Get the free Nc Only Account Application

Get, Create, Make and Sign nc only account application

Editing nc only account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nc only account application

How to fill out nc only account application

Who needs nc only account application?

The complete guide to the NC only account application form

Understanding the NC only account

The NC Only Account is designed as a specialized financial product intended for North Carolina residents. It caters to individuals seeking to manage their finances with services tailored specifically to their geographic location and economic needs.

Eligibility for applicants typically includes baseline requirements such as age and residency. For individuals wishing to open this account, the minimum age requirement is often 18 years, ensuring that all account holders are legally recognized to enter into binding contracts. Additionally, proof of residency is a crucial component, often necessitating documentation that verifies the applicant’s current living situation in North Carolina.

Among the key benefits of holding an NC Only Account are access to exclusive financial services specifically tailored for residents, which may include lower fees and community-based support. This account type enables easier management of local transactions and financial operations, giving account holders an edge in handling regional financial opportunities.

Overview of the NC only account application process

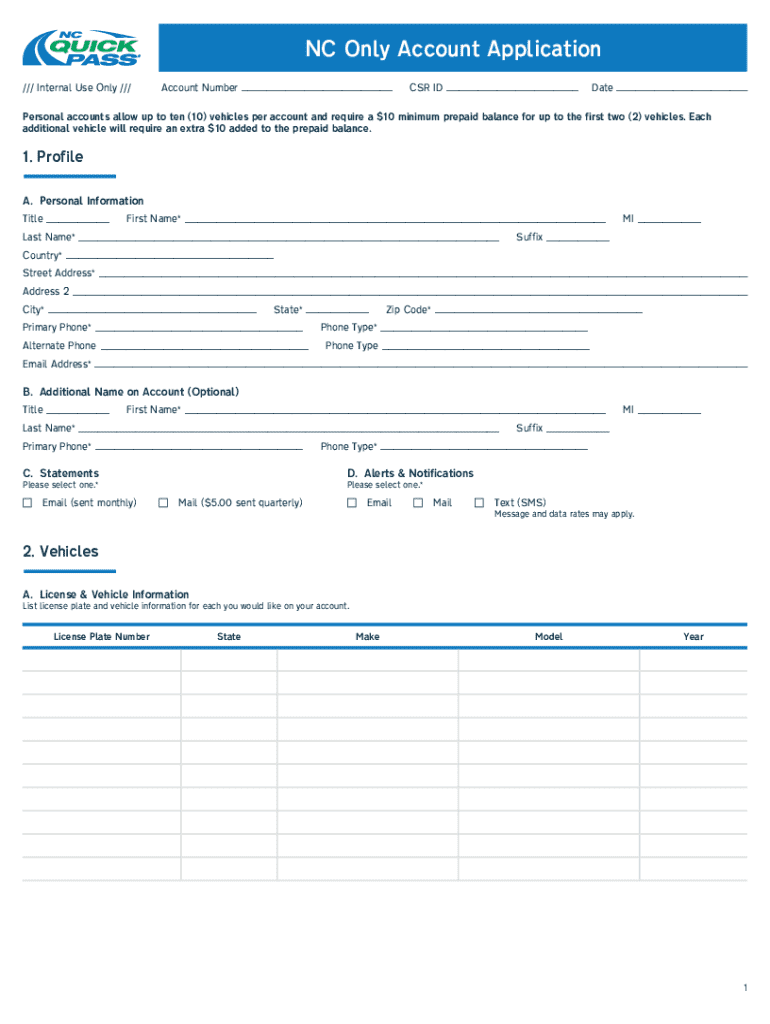

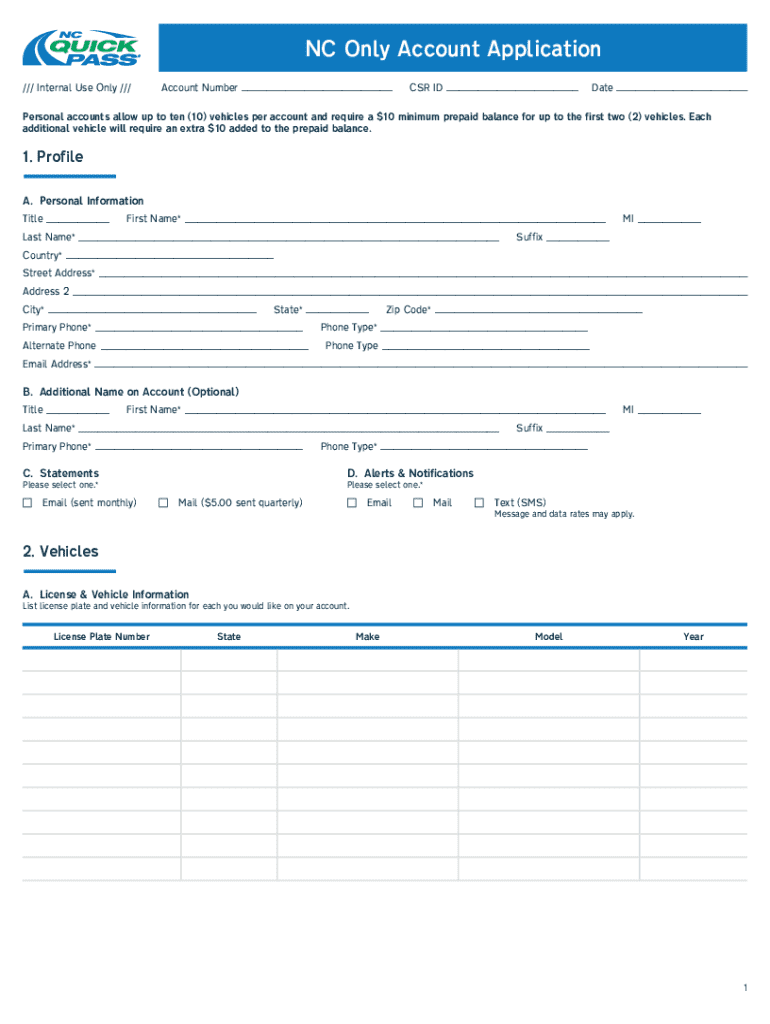

Applying for an NC Only Account involves a straightforward process characterized by a series of clear steps. Starting with the preliminary phase, applicants must gather necessary documentation, including identification and proof of residency. These documents not only verify the applicant's identity but also confirm their local residency status, both vital components of the application.

