Get the free Beneficiary Change Form

Get, Create, Make and Sign beneficiary change form

Editing beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change form

How to fill out beneficiary change form

Who needs beneficiary change form?

Beneficiary Change Form - How-to Guide

Understanding the beneficiary change form

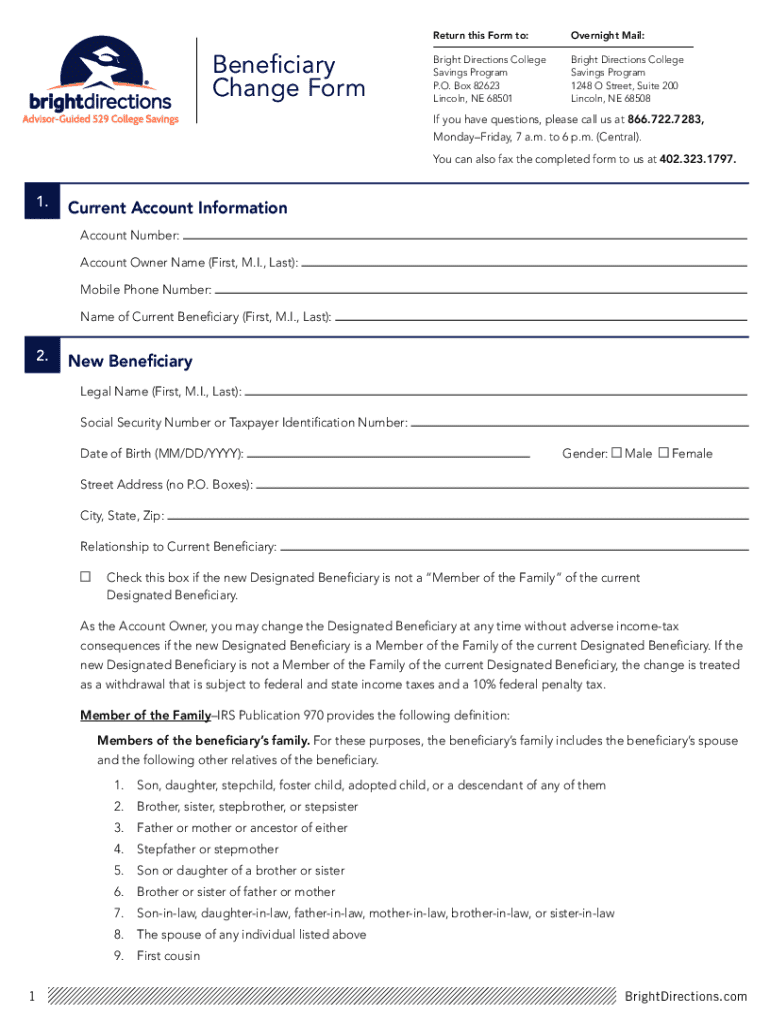

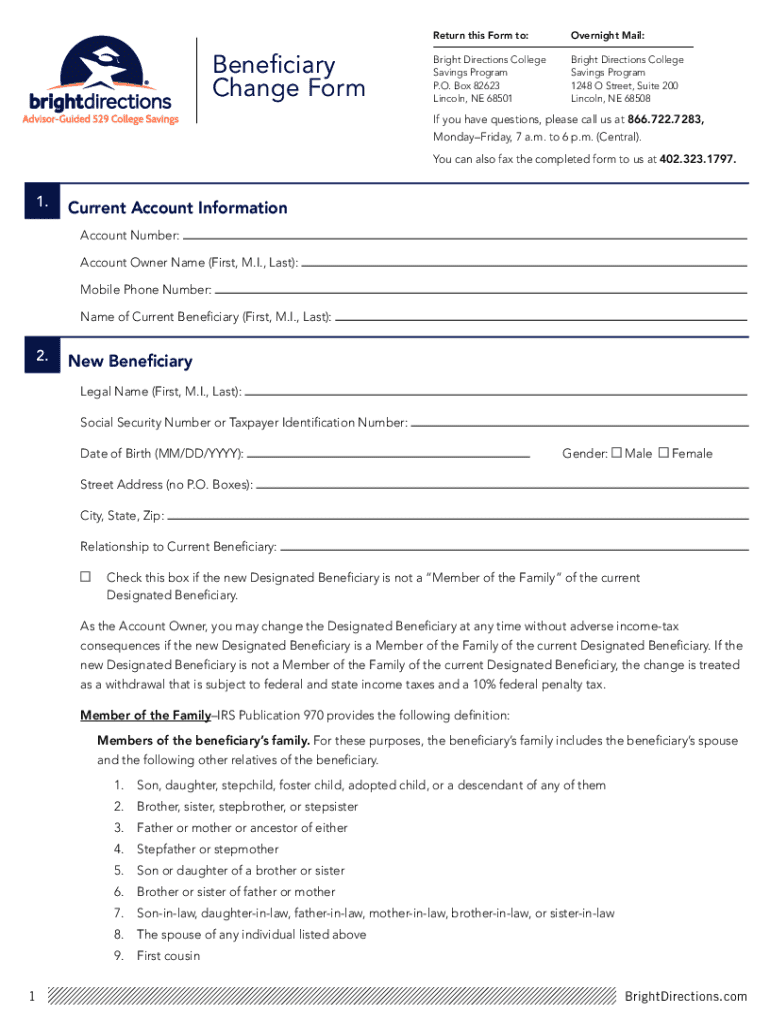

A beneficiary change form is a crucial document that allows individuals to designate or alter the beneficiaries of various financial accounts, including life insurance policies, retirement accounts, and trusts. The primary purpose of this form is to ensure that the assets are distributed according to your wishes upon your passing or in case of incapacitation.

