Get the free Annual Obligations Report

Get, Create, Make and Sign annual obligations report

How to edit annual obligations report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual obligations report

How to fill out annual obligations report

Who needs annual obligations report?

Understanding the Annual Obligations Report Form

Understanding annual obligations

Every year, businesses and organizations face the critical task of reporting specific obligations to ensure compliance with regulatory frameworks. Annual obligations involve various duties that encompass financial reporting, tax submissions, and adherence to industry standards. Fulfilling these obligations is vital as it not only reflects the health of an organization but also impacts the trust of stakeholders, clients, and the public.

Typically, the annual obligations report form includes several essential documents, such as financial statements, tax returns, and compliance certifications. Understanding what documents you need to compile can set the stage for an efficient reporting process. However, many individuals misinterpret annual obligations as a mere formality, overlooking that they play a significant role in resource allocation, strategic planning, and operational transparency.

Key components of the annual obligations report form

The annual obligations report form serves as a vehicle for organizations to convey vital information regarding their operations and financial status over a defined reporting period. This form aids in maintaining transparency with regulatory authorities, stakeholders, and the general public. Familiarizing oneself with its essential components can significantly enhance the filing experience.

The report typically includes several key sections. The personal information section captures fundamental details about the entity, such as its name, address, and contact information. The reporting year and period section specifies the timeframe of the report, which is crucial for clarity and accuracy. Financial information requirements are especially important as they dictate the nature and extent of the financial disclosures that must be provided.

Who is required to submit an annual report?

Understanding who must submit the annual obligations report is crucial for compliance. Generally, all businesses and organizations that meet specific criteria, such as revenue thresholds or employee counts, are obligated to file this report. This includes corporations, partnerships, sole proprietorships, and non-profit entities.

Small businesses and non-profits often have unique considerations when approaching annual reporting. Many jurisdictions provide relief measures or simplified reporting options tailored to reduce the burden on smaller entities. For instance, simplified forms or fewer documentation requirements can apply, rendering compliance more accessible and manageable.

Important deadlines for submission

Each reporting entity must adhere to specific deadlines for submitting their annual obligations report. These deadlines often vary by jurisdiction and can depend on the entity type or financial year-end. Missing these deadlines can lead to serious complications, including penalties, increased scrutiny from regulators, and potential harm to an organization's standing.

Late submissions attract penalties that range from monetary fines to restrictions on business operations. In some cases, an entity may face an automatic extension, but this typically requires prior communication with the relevant authority. Staying organized and well-informed on deadlines is essential; utilize calendar alerts, set reminders, and maintain an organized filing system to aid in timely submissions.

Step-by-step instructions for completing the annual obligations report form

Completing the annual obligations report form requires careful preparation and attention to detail. Start by gathering all necessary documentation and data well ahead of the submission deadline. Essential financial records may include income statements, balance sheets, tax filings, and supporting documents such as bank statements or invoices.

When filling out the form, it’s vital to do so accurately. A line-by-line approach could involve tracing each entry back to financial documents to ensure accuracy. Common errors include miscalculating figures and omitting required sections. After completing the report, reviewing and verifying all information is crucial to avoid mistakes that could lead to penalties or queries from regulatory bodies.

Submitting the annual obligations report form

Once completed, submitting the annual obligations report form properly is essential for compliance. Submission methods can vary, including electronic submission options and paper submission processes. Electronic uploads are generally recommended due to ease of tracking and quicker processing times. Always follow the specific submission guidelines provided by the relevant authority to ensure that your report is accepted without issue.

To avoid problems during submission, it’s beneficial to recheck submission guidelines before finalizing the upload or mailing the report. If you encounter issues, take proactive measures to address them immediately. Contacting technical support or the regulatory office can help clarify submission errors or challenges.

Post-submission steps

After submitting the annual obligations report form, it’s vital to track the status of your submission. Many jurisdictions provide online portals where you can check the progress of your report. Being proactive allows you to respond swiftly to any follow-up queries or issues that may arise.

