Get the free Financial Policy

Get, Create, Make and Sign financial policy

Editing financial policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial policy

How to fill out financial policy

Who needs financial policy?

Understanding the Financial Policy Form: A Comprehensive Guide

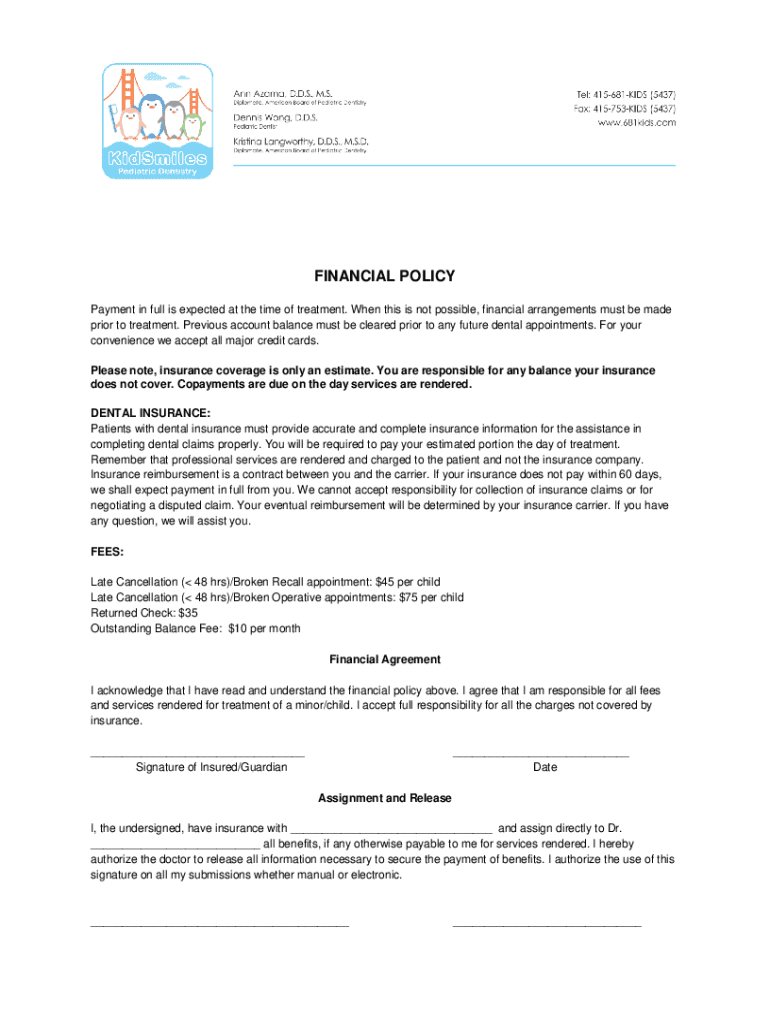

Understanding the financial policy form

A financial policy form serves as a critical document outlining the financial practices and guidelines of an individual or organization. It articulates the financial responsibilities, obligations, and procedures governing financial activities, catering to both personal and team settings. The purpose of this document is to provide clarity and structure, ensuring that everyone involved understands their financial roles and responsibilities.

Having a financial policy in place is essential, especially for organizations aiming to maintain fiscal integrity. This policy acts as a safeguard against financial mismanagement by establishing clear expectations for budgeting, spending, and financial reporting. By documenting these policies, individuals and teams can reduce the risk of financial errors and ensure compliance with legal and regulatory requirements.

Types of financial policy forms

Financial policy forms can be categorized into individual forms or team forms, catering to different needs. Individual financial policy forms typically focus on personal finance management, detailing budgeting and spending behaviors that help maintain financial health. Conversely, team financial policy forms are geared toward organizations, outlining how team members should handle financial transactions, budget allocations, and expense reporting.

Moreover, the variations of financial policy forms can often depend on industry standards or the size of an organization. For instance, small businesses might require simpler forms emphasizing basic budgeting and reporting processes. In contrast, larger corporations or non-profit organizations may have intricate policies that encompass auditing standards, departmental budgets, and compliance laws specific to their sector.

Key elements of a financial policy form

Essential components of a financial policy form include a clear definition of financial responsibilities and obligations, which delineates who is accountable for what areas of spending and budgeting. This section ensures that all stakeholders understand their roles, helping avoid misunderstandings in financial dealings. Additionally, budgeting procedures and guidelines should be included to provide a framework for how finances are managed throughout the organization.

Payment terms and conditions are also crucial, specifying how funds will be handled, which can include payment timelines, invoicing procedures, and approval processes. Optional components can enhance the form's comprehensiveness, such as tax information for compliance purposes, and insurance requirements that may be needed to mitigate financial risks.

