Get the free Bs in Accounting (bacc)

Get, Create, Make and Sign bs in accounting bacc

Editing bs in accounting bacc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bs in accounting bacc

How to fill out bs in accounting bacc

Who needs bs in accounting bacc?

Understanding the BS in Accounting: A Comprehensive Guide

Understanding the BS in Accounting

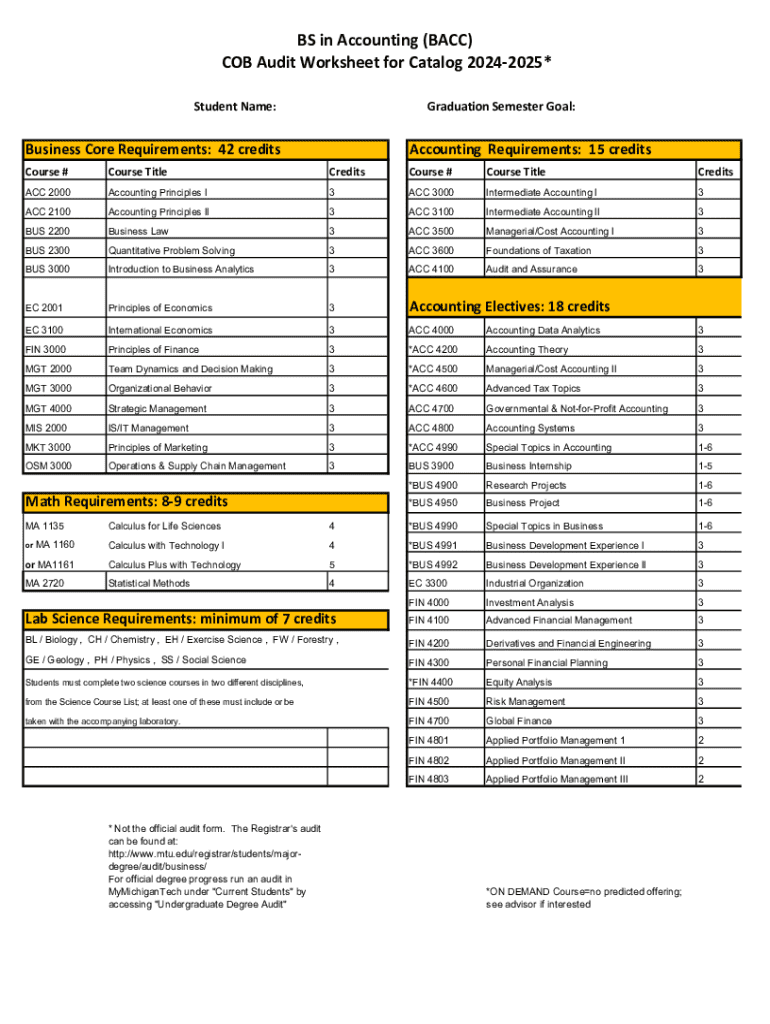

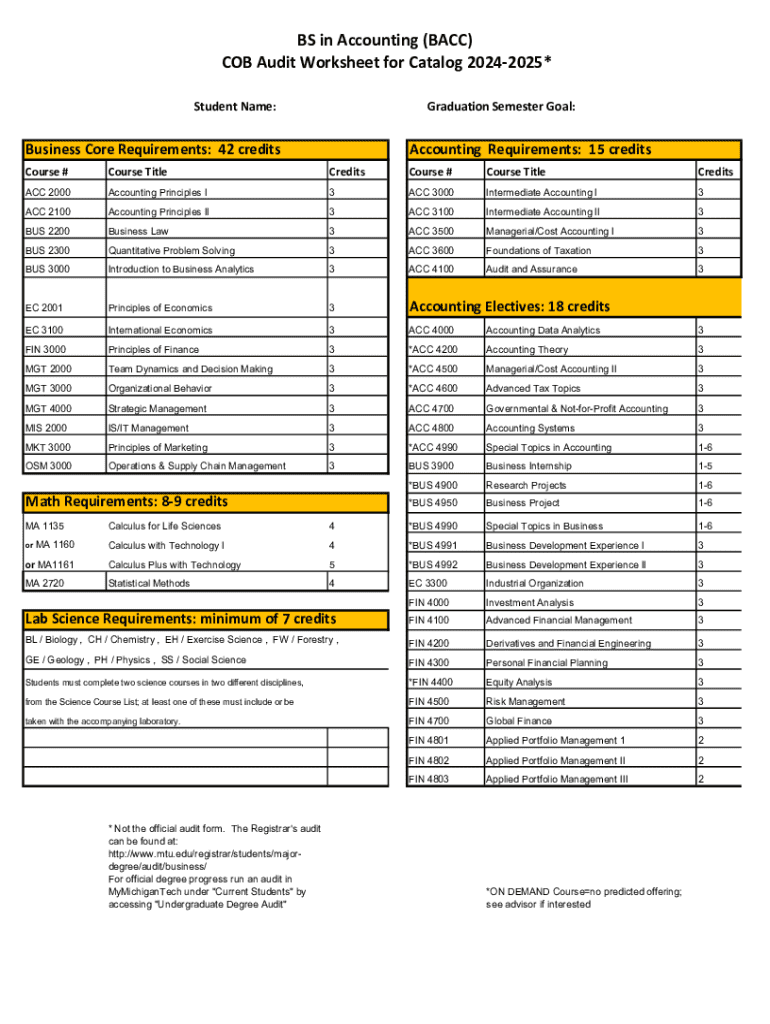

The Bachelor of Science in Accounting (BS in Accounting) focuses on the application of accounting principles and methods. It equips students with the technical skills and analytical tools needed to navigate the complex financial landscape of businesses.

Additionally, the BS in Accounting is pivotal in the business world. As organizations grow and evolve, the necessity for proficient accountants has never been more pronounced. This program prepares graduates to analyze financial statements, ensure regulatory compliance, and provide insights for organizational decision-making.

Program structure and curriculum

The BS in Accounting curriculum is structured to provide both theoretical knowledge and practical skills. Core courses are designed to cover essential topics that form the foundation of accounting practices.

Electives allow students to tailor their education to fit career goals, while capstone projects enable them to apply their learning to real-world situations. These opportunities foster critical thinking and problem-solving skills, vital in any accounting role.

Admission criteria

Pursuing a BS in Accounting requires meeting specific admission criteria. Most colleges demand a high school diploma or equivalent and a satisfactory GPA. Some institutions may additionally require standardized test scores.

Selecting the right accounting program

Choosing the suitable accounting program is a critical step in your educational journey. Consider various factors to ensure that you align your choice with your long-term career goals.

As of 2025, consider looking into programs with strong industry ties and internships, which can be invaluable in transitioning from academics to the workforce.

Career opportunities with a BS in Accounting

A BS in Accounting opens the door to a variety of career opportunities. Graduates can seek positions in both public and private sectors, emphasizing that the demand for qualified accountants continues to rise, ensuring strong job security.

