Get the free Consumer Credit Application and Credit Agreement

Get, Create, Make and Sign consumer credit application and

How to edit consumer credit application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer credit application and

How to fill out consumer credit application and

Who needs consumer credit application and?

A comprehensive guide to consumer credit applications and forms

Understanding consumer credit applications

Consumer credit applications are essential documents used by lenders to evaluate the creditworthiness of an individual seeking to borrow money. Their primary purpose is to gather relevant financial information, enabling lenders to make informed decisions on loan approvals. Understanding how these applications function and their importance is crucial for anyone looking to obtain credit.

Accurate information in a credit application is vital; even minor discrepancies can lead to delays or denials. This underscores the need for applicants to carefully review their details before submission. Many individuals mistakenly believe that their application will be approved based solely on their income or employment status; however, factors such as credit history, outstanding debts, and even the type of credit being applied for play significant roles in the decision-making process.

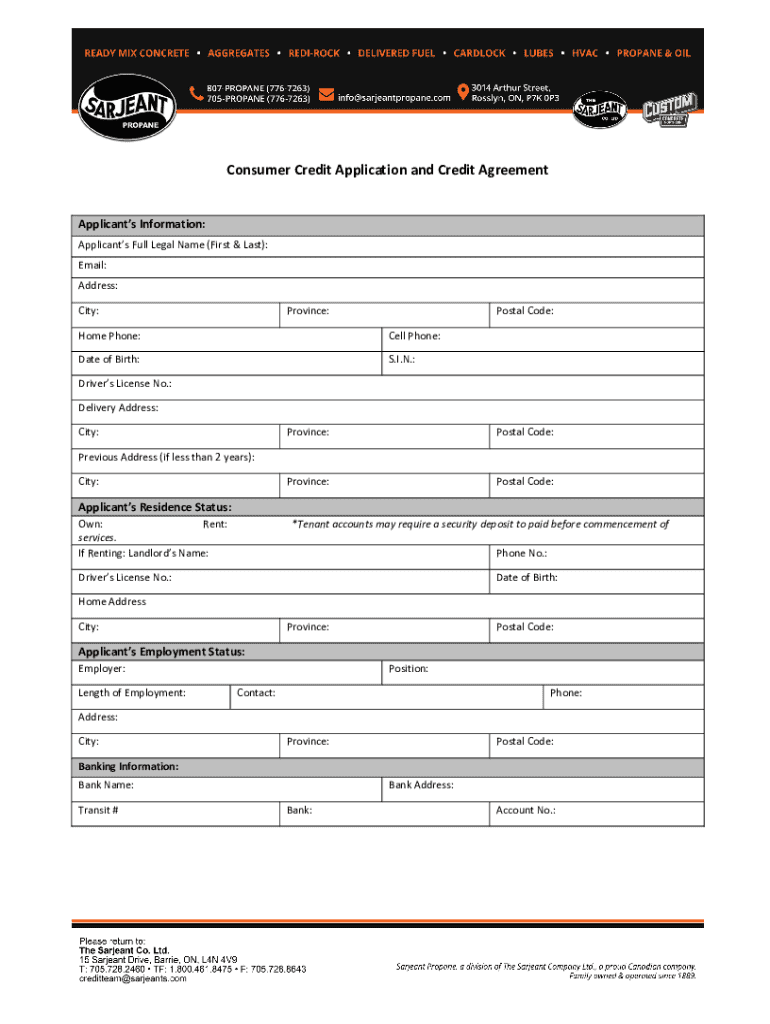

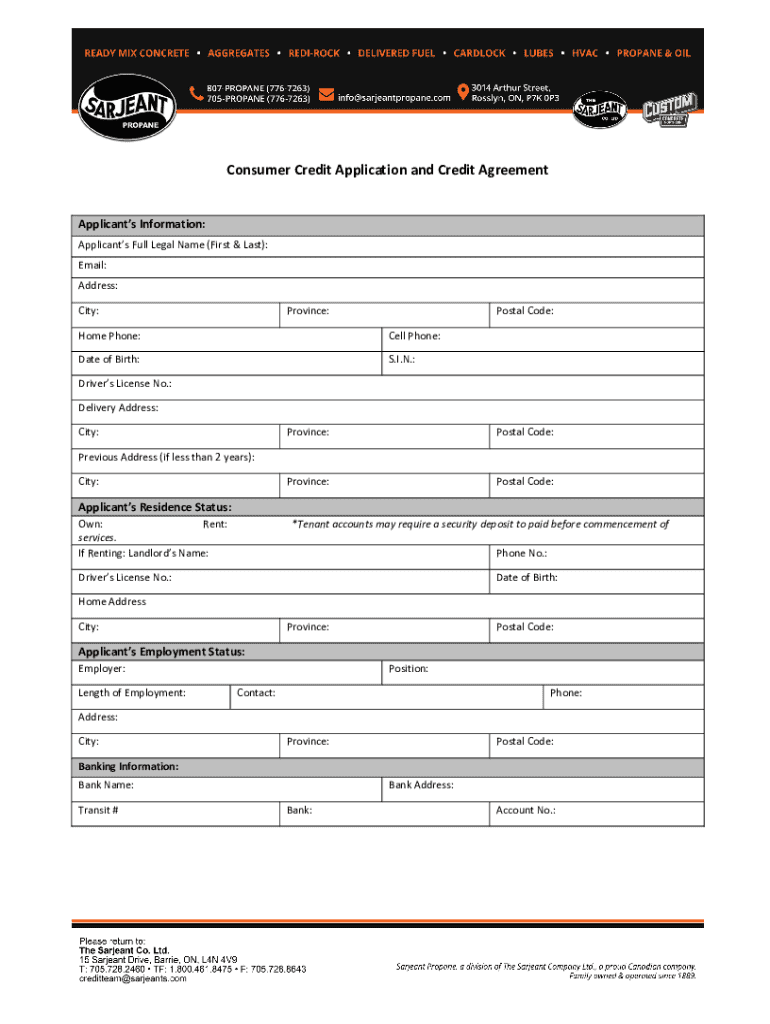

Overview of the consumer credit application form

A typical consumer credit application form consists of several sections designed to capture essential information about the applicant's financial health and history. This ensures lenders can assess risk effectively. The key components usually include personal information, employment details, financial information, and a section for consent and acknowledgment.

There are various types of consumer credit applications available, depending on the borrowing situation. Individual applications are standard but might differ significantly from joint applications where more than one person is responsible for the loan. Furthermore, with the growth of technology, applicants can choose between online and paper applications, each having its unique benefits.

Step-by-step guide to filling out the consumer credit application

Filling out a consumer credit application can seem daunting, but breaking it down into manageable steps can simplify the process. Here’s how you can achieve that with precision and confidence.

Interactive tools for application preparation

To streamline the consumer credit application process, tools like pdfFiller provide essential features that can enhance how users manage their forms. With user-friendly platforms, individuals can easily fill out, edit, and eSign their forms.

