Employee Representation Regarding Use of Company Vehicle 2011 free printable template

Show details

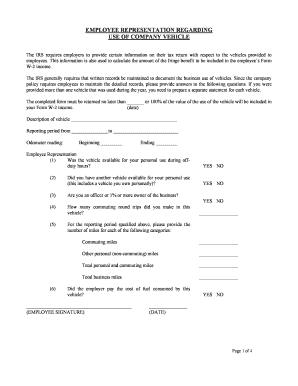

(ALL EMPLOYEES TO COMPLETE THIS FORM) EMPLOYEE REPRESENTATION REGARDING USE OF COMPANY VEHICLE The IRS requires employers to provide certain information on their tax return with respect to the vehicles

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Employee Representation Regarding Use of Company Vehicle

Edit your Employee Representation Regarding Use of Company Vehicle form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Employee Representation Regarding Use of Company Vehicle form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Employee Representation Regarding Use of Company Vehicle online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Employee Representation Regarding Use of Company Vehicle. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Employee Representation Regarding Use of Company Vehicle Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Employee Representation Regarding Use of Company Vehicle

How to fill out Employee Representation Regarding Use of Company Vehicle

01

Start by obtaining the Employee Representation form from the HR department or company intranet.

02

Fill in your personal information including your name, employee ID, and department.

03

Provide details about the vehicle you are requesting representation for, including make, model, and license plate number.

04

Indicate the purpose of using the company vehicle, including dates and times.

05

Read and adhere to the company's policies regarding vehicle usage.

06

Provide any additional information required pertinent to the vehicle usage.

07

Sign and date the form to confirm your agreement to follow the company's rules.

08

Submit the completed form to your supervisor or HR for approval.

Who needs Employee Representation Regarding Use of Company Vehicle?

01

Employees who are authorized to use company vehicles.

02

Employees who need clarification on the policies governing vehicle usage.

03

Employees seeking representation in case of an incident while using a company vehicle.

Fill

form

: Try Risk Free

People Also Ask about

What is the best option for a company car?

Our pick of the top company cars with low tax are: BMW 3 Series (BMW 330e) Volkswagen ID. Tesla Model 3. Skoda Superb iV. Volvo XC40 (T5 Recharge) Kia e-Niro. Range Rover Evoque (P300e PHEV) Mercedes A-Class (A250e)

Who pays when employee gets a speeding ticket in a company car UK?

“With that said, the general rule is if the ticket is against the company vehicle, the employer will usually have to pay the ticket. If the ticket is against the driver, then the employer generally will not be responsible for the ticket.”

Can you use your personal truck for your business?

The IRS considers vehicles as listed property, which means they can be used for both business and personal purposes.

Should my employer pay for my parking ticket?

As far as parking (or speeding) tickets are concerned, things aren't definitive. As a rule of thumb, if the ticket is against the employees, not the company vehicle, they're responsible for the ticket. If the employee uses the company car for unauthorized uses, the driver will have to pick up the costs.

Under what circumstances can a driver claim the personal use exemption?

Personal driving (personal use) vacation trips. driving to conduct personal activities. travel between home and a regular place of employment, other than a point of call. travel between home and a regular place of employment even if you insist the employee drives the vehicle home, such as when they are on call.

Can my employer pay my speeding fine?

The cost of a speeding offence If the driver is over the speed limit by a relatively small amount they will generally have to accept penalty points and pay a fine. The fine itself is payable by the employee.

How do you justify a company car?

How to Justify a Company Car Determine the amount of travel required to operate the business. Determine the needs of your workforce. Consider the potential tax benefits of getting a company car. Determine the cost of your current mode of transportation.

How much should you get paid to use your car for work?

Many employers reimburse employees for vehicle expenses, but federal law doesn't require reimbursement. Some states require mileage reimbursement. Check your state department of labor website for details. Effective July 1, 2022, the standard mileage reimbursement rate for business travel is 62.5 cents per mile.

Can I put my personal car on my business insurance?

