Get the free Tax Preparer Surety Bond

Get, Create, Make and Sign tax preparer surety bond

Editing tax preparer surety bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax preparer surety bond

How to fill out tax preparer surety bond

Who needs tax preparer surety bond?

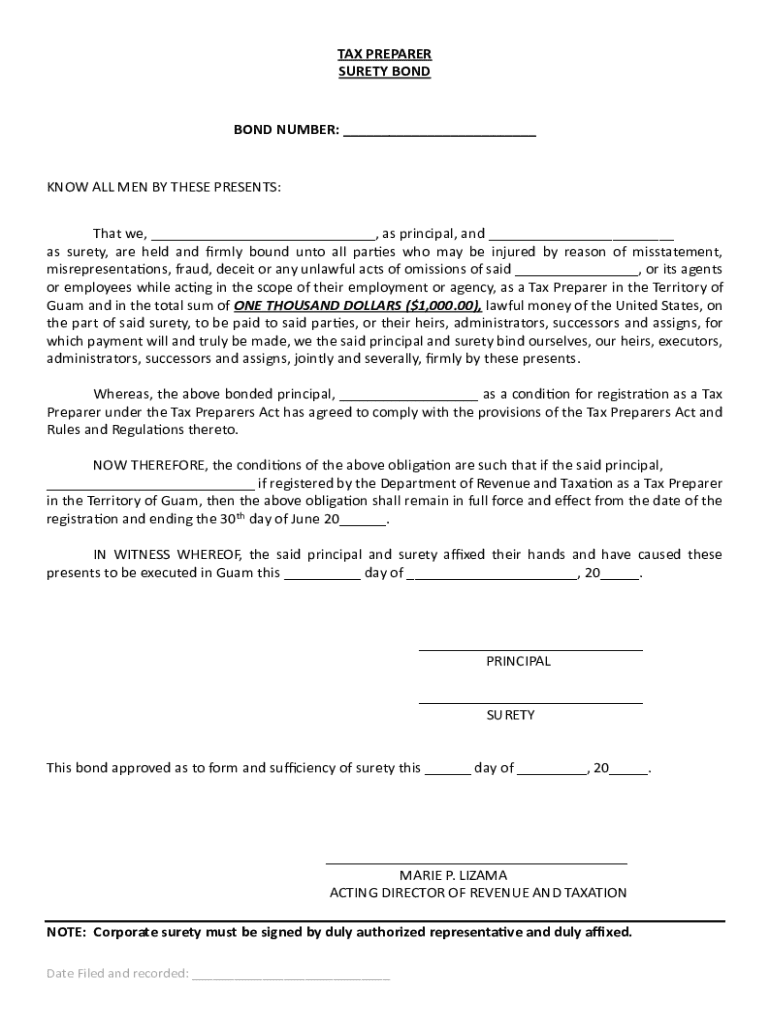

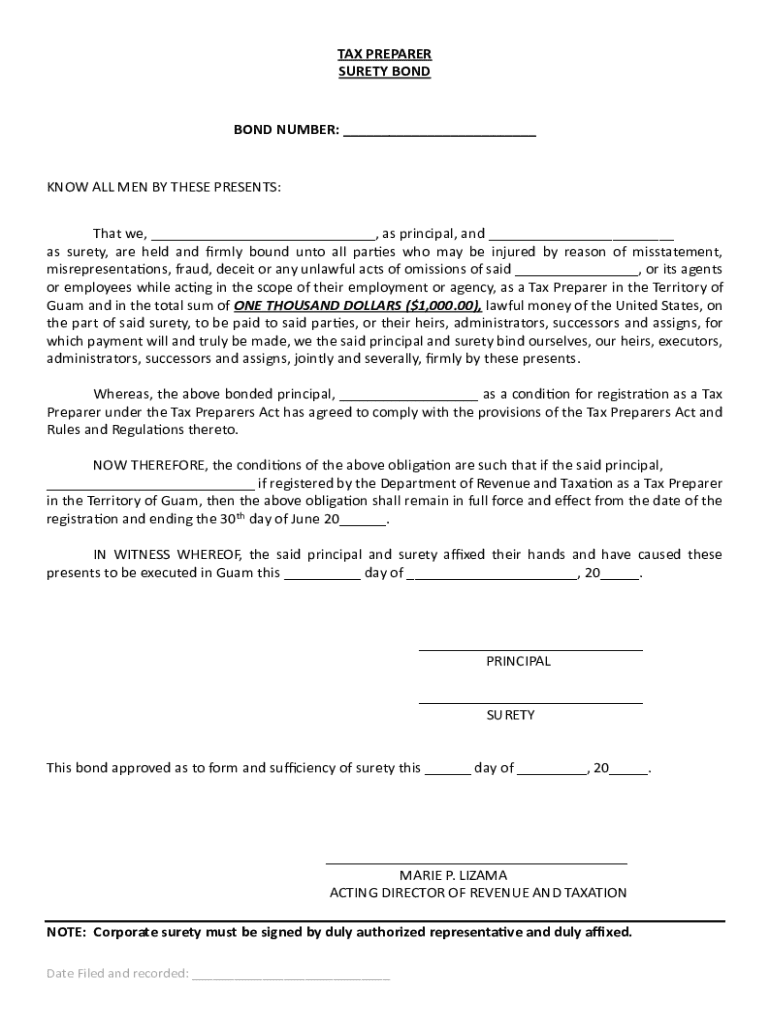

Understanding the Tax Preparer Surety Bond Form

Overview of tax preparer surety bonds

A tax preparer surety bond acts as a safeguard between clients and tax preparers, providing financial protection against potential misconduct. It ensures compliance with applicable state regulations, requiring tax preparers to possess a bond to operate legally. The bond serves as a guarantee that the tax preparer will maintain ethical standards and conduct their business in accordance with legal guidelines.

Importantly, this bond not only protects clients but also enhances the credibility of the tax preparer. Holding this bond instills trust and confidence in clients, proving that the preparer is backed by a guarantee that can address potential grievances. This bond is crucial as it can lead to more clients and better reputations within the industry.

Who needs a tax preparer surety bond?

The need for a tax preparer surety bond typically arises from state licensing requirements. Many states mandate that tax preparers acquire a surety bond as a prerequisite for obtaining a license. By ensuring these professionals are bonded, states aim to protect consumers and maintain industry standards.

Professionals including independent tax preparers, tax consultants, and those who handle tax returns for businesses often require this bond. Additionally, certain situations such as client disputes or claims of negligence can trigger the need for bond coverage, emphasizing the importance of being properly bonded in the industry.

Understanding the tax preparer surety bond form

