Understanding the New Hampshire Independent Contractor Form

Understanding the New Hampshire Independent Contractor Form

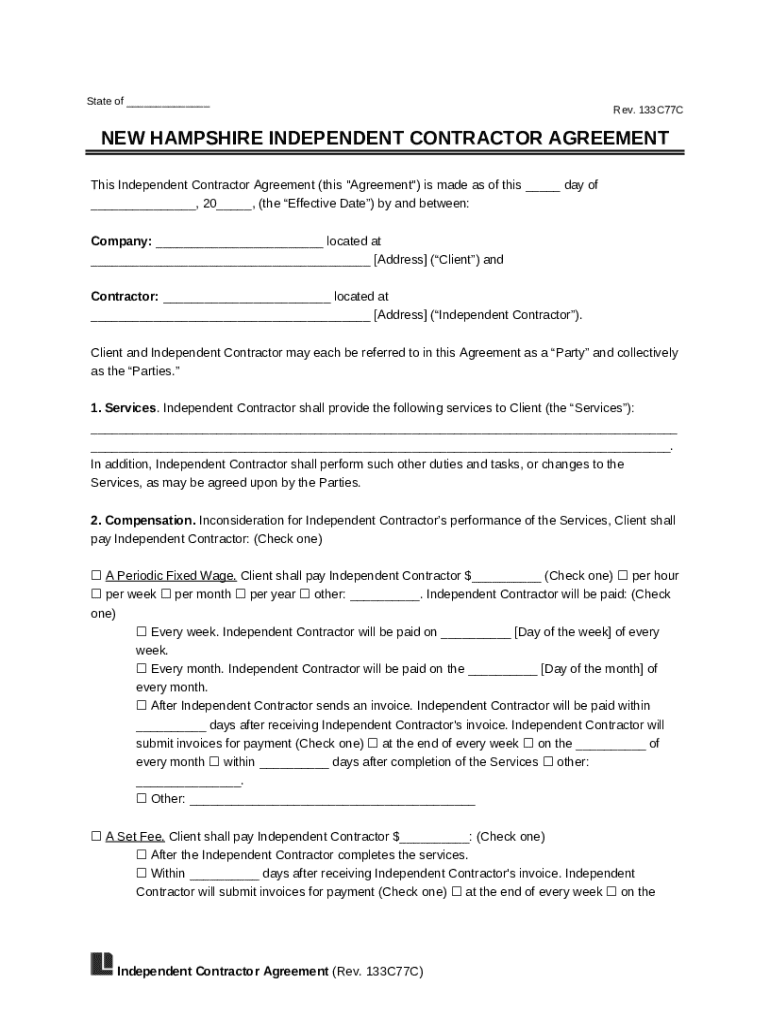

The New Hampshire Independent Contractor Form is an essential document that delineates the relationship between businesses and independent contractors. This form acts as a mutual agreement, articulating the specifics of each party's responsibilities, the nature of the work to be performed, and the compensation structure. For businesses in New Hampshire, using this form not only facilitates clear communication but also helps ensure legal compliance.

Independent contractors operate differently from employees, particularly in terms of taxes, control over work processes, and benefits entitlement. Understanding how New Hampshire classifies independent contractors aids both parties in navigating their rights and responsibilities.

In New Hampshire, the differentiation between employees and independent contractors centers on the degree of independence the worker has in executing their tasks. This is a crucial factor influenced by state laws and federal government guidelines.

Importance of the New Hampshire Independent Contractor Form

The importance of the New Hampshire Independent Contractor Form extends into several critical areas, starting with the clear classification of worker status. Misclassification can lead to penalties for businesses, while providing an incorrect level of protection for workers. Using this form allows both parties to ensure that they are on the same page regarding the nature of the work relationship.

Moreover, this form serves to protect the rights and responsibilities of both the contractor and the hiring entity. It outlines what is expected from each party, helping to mitigate potential disputes. Establishing terms regarding work deadlines, payment dates, and the scope of services helps the relationship flourish.

Legal compliance is another significant reason to utilize this form. New Hampshire businesses must adhere to state regulations, which specify how independent contractors should be treated. By documenting these terms, businesses can safeguard themselves against legal repercussions.

Essential components of the New Hampshire Independent Contractor Form

The New Hampshire Independent Contractor Form is structured to capture essential information that defines the working relationship. Here's a breakdown of the critical components:

Contractor’s Name and Contact Information: This includes the full legal name and up-to-date contact details of the contractor.

