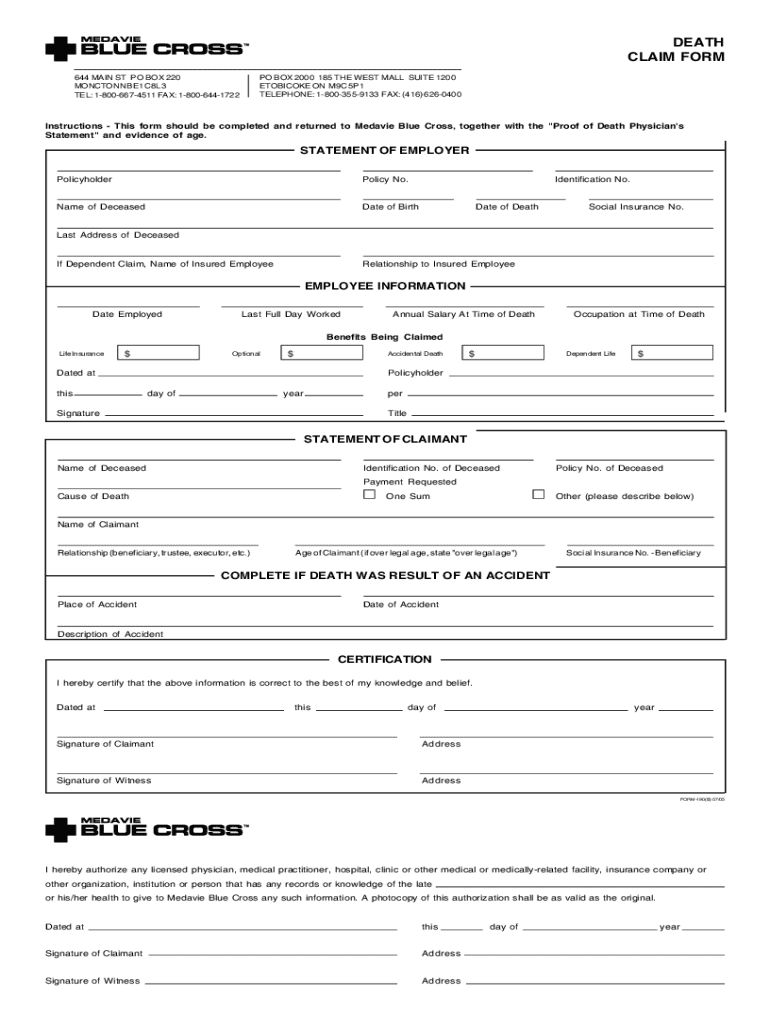

Get the free Death Claim Form

Get, Create, Make and Sign death claim form

How to edit death claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out death claim form

How to fill out death claim form

Who needs death claim form?