The tax preparer surety bond form is a crucial document that outlines the terms and obligations associated with the bond. It acts as an official record of the bond, indicating who is covered under the bond and the liabilities involved. This form is necessary for both the bond issuer and the tax preparer to establish a transparent relationship regarding the bond's coverage.

To complete the form, specific information is required, including personal identification details, business structure, and financial background. Additionally, the form typically requires bonding information which outlines the bond amount, effective dates, and all relevant parties involved.

How much does a tax preparer surety bond cost?

The cost of obtaining a tax preparer surety bond can vary significantly based on several factors. The bond amount required by the state, the applicant's creditworthiness, and the specific legal requirements within a jurisdiction all contribute to determining the final price.

Typically, bonds can range from $1,000 to $25,000 depending on state mandates and applicant details. Most tax preparers can expect to pay a premium that generally falls between 1% to 15% of the bond value annually. It’s also essential to consider additional fees for processing, underwriting, and potential application costs, which can add to the overall expenditure.

Types of tax preparer surety bonds

Various types of tax preparer surety bonds exist, reflecting the differing legal requirements imposed by individual states. For instance, California, New York, Texas, and Nevada each have unique bond specifications that impact the required bond amount and coverage.

Some states have specific classifications for bonds based on the services provided, such as tax preparation, tax consulting, or electronic filing. Understanding which specific bond applies to your services is essential for compliance and safeguarding your practice.

Step-by-step guide to completing the tax preparer surety bond form

To successfully complete the tax preparer surety bond form, follow these structured steps to ensure accuracy and compliance with state requirements.

