Get the free Returns Form

Get, Create, Make and Sign returns form

Editing returns form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out returns form

How to fill out returns form

Who needs returns form?

The Complete Guide to Returns Forms

Understanding the returns process

A returns form is a critical document utilized to facilitate the return of products by customers to businesses. By defining the specific reasons for the return, listing the items involved, and outlining the preferred course of action—be it a refund, exchange, or repair—the returns form serves as a formal request that initiates the returns process. Its significance extends beyond mere paperwork; it acts as a bridge between customers and businesses, ensuring a seamless and organized method for processing returns.

For customers, a returns form helps to articulate their intentions clearly, supporting their rights and ensuring that their requests are acknowledged and processed efficiently. Conversely, for businesses, this form assists in maintaining accurate inventory levels, stops losses due to mishandled returns, and enhances overall customer satisfaction.

Why use a returns form?

The utilization of a returns form streamlines the return procedure, making it easier for both parties to manage expectations and outcomes. By having a structured format to follow, customers can expedite their return process. This not only saves time but also helps reduce confusion, ultimately leading to fewer disputes over returns.

Moreover, accurate data gathered from returns forms ensures that returns are processed without unnecessary delays. For customers, this accuracy means quicker refunds or replacements, while businesses benefit from statistical insights that can reveal product issues or trends.

In the competitive landscape of retail, maintaining customer satisfaction is paramount. A well-handled return process, enabled by an effective returns form, can be a crucial differentiator that fosters loyalty and repeat business.

When to use a returns form

Returns forms are typically utilized in several common scenarios. The most frequent reasons people fill them out include receiving damaged items, incorrect orders, or simply changing their mind after a purchase. In each case, having a standardized form allows customers to clearly specify their grievances and make their requests unmistakable.

Before filling out a returns form, customers should consider the details outlined in the business's return policy. Factors like timeframes for returns—often ranging from 14 to 30 days—should not be overlooked, as they may affect eligibility. Additionally, understanding the required condition of the product upon its return (e.g., unopened, tags intact) is crucial in ensuring a smooth process.

