Get the free Monthly Return of Equity Issuer on Movements in Securities

Get, Create, Make and Sign monthly return of equity

How to edit monthly return of equity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly return of equity

How to fill out monthly return of equity

Who needs monthly return of equity?

Navigating the Monthly Return of Equity Form: A Comprehensive Guide

Understanding the monthly return of equity (ROE)

The Monthly Return of Equity (ROE) is a critical financial metric that provides insights into how effectively a company utilizes its equity to generate profits. Tracking this metric on a monthly basis allows businesses and investors to have a closer approximation of financial trends and performance indicators over time.

For businesses, monitoring monthly ROE helps in making informed decisions regarding investment and operational management. Investors, on the other hand, use ROE as a benchmark to measure the profitability of their investments compared to competitors in the same industry.

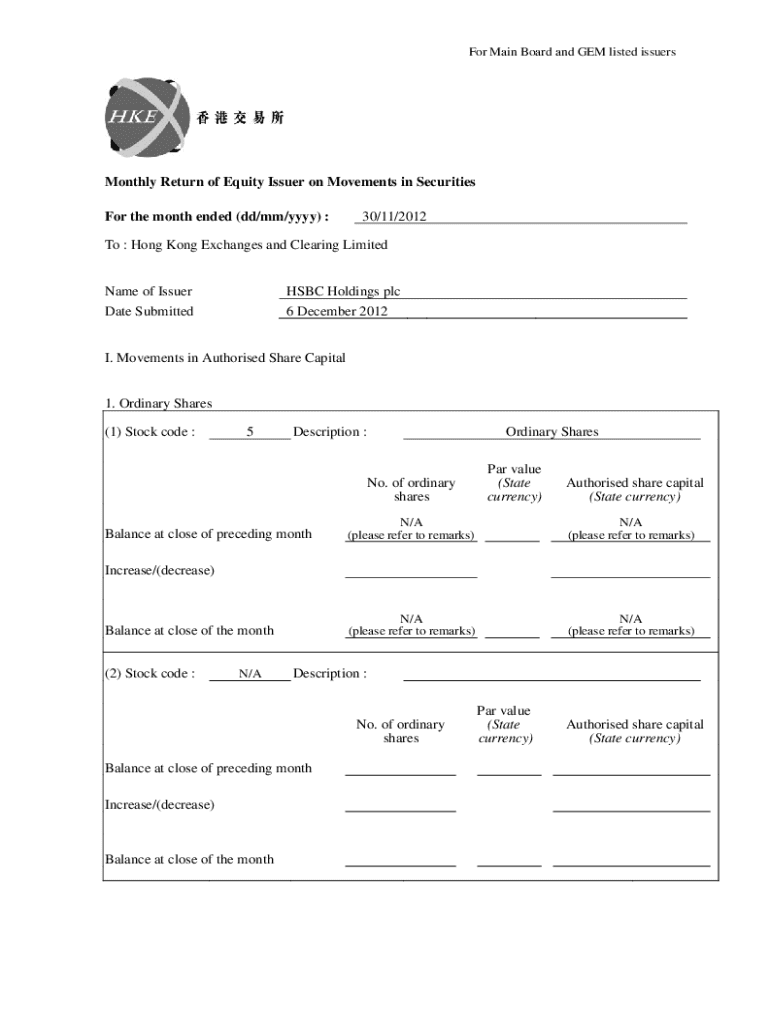

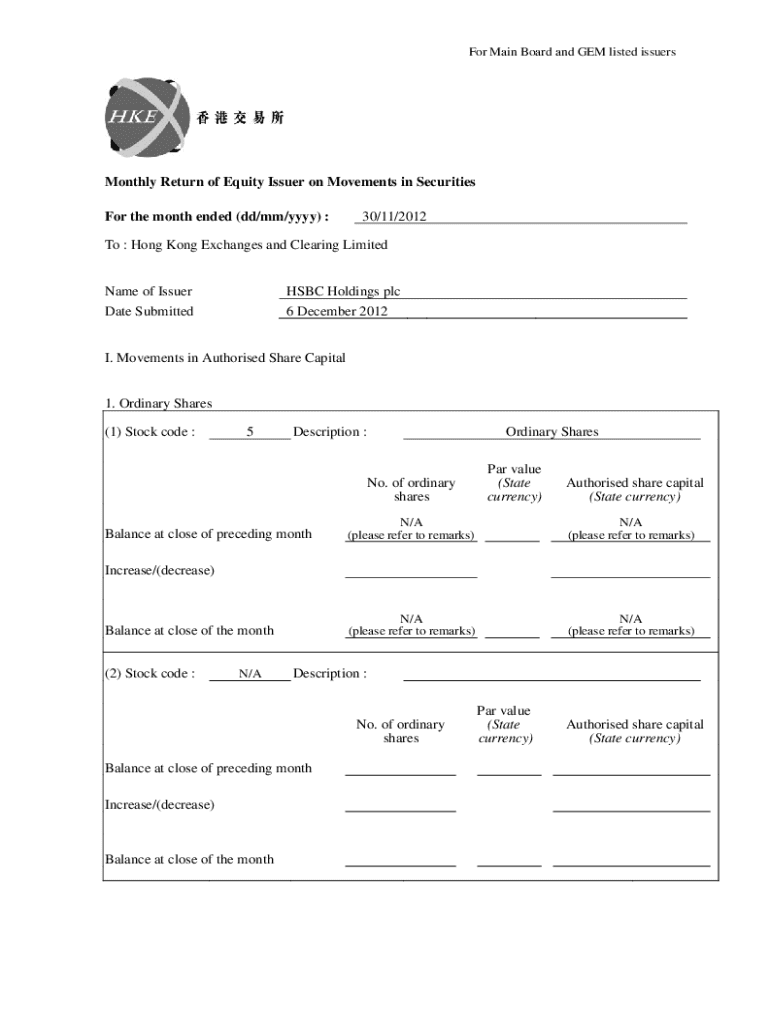

Key components of the monthly return of equity form

The Monthly Return of Equity Form consists of several sections that detail a company's financial inputs and outputs for a given period. Understanding these sections is vital for accurate completion and effective analysis.

The primary components typically include sections for company information, financial inputs such as net income and average shareholder equity, and the calculation of ROE. Each section plays a fundamental role in determining how efficiently a firm is using its equity to generate profits.

Step-by-step guide to filling out the monthly return of equity form

Filling out the Monthly Return of Equity Form necessitates the preparation of accurate financial data. Start with compiling your financial statements and other documentation that detail your income and shareholder equity for the reporting period.

Begin the form with Section 1, entering necessary company information such as the name, address, and reporting period. In Section 2, input net income and average equity figures directly from your financial statements. For Section 3, apply the formula ROE = Net Income / Average Shareholder’s Equity to determine your ROE. Finally, Section 4 requires a thorough review for accuracy before submission.

Interactive tools for calculating monthly ROE

Digital tools can simplify the process of calculating your Monthly Return of Equity. There are several online calculators specifically designed for calculating ROE that can be found on platforms like pdfFiller.

Additionally, pdfFiller offers downloadable templates that allow users to enter necessary data easily, streamlining the form completion process. These tools not only enhance efficiency but also minimize calculation errors.

Monthly return of equity analysis

Understanding the result of your ROE calculation is crucial for interpreting your company's financial performance. A high ROE indicates that a company is effective at generating profits from equity, while a low ROE might suggest inefficiencies or challenges.

Benchmarking your ROE against industry standards is also key. By comparing your metrics with those of similar companies, you can identify competitive advantages or areas needing improvement. This benchmarking process is essential for formulating strategic business decisions.

The role of leverage in monthly ROE calculation