Company Details (if applicable): If the contractor operates as a business entity, their business name and contact information should be included.

Description of Services to be Provided: Clearly outlining what services the contractor will perform is vital to avoid misunderstandings or disputes.

Compensation Structure: Specify whether the payment is hourly, project-based, or on commission, offering clarity on financial expectations.

Payment Schedule: Indicate when payments are due (weekly, bi-weekly, or upon project completion).

Duration of Contract: Clearly state the start and end dates of the contract, including any renewal or termination clauses.

Steps to successfully fill out the New Hampshire Independent Contractor Form

Filling out the New Hampshire Independent Contractor Form thoroughly and accurately is critical for a smooth working relationship. Here are steps to follow:

Gathering Necessary Information: Before filling out the form, collect all necessary information about both parties involved.

Entering Contractual Details: Input all required information responsibly, being clear and concise about the services to be provided and payment terms.

Reviewing the Contract for Completeness: Double-check all entries for accuracy to prevent issues later.

Adding Signatures: Utilize eSignatures for convenience, especially for remote collaboration; pdfFiller offers tools for expedited document signing.

Features of pdfFiller for editing and managing the form

pdfFiller streamlines the process of filling out and managing the New Hampshire Independent Contractor Form through its innovative features. Its editing tools allow users to add text, images, and signatures easily, ensuring that documents are tailored to specific needs.

Being cloud-based, pdfFiller enables users to access their documents anytime, anywhere, enhancing collaboration among team members. Users can track changes and add comments, which is beneficial for reviewing versions of the contract.

Common pitfalls to avoid when using the New Hampshire Independent Contractor Form

While filling out the New Hampshire Independent Contractor Form may seem straightforward, there are common pitfalls to watch out for. Firstly, ambiguities in service descriptions can lead to frustration and disputes. Be specific about what services the contractor will provide.

Secondly, overlooking payment details can create tension between both parties; ensure the payment terms are crystal clear. Lastly, failing to comply with state tax requirements can result in penalties, so remain informed about current regulations regarding independent contractors in New Hampshire.

Exploring related documents and forms

There are several documents related to the New Hampshire Independent Contractor Form that businesses and contractors may find helpful:

New Hampshire Employment Agreement: This outlines the terms and conditions of employment for traditional employees.

IRS Form 1099-MISC for Independent Contractors: This form is necessary for tax reporting purposes, ensuring that contractors receive proper documentation of their earnings.

Liability Waiver Forms: When working with contractors, it may be prudent to have waivers in place to protect businesses from claims of negligence.

Understanding rights and responsibilities of independent contractors in New Hampshire

Independent contractors in New Hampshire enjoy certain legal protections that ensure their rights are upheld. These protections include the right to receive payment for services rendered and the ability to negotiate their terms.

However, responsibilities also fall on the contractor, including the obligation to pay self-employment taxes and maintain appropriate liability insurance. If uncertain about these facets of independent contractor status, seeking legal advice can clarify any confusion.

FAQs about the New Hampshire Independent Contractor Form

Several frequently asked questions arise about the New Hampshire Independent Contractor Form:

What if I need to modify the contract? Always discuss and agree on any modifications, then document the changes formally to maintain clear records.

How to handle disputes or non-compliance? Initially, communicate directly with the contractor to resolve issues amicably; if necessary, seek mediation or legal counsel.

Are independent contractors eligible for unemployment benefits? Generally, independent contractors do not qualify for unemployment benefits as they are self-employed.

Practical examples and sample forms

Utilizing practical examples can clarify how to use the New Hampshire Independent Contractor Form effectively. A fully filled-out sample form can provide a clear picture of what information needs to be documented. Reviewing case studies of successful independent contractor agreements can demonstrate good practices.

Leveraging pdfFiller for comprehensive document management

pdfFiller offers more than just a platform to fill out the New Hampshire Independent Contractor Form. Its tools enable users to create, edit, and manage a variety of documents efficiently. With pdfFiller, users can maintain comprehensive records, ensuring all their documentation is organized and easily accessible.

The cloud-based nature of pdfFiller means users can access their documents from anywhere, reducing the hassle of paperwork and improving collaboration amongst teams, ensuring everyone has up-to-date information at their fingertips.