Keeping copies of all submitted reports is crucial for future reference. This documentation serves not only as proof of compliance but is also useful for preparing for future reporting periods or if disputes arise. Make sure to store these records in an organized manner for efficient retrieval.

Understanding penalties for non-compliance

Non-compliance with submission requirements can result in significant penalties. These can manifest as late fees, fines, and even operational restrictions. In some jurisdictions, repeated non-compliance can lead to heightened scrutiny and audits, which can further complicate a business's operations.

However, organizations can often appeal penalties if they can provide valid justifications for late submissions or inaccuracies. Having a structured process for addressing discrepancies can mitigate risks and streamline compliance efforts going forward. Understanding the rules not only prevents penalties but also fosters better organizational practices.

Resources for assistance

Utilizing the right tools can greatly streamline the process of managing your annual obligations report. pdfFiller offers interactive tools that simplify document management. Its features facilitate the easy filling out, editing, signing, and sharing of documents directly from the cloud.

For individuals or teams seeking guidance, pdfFiller provides access to a robust customer support system, which can assist with any questions during the filling process. Additionally, an array of educational resources including webinars and tutorials can enhance understanding of compliance obligations, ultimately aiding in successful reporting.

Frequently asked questions

Addressing frequently asked questions related to the annual obligations report form can demystify the reporting process. Many individuals inquire about specific details such as acceptable forms of financial documentation, how to amend errors post-submission, and what to include if a business has had no activity during the reporting period.

Extra resources often include troubleshooting tips for common issues faced during the completion of the report. Ensuring clarity on terminology used within the report is also essential to avoid misunderstandings and ensure accurate reporting.

Related forms and documents

Organizations often encounter various forms throughout their annual reporting process. Familiarity with related documents aids in a smooth reporting experience. Highlighting forms that may relate to the annual obligations, such as tax return forms, compliance certifications, or updated operational registrations, can enhance the filing process.

Being aware of the different reporting forms based on entity types, such as for small businesses versus large corporations, can also help clarify specific obligations. Each document serves a unique purpose in compliance and should be understood in the context of overall reporting.

Staying informed on annual reporting changes

Regular updates to annual reporting obligations are common and applying these changes is necessary for compliance. Ensuring you are informed about recent updates or changes in regulations helps avoid penalties and ensures adherence to best practices. Many regulatory bodies provide newsletters, updates via email, and public notices regarding these shifts.

Continuous education regarding compliance is paramount; understanding evolving obligations promotes better organizational management. Subscribing to notifications from relevant authorities can also keep you ahead of changes in reporting requirements, allowing sufficient time to adapt procedures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my annual obligations report in Gmail?

Can I sign the annual obligations report electronically in Chrome?

Can I create an electronic signature for signing my annual obligations report in Gmail?

