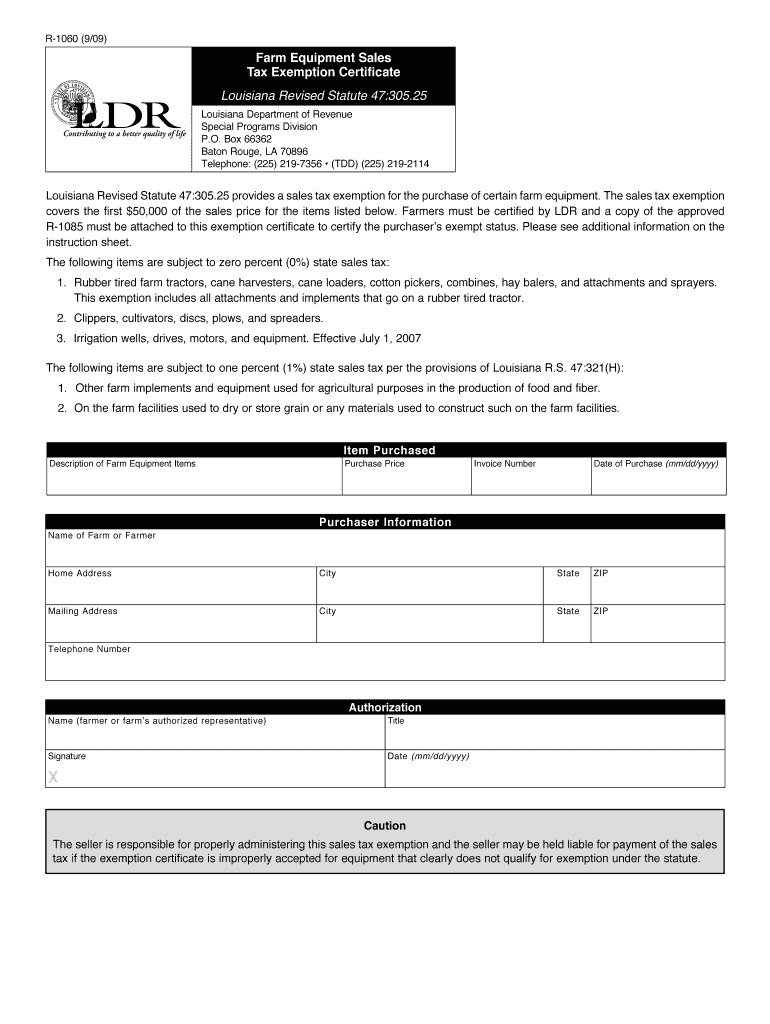

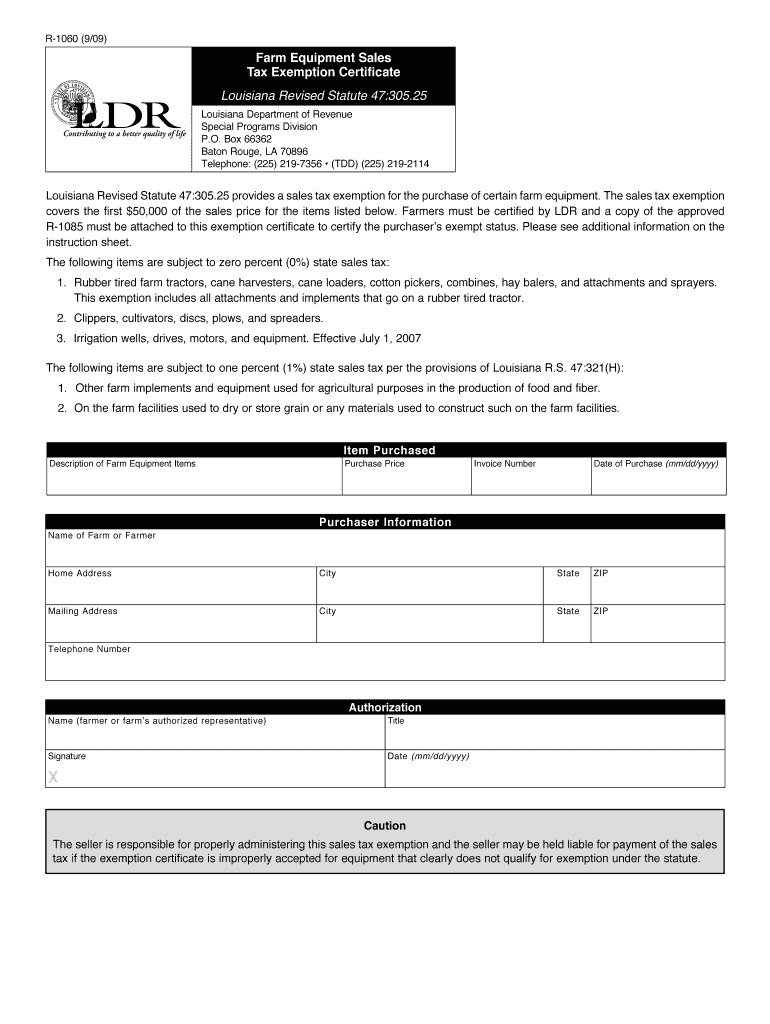

Get the free R1060 (9/09) Farm Equipment Sales Tax Exemption Certificate Louisiana Revised Statut...

