Get the free Nomination of Beneficiary Form

Get, Create, Make and Sign nomination of beneficiary form

How to edit nomination of beneficiary form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nomination of beneficiary form

How to fill out nomination of beneficiary form

Who needs nomination of beneficiary form?

Understanding the Nomination of Beneficiary Form

Understanding the nomination of beneficiary form

A nomination of beneficiary form is a legal document that allows individuals to designate one or more beneficiaries to receive their assets after death. This form is pivotal for managing how your financial assets—like life insurance policies, retirement accounts, and other financial instruments—are distributed upon your demise. Additionally, it helps to clarify your wishes and ensures that your loved ones receive their intended inheritance without unnecessary complications.

The significance of the nomination of beneficiary form extends beyond just a simple preference of where your assets should go. It's an essential component of effective financial planning. By nominating beneficiaries, you not only prioritize the distribution of your assets but also potentially bypass the lengthy and often expensive probate process, ensuring that your heirs receive their inheritance promptly.

Who should use this form?

Anyone handling life insurance policies, retirement funds, or other significant financial assets should utilize a nomination of beneficiary form. This form is crucial for individuals, but it is equally important for teams managing corporate benefits and policies, ensuring that the company’s intentions align with the interests of its employees or stakeholders.

Importance of nomination of beneficiary

Nominating beneficiaries is not merely a procedural exercise; it is a crucial step in ensuring that your assets are distributed according to your wishes. Without a nomination, your assets could fall into a legal limbo, subject to the probate process, which can be time-consuming and costly. By clearly designating beneficiaries, you avoid potential disputes among surviving relatives over your intentions, fostering harmony in a time that might otherwise be fraught with emotions.

However, several misconceptions exist regarding beneficiary designations. For example, many believe that simply having a will is sufficient for asset distribution. In reality, many financial accounts operate independently of a will and rely on the nomination of beneficiary form to dictate who receives funds after one's passing. Understanding the distinction between primary and contingent beneficiaries is also crucial, as primary beneficiaries are the first in line to inherit, while contingent beneficiaries receive assets only if the primary choice is unavailable.

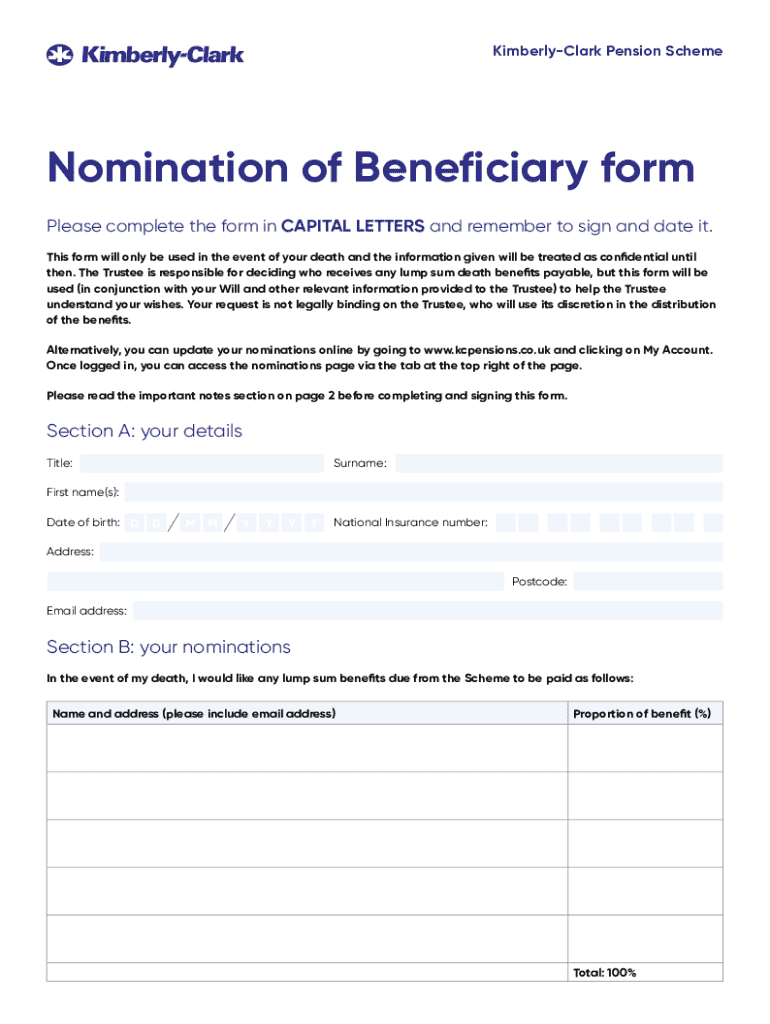

Key components of the nomination of beneficiary form

Completing a nomination of beneficiary form requires accurate and comprehensive information, starting with personal details. You must fill out your name, address, and contact information, which serves as your identification on the document.