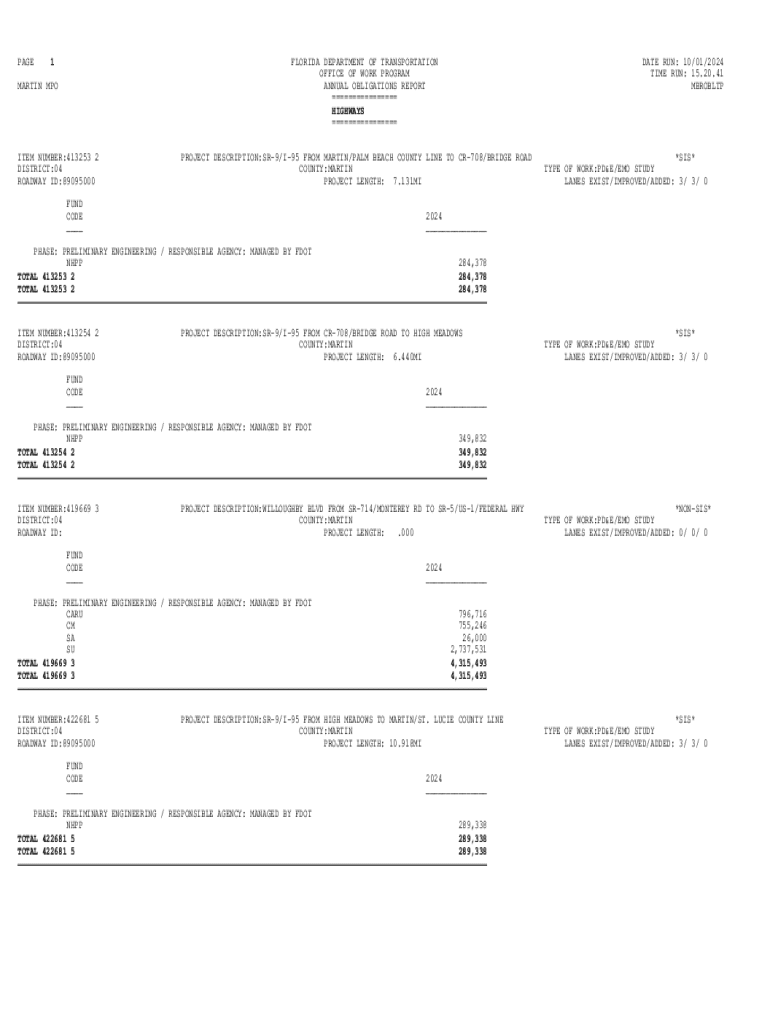

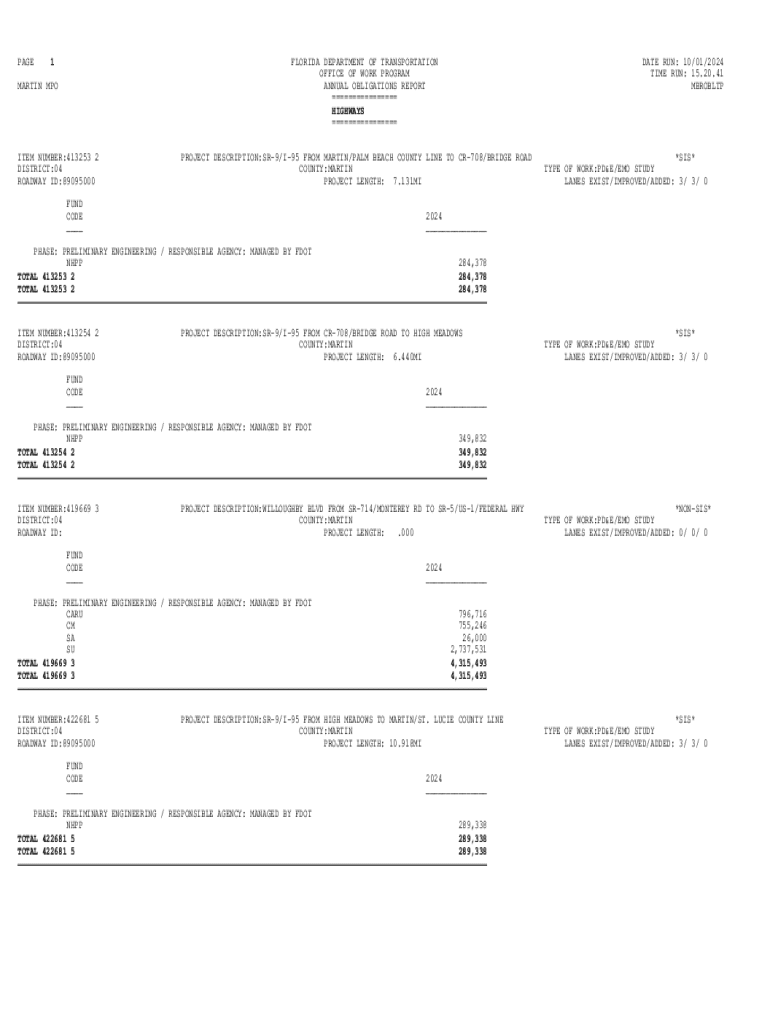

What is annual obligations report?

Who is required to file annual obligations report?

How to fill out annual obligations report?

What is the purpose of annual obligations report?

What information must be reported on annual obligations report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.