Get the free Financial Intermediary Form

Get, Create, Make and Sign financial intermediary form

How to edit financial intermediary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial intermediary form

How to fill out financial intermediary form

Who needs financial intermediary form?

Understanding Financial Intermediary Forms: A Comprehensive Guide

Understanding financial intermediaries

Financial intermediaries are crucial entities in the financial ecosystem that facilitate the flow of funds between savers and borrowers. They serve as a bridge, channeling money from those who have surplus funds to those in need of financing. Common examples include banks, credit unions, and microfinance institutions (MFIs). These organizations not only provide a means for loans and savings but also enhance liquidity in the economy, enabling smoother transactions and more efficient resource allocation.

The role of financial intermediaries extends beyond mere transactions; they help to manage risks and provide services that might be unavailable otherwise. Through pooling money, they can offer larger loans to businesses or individuals requiring substantial capital, which would be challenging for individual investors to achieve. By doing so, they contribute significantly to economic stability and growth by making credit available, fostering entrepreneurship, and facilitating consumer spending.

Overview of financial intermediary forms

Financial intermediaries use various forms to operate effectively and remain compliant with regulatory standards. Common forms include applications, agreements, and disclosures necessary for transactions like opening accounts, applying for loans, or understanding investment products. Each type of form serves a distinct purpose in the financial process and is tailored to the specific activities undertaken by the institution.

Regulatory necessities play a vital role in the use of these forms, ensuring that financial intermediaries adhere to legal requirements designed to protect consumers and maintain transparency in the financial system. The accuracy and completeness of the information provided in these forms are essential for compliance, as inaccuracies can lead to legal consequences or financial losses. Thus, understanding these forms is fundamental for individuals interacting with financial intermediaries.

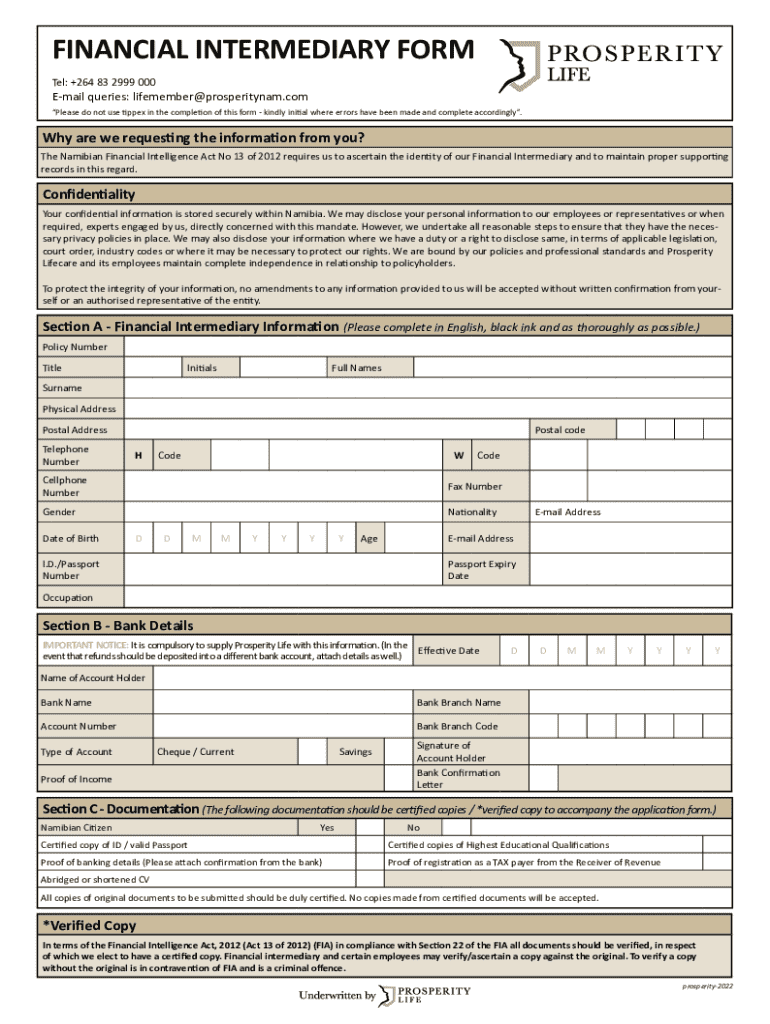

The financial intermediary form: detailed breakdown

A financial intermediary form typically consists of several essential components. These include personal information sections, where individuals enter their names, addresses, and contact details, followed by financial data pertaining to their income, expenses, and borrowing history. Clear guidelines on how to fill these sections are vital, as they directly impact the approval process of loans or the eligibility for financial products.