The form will also request detailed information on each beneficiary. This includes full names, the nature of their relationship to you, and the percentage of the asset they are entitled to receive. Such clarity helps avoid misunderstandings in the future. Additionally, there are special considerations when dealing with minor beneficiaries, who may require a guardian to manage their portion until they reach adulthood. In some cases, individuals might choose to establish a trust or designate an organization as beneficiaries, which necessitates further specificities.

Step-by-step instructions for completing the form

Before filling out the nomination of beneficiary form, gather all necessary documentation. This includes identification documents and information about your assets and the beneficiaries you're appointing. Compile this data in advance to streamline the process and minimize errors, ensuring each section is accurately completed.

Moving onto the actual form, start with your personal information at the top. Follow through to the beneficiary sections, specifying each person’s full name, relationship to you, and the percentage of the asset they will receive. It's prudent to consider designating contingent beneficiaries to cover scenarios where a primary beneficiary cannot accept their inheritance. After you’ve filled out the form, review it thoroughly to double-check for spelling, accuracy, and completeness to avoid any discrepancies that could cause issues later.

Editing and managing your nomination of beneficiary form

Life changes often necessitate updates to your nomination of beneficiary form. Major events such as marriage, divorce, or the birth of a child are critical moments that should trigger a reassessment of who you want to benefit from your assets. It's advisable to set a reminder to review your nomination periodically—not just after significant life events—to ensure alignment with your current wishes.

Utilizing tools designed for document management, like pdfFiller's cloud-based platform, simplifies the editing process. You can access your form from anywhere and make necessary adjustments quickly. Additionally, understanding the legal considerations surrounding electronic updates is important; ensure that any modifications comply with regulations to maintain the legitimacy of your beneficiary designations.

Signing and submitting your nomination of beneficiary form

After completing your nomination of beneficiary form, it is critical to sign it properly. Many platforms, including pdfFiller, offer electronic signature options that simplify the submission process. This method not only adheres to legal standards but also enhances the convenience of submitting your form to various institutions.

Submission methods can vary depending on the institution that the form is directed to. You may be able to submit the form electronically or deliver it physically via mail or in-person. Regardless of the method, it’s vital to keep a record of your submission, including a confirmation receipt if submitted electronically. Proper document retention practices safeguard against potential disputes in the future regarding beneficiary designations.

FAQs about the nomination of beneficiary form

The nomination of beneficiary form may raise various questions amongst individuals considering their estate planning options. Common queries include how to choose the right beneficiary or what to do if a beneficiary predeceases you. Moreover, it’s also essential to understand what happens if you forget to update the nomination following a significant life change.

Addressing these concerns proactively can prevent misunderstandings later. For instance, always ensure that your primary beneficiaries are in good health and aware of their designation. If you encounter issues while filling out your form, don't hesitate to reach out to a financial advisor or utilize online resources tailored for this purpose, including FAQs provided by institutions offering the forms.

Additional considerations and resources

Integrating your nomination of beneficiary with overall estate planning ensures that all moving parts of wealth transfer remain seamless. Financial planning tools such as estate planning software can aid in visualizing how your beneficiaries fit into your broader financial strategy.

In scenarios where your financial situation is complex or involves larger estates, seeking professional financial or legal advice is recommended. Experts can provide personalized insights and help navigate the legal landscape related to beneficiary designations. For those looking for assistance in filling out the form, pdfFiller offers resources and templates that guide users through every step.

Final thoughts on beneficiary designation

Maintaining an up-to-date nomination of beneficiary form is essential to effective financial management. As life circumstances evolve, so too should your nominations. Regular reviews and updates facilitate peace of mind, knowing your assets will be distributed according to your current wishes rather than outdated preferences.

Leveraging pdfFiller’s cloud-based platform empowers users with the ability to manage, edit, and collaborate on essential documents like the nomination of beneficiary form efficiently. The convenience of accessing these forms from anywhere at any time ensures you have control over your documentation, making financial planning smoother and more reliable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in nomination of beneficiary form without leaving Chrome?

How do I edit nomination of beneficiary form on an iOS device?

How do I edit nomination of beneficiary form on an Android device?

What is nomination of beneficiary form?

Who is required to file nomination of beneficiary form?

How to fill out nomination of beneficiary form?

What is the purpose of nomination of beneficiary form?

What information must be reported on nomination of beneficiary form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.