Get the free Btl Applicant’s Assets & Liabilities

Get, Create, Make and Sign btl applicants assets liabilities

Editing btl applicants assets liabilities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out btl applicants assets liabilities

How to fill out btl applicants assets liabilities

Who needs btl applicants assets liabilities?

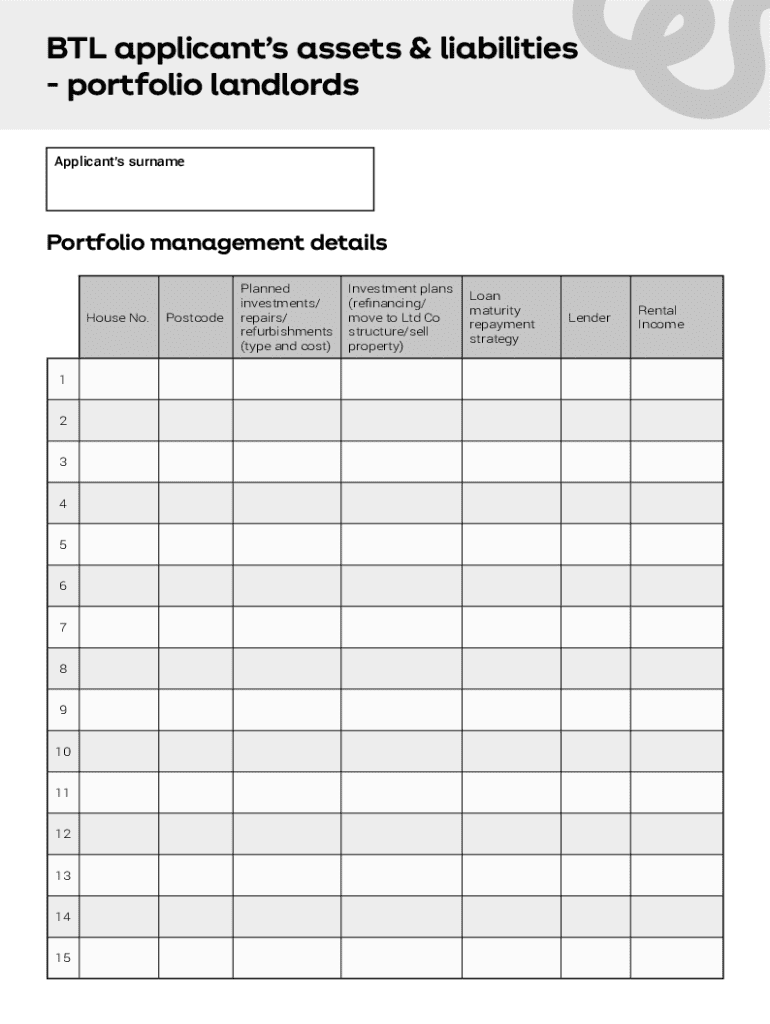

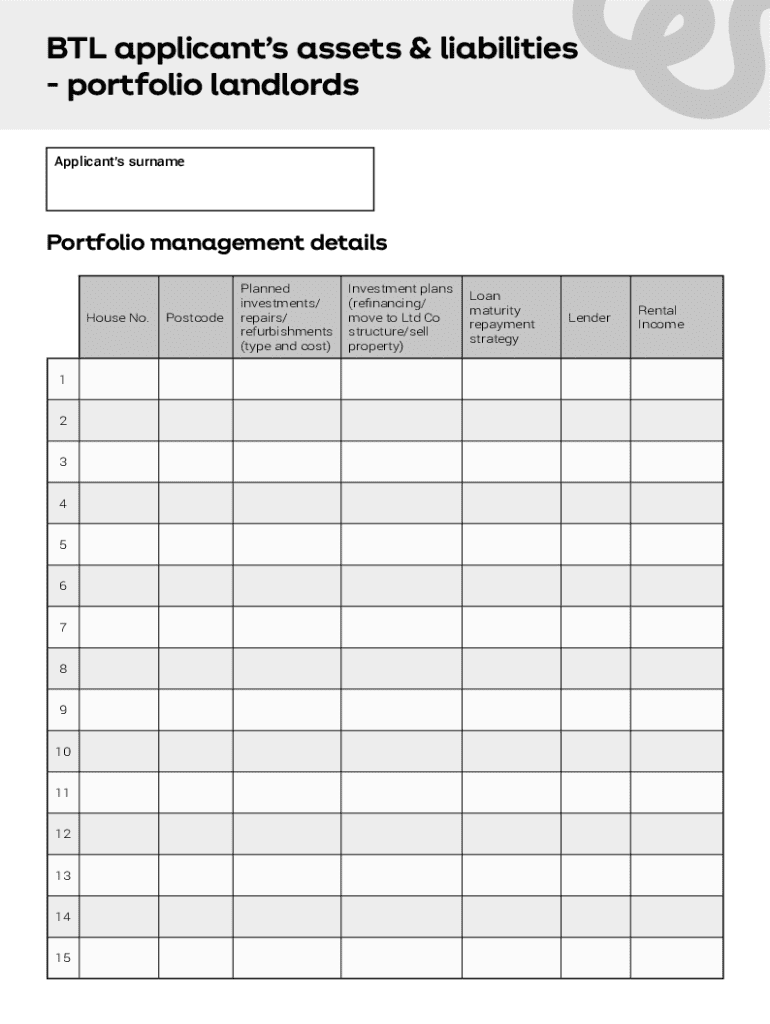

Understanding the BTL Applicants Assets Liabilities Form

Understanding the Buy-to-Let (BTL) Applicants Assets Liabilities Form

The BTL Applicants Assets Liabilities Form is a crucial component of the buy-to-let mortgage application process. This form collects essential information regarding an applicant's financial standing, which lenders evaluate to determine eligibility for a mortgage. It serves as a snapshot of one's financial health, juxtaposing assets against liabilities to ascertain one’s ability to repay the mortgage.

Accurate reporting in this form significantly influences mortgage eligibility, as it directly impacts the lender’s assessment of risk. If the provided data is misleading or inaccurate, the chances of securing financing diminish, potentially leading to denial of the mortgage application.

Key components of the BTL applicants assets liabilities form

The BTL Applicants Assets Liabilities Form is divided into two primary sections: the assets section and the liabilities section. Each of these segments plays a vital role in portraying a full picture of an applicant's financial status.

Assets section

In the assets section, applicants must disclose various types of assets that contribute to their financial profile. This typically includes:

To value these assets accurately, applicants are encouraged to provide documentation such as bank statements, valuations from licensed appraisers, or recent transaction statements.

