods, and any potential fees.

What to watch for in loan agreements

Privacy and data protection are also vital when it comes to loan applications. pdfFiller protects user data through encryption, ensuring that your personal and financial information is secure. It's important to understand your rights as a borrower, including how your information is used and stored.

Frequently asked questions

Additional considerations

Ensuring a successful loan application requires several best practices, including maintaining a good credit score. Regularly checking your credit report and addressing any discrepancies can positively influence your loan applications.

A solid understanding of financial literacy also plays a crucial role in loan applications. Familiarity with financial terms can help you navigate the paperwork seamlessly and make informed decisions.

How pdfFiller can support your ongoing document needs

Once you’ve submitted your loan application, pdfFiller has tools that can assist with ongoing document management. From budgeting templates to financial planning documents, the platform accommodates various needs for individuals and teams.

Related forms & tools

Tips for using pdfFiller effectively

Navigating pdfFiller can greatly enhance your user experience. Familiarize yourself with the platform’s features, such as document sharing, commenting, and advanced form editing. These tools can improve efficiency for individuals and teams alike.

Moreover, utilizing integrations with other services can streamline your workflow. Should you encounter any difficulties, pdfFiller's customer support is readily available to assist with troubleshooting.

Real-life examples of quick loan applications

To illustrate the effectiveness of quick loan applications, consider case studies showcasing individuals and businesses who successfully navigated the process using pdfFiller. They report reduced stress levels and quicker access to funding, essential for both personal emergencies and business opportunities.

Testimonials from pdfFiller users often highlight the platform's ease of use, specifically mentioning how intuitive the tools are for creating, signing, and submitting documents seamlessly. This positive feedback underscores the platform's role in transforming the way individuals and teams approach financial documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my motswedi saccos forms pdf directly from Gmail?

How do I complete motswedi saccos forms pdf online?

How do I edit motswedi saccos forms pdf on an Android device?

What is quick loan application form?

Who is required to file quick loan application form?

How to fill out quick loan application form?

What is the purpose of quick loan application form?

What information must be reported on quick loan application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.