Instant bond issuance process

Once the tax preparer surety bond form is completed and submitted, the bond issuance process is initiated. In most cases, the processing time can be as short as a few hours to several days, depending on the bond company and the complexity of your application.

After approval, the bond will be issued, and you will receive a copy for your records. It’s important to file this bond with the relevant state agency as required and maintain a copy in your business records to ensure compliance.

Managing your tax preparer surety bond

Effective management of your tax preparer surety bond is vital to ensure ongoing compliance and business integrity. At the core of this management is the renewal process, which varies by state and typically occurs annually or biennially.

Be proactive in filing claims when necessary, understanding the specific circumstances that justify such actions. Keeping your details updated, including any changes in address, business structure, or contact information, is essential to maintain the validity of your bond.

State-specific requirements for tax preparer bonds

Each state establishes its regulations regarding tax preparer surety bonds, leading to a diverse landscape of requirements. For example, in California, tax preparers must obtain a bond amounting to $5,000, while Nevada may require a different threshold of $10,000.

Understanding these nuances is pivotal for compliance and requires tax preparers to conduct diligent research. It's advisable to consult with state-specific guidelines to identify unique considerations relevant to your service area.

Common questions about tax preparer surety bonds

Navigating the world of tax preparer surety bonds raises certain questions. For instance, if a tax preparer fails to obtain a bond, they may face severe penalties, including fines and loss of licensure, severely impacting their ability to operate.

Tax preparers may also seek to change their bond provider. This is entirely possible, provided they follow the appropriate process to cancel their current bond. Understanding cancellation policies is fundamental for ensuring no coverage gaps occur.

Advantages of using pdfFiller for your tax preparer bond needs

pdfFiller offers numerous advantages for tax preparers looking to manage their surety bond needs efficiently. As a powerful document management platform, pdfFiller ensures easy access to the tax preparer surety bond form without complicated procedures.

Features like easy editing, electronic signing, and collaborative tools empower users to complete, sign, and manage documents seamlessly. With secure data storage and compliance assurance, pdfFiller stands out as a reliable choice for busy tax preparers.

Client testimonials and case studies

Numerous tax preparers have benefited from utilizing pdfFiller’s efficient document management system. Many have reported significant time savings through streamlined processes, which have positively impacted their business operations.

Clients have shared success stories illustrating how pdfFiller’s tools have enhanced their ability to handle clients’ needs swiftly while ensuring compliance. These testimonials underscore the platform's effectiveness and its contribution to improving overall client satisfaction.

Additional services offered by pdfFiller

Beyond the tax preparer surety bond form, pdfFiller provides a comprehensive suite of related forms and templates designed for tax preparers. These resources aid in compliance, facilitate task completion, and offer guidance throughout the tax preparation process.

Additionally, pdfFiller hosts expert consultation services to guide tax preparers through compliance intricacies, ensuring they remain up-to-date in the ever-changing landscape of tax regulations. This bolstered support is invaluable for maintaining best practices.

Getting started with your tax preparer surety bond on pdfFiller

Getting started with your tax preparer surety bond on pdfFiller is straightforward. New users can follow a quick start guide available on the website, which walks them through the document preparation process. The platform features interactive tools that simplify the completion of necessary forms.

In addition, pdfFiller offers abundant support resources, including FAQs and direct assistance options, ensuring users can resolve any issues as they arise. With these tools available, tax preparers can focus more on service and less on paperwork.

Contact information for support and inquiries

pdfFiller is dedicated to offering excellent support for users with questions or concerns regarding tax preparer surety bonds. Users can reach out via multiple dedicated customer support channels, ensuring their inquiries are handled quickly and effectively.

Additionally, the website features a comprehensive section of frequently asked questions to aid users in finding the information they need. This commitment to user satisfaction allows tax preparers to manage their documentation needs with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax preparer surety bond without leaving Google Drive?

Where do I find tax preparer surety bond?

How do I edit tax preparer surety bond online?

What is tax preparer surety bond?

Who is required to file tax preparer surety bond?

How to fill out tax preparer surety bond?

What is the purpose of tax preparer surety bond?

What information must be reported on tax preparer surety bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.