Required documentation often accompanies these forms, including identification documents, proof of income, and bank statements. Gathering accurate and complete documentation ensures a smoother processing experience. Additionally, individuals should be wary of common mistakes, such as data entry errors or failing to include necessary attachments, both of which can delay the processing time or lead to rejected applications.

How to fill out financial intermediary forms

Filling out financial intermediary forms efficiently ensures a smooth process. Here’s a step-by-step guide to assist you:

Following these steps can dramatically enhance the likelihood of your form's successful processing. Take particular care during the review stage to catch any errors and consult with a financial advisor if you're unsure about any details.

Editing and managing your financial intermediary form

Document management tools like pdfFiller streamline the process of editing financial forms. By utilizing pdfFiller, users can upload their financial intermediary forms and easily make necessary edits or adjustments. The platform also offers features such as eSigning and collaborative capabilities, allowing multiple parties to review and sign documents securely.

Furthermore, understanding version control is essential. Keeping track of changes made to a document in the cloud ensures that you can always revert to an earlier version if necessary. With cloud storage, users can access their financial intermediary forms from multiple devices, enhancing flexibility and convenience in managing their documentation.

Managing collaborative processes

Collaboration in filling out financial intermediary forms can often lead to more accurate and complete applications. Teams working together should prioritize secure sharing methods, ensuring that sensitive information is protected throughout the process. Tools available within pdfFiller facilitate secure document sharing while enhancing team collaboration through interactive features, reducing the likelihood of miscommunications.

Best practices for maintaining compliance and security center around the use of encryption protocols and secure sharing mechanisms. Always check that the platforms used for collaboration are compliant with data protection regulations to safeguard financial information. Regular updates and audits of the document-sharing process can further enhance security and help maintain trust.

The future of financial intermediary forms

The future of financial intermediary forms is evolving rapidly, thanks to innovations in digital document management. Emerging technologies are streamlining the process of form creation and management, allowing for greater automation and integration of artificial intelligence. These advancements can reduce human error and speed up the processing of applications, fundamentally changing how financial intermediaries engage with clients.

Evolving regulatory standards will also shape the landscape of financial intermediary forms. As compliance requirements grow more stringent, institutions must adapt to new protocols for data protection and transparency. Preparing for these changes means staying informed about upcoming legislative shifts and technological advancements that will likely impact operations in the financial sector.

Practical scenarios and case studies

Real-life case studies of financial intermediary forms illustrate their significance in various contexts. One poignant example is a startup that successfully acquired funding through precise documentation of their financial intermediary forms, leading to a loan approval that facilitated their initial operations. Another case involves a family applying for a mortgage and encountering delays due to incomplete forms, highlighting the importance of thoroughness.

Gleaning insights from user experiences can significantly impact how forms are managed. Many users recommend maintaining an organized digital folder for documentation and suggest routinely checking for updates in requirements specific to financial institutions. These proactive steps encourage efficiency and ultimately lead to smoother interactions with financial intermediaries.

Conclusion and next steps

Optimizing document management processes is essential for anyone interacting with financial intermediaries. Leveraging tools like pdfFiller can simplify the editing, signing, and management of financial intermediary forms, making these processes faster and more accurate. With enhanced organization and accuracy, individuals can experience improved outcomes when dealing with financial institutions.

Accurate documentation plays a crucial role in financial success. Users should prioritize understanding the nuances of financial intermediary forms, ensuring that their data is always complete, accurate, and compliant with any regulatory requirements. Equipped with this knowledge, individuals and teams can better navigate the financial landscape with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial intermediary form in Gmail?

How do I make changes in financial intermediary form?

How do I fill out the financial intermediary form form on my smartphone?

What is financial intermediary form?

Who is required to file financial intermediary form?

How to fill out financial intermediary form?

What is the purpose of financial intermediary form?

What information must be reported on financial intermediary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.