Get the free Cash Handling Policy Appointment Form

Get, Create, Make and Sign cash handling policy appointment

Editing cash handling policy appointment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash handling policy appointment

How to fill out cash handling policy appointment

Who needs cash handling policy appointment?

Understanding the Cash Handling Policy Appointment Form

Overview of cash handling policies

Cash handling policies are a defined set of guidelines and procedures designed to ensure the secure and effective management of cash within an organization. These policies are crucial as they provide a framework that helps mitigate the risk of loss, theft, or mishandling of cash. Organizations that implement effective cash management strategies can not only streamline their financial operations but also uphold their reputation by maintaining trust with stakeholders. Moreover, legal implications and compliance requirements necessitate that organizations adhere to specific cash handling standards, making these policies essential for operational integrity.

In a world where financial accountability is paramount, cash handling policies serve to protect both the organization and its employees. Compliance with local and federal regulations, including tax obligations and anti-fraud measures, can also be directly influenced by the robustness of these policies. Therefore, an effective cash management strategy is not just a regulatory requirement; it is a business imperative.

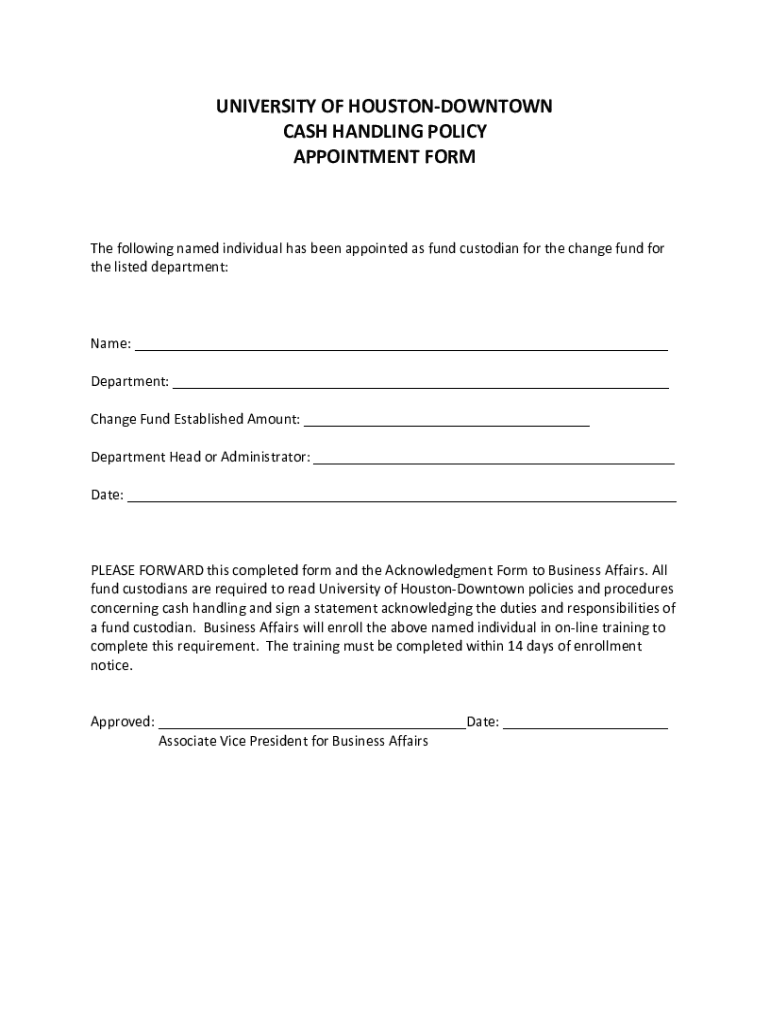

Understanding the cash handling policy appointment form

The cash handling policy appointment form is a critical document that organizations use to formally appoint individuals or teams responsible for managing cash-related tasks. Its primary purpose is to establish accountability and ensure that the appointed personnel are aware of their responsibilities under the organization's cash handling policies. This form is essential not only for internal record-keeping but also for fostering a culture of transparency and compliance.

Key features of the form typically include sections for personal information (name, address, contact details), appointment details (date, purpose), and specific cash handling responsibilities. This ensures that there is a clear documentation trail of all cash handling appointments. Those who should utilize this form include individuals assuming cash handling roles, teams responsible for managing cash, and organizations that require structured documentation of cash handling authority.

Benefits of using the cash handling policy appointment form

Utilizing the cash handling policy appointment form brings multiple benefits. First and foremost, it streamlines the cash management process, allowing organizations to efficiently designate responsible individuals or teams based on their competencies. By clarifying roles, the form minimizes the potential for misunderstandings and helps ensure that cash handling adheres strictly to established procedures.

Secondly, it enhances accountability and transparency; when individuals sign the form, they acknowledge their responsibility, creating a personal commitment to adhere to the organization's cash handling policies. Furthermore, compliance with necessary regulations is improved, as the form serves as a procedural safeguard. Establishing clear documentation through the appointment form can significantly reduce the risk of financial discrepancies, a common challenge in cash flow management.

Step-by-step instructions for filling out the form

Filling out the cash handling policy appointment form requires attention to detail to ensure accuracy and completeness. The first section typically involves personal information, where individuals should provide their name, contact information, and department. This foundational data establishes who is being appointed and sets the context for the appointment.

