Get the free Business Loan Application

Get, Create, Make and Sign business loan application

Editing business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form - How-to Guide

Understanding the business loan application process

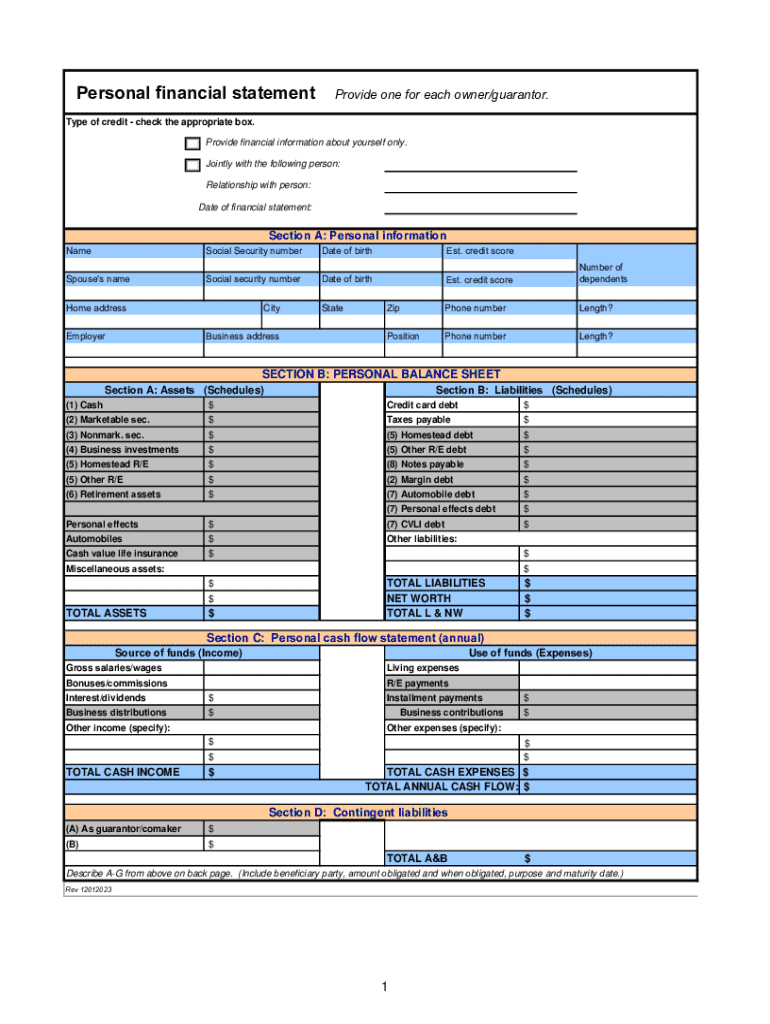

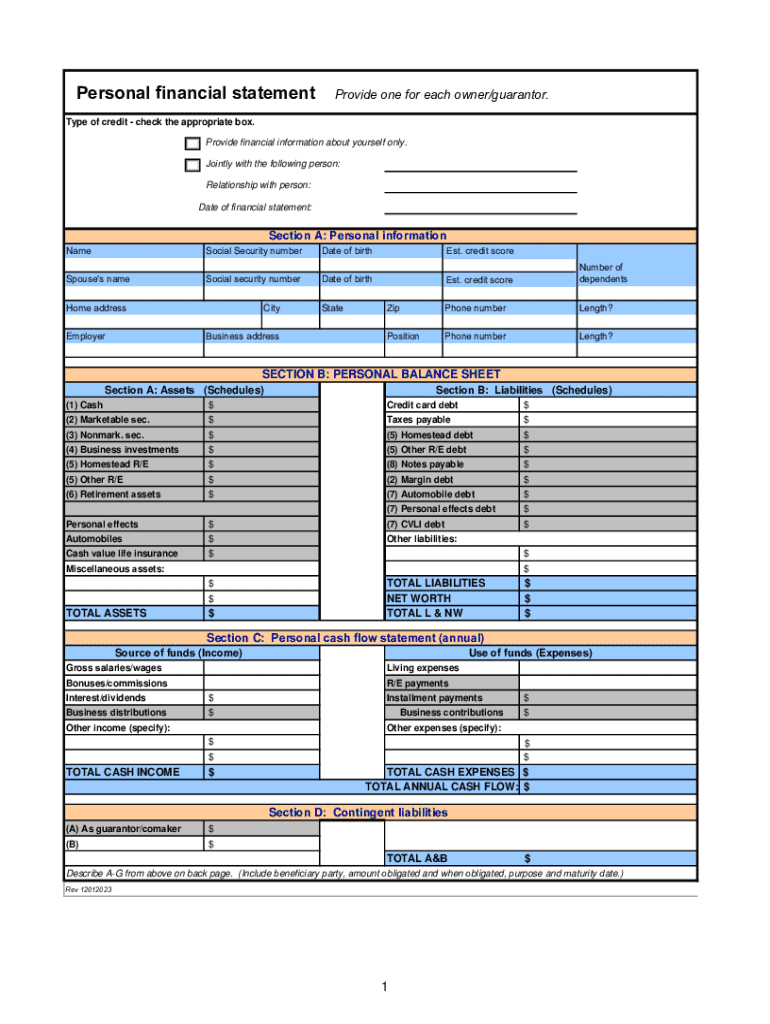

Applying for a business loan involves several steps, with the application form being a critical component. A business loan provides capital to entrepreneurs to start, operate, or expand their ventures. Understanding the necessity of the application form and its structure will aid in streamlining your borrowing process.

Why a business loan application form is essential

The business loan application form is not just a formality; it is crucial for several reasons. First, it provides lenders with essential information needed to evaluate your business’s financial health and its capacity to repay the loan. Secondly, a well-drafted application can significantly influence your chances of approval. Clear articulation of your business's value proposition and financial metrics can lead to more favorable terms.

The importance of a formal application cannot be overstated, as lenders use this document to assess risk, verify details, and make informed decisions about your financial future.

Key components of a business loan application form

A comprehensive business loan application form comprises several important sections that capture personal, business, and financial information.

Preparing to fill out the application

Before undertaking the application, preparation is key. Gathering essential documents will save time and enhance the quality of your application. Maintaining organized records will not only facilitate the application process but also foster accurate reporting.

Be mindful of common mistakes such as entry errors, missing documentation, or misrepresentation of financials, which can hinder approval chances.

Step-by-step guide to filling out the business loan application form

Following a structured approach will simplify your application process. Each section serves a specific purpose and must be completed with care.

Editing and formatting the application

Once the application is filled, focus on editing and formatting to enhance clarity and professionalism. pdfFiller provides excellent tools to help format your documents seamlessly.

eSigning and submitting your application

Electronic signatures are valid and convenient methods for signing documents today. Understanding what constitutes a legal eSignature can streamline the submission process.

Follow-up after submission

After submitting your application, it’s important to know what happens next. Generally, lenders will review your application thoroughly.

Troubleshooting common issues

Challenges such as application rejections or processing delays can occur. Understanding these issues helps in strategizing your next steps.

Case studies: Successful business loan applications

Real-world examples illustrate that successful applications often feature a clear narrative complemented by solid financial documentation. These scenarios show diverse strategies yielding positive outcomes.

Key takeaways from these applications can serve as a roadmap for your own process, underscoring the need for preparation and clarity.

Additional tools and resources

Accessing tools for ongoing document management post-application ensures your financial records stay organized. pdfFiller supports users through various features designed for efficient document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my business loan application directly from Gmail?

How can I edit business loan application from Google Drive?

How do I make edits in business loan application without leaving Chrome?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.