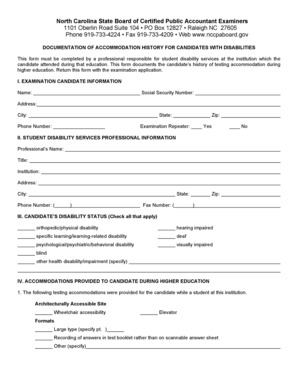

Steps to create a financial policy form

Creating a financial policy form involves a systematic approach. The first step is to identify your objectives, which involves assessing financial needs and aligning them with your company's goals. Understanding the financial landscape of the organization will allow you to draft a relevant policy that supports its mission.

Next, gather relevant information from various stakeholders. This could include input from financial advisors, team leaders, or accountant staff who can provide insights into best practices and common challenges. After compiling this data, proceed to draft the policy. Utilizing templates available on platforms like pdfFiller can streamline this process, ensuring clarity and comprehensive coverage of the necessary policies.

Filling out the financial policy form

Completing a financial policy form requires attention to detail. Specific sections should be filled out according to their intended purpose, ensuring that all financial practices align with the documented policies. It's crucial to read through each section carefully, as common pitfalls include skipping vital information or misinterpreting obligations and terms outlined in the form.

pdfFiller provides interactive tools designed to assist users in filling out forms efficiently. Users can take advantage of online form filling capabilities, and editing options that allow for adjustments as needed. Ensuring that your form is filled out correctly can help prevent misunderstandings later on and facilitate a smooth financial operation.

Editing and customizing your financial policy form

Once the financial policy form is drafted, editing and customizing are key to ensuring it accurately represents the organization's needs. pdfFiller provides various features enabling users to modify text, adjust designs, and incorporate multimedia elements that can enhance the document's clarity. This capability is crucial in creating a professional-looking form that reflects the organization's branding.

Branding your financial policy form is also vital, as it allows for the incorporation of company logos and colors. This not only boosts brand recognition but also fosters a sense of professionalism. By ensuring that the document is visually aligned with the organization's identity, stakeholders can immediately recognize its authenticity and importance.

eSigning the financial policy form

Signing a financial policy form electronically has become increasingly important in today's digital landscape. However, it’s essential to be aware of the legal considerations surrounding electronic signatures. Validity can vary depending on jurisdiction, so understanding the eSignature laws applicable in your area can help mitigate risks. This includes confirming that digital signatures are acceptable for your financial documents.

The eSigning process on pdfFiller is straightforward and user-friendly. Users can invite colleagues to sign directly through the platform, allowing for streamlined collaboration. Additionally, tracking signature status keeps all parties informed about the document’s progress and improves accountability.

Collaboration and sharing of financial policy forms

Collaboration is vital when finalizing a financial policy form. Many tools allow teams to edit documents in real-time, providing a space where feedback can be shared instantly. This fosters a sense of teamwork and ensures that everyone’s voice is considered in formulating the policy while promoting a unified direction.

Best practices for sharing your form include utilizing secure sharing options through pdfFiller. Ensuring data privacy is critical, especially when sensitive financial information is involved. Implementing permissions controls allows you to manage who can view, edit, or share the document, safeguarding the integrity of your financial policy.

Managing the financial policy form post-completion

Post-completion management of your financial policy form is essential for maintaining its relevance and effectiveness. Proper storage and organization of your documents in the cloud facilitate easy access and retrieval when needed. Setting up a structured folder system where each policy is categorized according to its nature ensures an organized approach to document management.

Periodic reviews and updates of the policy should be scheduled to ensure it remains compliant with any legal or regulatory changes. Establishing a timeline for policy reevaluation assists organizations with staying abreast of necessary adjustments and allows for proactive management of their financial policies.

Common mistakes to avoid

When filling out financial policy forms, certain common errors can surface. Key components may be omitted, which can lead to significant misunderstandings about financial governance. Moreover, misinterpretation of obligations and terms could result in compliance issues.

To ensure error-free documentation, consider employing strategies such as checklists to validate completion or requesting feedback from multiple stakeholders before finalization. Ensuring thorough review and validation of the completed form can safeguard against these pitfalls.

Explore additional resources on financial forms

In addition to financial policy forms, explore other related document templates available on pdfFiller. Resources like borrowers’ financial disclosure forms or expense reimbursement forms can provide added support for comprehensive financial management. Engaging in webinars and training sessions offered on document management can further enhance your understanding of effective policy formulation.

By equipping yourself with these resources, you can ensure that your organization remains compliant, efficient, and well-prepared for any financial challenges ahead. Staying informed and proactive in your financial policy management plays a pivotal role in your organization’s overall success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit financial policy from Google Drive?

How can I get financial policy?

Can I edit financial policy on an Android device?

What is financial policy?

Who is required to file financial policy?

How to fill out financial policy?

What is the purpose of financial policy?

What information must be reported on financial policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.