Leverage, or the use of debt in financing, can significantly impact a company’s ROE. When companies use debt to finance their assets, they can potentially inflate their ROE as they utilize borrowed funds to enhance returns.

However, this practice comes with risks. Higher leverage means increased debt obligations, which can affect overall financial stability. Understanding how different capital structures impact ROE is essential for investors when assessing the quality of earnings.

Common mistakes in completing the monthly return of equity form

While filling out the Monthly Return of Equity Form, several common errors can occur. Frequently, inaccuracies arise from incorrect data entry, misunderstanding financial terms, or neglecting to review calculations.

To enhance accuracy, it’s recommended that users double-check all inputs against supporting financial documents. Staying organized and methodical in the approach to completing the form will also aid in preventing errors.

Frequently asked questions about monthly return of equity

Users might have questions or encounter issues while filling out the Monthly Return of Equity Form. Common troubleshooting inquiries include challenges with specific sections and uncertainties regarding compliance with submission timelines.

Understanding the deadlines for filing this form is also critical as non-compliance can lead to penalties. Keeping track of submission windows and integrating reminders into your workflow can ensure timely completion.

Enhancing your understanding of return on equity

To further master the concept of Return on Equity and its calculations, accessing in-depth resources can be invaluable. Books detailing financial management topics and online articles can expand comprehension beyond basic definitions and formulas.

Courses and webinars on financial analysis, particularly those focusing on ROE metrics, can provide a more structured learning environment and practical application of concepts discussed.

Accessing pdfFiller’s document management solutions

pdfFiller offers robust document management solutions, empowering users with the ability to edit, sign, and manage the Monthly Return of Equity Form seamlessly through a cloud-based platform.

Utilizing pdfFiller makes the process of creating and managing financial documents not only simpler but also more efficient. The intuitive interface allows for quick navigation of tools that facilitate document editing and management.

Engaging with the financial community

Engaging with the financial community offers opportunities to network with other professionals interested in Monthly Return of Equity insights. Online forums and social media groups can provide platforms for discussion and shared learning experiences.

Staying updated with changes in regulations and industry standards that affect ROE reporting is crucial. Subscribing to financial newsletters and participating in industry conferences can ensure you're always informed about relevant developments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find monthly return of equity?

How do I edit monthly return of equity on an iOS device?

How do I complete monthly return of equity on an Android device?

What is monthly return of equity?

Who is required to file monthly return of equity?

How to fill out monthly return of equity?

What is the purpose of monthly return of equity?

What information must be reported on monthly return of equity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.