Step-by-step guide to completing your returns form

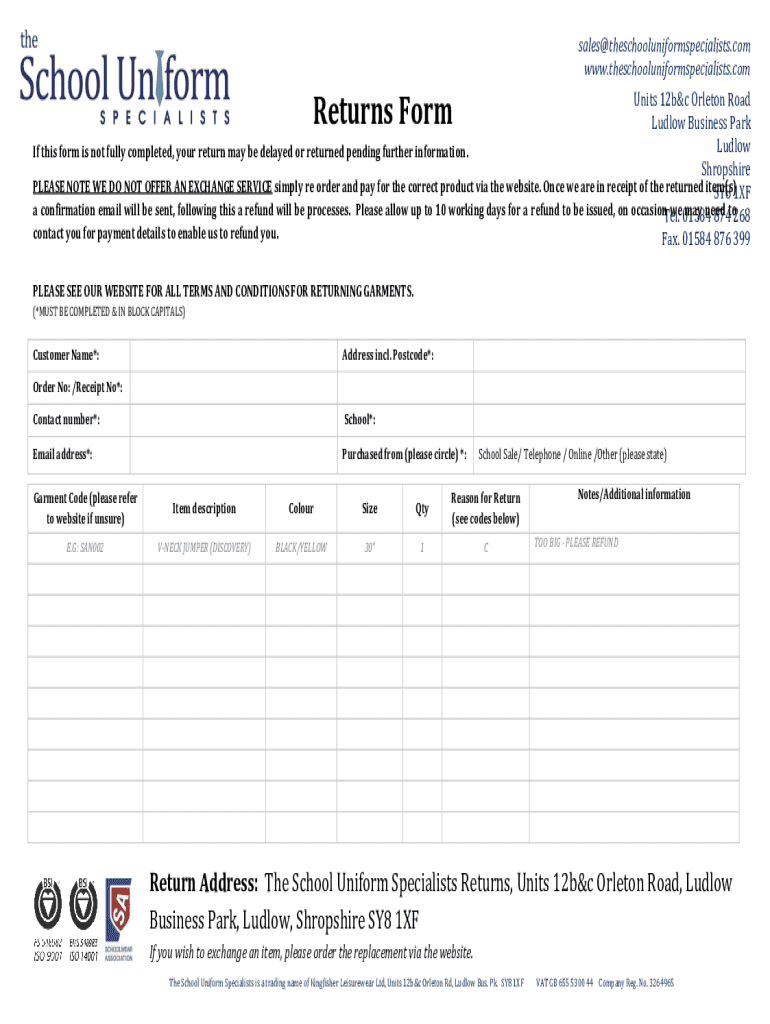

To effectively complete a returns form, start by gathering all necessary information. This typically includes details such as your order number, the date of purchase, and your customer information like name, address, and contact numbers. Ensuring you have all this information handy will expedite the process and reduce errors.

Next, begin filling out the returns form. Offer detailed responses for each section: describe the item, state the reason for the return, and select your preferred resolution—be it a refund or an exchange. Whether you are handwriting your answers or using a digital platform, clarity is key. For digital forms, consider using straightforward language; for handwritten entries, ensure that your writing is legible.

Once the form is completed, review your information for any inaccuracies. Double-checking your details enhances clear communication with the business and minimizes the likelihood of processing delays.

Finally, submit your returns form. Depending on the retailer, submissions can be made through various methods, such as online platforms, email, or traditional mail. After submission, keep track of your return status by saving all documentation associated with the return.

Additional considerations for returns

When dealing with multi-item returns, it is advisable to include all items on a single returns form for simplicity. This helps consolidate the return and keeps processing straightforward. If the items are from different orders, check the specific return policies of the retailer to determine how best to group the forms.

However, issues may arise during the returns process. Common mistakes include failure to fill in all required fields or submitting the form beyond the specified return window. If discrepancies occur after submission, promptly reach out to customer service to resolve issues. Keeping track of your return is paramount; always save copies of return shipping receipts and documents related to the return for reference.

The role of technology in returns management

Digital returns forms are transforming the returns management landscape. Offering accessibility from various locations, these forms are user-friendly and cater to a wider audience, allowing for easy interaction. Businesses can leverage technology to include interactive tools that guide customers through the returns process, adapting to their individual needs.

One powerful solution in this domain is pdfFiller, which enhances the returns process by providing a cloud-based platform for document management. With features such as easy editing, electronic signatures, and even team collaboration options, pdfFiller simplifies the process of filling out, editing, and tracking returns forms.

FAQs regarding returns forms

An important question that often arises is what to do if your returns form is lost. If this happens, it's recommended to contact the customer service of the retailer promptly. They can either resend the form or provide instructions on how to proceed.

Another frequently asked question is whether you can modify a returns form after it has been submitted. While potential adjustments may be limited, it is essential to reach out to customer service to discuss any necessary changes.

Lastly, some businesses may charge a fee for processing returns. It’s prudent to review the specific return policies of each business before submitting your returns form to avoid unexpected charges.

Real customer experiences

Analyzing success stories gives valuable insight into how effective returns management can improve customer experiences. Companies that have implemented streamlined returns processes, highlighted by user-friendly returns forms, often see a boost in customer loyalty. For instance, businesses utilizing pdfFiller for their returns documentation noted a significant reduction in processing times, enhancing overall customer satisfaction.

Customer testimonials reveal a strong positive sentiment towards utilizing digital returns forms. Users often emphasize the convenience and efficiency of being able to manage returns from any location, reaping the benefits of comprehensive monitoring and supports provided by pdfFiller's tools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify returns form without leaving Google Drive?

How do I fill out the returns form form on my smartphone?

How do I edit returns form on an Android device?

What is returns form?

Who is required to file returns form?

How to fill out returns form?

What is the purpose of returns form?

What information must be reported on returns form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.