Complete Guide to Understanding and Filing a Death Claim Form

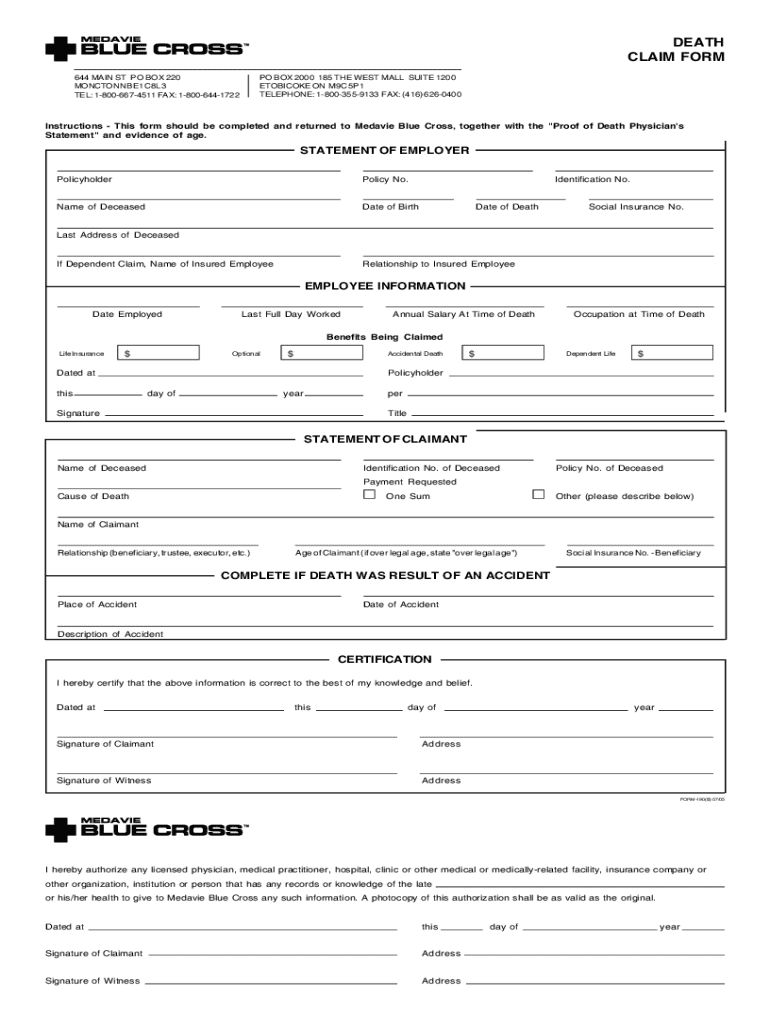

Understanding the death claim form

A death claim form is a crucial document required by insurance providers to initiate the claims process following the death of an insured individual. Its primary purpose is to collect necessary information regarding the deceased and the claimant to process the insurance benefits efficiently.

A death claim form is required when a policyholder passes away, and beneficiaries seek to claim the insurance payout to cover the costs associated with the loss. The form gathers essential details, ensuring that the claim is valid and expedited.

Understanding key terms related to the death claim form is essential. Beneficiary refers to the person entitled to receive the insurance payout. Nomination involves specifying this beneficiary in the policy itself. Legal representation may be necessary if disputes arise regarding claim entitlement.

Essential documents for filing a death claim

Filing a death claim requires specific documentation to validate the claim. Preparing these documents ahead of time can streamline the process significantly.

Gathering these documents requires attention to detail. Begin by requesting a certified copy of the death certificate from a local authority or hospital. Review your insurance policy to locate the necessary documentation and ensure that your ID is up to date. Compiling additional supporting documents may involve contacting relevant parties for reports or records.

Steps to complete the death claim form

Filling out the death claim form accurately is critical. The form typically consists of multiple sections, each requiring specific information.

Section 1: Claimant information

This section requires your personal details, including full name, address, relationship to the deceased, and contact information. Ensuring accuracy is essential as incorrect details can delay the process.

Section 2: Policy details

You can locate policy information on the original policy document that is often mailed to the policyholder. Ensure that you accurately record the policy number and the name of the insurance company.

Section 3: Details of the deceased

Required information includes the deceased’s full name, date of birth, and date of death. Common mistakes include entering incorrect dates or names that do not match the policy details.

Section 4: Beneficiary information

List all beneficiaries as per the policy. It's crucial to mention their relationship to the deceased and the share of the claim they are entitled to. If nomination details are available, they should also be referenced.

Section 5: Declaration and signature

You must sign and date the form to validate it. This signature signifies that the information provided is accurate to the best of your knowledge and signifies your declaration as the claimant.

Filing the death claim form

Once the death claim form is complete, it must be submitted according to the insurance provider’s requirements.

After submission, you should expect an acknowledgment from the insurer within a specified response time, typically ranging from a few days to several weeks. Follow-up procedures may involve contacting customer service if you haven’t received feedback after the stipulated period.

Understanding the claims process

The claims process generally involves several steps, each critical to reaching a decision on your claim. Insurance companies will evaluate the provided documents, scrutinize the policy’s terms and conditions, and might even request additional information.

If your claim is approved, the next step will be receiving your payout. If under review or denied, you should receive clear reasons for the company’s decision and guidance on any potential appeals.

Special considerations in claims

The process can vary based on whether a nomination is available or if legal representation is involved. For example, death claims where a nomination is present may be processed faster compared to claims missing this important document.

For amounts up to Rs. 5,000, claims may be processed quickly. However, larger claims may require further verification and documentation. Claims exceeding Rs. 50,000 typically call for thorough examinations, especially if no nomination exists.

Maximizing your experience with pdfFiller

pdfFiller simplifies the entire process of filling out a death claim form. Users can edit and customize the form easily, ensuring that all necessary information is included accurately.

By utilizing pdfFiller's features, you can reduce the stress associated with filing a death claim. This accessibility allows you to focus more on supporting your loved ones during a challenging time.

Common challenges and solutions

Filing a death claim can often come with significant challenges. Confusion regarding required documentation or discrepancies in information can lead to delays or rejections.

Staying proactive and utilizing available resources can greatly simplify your claims experience.

Frequently asked questions (FAQs)

As you navigate the death claim process, you may have several questions regarding eligibility, changes to beneficiaries, or timeline expectations.

By addressing these common concerns, you can better prepare for the challenges ahead in the claims process.

Appendices

While the detailed sections above provide a comprehensive look at the death claim form process, additional resources such as a sample death claim form template and a glossary of related terms can further enhance your knowledge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit death claim form from Google Drive?

How can I get death claim form?

How do I edit death claim form in Chrome?

What is death claim form?

Who is required to file death claim form?

How to fill out death claim form?

What is the purpose of death claim form?

What information must be reported on death claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.