Liabilities section

In the liabilities section, applicants need to declare their financial obligations. Common items to note include:

Full disclosure is essential, as lenders assess creditworthiness based on an accurate representation of liabilities.

Step-by-step guide to filling out the form

Filling out the BTL Applicants Assets Liabilities Form may seem daunting, but breaking it down into steps can simplify the process. The first step involves gathering all needed documentation.

Gathering required documentation

Necessary documents include but are not limited to:

Organizing these documents efficiently can greatly reduce the time taken to complete the form. Consider using a digital document management system that allows easy access and viewing.

Completing the assets section

When entering information for the assets section, ensure accuracy in the values provided. Avoid rounding numbers unnecessarily, as lenders will require precise figures. It can help to keep the documents handy during this process.

Common pitfalls include over-inflating asset values or providing incomplete data. Be straightforward and honest in your reporting, as lenders appreciate transparency.

Filling in the liabilities section

In the liabilities section, tackle this the same way—methodically. List all debts with their current outstanding balance. This includes estimating monthly repayments where applicable, which lenders typically request.

Even minor details can influence the lending decision; hence double-checking figures is critical. The more accurate the information, the smoother the approval process.

Tools for managing your BTL application documentation

Effective document management is key for a successful BTL mortgage application. Utilizing tools such as pdfFiller can streamline this process significantly.