Steps typically include completing the application form, submitting verification documents, and potentially undergoing additional validation checks. Common challenges faced during this process may include missing documentation or misunderstanding application requirements. To mitigate these issues, it's advisable to prepare a checklist of needed documents and confirm all entries are accurate before submission.

Accessing the NC only account application form

Locating the NC Only Account Application Form on pdfFiller is a simple process. Users can easily navigate the platform to find the document, which is readily available for access, editing, and submission. The application form is usually available in PDF format, ensuring consistency and ease of use.

Once located, applicants have varied options for accessing the form. They can download it in PDF format directly or utilize interactive functionalities that allow for real-time editing and annotation. pdfFiller not only streamlines the process but also offers enhanced features, making it easier to fill in detailed information systematically.

Filling out the NC only account application

Completing the NC Only Account Application Form requires careful attention to detail. Each section is designed to capture specific information about the applicant, starting with personal details, transition into financial information, and concludes with account preferences. An accurate completion is crucial for a smooth processing experience.

Potential pitfalls to avoid include common data entry error and incomplete sections. To mitigate these, applicants should double-check their entries and consider using pdfFiller’s validation features to assist in accurate completion.

Editing the NC only account application form

Once the NC Only Account Application Form is filled, utilizing pdfFiller’s editing tools can enhance clarity and accuracy. The platform provides users the ability to add comments, suggest edits, and modify existing fields. This versatility ensures that every detail is perfectly aligned with application requirements before final submission.