After submission: what to expect

Once you have submitted your consumer credit application, it enters the review process, where lenders will assess the provided information. This process typically includes checking your credit report, verifying employment, and evaluating your financial history.

The timeframe for credit application approvals can vary; most lenders will communicate a decision within a few business days, but some may take up to a week. Possible outcomes include approval, denial, or conditional approval, where the lender requests additional information or documentation before a final decision is made.

Managing your credit application with pdfFiller

After you submit your consumer credit application through pdfFiller, you can use the platform to track its status effortlessly. The cloud-based system enables you to check for updates without requiring physical copies of the application.

Frequently asked questions (FAQs)

Understanding the consumer credit application process can lead to many questions. Here are some of the most common queries people have:

Tips for future credit applications

To enhance your chances of securing favorable credit terms in the future, consider implementing the following best practices: consistently monitor your credit report for inaccuracies, pay down existing debts to improve your debt-to-income ratio, and maintain a stable income focus.

Conclusion: streamlining your credit application process

Having a well-organized approach to your consumer credit application can significantly enhance your chances of a swift and favorable outcome. By understanding the steps involved and utilizing tools like pdfFiller, you simplify the process and ensure that your applications are clear, complete, and submitted efficiently.

As you prepare for your next application, take advantage of the resources and features available on pdfFiller, allowing for an easier and more straightforward document management experience, ultimately benefiting your broader financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in consumer credit application and without leaving Chrome?

How do I edit consumer credit application and straight from my smartphone?

How do I complete consumer credit application and on an iOS device?

What is consumer credit application?

Who is required to file consumer credit application?

How to fill out consumer credit application?

What is the purpose of consumer credit application?

What information must be reported on consumer credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.