Get the free Pre-authorized Withdrawal Agreement

Get, Create, Make and Sign pre-authorized withdrawal agreement

How to edit pre-authorized withdrawal agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-authorized withdrawal agreement

How to fill out pre-authorized withdrawal agreement

Who needs pre-authorized withdrawal agreement?

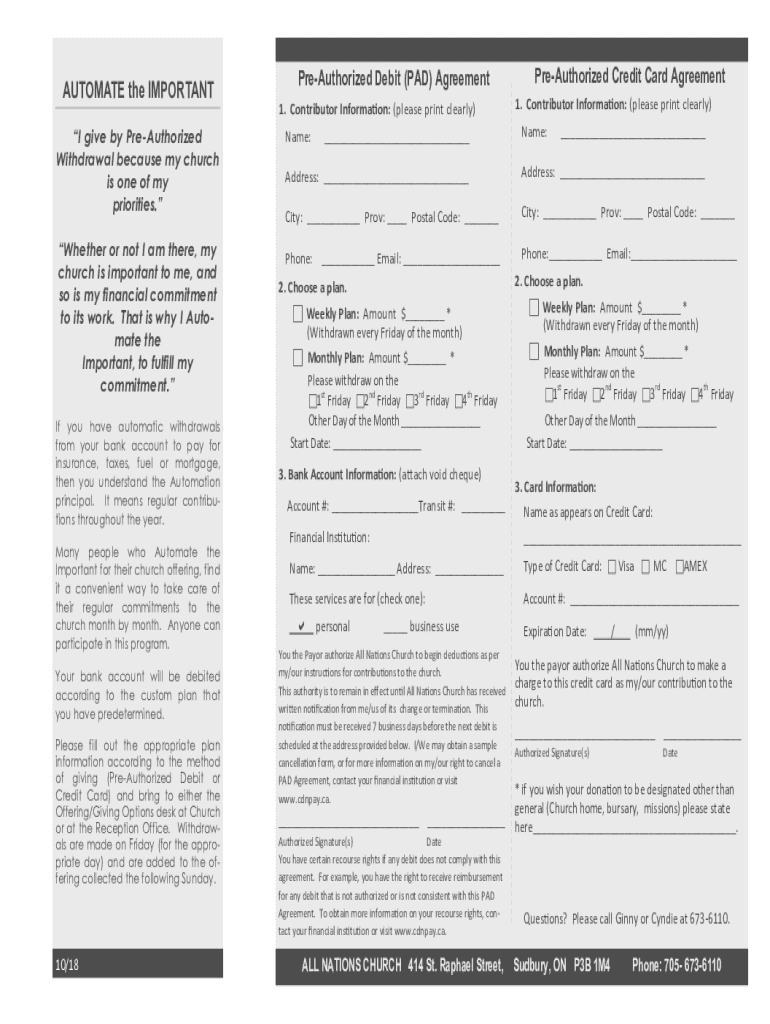

Understanding the Pre-Authorized Withdrawal Agreement Form

Understanding the pre-authorized withdrawal agreement form

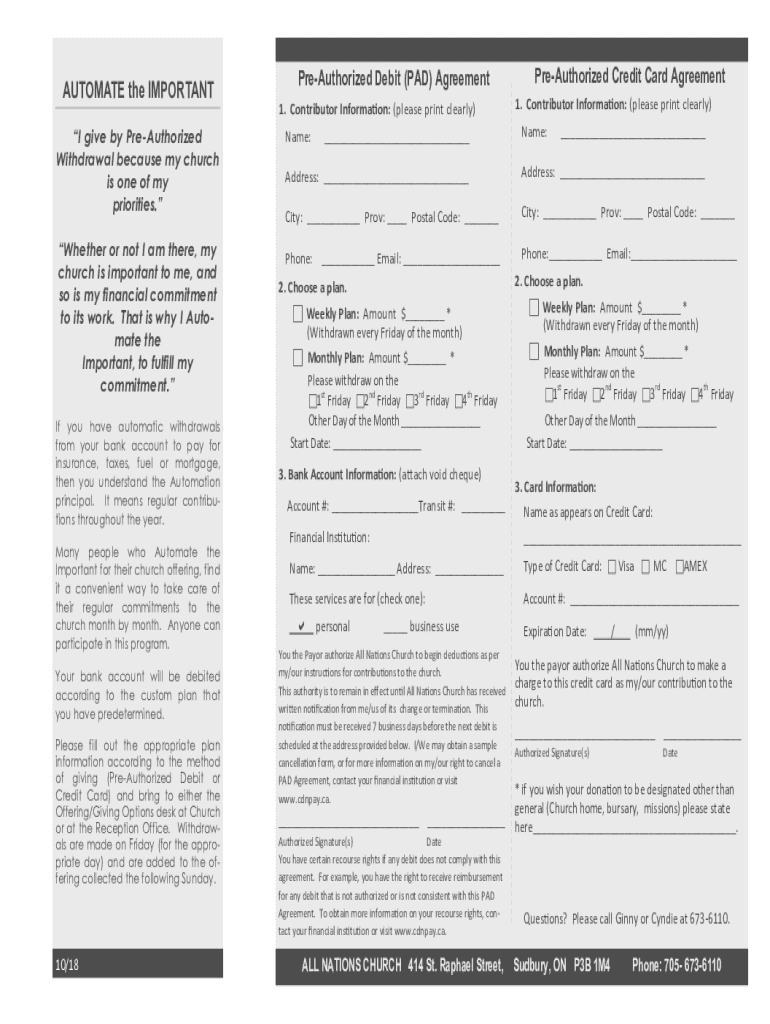

A pre-authorized withdrawal agreement form is a document that enables an account holder to authorize a service provider or financial institution to withdraw funds directly from their bank account. This agreement serves as a formal consent that allows recurring payments, thereby streamlining financial transactions without the need for manual intervention.

