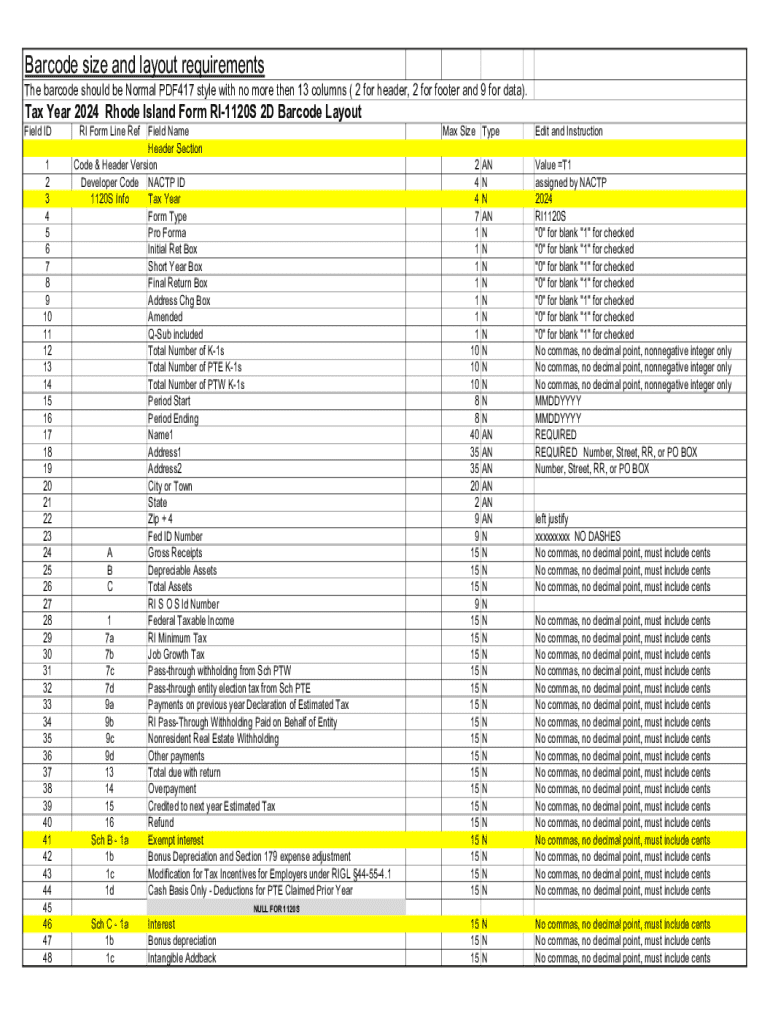

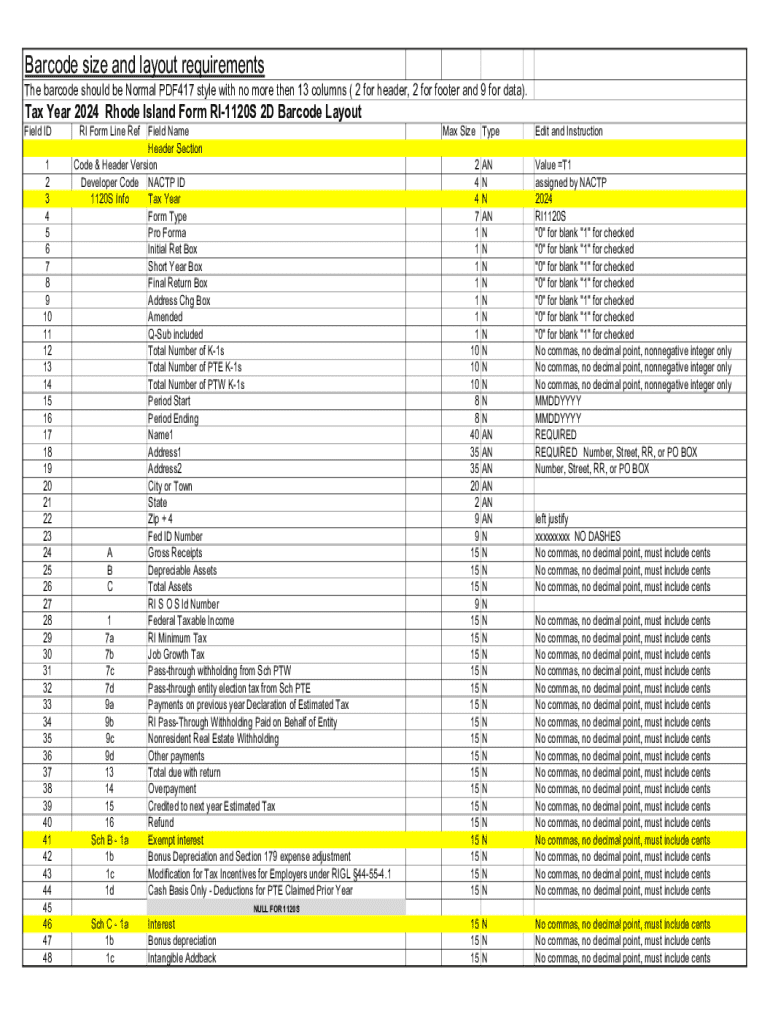

Get the free Tax Year 2024 Rhode Island Form Ri-1120s 2d Barcode Layout - tax ri

Get, Create, Make and Sign tax year 2024 rhode

How to edit tax year 2024 rhode online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax year 2024 rhode

How to fill out tax year 2024 rhode

Who needs tax year 2024 rhode?

Tax Year 2024 Rhode Form: Your Complete Guide

Overview of tax year 2024 in Rhode Island

For the tax year 2024, Rhode Island residents can expect several changes that may affect how they file their taxes. Understanding these changes is essential for effective tax planning and compliance. Key features of Rhode Island tax forms for 2024 may include updates to personal income tax rates, new credits, and adjustments to deductions that could influence overall tax liability.

Types of Rhode Island tax forms for 2024

In Rhode Island, taxpayers will primarily encounter two types of tax forms: personal income tax forms and business tax forms. Each category serves different taxpayer needs, and understanding the specifics can help you choose the right form and ensure compliance.

Personal income tax forms

The personal income tax forms for 2024 include the Rhode Island resident and non-resident tax returns. Each form is designed to accommodate different income sources and filing statuses. Key personal income tax rates for Rhode Island will reflect the state’s progressive tax system, which means higher earners will pay a larger percentage of their income in taxes.

Business tax forms

For business entities, Rhode Island offers several tax forms that differ based on the type of business and its organizational structure. Understanding your tax responsibilities as a business owner is crucial for compliance and to leverage available deductions.

Filling out your Rhode Island tax form for 2024

Completing your Rhode Island tax form can feel overwhelming, but with a structured approach, it can be manageable. Here’s a step-by-step guide to help you through the process.

Interactive tools for managing your tax forms

Utilizing online tools such as pdfFiller can significantly streamline the process of managing your tax documents. With features specifically designed for tax preparation, pdfFiller allows users to edit, eSign, and collaborate on forms seamlessly from any location.

