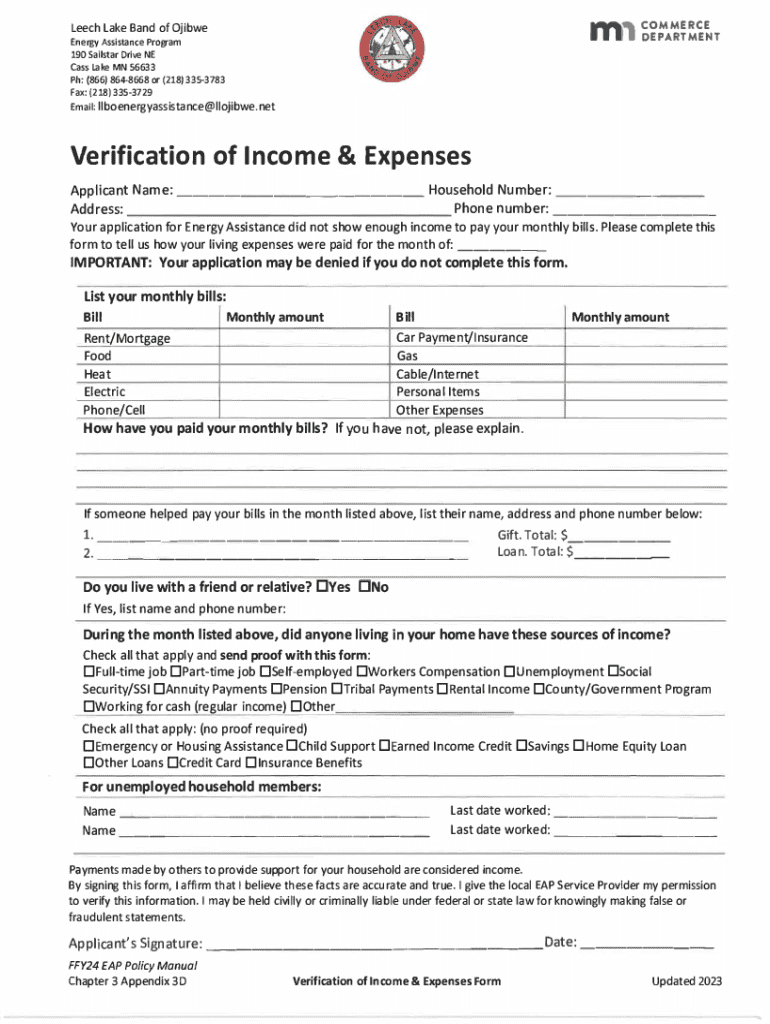

Get the free Verification of Income & Expenses Form

Get, Create, Make and Sign verification of income expenses

Editing verification of income expenses online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of income expenses

How to fill out verification of income expenses

Who needs verification of income expenses?

A comprehensive guide to the verification of income expenses form

Understanding the verification of income expenses form

The verification of income expenses form is a crucial document utilized by individuals and businesses to confirm financial health and stability. This form is an essential prerequisite for various financial applications, such as loans, grants, and rental agreements. Completing this form accurately ensures that your income and expenses are documented correctly, providing a thorough picture of your financial situation.

Verifying income and expenses holds significant importance not just in personal finance but also in business contexts. For individuals, an accurate verification is pivotal for obtaining loans, as it demonstrates to lenders that you have a reliable income source. Similarly, businesses depend on this verification for establishing their financial credibility, which is crucial for securing loans or attracting investors.

Key components of the verification of income expenses form

To fill out the verification of income expenses form correctly, it is essential to be aware of its key components. The form generally includes detailed sections for both income and expenses, ensuring a holistic view of financial health.

The income section requires you to disclose various types of income. This may include regular wages, bonuses, and self-employment income, among others. It's crucial to recognize all possible income streams to present an accurate representation.

In the expenses section, it is equally important to itemize all expenses, with attention to fixed and variable expenses. Understanding both types is necessary to communicate accurate financial needs.

How to complete the verification of income expenses form

Filling out the verification of income expenses form involves several clear steps that, if followed meticulously, can result in a well-prepared document.

Common mistakes to avoid

Filling out the verification of income expenses form might seem straightforward, but some common pitfalls can undermine its accuracy. One frequent mistake is overlooking minor income sources, which can lead to significant discrepancies within your reported financial position.

Another common error is misreporting expenses. Ensure that you categorize expenses correctly and include all relevant liabilities. A final noteworthy mistake is failing to regularly update the information; fluctuations in income or expenses should be reflected accordingly each time you complete this form.

Special considerations for different audiences

Different individuals and businesses require tailored approaches regarding the verification of income expenses form. For business owners, certain expenses are unique, such as payroll, operational costs, and more complex tax considerations. Self-employed individuals face distinct IRS requirements that require careful attention to income reporting, ensuring that all income sources are documented accurately.

Students and recent graduates, often with fluctuating income, must also navigate this form carefully. They typically need to provide clear proof of income for educational grants and loans, which may necessitate additional documentation like scholarship awards, internships, or part-time job earnings.

Tools and resources for managing your income and expenses

Efficiently managing income and expenses adds to the accuracy and success of completing your verification of income expenses form. Numerous digital tools are available that can streamline the form completion process while allowing users to track their finances effectively.

For instance, pdfFiller provides a user-friendly platform allowing users to edit, sign, and manage PDFs with ease. Features such as interactive templates make it particularly helpful for inputting required information quickly, thereby saving time.

The impact of verification on financial trustworthiness

Proper documentation within the verification of income expenses form builds credibility, vital for both personal and business financial narratives. When lenders or financial institutions see that you have provided accurate and well-documented information, it boosts their confidence in approving loans or extending credit.

Verification plays a crucial role in eligibility for financial aid as well. Institutions thoroughly examine income and expense details, with accurate verification ensuring that you're qualified for the needed assistance. Maintaining best practices for documenting financial records can further enhance your financial reputation.

Advantages of using pdfFiller for your verification needs

Utilizing pdfFiller offers several advantages for those looking to manage their verification of income expenses form effectively. Its cloud-based platform empowers users to create, manage, and store documents from anywhere, which is invaluable in today’s mobile landscape.

Through pdfFiller, users can enjoy seamless PDF editing and eSigning capabilities. These features simplify the verification process, making it easier than ever to collaborate on documents, ensuring all parties have the most current information.

Frequently asked questions

When undertaking the verification of income expenses form, questions may arise regarding its completion and requirements. Many users often wonder how long it typically takes to complete this form. On average, depending on the complexity of one's finances and the availability of documents, it can take anywhere from one hour to a few hours to complete this form accurately.

Additionally, fluctuations in income can pose challenges, particularly for self-employed individuals or those with seasonal work. In such cases, it’s crucial to provide a comprehensive view of your earnings over a specified period, supporting your claims with relevant documents.

Related forms and documents for financial verification

The verification of income expenses form does not operate in isolation; numerous related forms and documents play a significant role in the financial verification process. It's important to understand how these documents interconnect, as this helps create a cohesive narrative around your financial situation.

Consistency across various financial forms is vital, especially when seeking loans or financial aid. Cross-referencing these forms with other financial statements, such as tax returns or pay stubs, ensures that every aspect of your financial history aligns properly, providing a solid basis for any financial claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the verification of income expenses in Chrome?

Can I create an eSignature for the verification of income expenses in Gmail?

How do I fill out verification of income expenses using my mobile device?

What is verification of income expenses?

Who is required to file verification of income expenses?

How to fill out verification of income expenses?

What is the purpose of verification of income expenses?

What information must be reported on verification of income expenses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.