The importance of this document lies in its ability to facilitate timely payments for various services. It enhances financial efficiency by ensuring that payments like utility bills, subscription services, and loan repayments are made automatically, reducing the risk of late fees and service interruptions.

Key components of the pre-authorized withdrawal agreement form

A pre-authorized withdrawal agreement typically contains several critical components that define the terms of the withdrawal arrangement. Understanding these components is crucial for both account holders and service providers.

The parties involved must be clearly delineated; this includes the account holder, who grants permission for the withdrawal, and the service provider or financial institution, who will execute the withdrawal. Details about the withdrawal amounts also need clarification, whether they are fixed or variable, ensuring that both parties have an accurate understanding of the payment responsibilities.

How to fill out the pre-authorized withdrawal agreement form

Filling out a pre-authorized withdrawal agreement form can be straightforward if you follow a step-by-step approach. Here is a guide tailored for individuals looking to complete this form successfully.

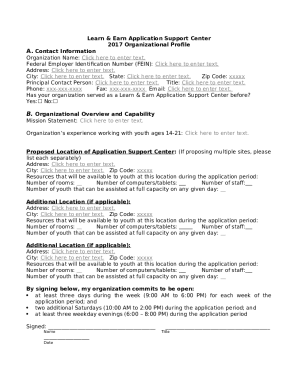

Organizations or teams may require special instructions to ensure that multiple users or accounts can be managed efficiently. Emphasizing additional authorizations or utilizing templates can streamline this process.

Editing and customizing your form with pdfFiller

One of the key advantages of using pdfFiller is its robust editing features, which allow you to customize your pre-authorized withdrawal agreement form to fit specific needs. Whether you want to change the withdrawal amounts, frequency, or even add additional clauses, pdfFiller makes it easy.

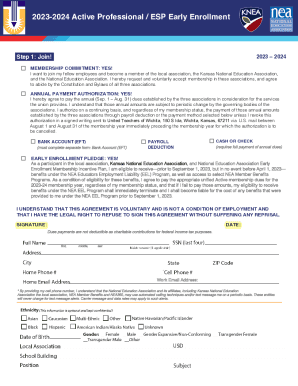

Users can edit pre-filled fields, ensuring that all information remains current and relevant. Additionally, pdfFiller provides templates for various scenarios, making it convenient to find a starting point for your form. Secure authentication methods, such as e-signatures, can also be integrated, enhancing the security and validity of your agreement.

Collaborating on your pre-authorized withdrawal agreement

Effective collaboration is essential when developing a pre-authorized withdrawal agreement, especially for organizations managing multiple users. pdfFiller provides tools that allow stakeholders to share and review documents in real-time, removing communication barriers.

It's crucial to ensure that all parties involved clearly understand their rights and responsibilities. By making use of collaborative features, you can facilitate discussions and obtain feedback, leading to a more comprehensive and mutually agreeable document.

Managing your pre-authorized withdrawals

Successful management of pre-authorized withdrawals requires vigilance and regular monitoring. Account holders should keep track of scheduled payments, as this can prevent any surprises that may arise from unexpected charges.

Monitoring account statements for accuracy is essential. If discrepancies occur, they should be addressed immediately with the relevant service providers. Additionally, should you need to manage changes in payment methods or amounts, having a clear cancellation and modification policy on hand helps streamline the process.

Frequently asked questions (FAQs)

As you navigate the world of pre-authorized withdrawal agreements, you may have a range of concerns. Addressing these common questions can provide essential clarity regarding your agreement.

Best practices for establishing a pre-authorized withdrawal

To ensure smooth transactions with your pre-authorized withdrawal agreement, consider adopting a few best practices. First, it’s essential to review all terms annually and adjust them based on your changing financial situation.

Keeping personal information secure is another paramount concern. Ensure that any digital copies of the agreement are stored safely, and only share them with trustworthy parties. By adhering to these best practices, you can maintain a smooth and secure payment process.

Troubleshooting common issues with pre-authorized withdrawals

There are various issues one might encounter with pre-authorized withdrawals, such as unauthorized charges or missed payments. If you notice an unauthorized transaction, the first step is to notify your bank and arrange for the cancellation of future withdrawals.

In cases where payments are missed or delayed, reaching out to the service provider to resolve any issues as soon as possible is essential. Always follow the outlined cancellation policy if you need to terminate an agreement to avoid complications.

Enhancing document security with pdfFiller

Document security is a critical aspect of managing pre-authorized withdrawal agreements. pdfFiller provides robust features that enhance the security of your documents, including advanced encryption and data protection.

Utilizing e-signatures not only helps in securing your agreements but also ensures compliance with various financial regulations. By employing these security features, you can rest assured that your pre-authorized withdrawal agreements are safe and legally binding.

Success stories: How others have benefited from using pre-authorized withdrawals

Numerous individuals and businesses have found success through the utilization of pre-authorized withdrawal agreements. For example, many households have streamlined their utility payments by employing this method, reducing late fees and ensuring consistent service.

Businesses have likewise reported enhanced cash flow management by automating client payments. Testimonies indicate that the convenience and effectiveness of pre-authorized withdrawals significantly reduce the stress of financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pre-authorized withdrawal agreement directly from Gmail?

How can I edit pre-authorized withdrawal agreement from Google Drive?

How do I make edits in pre-authorized withdrawal agreement without leaving Chrome?

What is pre-authorized withdrawal agreement?

Who is required to file pre-authorized withdrawal agreement?

How to fill out pre-authorized withdrawal agreement?

What is the purpose of pre-authorized withdrawal agreement?

What information must be reported on pre-authorized withdrawal agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.