Benefits of using pdfFiller for document management

pdfFiller offers a range of features designed specifically for managing your documents efficiently. Some of these include:

This solution enhances efficiency and ensures that the application documents are always organized and easily accessible from any device.

Interactive tools to simplify the process

pdfFiller's functionalities extend to utilizing automated templates and eSignature solutions. These tools allow applicants to track updates and make changes easily, as all edits are saved securely in the cloud.

Common mistakes in completing the BTL applicants assets liabilities form

There are several common mistakes applicants make when filling out the BTL Applicants Assets Liabilities Form, which could jeopardize their application.

Incomplete information

Missing data is one of the most frequent errors; any missing critical information can slow down the processing time or lead to outright denial of the mortgage.

Misvaluation of assets

Providing inflated or incorrect valuations can misrepresent your financial health. This misrepresentation might raise suspicion and affect lender trust.

Underreporting liabilities

It’s crucial to disclose all liabilities, as underreporting could suggest that the applicant is attempting to hide financial trouble, thereby impacting mortgage approval.

FAQ: Addressing your queries about the BTL applicants assets liabilities form

After spending time completing the BTL Applicants Assets Liabilities Form, applicants often have questions about the next steps.

What happens after submission?

Once submitted, lenders will review the provided information against other factors like credit history and income stability to assess mortgage eligibility.

Can amend my form post-submission?

Modifications to the form after submission may be necessary but should be done with caution. Contact your lender directly for guidance on how to make changes.

How do lenders verify reported assets and liabilities?

Lenders typically verify reported information through credit bureaus and may request additional documentation. Having organized and detailed records can help facilitate this verification.

Navigating the BTL mortgage application process

The BTL mortgage application process involves various steps, starting with an understanding of how lenders assess the completed form.

The role of lenders in the BTL process

Lenders will evaluate the assets and liabilities submitted to gauge the risk they will take by approving the mortgage. They will analyze income relative to debts and assess how the purchase aligns with rental income potential.

Next steps after completing the form

After you submit your application, stay informed about any communication from lenders. Be prompt in responding to requests for additional documents or clarifications, as this can expedite the approval process.

Help and support resources

While filling out the BTL Applicants Assets Liabilities Form can be a complex process, ample support is available to ease this journey.

Contacting customer support for assistance

Many lenders and document management platforms like pdfFiller offer customer support channels. Whether via phone, email, or online chat, it's advisable to seek assistance whenever necessary.

Online community and discussion forums for BTL applicants

Engaging with peers in online forums, such as Reddit or specialized property investment forums, can yield valuable tips and shared experiences. By learning from others, you can navigate your application process more confidently.

Understanding legal and compliance aspects

Navigating the compliance landscape is critical when completing the BTL Applicants Assets Liabilities Form, as regulations surrounding mortgage applications can be intricate.

Regulatory obligations when completing the form

Applicants must remain compliant with all regulatory requirements to avoid legal issues. This includes proper documentation and accurate representation of financial data.

Data protection measures in document submission

Protecting personal information during the documentation process is paramount. Utilizing secure platforms such as pdfFiller ensures that all sensitive data submitted retains confidentiality.

About pdfFiller's document management solutions

pdfFiller stands out in the marketplace of document management solutions, especially for BTL applicants.

Why choose pdfFiller for your BTL document needs?

With features tailored towards BTL applications, pdfFiller enhances efficiency by allowing you to manage, edit, and securely store your documents all in one place.

Case studies of successful BTL applications using pdfFiller

Many users have reported smoother application processes with pdfFiller. For instance, applicants have recounted that editing and adjusting information in real-time helped them present updated financial positions, facilitating favorable lending decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit btl applicants assets liabilities from Google Drive?

How do I fill out btl applicants assets liabilities using my mobile device?

How do I edit btl applicants assets liabilities on an iOS device?

What is btl applicants assets liabilities?

Who is required to file btl applicants assets liabilities?

How to fill out btl applicants assets liabilities?

What is the purpose of btl applicants assets liabilities?

What information must be reported on btl applicants assets liabilities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.