Keeping your beneficiary information updated is vital since neglecting to do so can lead to unintended consequences, such as distributing your estate in a way that contradicts your intentions. This form serves to reflect any significant changes in your life or priorities, ensuring that your assets go to the right people.

Types of beneficiary changes

Beneficiary changes can take several forms, each addressing specific needs and circumstances. Understanding these categories can help in making informed choices.

Designating new beneficiaries is one of the most common changes. Within this category, it's important to distinguish between primary beneficiaries, who are the first in line to receive your assets, and contingent beneficiaries, who will inherit only if the primary beneficiaries are unable to do so.

Revoking existing beneficiaries is equally straightforward but equally important, especially when relationships change. Additionally, you may wish to add more beneficiaries, particularly in larger families or when partnerships evolve, allowing for a more equitable distribution of assets.

Getting started: what you need to know

Before filling out the beneficiary change form, there are prerequisites you need to fulfill. This includes gathering the required personal information, such as your contact details and identity verification elements like social security numbers.

You’ll also require documentation linking you to the account or policy. This could involve statements or account numbers associated with the assets you’re modifying.

To access the form conveniently and ensure its validity, you can easily download the beneficiary change form from pdfFiller. This platform offers the form in various formats, including PDF and Word, facilitating easy completion and accessibility.

Step-by-step instructions for filling out the form

Filling out the beneficiary change form can appear daunting at first, but breaking it down into steps simplifies the process. Start by entering your personal information, such as your full name, address, and any pertinent identification numbers like your policy or account number.

The next step is to specify your beneficiaries' details. You will need to provide the full names and contact information for each beneficiary and, if applicable, the percentage distribution of your assets among them. This clarity ensures that there are no discrepancies later on.

Finally, take a moment to review and modify the information filled out in the form. It’s essential to double-check all entries for accuracy and clarity, especially if you are designating multiple beneficiaries with specific instructions.

Editing and signing the beneficiary change form

Once you have filled out the beneficiary change form, utilizing pdfFiller's features can further enhance your experience. The platform provides easy editing tools that allow you to modify any section of the form seamlessly.

Adding signatures electronically is also possible, giving you a secure and convenient way to finalize the document. After editing and signing, you should save your document securely and, if required, share it with relevant parties either through secure email or cloud storage.

Submitting your beneficiary change form

After completing your beneficiary change form, you must submit it for your changes to take effect. There are multiple submission methods available. For a fast and efficient process, you can choose online submission via pdfFiller.

Alternatively, mailing the form to the appropriate address can also be an option, especially if you need a physical copy for your records. To ensure your changes are processed timely, consider confirming the submission with your financial institution or insurance provider.

Managing your beneficiary information

Managing your beneficiary information doesn't stop after submitting the form. Keep records of all changes made, along with any notifications sent. This documentation is essential not only for your clarity but also for your beneficiaries' understanding.

Regularly reviewing your beneficiary information is a prudent practice. Make it a habit to revisit this information especially after significant life events, such as marriages, divorces, or births, to ensure that your asset distribution aligns with your current intentions.

Common mistakes to avoid

Errors in the beneficiary change form can lead to complications in asset distribution. One common mistake is providing missing or incorrect information, which can result in legal disputes. Always verify that each detail is accurate before submitting.

Another common error is failing to sign the form. Signatures validate the changes, and without them, your request may not be processed. Furthermore, neglecting to update your beneficiary information after major life changes can leave your assets in limbo, so clarity and timeliness are critical.

FAQs regarding the beneficiary change process

A common question is how long it takes for changes to take effect after submitting your form. Generally, processing times vary by institution, but it typically ranges from a few days to several weeks.

Another frequently asked question concerns what happens if you submit your form inaccurately. If errors are found, institutions might require a complete resubmission, potentially delaying the update. Lastly, many wonder if they can change their beneficiaries again in the future; the good news is that beneficiary designations can be revised as often as needed, ensuring your assets always reflect your current wishes.

Leveraging pdfFiller for comprehensive document management

pdfFiller serves as an excellent solution for comprehensive document management related to beneficiary changes. By accessing additional tools for document collaboration, users can easily work on forms together, ensuring all necessary parties are on the same page.

The platform’s security features protect sensitive information, giving users peace of mind as they manage important legal documents. Lastly, pdfFiller integrates with various platforms and services, streamlining the management process and enhancing user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit beneficiary change form on an iOS device?

How can I fill out beneficiary change form on an iOS device?

How do I edit beneficiary change form on an Android device?

What is beneficiary change form?

Who is required to file beneficiary change form?

How to fill out beneficiary change form?

What is the purpose of beneficiary change form?

What information must be reported on beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.