Best practices for ensuring clarity include maintaining consistent formatting, clearly delineating sections, and using straightforward language. Engaging with pdfFiller's user interface can further simplify this process, allowing for real-time adjustments and reductions in potential miscommunication.

Signing the NC only account application

The importance of electronic signatures cannot be overstated in the context of the NC Only Account Application. They provide a legally binding way to authenticate the applicant’s identity and affirm their intent. pdfFiller allows users to electronically sign their applications with ease, ensuring the process is both fast and secure.

To successfully sign the application within pdfFiller, users will follow a step-by-step guide that includes selecting the signature option, positioning it appropriately on the document, and finalizing the sign-off with a click. Robust security measures in place, including encryption and secure access, further reinforce the integrity of the document throughout this process.

Submitting the NC only account application

Once the NC Only Account Application Form is completely filled out and signed, the next significant step is submission. Applicants have various options available for submission, including an electronic submission process that allows direct uploading through pdfFiller or traditional methods such as mailing hard copies.

For those opting to submit electronically, pdfFiller simplifies the process, providing prompts that guide users through each stage. If mailing a hard copy is preferred, it's crucial to follow the provided mailing instructions closely to ensure prompt processing. After submitting, applicants can typically expect a confirmation email detailing the next steps in the review process.

Managing your NC only account post-application

Once your NC Only Account is active, accessing your account online becomes pivotal for effective financial management. Utilizing the online platform provided by your financial institution allows for easy monitoring of transactions, setting up notifications, and keeping track of balances and statements.

Tips for optimizing account management include setting reminders for fee payments, regularly reviewing transaction histories, and understanding the specific fees and policies associated with your account. Moreover, resources such as customer support or community forums can significantly enhance the user experience by offering assistance and insights into navigating account features.

Troubleshooting common issues with the NC only account application

Navigating common issues during the NC Only Account Application process can enhance the overall experience for applicants. Addressing frequently asked questions often highlights prevalent concerns, such as loss of submission confirmation or inquiries about application review timelines. Understanding these factors can help manage expectations through the application process.

For more personalized support, users should utilize available contact information for assistance. Many institutions provide dedicated customer service representatives to help resolve problems or clarify any doubts related to the application status or documentation.

Additional insights on the NC only account

Collecting real-life testimonials from current NC Only Account holders can provide a wealth of insights for potential applicants. These perspectives can highlight the unique benefits and experiences associated with this account type, including ease of access to community programs and tailored financial advice.

Comparing the NC Only Account with other account types ensures potential customers make informed decisions. Identifying distinguishing features, such as lower fees or targeted educational resources, can greatly influence one's choice. Additionally, discussing future enhancements may raise expectations and engagement among account holders.

Interactive tools for your NC only account journey

Engaging with interactive tools enhances the overall user experience regarding the NC Only Account. Utilizing budgeting calculators allows account holders to plan their finances effectively while checklists assist applicants in preparing necessary documents and understanding submission requirements.

Additionally, interactive FAQs and support chat features enrich the process by offering immediate assistance. These tools respond promptly to inquiries, facilitating a smoother transition into account management and enhancing user satisfaction.

Community engagement and feedback

Sharing personal experiences with the NC Only Account can provide valuable insights for newcomers, fostering a sense of community among users. Encouraging feedback from current account holders can significantly influence future improvements and adjustments, aligning services more closely with user preferences.

Connecting with other users through forums or social media platforms can enhance the experience further, promoting engagement and knowledge sharing that benefits all involved. Participating in community discussions enables individuals to articulate their needs while actively influencing better services and account features.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nc only account application from Google Drive?

How do I make edits in nc only account application without leaving Chrome?

Can I create an electronic signature for the nc only account application in Chrome?

What is nc only account application?

Who is required to file nc only account application?

How to fill out nc only account application?

What is the purpose of nc only account application?

What information must be reported on nc only account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.