Commercial auto insurance is for vehicles owned by a company, such as company cars loaned out to employees or trucks used to transport equipment to job sites. Commercial or business car insurance never covers personally owned vehicles, and personal car insurance never covers company-owned vehicles.

What are the 3 things everyone one must have with them when operating a vehicle?

License, Insurance, and Registration It may seem obvious, but you should always have your license, registration, and insurance in the car whenever you are driving it.

Can I use my personal vehicle for work?

Under California Labor Code 2802, the employer must reimburse their employees for vehicle expenses if they are required to use their personal vehicle for work-related activities. This does not include commuting to and from work. There are three main ways an employer can reimburse an employee for vehicle costs.

What should be in a company car policy?

A company vehicle policy, or company vehicle use agreement, establishes which employees are eligible for a company fleet vehicle. It also outlines the requirements for qualifying for a company car, basic rules employees must follow when using company vehicles, and disciplinary action for misusing vehicles.

How is taxable benefit calculated for a company car?

The calculation is based on the following: the purchase cost or the lease cost of the automobile. the number of days that the automobile is made available to the employee. the actual extent of personal use (under certain conditions)

How do you handle personal use of a company vehicle?

If an employer provides an employee with a company vehicle that is available for the employee's personal use, in most cases, the value of the personal use must be included in the employee's wages (unless the employee reimburses the employer for the personal use).

What can I write off if I use my car for work?

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return.These include: Depreciation. Lease payments. Gas and oil. Tires. Repairs and tune-ups. Insurance. Registration fees.

What is a company car policy?

A company vehicle policy, or company vehicle use agreement, establishes which employees are eligible for a company fleet vehicle. It also outlines the requirements for qualifying for a company car, basic rules employees must follow when using company vehicles, and disciplinary action for misusing vehicles.

Who is responsible for a company vehicle?

Duty of care regulations dictate vehicle is place of work And companies have a duty of care responsibility to their drivers to make sure that vehicles are fit for purpose and that they are as safe as possible while out on the road, with adequate and appropriate insurance.

How is taxable car benefit calculated?

For 2021, the benefit is equal to 27¢ per kilometre of personal use. For 2022, the benefit is equal to 29¢ per kilometre of personal use. An employer may choose an optional method if certain conditions are met.

Is using a company vehicle a taxable benefit?

There is no taxable benefit if the employee uses the automobile only for work, even if the vehicle is available to the employee throughout the year. A taxable benefit results if the employee uses the automobile for personal purposes, or if the automobile made available to the employee is not required for their job.

What happens if you get caught speeding in a company vehicle?

If it can be proven that the employer did not demonstrate fulfilment of their care obligations, then the employer might be liable. When a driver is caught speeding, they will receive penalty points on their licence and a fine.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Employee Representation Regarding Use of Company Vehicle from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including Employee Representation Regarding Use of Company Vehicle, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I fill out Employee Representation Regarding Use of Company Vehicle on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your Employee Representation Regarding Use of Company Vehicle by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit Employee Representation Regarding Use of Company Vehicle on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as Employee Representation Regarding Use of Company Vehicle. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is Employee Representation Regarding Use of Company Vehicle?

Employee Representation Regarding Use of Company Vehicle is a formal document that outlines the policies, responsibilities, and guidelines governing the use of company vehicles by employees.

Who is required to file Employee Representation Regarding Use of Company Vehicle?

Employees who are authorized to use company vehicles or those who wish to seek approval for such use are typically required to file this representation.

How to fill out Employee Representation Regarding Use of Company Vehicle?

To fill out the form, employees should provide their personal information, details of the vehicle they wish to use, purpose of use, and any additional relevant information as specified in the form.

What is the purpose of Employee Representation Regarding Use of Company Vehicle?

The purpose is to ensure compliance with company policies, promote accountability, and provide a record of how company vehicles are used by employees to prevent misuse.

What information must be reported on Employee Representation Regarding Use of Company Vehicle?

The information that must be reported includes the employee's name, department, vehicle details (make, model, license plate), intended use, dates of use, and any other specifics required by the company policy.

Fill out your Employee Representation Regarding Use of Company Vehicle online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Representation Regarding Use Of Company Vehicle is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.