Utilizing pdfFiller’s tools for seamless tax form management

The platform offers functionalities that can profoundly enhance the filing experience.

Collaboration features: working with tax professionals

PdfFiller's collaboration features facilitate easy sharing of your tax forms with accountants or tax professionals for review and feedback, ensuring that no crucial information is overlooked.

Deadlines and important dates for 2024

To avoid late fees or penalties, Rhode Island taxpayers must be aware of critical deadlines related to tax filing and payment. Marking these dates on your calendar can save you from unnecessary stress.

Special considerations for Rhode Island taxpayers

Tax planning is vital for achieving financial goals and ensuring compliance for the tax year 2024. Taxpayers should consider strategies that optimize their situation.

Tax planning strategies for the 2024 tax year

Health Savings Accounts (HSAs) can be an excellent resource for mitigating tax liabilities while saving for medical expenses. Additionally, proactive retirement contributions can significantly affect your taxable income.

Understanding Rhode Island tax relief programs

Several tax relief programs are available for low-income residents, which can provide financial assistance and reduce tax burdens. Researching these programs is crucial for eligible taxpayers.

Troubleshooting common issues

Even with the best preparation, errors can happen during tax filing. Recognizing common pitfalls can save you time and prevent complications.

Tax resources and support in Rhode Island

Tax season can be daunting, but Rhode Islanders have access to a wealth of resources to help guide them through the process.

Preparing for the next tax year

As the tax year 2024 concludes, it’s essential to start preparing for tax year 2025. Good organizational habits can aid in this transition.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax year 2024 rhode?

How do I complete tax year 2024 rhode online?

How do I edit tax year 2024 rhode online?

What is tax year 2024 rhode?

Who is required to file tax year 2024 rhode?

How to fill out tax year 2024 rhode?

What is the purpose of tax year 2024 rhode?

What information must be reported on tax year 2024 rhode?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.