The second section focuses on appointment details, allowing the individual to select the date and time for their appointment, along with a description of the purpose behind the appointment. It is essential to be precise about the purpose to avoid any ambiguity.

The third section entails cash handling responsibilities where the individual must outline their specific duties and tasks. It is important here to be detailed and specific to ensure clarity regarding expectations.

Lastly, the acknowledgment and signature section is crucial. This not only confirms that the person accepting the appointment understands their responsibilities but also highlights the importance of maintaining adherence to the cash handling policies of the organization.

Editing and managing your cash handling policy appointment form

Editing the cash handling policy appointment form can be simplified with digital tools such as those offered by pdfFiller. The platform allows users to modify text, adjust fields, and insert additional information as needed, ensuring that forms are always up to date with current information. The intuitive editing tools enable users to make changes quickly and easily, whether they are adjusting their contact information or updating responsibilities.

Once the form is completed, pdfFiller provides options to save and share the document securely. Users can download the form in various formats or share it directly via email. With the cloud-based features available, users can also access their forms anytime and anywhere, making it convenient for ongoing management and updates, particularly in dynamic organizational environments where changes can occur rapidly.

Collaboration features for teams

Collaboration is a vital aspect of effectively managing cash handling policies within teams. pdfFiller offers features that allow team members to collaborate on the cash handling policy appointment form in real-time. This includes inviting other team members to review the form, making it easier to gather feedback and ensure that all relevant parties are aligned with any updates or changes.

Tracking changes and comments in real-time enhances team dynamics as it allows team members to see who made specific modifications and when. This transparency fosters a culture of accountability and encourages best practices for collaborative completion. Combining collaborative tools with a well-structured form ensures that cash handling processes are not only efficient but also involve the expertise and insights of the entire team.

Troubleshooting common issues

While filling out the cash handling policy appointment form, users may encounter some common issues. A frequent concern relates to form access and permissions. Ensuring that you have the right level of access is crucial for editing and submitting forms. If you find that your access is restricted, verify with your organizational administrator regarding permissions.

Technical issues may also arise, particularly if there are browser compatibility problems or connectivity issues. If you encounter difficulties while filling out the form, a good first step is to refresh your browser or switch to a different one to see if that resolves the issue. For persistent problems, contacting support is recommended to get specialized assistance without delay.

Best practices for cash handling

Implementing robust cash handling policies necessitates adherence to best practices that promote safe cash management. Regular audits and reviews are intrinsic components of a sound cash management strategy. Conducting periodic evaluations ensures compliance with established procedures and helps to identify any areas for improvement. In addition, it's vital to keep employees informed and trained on cash handling procedures, including fraud prevention techniques, to cultivate a security-conscious workplace.

Guidelines for safe cash management can include establishing clear roles and responsibilities, maintaining accurate cash logs, and ensuring secure storage of cash. Providing employees with resources and training sessions can also foster continuous improvement in cash handling practices. By establishing a culture focused on vigilant cash management, organizations can effectively mitigate risks associated with cash handling operations.

Additional forms and templates related to cash handling

In addition to the cash handling policy appointment form, there are several complementary forms and templates available on pdfFiller that organizations may find useful. These can include cash deposit slips, expense reimbursement forms, and cash management checklists. Having a suite of forms readily available can minimize redundancy and ensure that staff can smoothly transition between different procedures as necessary.

Utilizing related policies and procedures found within pdfFiller can enhance overall cash management practices and ensure that all documentation aligns with the organizational framework. Easy navigation between forms aids significantly in optimizing workflows and maintaining comprehensive records.

Frequently asked questions (FAQs)

To assist users with their queries regarding the cash handling policy appointment form, a section addressing frequently asked questions can be very helpful. Common queries may revolve around the specific responsibilities outlined within the form, the approval workflow following submission, and how to ensure compliance with cash handling policies.

Providing clarifications on procedures and responsibilities is vital for ensuring that all parties involved understand their roles clearly. Offering quick and comprehensive answers within this section can significantly reduce confusion and enhance adherence to effective cash management practices.

Conclusion and next steps

Implementing a robust cash handling policy appointment form is crucial for effective cash management within any organization. This form not only formalizes appointments but also enhances accountability and compliance with financial regulations. Organizations are urged to leverage digital tools such as those provided by pdfFiller to streamline the document management process, ensuring that all paperwork is accurately completed, edited, and stored.

As the next step, consider reviewing existing cash handling policies and examining your current forms. Explore how pdfFiller can empower your team to manage cash handling documentation more efficiently, enabling a seamless and secure cash management process.

Contact information for further assistance

For more assistance with the cash handling policy appointment form or other related queries, you can reach out to pdfFiller support directly. They offer a dedicated team ready to help users navigate any challenges they might face with the platform. Furthermore, consult with your organization's financial compliance teams or advisors to ensure adherence to regulations and best practices tailored to your specific industry requirements.

Engaging with the proper channels for support not only enhances user experience but also reinforces the importance of effective cash handling within your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit cash handling policy appointment in Chrome?

Can I create an eSignature for the cash handling policy appointment in Gmail?

How do I fill out cash handling policy appointment on an Android device?

What is cash handling policy appointment?

Who is required to file cash handling policy appointment?

How to fill out cash handling policy appointment?

What is the purpose of cash handling policy appointment?

What information must be reported on cash handling policy appointment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.