The average starting salary for accounting graduates varies but is generally competitive. Career advancement can lead to senior roles, providing opportunities for specialization in areas like forensic accounting or financial planning.

The value of certification

One of the critical considerations for accounting graduates is obtaining certification. The Certified Public Accountant (CPA) designation is held in high regard and often required for higher-level positions.

Financial considerations

When pursuing a BS in Accounting, it is essential to account for tuition costs and seek financial aid options. Understanding the financial commitment upfront can guide students during their educational journey.

Prospective students should actively search for scholarships specifically targeted towards accounting programs to maximize financial support.

Pros and cons of earning a BS in Accounting online

Online learning has revolutionized the way students can earn their degrees. While it offers many advantages, there are also challenges to consider. Understanding both sides is crucial for making an informed decision.

Trends and future of accounting education

As the field of accounting evolves, education must adapt to meet new challenges. The integration of technology, such as accounting software and data analytics, is increasingly necessary for modern accountants.

Frequently asked questions

Students often have questions about career prospects and the program structure while considering a BS in Accounting.

Interactive tools and resources

To navigate the accounting education process, various interactive tools and resources can be beneficial. These tools help streamline tasks and offer invaluable assistance through your educational journey.

Case studies and success stories

Gaining insight from successful accounting graduates can illuminate potential pathways for current students. Exploring their journeys reveals how they leveraged their degrees.

Next steps for prospective students

Entering the realm of accounting is an exciting opportunity, and proper preparation can enhance your success. Identifying next steps helps streamline your path toward achieving your BS in Accounting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get bs in accounting bacc?

How can I fill out bs in accounting bacc on an iOS device?

How do I edit bs in accounting bacc on an Android device?

What is bs in accounting bacc?

Who is required to file bs in accounting bacc?

How to fill out bs in accounting bacc?

What is the purpose of bs in accounting bacc?

What information must be reported on bs in accounting bacc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.