Show details

R1060 (9/09) Farm Equipment Sales Tax Exemption Certificate Louisiana Revised Statute 47:305.25 Louisiana Department of Revenue Special Programs Division P.O. Box 66362 Baton Rouge, LA 70896 Telephone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign r1060 909 farm equipment

Edit your r1060 909 farm equipment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your r1060 909 farm equipment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit r1060 909 farm equipment online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit r1060 909 farm equipment. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out r1060 909 farm equipment

How to fill out r1060 909 farm equipment:

01

Gather all necessary information: Before starting to fill out the form, ensure that you have all the required information at hand. This may include details about the farm equipment, its value, any relevant receipts or invoices, and other necessary documentation.

02

Download the r1060 909 form: Visit the official website of the appropriate tax authority or organization to download the r1060 909 form. Make sure to download the most recent version to ensure accuracy.

03

Provide your personal information: Begin by filling out the personal information section on the form. This may include your name, address, contact details, and any other relevant information as requested.

04

Describe the farm equipment: In this section, you will need to provide a detailed description of the farm equipment. Include information such as its make, model, serial number, and any unique identifiers. Providing accurate and comprehensive details is crucial to ensure proper identification.

05

Specify the value: Indicate the value of the farm equipment. This could be the original purchase price, fair market value, or any other valuation method as required by the form instructions. Attach any supporting documents, such as receipts or appraisals.

06

Determine the applicable deductions or credits: Depending on your tax jurisdiction, there may be certain deductions or credits associated with farm equipment. Consult the instructions provided with the form or seek professional advice to determine if any deductions or credits apply to your situation.

07

Review and submit: Once you have completed all the necessary sections, take the time to review your entries for accuracy. Ensure that all information provided is correct, and double-check any calculations or amounts. After reviewing, sign and date the form, and submit it as per the instructions provided.

Who needs r1060 909 farm equipment?

01

Farmers and agricultural businesses: The r1060 909 farm equipment form is typically required by farmers and agricultural businesses who own or operate farm equipment. This may include individuals, partnerships, corporations, or other entities engaged in farming activities.

02

Tax authorities: The form is used by tax authorities to monitor and assess the ownership, value, and utilization of farm equipment for taxation purposes. It helps ensure compliance with tax regulations and accurately assess the tax liabilities of farmers and agricultural businesses.

03

Farm equipment owners: Individuals who own farm equipment and need to report the details and value of their equipment to fulfill their tax obligations may also require the r1060 909 form. It allows them to provide the necessary information to tax authorities in a standardized format.

Fill

form

: Try Risk Free

People Also Ask about

What is exempt from manufacturing sales tax in Louisiana?

To qualify for the Louisiana sales tax exemption for manufacturing, the manufacturer must have a Louisiana Workforce Commission assigned NAICS code of one of the following: 113310, 2211, 31-33, 3211-3222, 327213, 3361, 423930, or 511110.

What is the sales tax on a tractor in Louisiana?

The use tax amount is 4.45% and is remitted to the Department. The taxpayer must remit the use tax on Form R-1029, Sales Tax Return, on Line 2.

How do I get sales tax exemption in Louisiana?

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

How to apply for exemption from collection of Louisiana state sales tax?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

Is farm equipment tax-exempt in Louisiana?

Qualifying farm equipment subject to 0% state sales tax: Includes all attachments and implements that go on a rubber tired tractor. Clippers cultivators, discs, plow, and spreaders.

What is the sales tax on farm equipment in Louisiana?

Qualifying purchases will be subject to zero percent state sales tax. Louisiana Revised Statutes 47:301(3)(i), (13)(k), (28)(a), and 47:305.25 do not provide an exemption from sales tax on parts or labor used in the repair or modification of qualifying farm equipment.

How do I apply for tax exemption in Louisiana?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is r1060 909 farm equipment?

r1060 909 farm equipment is a form used to report information about farm equipment owned or used by a taxpayer.

Who is required to file r1060 909 farm equipment?

Individuals or businesses who own or use farm equipment are required to file r1060 909.

How to fill out r1060 909 farm equipment?

r1060 909 farm equipment can be filled out by providing details about the farm equipment owned or used, such as description, value, and usage.

What is the purpose of r1060 909 farm equipment?

The purpose of r1060 909 is to report accurate information about farm equipment for tax or regulatory compliance purposes.

What information must be reported on r1060 909 farm equipment?

Information such as description of equipment, value, usage, and ownership details must be reported on r1060 909.

How do I modify my r1060 909 farm equipment in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your r1060 909 farm equipment and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in r1060 909 farm equipment?

The editing procedure is simple with pdfFiller. Open your r1060 909 farm equipment in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out r1060 909 farm equipment on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your r1060 909 farm equipment. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your r1060 909 farm equipment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

r1060 909 Farm Equipment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.